Across The Board Breakouts For Indices

Image Source: Unsplash

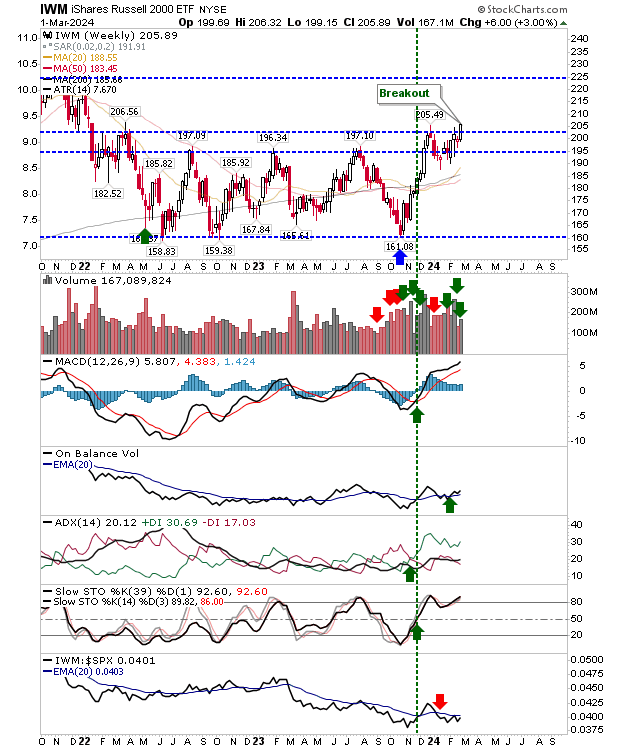

The week finished on a high note, with breakouts seen in the Russell 2000, the S&P 500, and the Nasdaq. The Russell 2000 went a step further, witnessing a breakout on the weekly time frame, too. The break on the weekly time frame for the Russell 2000 is critical, as it marks the start of a right-hand-side base after repeated attempts to clear the $195 mark had failed. If there is a concern (across the board), it's that breakout volume was modest.

(Click on image to enlarge)

(Click on image to enlarge)

The Nasdaq kept up with its step-by-step rally, delivering a breakout with new 'buy' triggers in the MACD and On-Balance-Volume, although the former indicator had flat-lined, so it's not the most effusive 'buy' trigger.

(Click on image to enlarge)

The S&P 500 gained just under 1%, a little less than the Nasdaq, but the breakout was just as valid. The index has a much stronger accumulation trend than the Nasdaq, and with all indices in alignment on breakouts with small-cap leadership, all indices should continue to perform well.

(Click on image to enlarge)

Heading into next week, we may see some early weakness, and if we do, it will be important we don't see a close below Friday's open. If this was to happen, we would be at risk of a 'bull trap.' Intraday losses, even losses that undercut the breakout, would be tolerable. It's how the markets finish that's important.

More By This Author:

Markets Respect Resistance As Gains Stall

Russell 2000 Makes Small Gains As Part Of Three Month Base

Markets Back Inside Prior Consolidations

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more