ESG: What Does The Future Of Investing Look Like?

A trend has the investment community buzzing with excitement, with talk about it reimagining how investors evaluate positions: ESG. But what is ESG? Is it a marketing gimmick? Or a fundamentally based investment strategy? Moreover, is ESG something that an average investor should take notice of and incorporate into their portfolios for the long term?

Here, we will discuss the development of ESG, its current outlook, including the challenges it must overcome and the potential opportunities it presents.

The Three Components of ESG. Source: Invesco.

ESG stands for Environmental, Social and Corporate Governance. It is often used as a catch-all term for sustainable investing (see above graphic). ESG takes these three factors and incorporates them into asset evaluations. Specifically, ESG uses these factors to better identify risks and opportunities of assets that may be disregarded by traditional valuation metrics and processes. The environmental portion of ESG gauges an asset’s impact on the environment. This can include concerns about carbon emissions produced, water or waste management practices, impact on deforestation or biodiversity, energy efficiency, to name just a few.

The social portion of ESG evaluates an asset’s business relationships. This can include diversity (such as gender and ethnicity), animal welfare practices, consumer protection practices, labor standards, data protection standards, respecting religious beliefs, employee health standards and impact on local communities, among other concerns.

The governance portion of ESG explores how a company is run. This can include considerations like business ethics, anti-competitive behavior, corruption, tax evasion, management structure, executive compensation, employee compensation, lobbying practices, and transparency to stakeholders.

After understanding what ESG takes into account one might be left wondering: which factor (environmental, social or governance) is most important? To this question, there is no easy answer for a variety of reasons.

First, when evaluating each factor there is a high level of subjectivity. For example: when evaluating a company’s environmental impact, one fund manager may focus solely on carbon emissions, while another may focus instead on water use, waste disposal practices, impact on deforestation, and more. Depending on what one investor (or manager) believes should be taken into account for each ESG factor will change how companies are evaluated.

Second, even if all ESG investors agreed on what concerns should make up each ESG factor, there would still be wide disagreement regarding which concerns should take precedence. Suppose for ESG’s social factor all investors agreed that companies should be evaluated on diversity, labor standards, and animal welfare practices. Leaving aside the fact that there are many ways to evaluate a company’s diversity, labor standards and animal welfare practices, should each of these concerns be given a third weight? Or, are they important to varying degrees? These questions can only be answered by an individual depending on their own preferences.

Third, each investor (or manager) must decide how important environmental, social and governance factors are in relation to one another. Perhaps the three categories each carry equal weight. Or, perhaps one is most important, diminishing the impact of the other factors. No matter what, there is no simple solution to each one of these three dilemmas.

As exhibited in the above paragraph, ESG is an inherently subjective and, thus, qualitative. This can be well illustrated by the fact that there is no standardized methodology for evaluating ESG metrics of companies. Proponents of ESG will (correctly) point out that steps have been made to better formalize processes for evaluating ESG standards. However, much work still needs to be done in this area to truly allow ESG to become mainstream.

ESG is not simply an attempt to “do good” while investing. It is a strategy designed to outperform the market. An ESG strategy believes that the environmental impact, social practices and governance of a company will actually have major impacts on the performance of a company long term. So, ESG ties previously assumed non-financial concerns with the valuation of a company. ESG is often mistaken for other investment philosophies like Socially Responsible Investing (SRI). The major difference between ESG and SRI is that SRI simply eliminates companies that do not align with a certain set of values (such as avoiding owning oil and tobacco companies due to ethical concerns). On the other hand, ESG attempts to identify opportunities presented by a company’s environmental, social and governance practices (missed by traditional valuation metrics) that provide value to investors and avoid companies that pose large risks (in other words ESG does not merely support a certain set of values).

