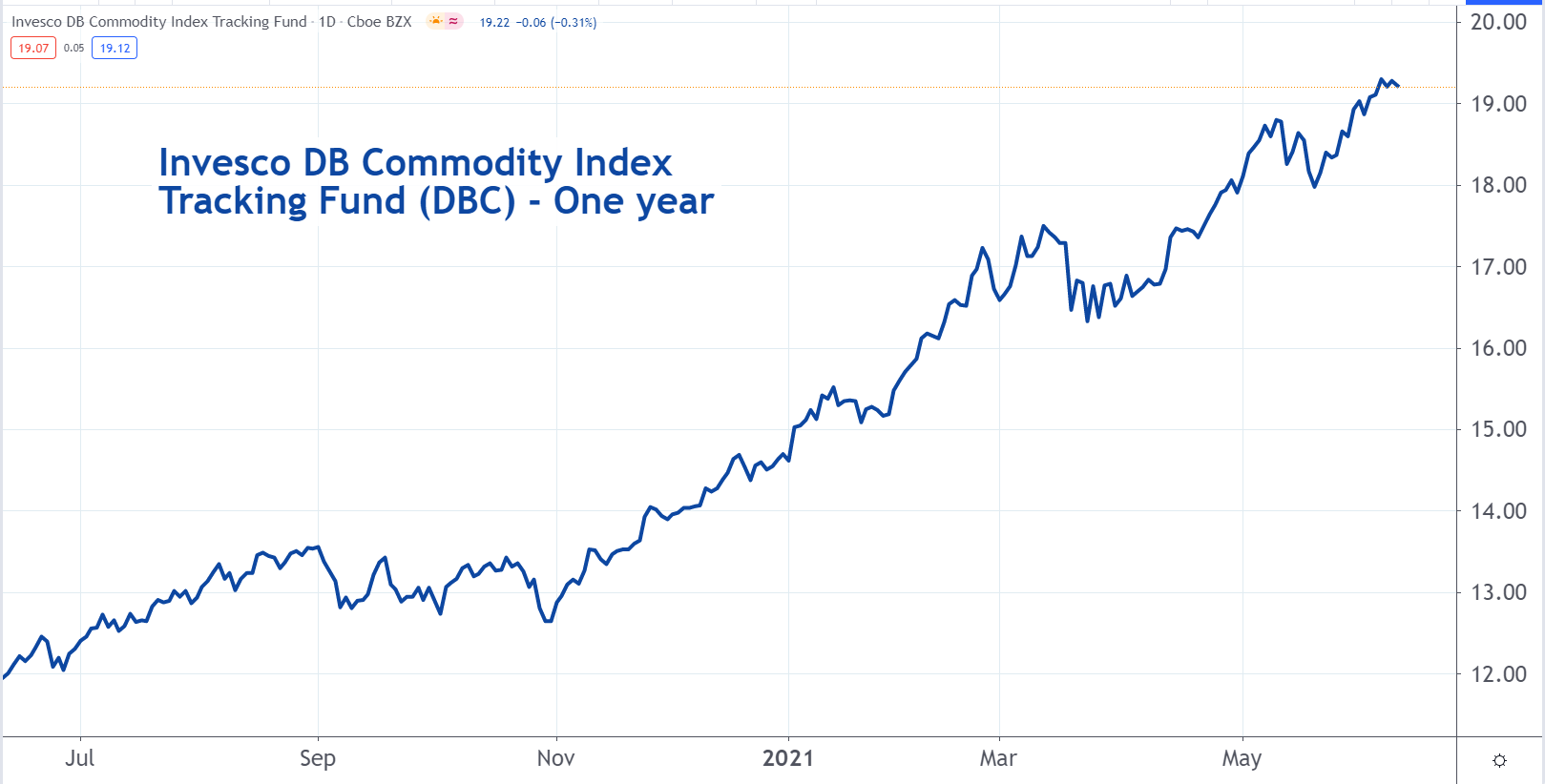

2 Commodity ETFs For Inflation

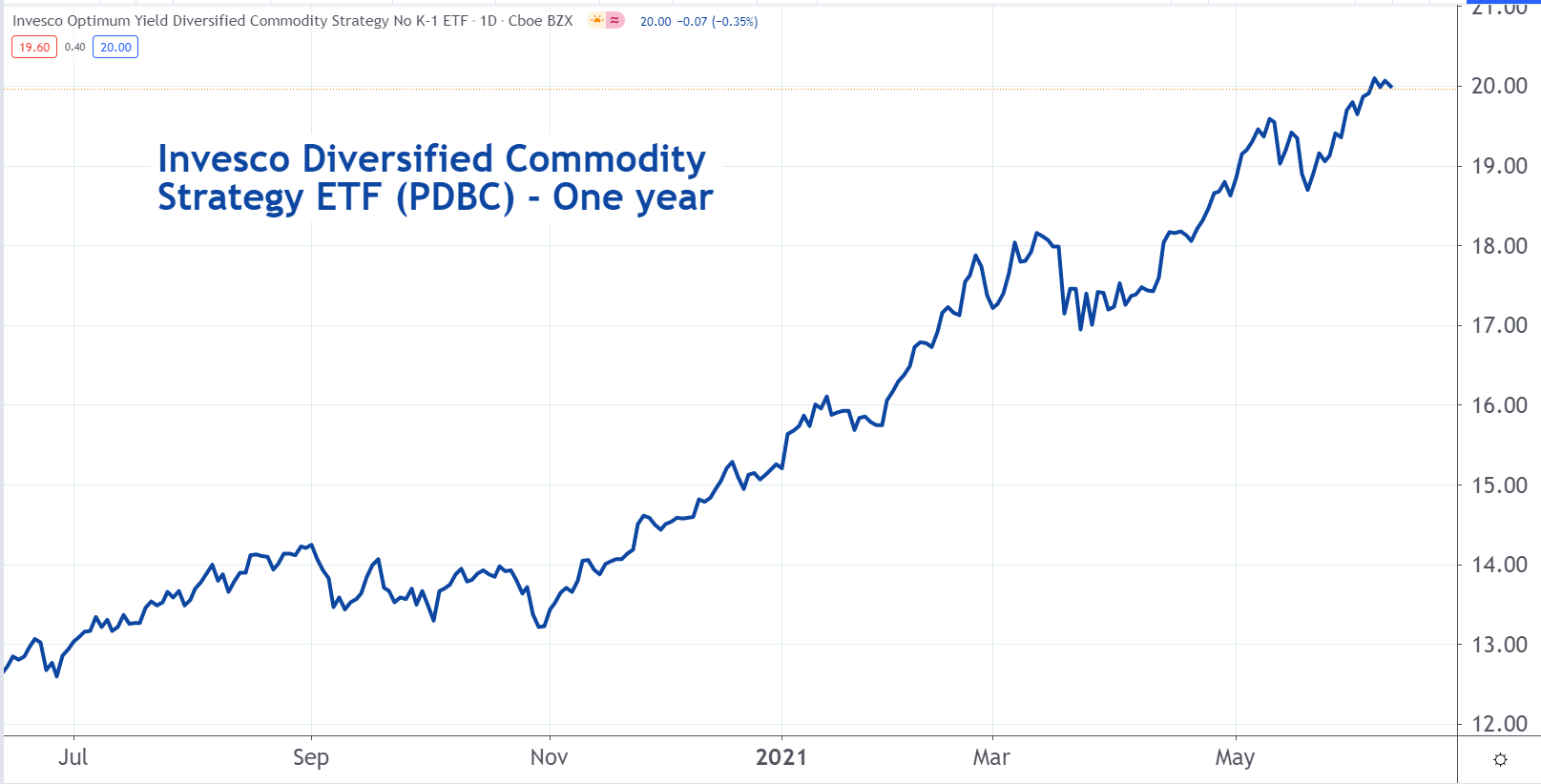

As inflation moves higher, so do the prices of commodity-based ETFs. These include the Invesco DB Commodity Index Tracking Fund ETF DBC, and the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF PDBC.

DBC tracks an index of a basket of commodities. It's considered a passive investment. There are no portfolio managers or analysts making decisions. It's designed to have the same returns that the index does.

(Click on image to enlarge)

PDBC is an actively managed fund. This means there are portfolio managers and analysts making decisions regarding the investments that the fund makes. The goal is to exceed the returns of the index.

This ETF is considered to be riskier than DBC. There’s a chance it doesn’t meet its goals and posts results that are worse than the index.

(Click on image to enlarge)

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.