3 Industry Leaders To Own Into Year-End

Image: Bigstock

This earnings season, several stocks plummeted 20% or more after earnings. I recently posted an article that talks about averting such disasters. With that said, earnings season is behind us, and the stock market is pulling back to significant price support for the first time since breaking out earlier this year. Below are three companies with significant catalysts that are at the top of their respective industries and are likely to move higher into year-end.

Coinbase (COIN - Free Report)

Zacks Rank #3 (Hold) Coinbase Global is the leading cryptocurrency exchange in the United States. Coinbase allows users to buy, sell, and trade various cryptocurrencies. Since going public in 2021, COIN investors have endured a crypto winter, an equity bear market, and scrutiny from regulators.

Catalysts - Bitcoin is Strong and Ready to Break Out

Like most crypto-related stocks, COIN is correlated to Bitcoin. Bitcoin has shown relative strength as of late. Furthermore, Bitcoin’s volatility has fallen sharply – a hint that a big move may be around the corner.

Image Source: TradingView

ETF Approval

Mike Novogratz, CEO of Galaxy Digital, recently said it is a “question of when, not if” Bitcoin ETFs get approved. Because COIN is the custodian exchange listed for Blackrock (BLK) and for every ETF listed, this is a significant catalyst for the firm.

COIN is Likely to Win the Lawsuit Against SEC

Last month, a US judge ruled that XRP token purchases via exchanges were not securities transactions. The ruling was a surprise win for XRP parent Ripple and a hint that COIN will likely win its ongoing legal battle versus the SEC.

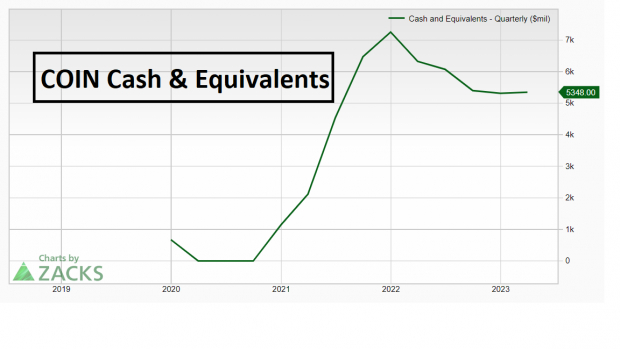

Strong Balance Sheet

In an uncharacteristic statement, legendary value investor Seth Klarman recently stated, “Coinbase is sitting on $5 billion in cash, has less than that in debt, and is doing some smart things.”

Image Source: Zacks Investment Research

Tesla (TSLA - Free Report)

Tesla is the pioneer and leader in the electric vehicle (EV) market. The company’s EVs gained widespread acclaim and adoption because of their performance, range, and advanced technology.

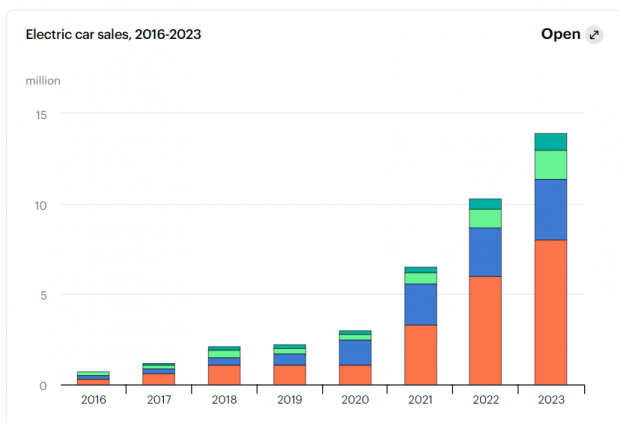

Exponential EV Growth

The EV market is growing at a blistering rate and is expected to continue growing. According to the International Energy Agency (IEA), between 2020 and 2022, the share of electric car sales rocketed from about 4% to 14%.

Image Source: IEA

Rising oil and gas prices and a more extensive charging network should also spur growth.

Buybacks and Investments

At the start of 2023, Tesla CEO Elon Musk was concerned about a potential recession. However, Bank of America (BAC - Free Report) analysts and other Wall Street juggernauts are flipping, and now expect that the economy is likely to avert a recession and have a "soft landing.” With recession concerns in the rear-view mirror, Musk is likely to put the growing cash hoard the company has to use in the form of stock buybacks or investments.

Cybertruck Launch

Tesla will soon start mass production of its one-of-a-kind Cybertruck. If the Cybertruck is anything like the other Tesla vehicles, it will be a hit (with high margin, too).

Baidu (BIDU - Free Report)

Baidu is China’s largest search engine and serves as China's equivalent to Alphabet (GOOGL - Free Report). BIDU owns 75% of the search market in China, however, it is growing beyond just the search space.

Artificial Intelligence (AI)

Baidu is the Chinese leader in AI and is bound to take advantage of being the “first mover” in the Chinese market. The search giant is launching an “Ernie Bot” AI service that the company claims is more powerful than Microsoft (MSFT - Free Report) and OpenAI’s wildly popular ChatGPT. Regardless of whether or not that’s true, Baidu enjoys the fact that US websites are blocked in China.

Rebounding Economy

Between a sinking economy and a government crackdown, BIDU and other public Chinese companies have endured the proverbial “kitchen sink” being thrown at them. However, recently, the government is showing signs of becoming more business-friendly and is hinting at government stimulus into year-end.

BIDU is benefiting from rising equity prices in China. For example, the iShares China Large-Cap ETF (FXI - Free Report) is up more than 20% off its 2022 lows.

Image Source: TradingView

More By This Author:

Airline Stock Roundup: Q2 Earnings Beat At Copa Holdings, Narrower Y/Y Loss At Azul & More3 Buy-Rated Construction Stocks With Bright Outlooks

3 Glenmede Funds To Buy For Impressive Returns

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more