8 Monster Stock Market Predictions For The Week Of May 2

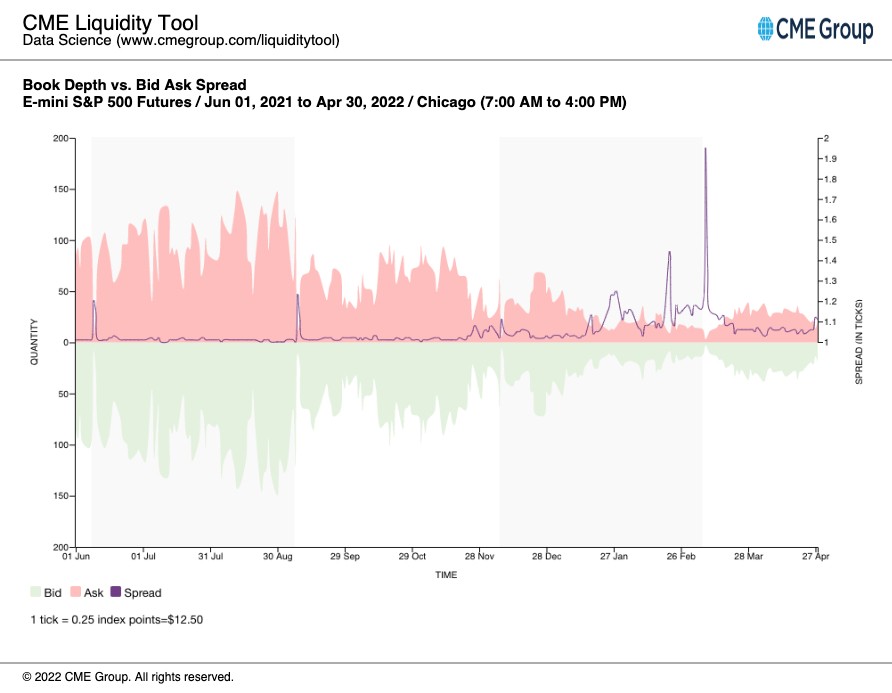

Stocks were crushed on Friday, with the S&P 500 dropping by more than 3%. The market has been very volatile, and that is because the liquidity in the market has thinned out again, with the top of the book shrinking and the bid/ask spread growing wider. Liquidity has been a persistent problem since mid-November.

S&P 500 (SPY)

The S&P 500 was basically in free fall mode on Friday, closing near 4,130, and it has now dropped nearly 8.5% since peaking on April 20. It certainly feels like the sell-off we saw on Friday isn’t over. Given where support is for the S&P 500, we could easily see a drop to around 4,020 on the S&P 500 before getting any bounce mid-week.

The best chance for a rally will come on Wednesday following the FOMC meeting. There is a sense of nervousness that the Fed could shock the markets, but I think that is highly unlikely to happen. Additionally, the FOMC meetings have served as events where stocks rally following the press conferences.

At this point, the most obvious place for the S&P 500 to rally back to is around 4,300. However, this will be tricky because a lot of this will depend on where markets are heading into the FOMC news on Wednesday. So I do not think any rally will last or that we will start some new bull market. I don’t believe that is likely.

I don’t see how this market rallies unless the Fed pivots to a more dovish stance or valuations get low enough that fundamentals can support the market. I don’t think fundamentals can help this market yet. So lower prices are likely to come after any FOMC rebound.

TIP (TIP)

The TIP ETF will also need to be watched because it broke down late in the day on Friday. Around 2:30, the ETF and real yields saw a very sharp move, with the 10-year TIP rate surging around -10 bps up to 0 bps. It isn’t clear what happened, but it was a massive move in only a brief period.

10-Year Yield

Of course, the move higher in real yields was accompanied by a move higher in nominal yields, with the 10-year rate rising to 2.94%. The 10-year rate is again approaching 3%, and it doesn’t seem like there is much standing in its way of climbing to the 3.25% region.

Amazon (AMZN)

Amazon was the biggest loser on Friday, dropping by nearly 15%. Given how poor the results have been the past few quarters, I think investors have finally given up on the name. It is all about the support region, around $2,450 to $2,475. If that holds, you may see a rebound up to resistance around $2650; if not, the chart suggests a drop to $2,025.

Meta Platforms (FB)

The only good part of Facebook’s better results was that the numbers weren’t as bad as everyone thought. That doesn’t mean the stock should trade up as much as it did, however. I would think that the stock may fill the gap at around $177 over time.

Tesla (TSLA)

Tesla looks pretty weak here, and the stock has struggled to get over the technical resistance level at $910. I think this stock is now at a point where the best days are behind it. The shares are likely to struggle as investors begin to think about the potential growth rate for future deliveries being too high. I would watch for a break of technical support at approximately $840.

AMD (AMD)

AMD continues to deflate, and there isn’t much keeping this stock from falling back to $73.50. Yes, the valuation is getting favorable, but after Intel’s disappointing guidance and the weakness in the semis in general, you have to wonder, if we could see the stock trading sub-$80 very soon.

Nvidia (NVDA)

Nvidia has also dropped, and now the shares are approaching $180. There may be no support after that until the mid-150's.

Disclaimer:

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with ...

more