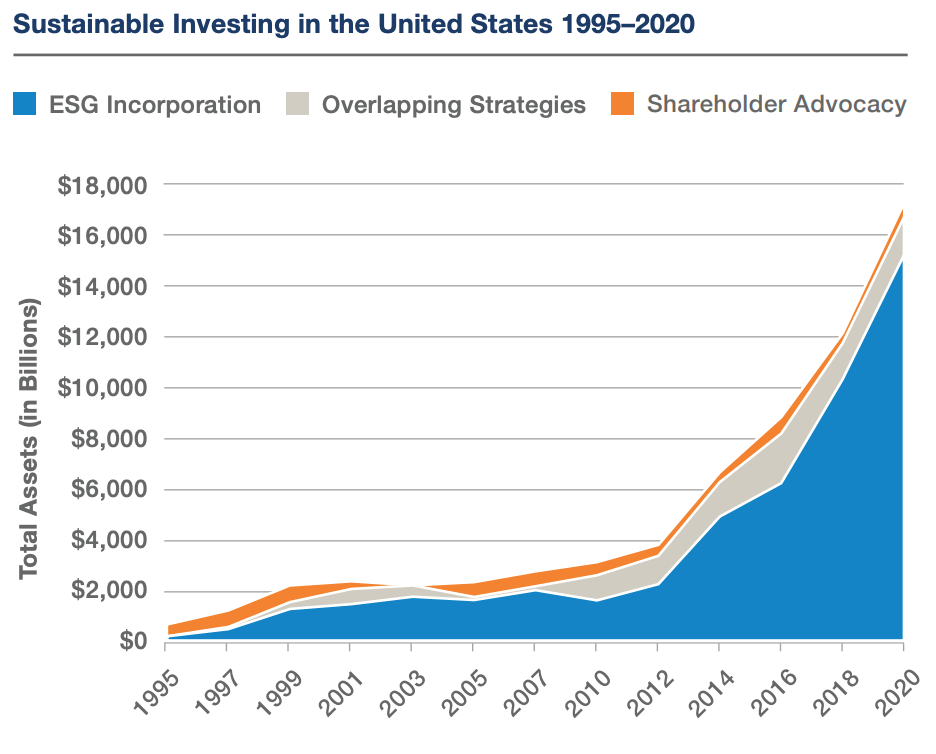

Sustainable Investing in the U.S. Over Time. Source: U.S. SIF Foundation

ESG’s credibility has been bolstered by massive inflows into funds focused on ESG strategies. Funds that use ESG methodologies hold one-third of all assets under management in America, or about $17 tillion (see above graphic). Globally, this figure is much greater, at about $37.8 trillion. ESG funds globally are expected to continue to grow to about $53 trillion by 2025, following historical 15% growth rates. The impressive performance of ESG also adds to its notoriety. From the period March 2020-March 2021, 73% of ESG funds have outperformed the S&P 500, many by substantial margins. This is in large part due to ESG funds’ significant holdings of technology stocks that have seen large rises due to COVID. In many ways, ESG funds often resemble quality factor funds. More broadly, the largest ESG ETF, iShares ESG Aware MSCI USA ETF (NASDAQ:ESGU), which has nearly $18 billion in assets under management, has outperformed the S&P 500 over a three-year period, offering a 19.1% annualized return, compared to the S&P 500’s roughly 18% annualized return. Whether or not this outperformance will continue, though, is anyone’s guess.

Empowering investors to invest while honoring their values without sacrificing returns is what ESG is all about. It has taken off in recent years and seems destined only to gain more and more widespread adoption. ESG faces many challenges and skeptics. To successfully take on these impediments ESG methodology standards must become more transparent and formalized. After all, the whole point of ESG investing is to allow investors to control where their money goes, and guide it to companies that provide unique opportunities and align with ESG values. Funds that bill themselves as ESG friendly must be able to ensure that the companies they invest in truly uphold the values they profess. I expect the ESG revolution to accelerate to even greater heights over the coming years. The future will be a more green, equitable and transparent one, and ESG is simply allowing investors to embrace this reality.

Disclosure: None.