3 Carbon Capture ETFs To Consider

Carbon capture is a process that captures carbon dioxide emissions. The carbon is either reused or stored so it won’t enter the atmosphere.

Investors are buying stocks of carbon capture companies because they think these companies will benefit from the "Green New Deal".

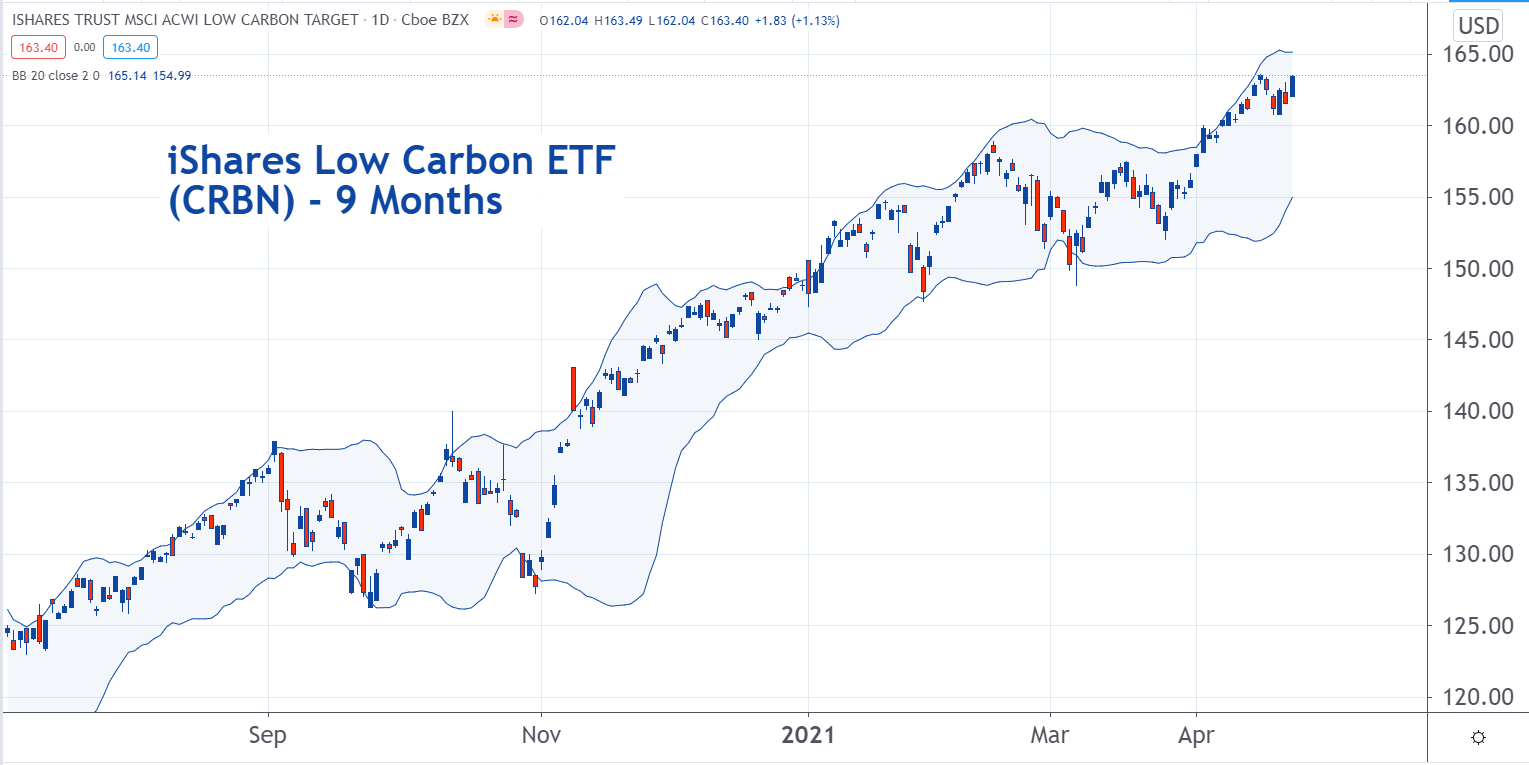

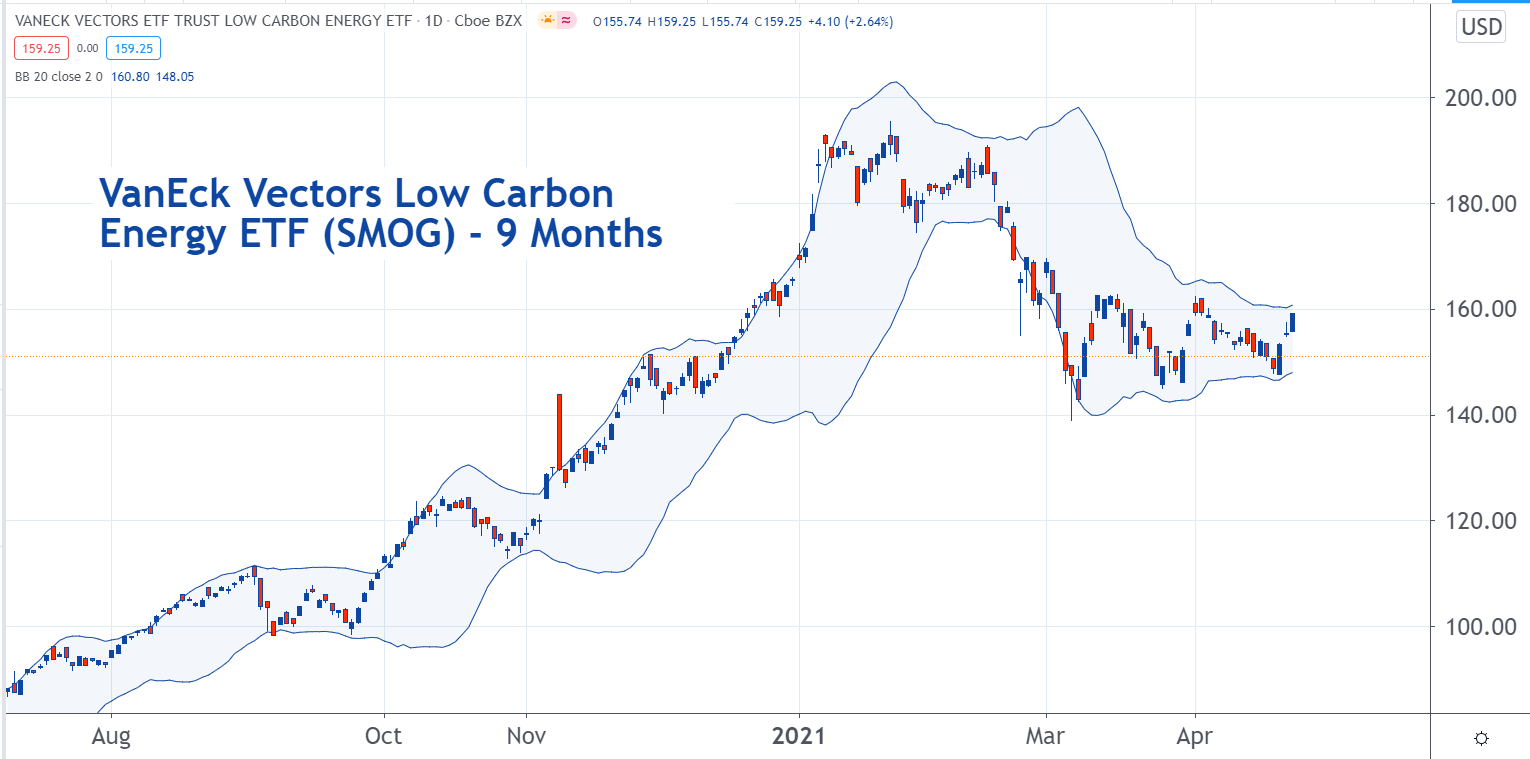

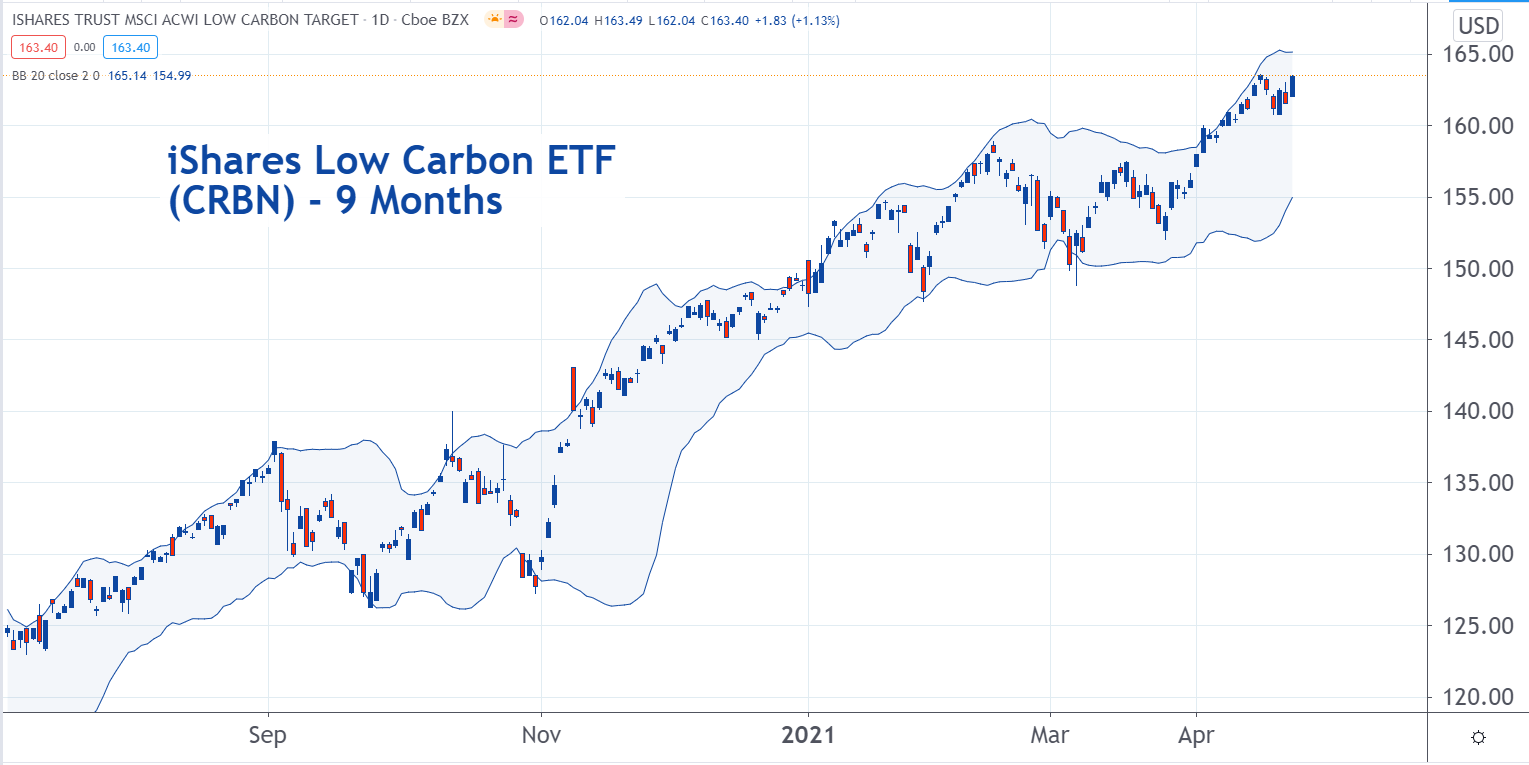

Investors interested in this part of the market but who are seeking some diversity should consider carbon capture ETFs. These include the KraneShares Global Carbon ETF (NYSE: KRBN), the VanEck Vectors Low Carbon Energy ETF (NYSE: SMOG), and the iShares MSCI ACWI Low Carbon Target ETF (NYSE: CRBN).

KRBN has net assets of $38.7 million. The average daily volume is about 300,000. The expense ratio is 0.79%.

(Click on image to enlarge)

SMOG is larger than KRBN. It has net assets of about $305 million. The 0.62% expense ratio is also lower.

(Click on image to enlarge)

CRBN is the largest, and cheapest, of these ETFs. It may be the best option of the three. The net assets are $770 million and the expense ratio is 0.20%.

(Click on image to enlarge)

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.