3 Of The Best Dividend ETFs For 2021

Since August interest rates have been moving higher. The 10-year U.S. Treasury Note’s yield has moved from 60 basis points to 1.6%.

On a historical basis, this is still very low. Investors seeking income may have better choices than buying treasuries.

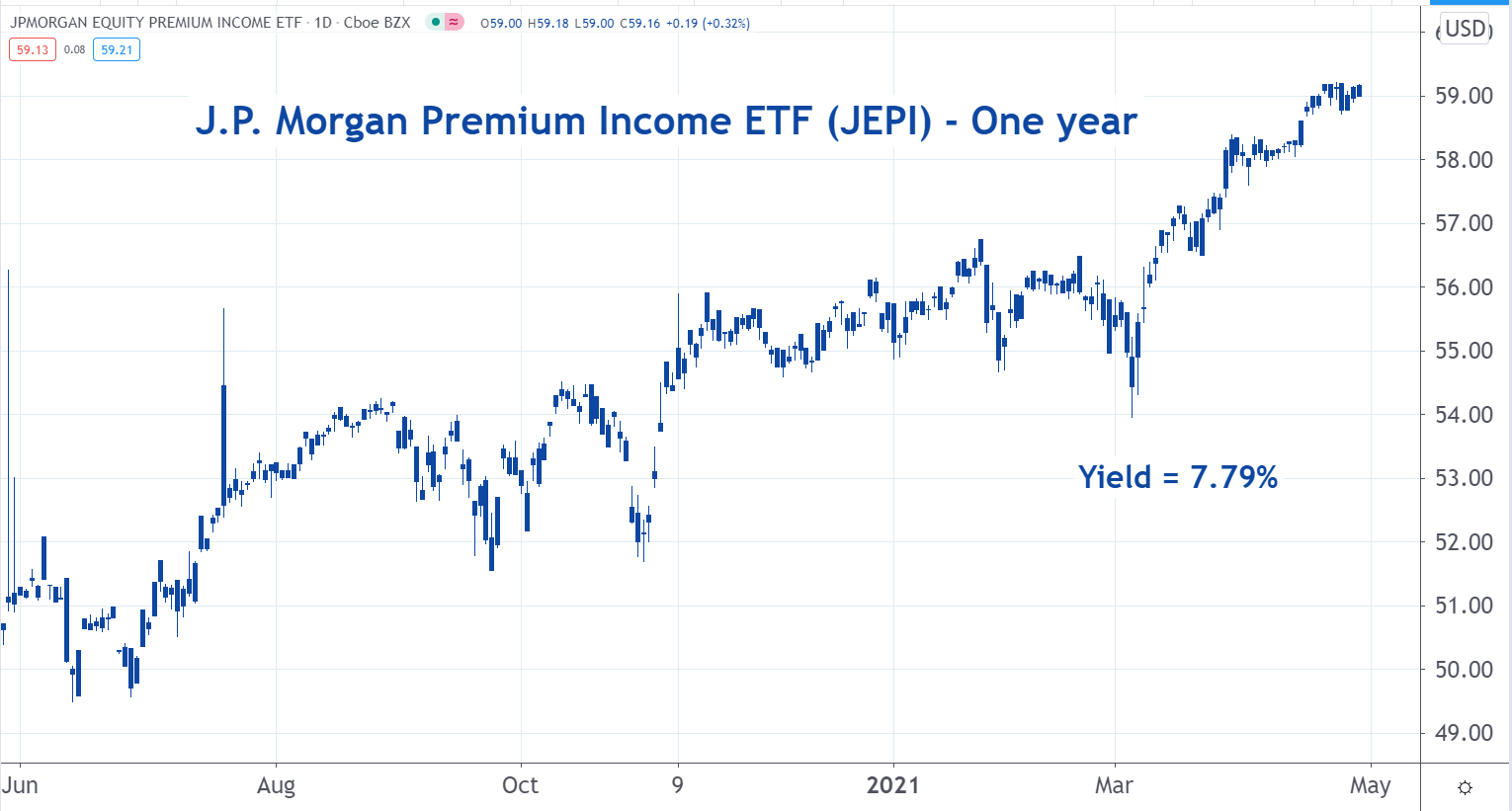

Some ETFs are structured to pay high dividends. These include the JPMorgan Equity Premium Income ETF (NYSE: JEPI), the Global X SuperDividend U.S. ETF (NYSE: DIV), and the Invesco KBW High Dividend Yield Financial ETF (Nasdaq: KBWD). All three are paying dividends that yield more than 6%.

The JP Morgan Income ETF generates income buy selling options and investing in high yielding large-cap stocks. It's currently yielding about 7.7%.

(Click on image to enlarge)

The Global X SuperDividend ETF invests in 50 of the highest dividend-yielding equity securities in the United States. It's yielding about 6.2%.

(Click on image to enlarge)

The Invesco High Yield Dividend ETF invests at least 90% of its assets in publicly traded companies with high dividend yields. The yield is about 6.90%.

(Click on image to enlarge)

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.