3 ETFs To Play A Potential Energy Crisis

Coming into last week, the price of a barrel of crude oil had increased by over 80% in the prior six months. This had investors nervous.

Then came the news that the Colonial Pipeline was successfully shut down by a cyberattack. Now there are reports of panic buying in the southeastern part of the country. This attack, added to signs of inflation that are appearing in different parts of the economy, means there’s a good chance the price of oil keeps moving higher.

Why it's Important: There’s a way that investors can profit from rising oil prices. They can buy ETFs that invest in companies in the oil industry.

These ETFs include the Energy Select Sector SPDR Fund (NYSE: XLE), the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP), and the Alerian MLP ETF (NYSE: AMLP).

XLE tracks the price and yield of the companies in the S&P 500 Energy Sector. These include companies in the oil, gas, and consumable fuels industries. There are also companies in the energy equipment and services industries.

(Click on image to enlarge)

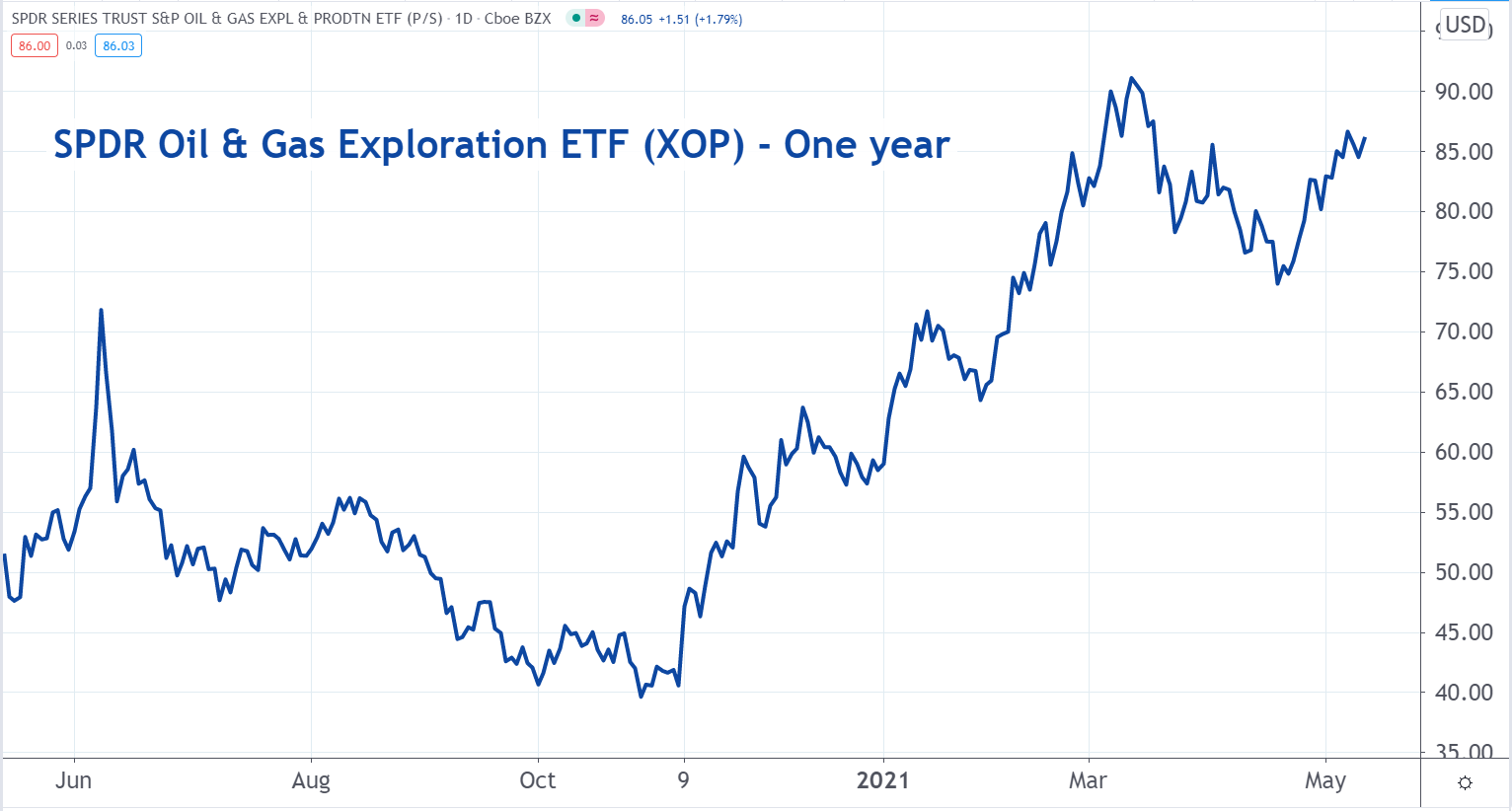

XOP seeks to track the performance of the S&P Oil & Gas Exploration & Production Select Industry Index. It invests in companies that are in the oil and gas exploration and production industries.

(Click on image to enlarge)

AMLP tracks the Alerian MLP Infrastructure Index. It invests in companies that get a majority of their revenues from the transportation, storage, and processing of energy commodities.

(Click on image to enlarge)

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.