2 ETFs To Play The Lumber Shortage

Retail investors can make money in the commodities markets. Lumber is a prime example right now.

The soaring prices of lumber have become mainstream news. The price per thousand board feet has moved from $320 to $1,675 over the past year, the highest it has ever been.

Hedge funds use complicated strategies to trade these markets. The strategies include the use of derivatives, swaps and futures. But there are also ways for everyday investors to get exposure to these markets.

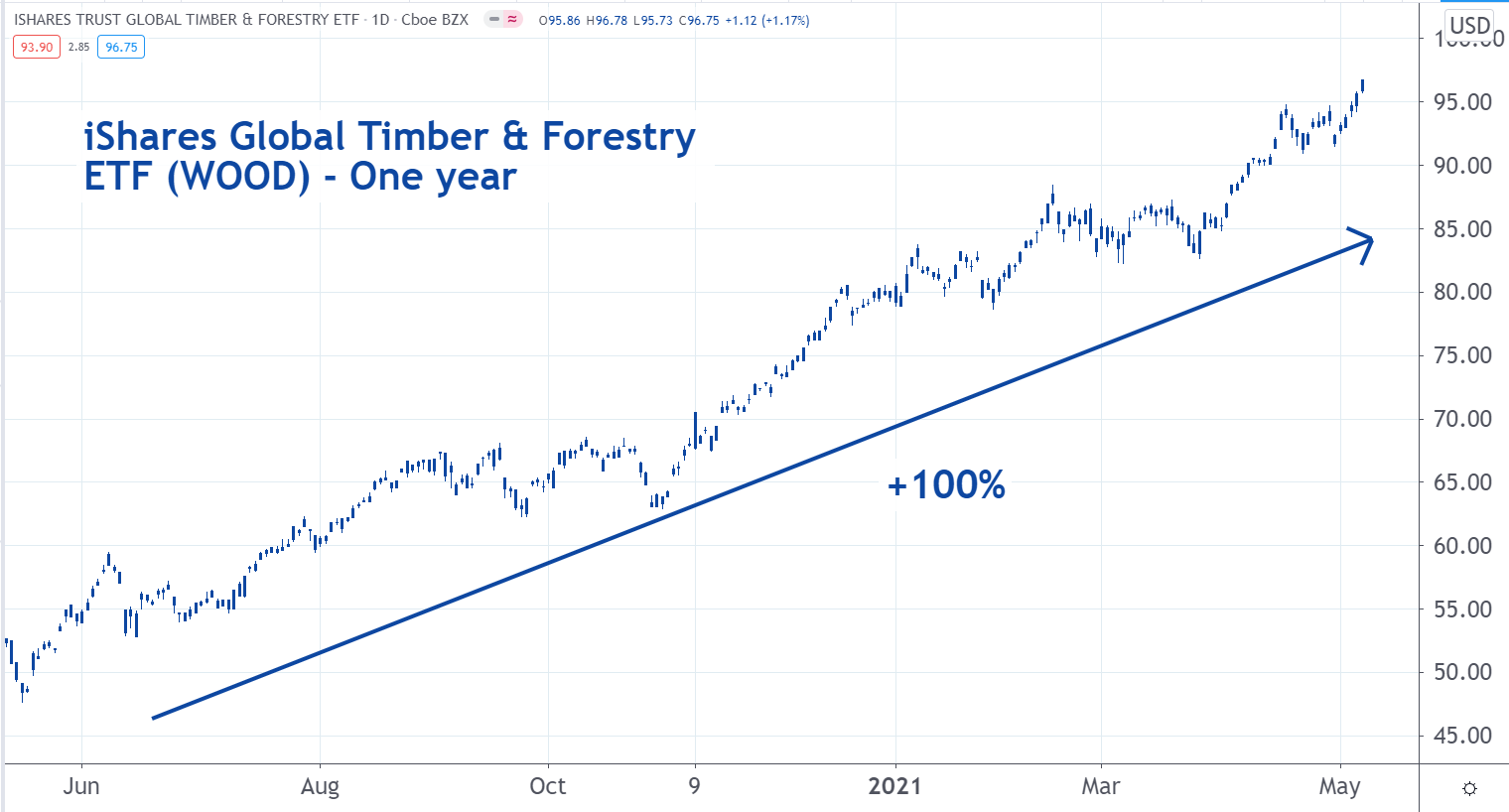

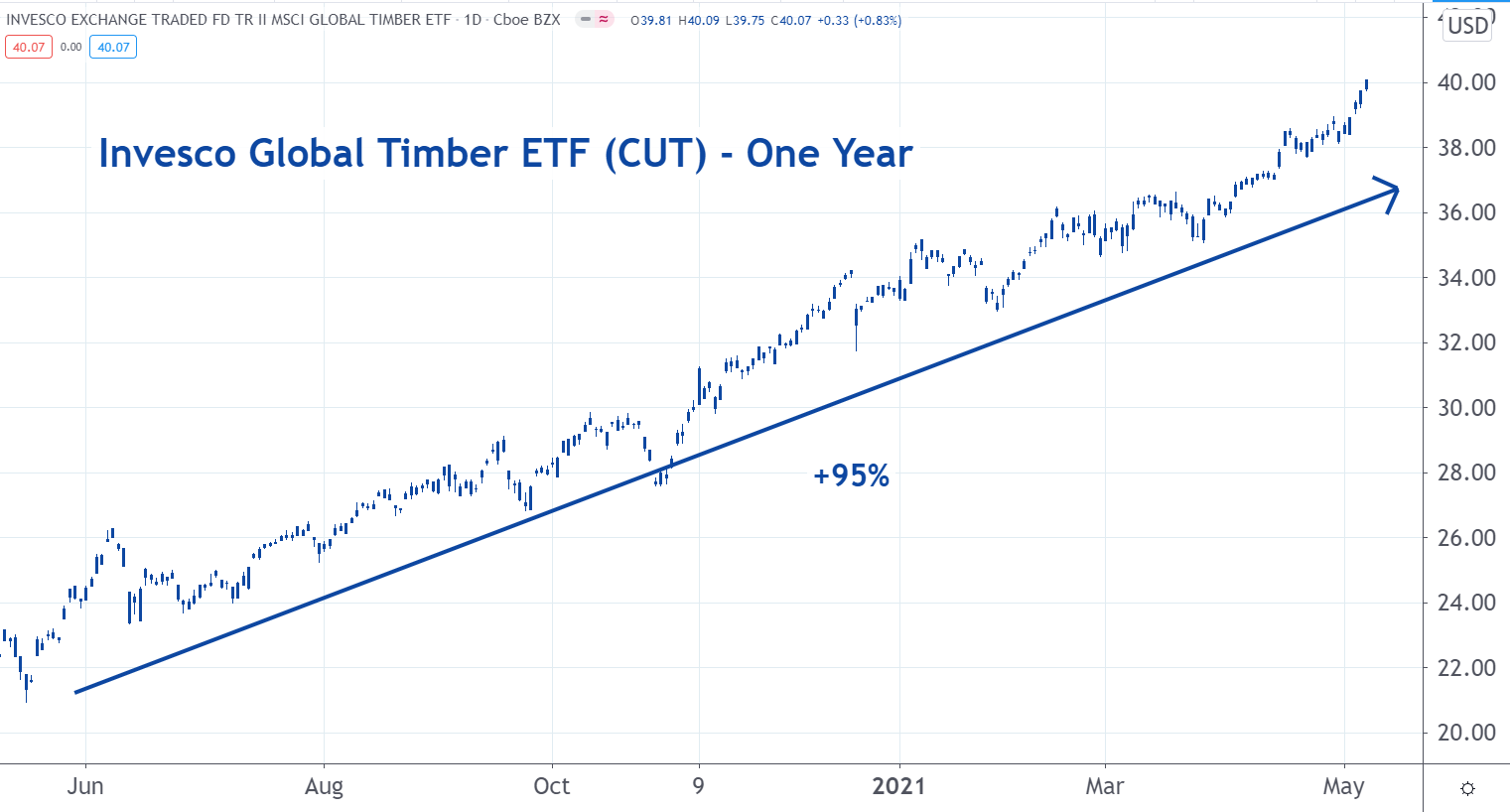

They can use ETFs, such as the iShares Global Timber & Forestry ETF (WOOD) and the Invesco MSCI Global Timber ETF (CUT).

WOOD is designed to follow an index of equities that are in the timber and forest industry. As the price of lumber increases, many of these companies become more profitable.

If lumber prices continue to move higher, so should the price of WOOD.

CUT seeks to track the MSCI ACWI IMI Timber Select Capped Index (Index). This index measures the performance of securities that own and manage forests, timberlands, and the production of products that use timber as raw materials.

If lumber prices continue to soar, the price of CUT should keep moving higher.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.