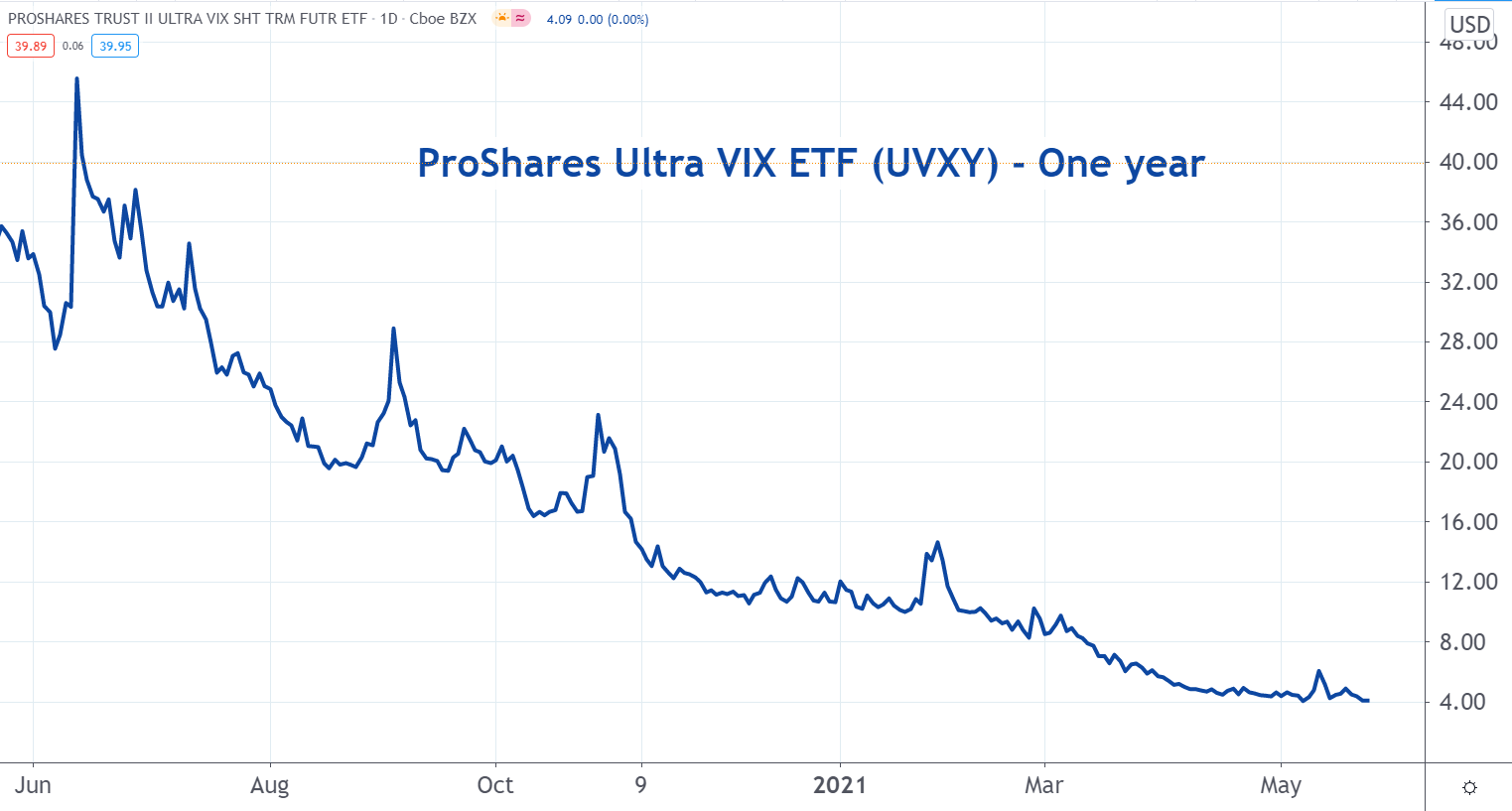

A VIX ETF For Market Volatility

The VIX index measures the implied volatility of the market. When markets go down, the VIX usually goes up. Because of this, many sophisticated investors buy options and futures on the VIX as a hedge against lower stock prices.

But retail investors can gain exposure to the VIX, too.

They can use the ProShares Ultra VIX Short-Term Futures ETF UVXY. It's designed to replicate one-half times (1.5x) the performance of the S&P 500 VIX Index for a single day. If the VIX is up by 1%, UVXY should gain about 1.5%.

If the stock market starts to sell off and move lower, there’s a good chance that UVXY moves higher.

(Click on image to enlarge)

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.