ESG Metrics: Just Information Or Value-Added Investment Intelligence?

Image Source: Pexels

The integration of Environmental, Social, and Governance (ESG) metrics into investment decision-making has become increasingly prevalent among institutional investors and asset managers. As portfolios incorporate more sustainability data—from climate impact assessments to labor practices and board diversity metrics—a critical question emerges: Does this wealth of ESG information actually enhance portfolio performance, or is it merely additional data without tangible investment value?

The Research: A Comprehensive Analysis

Giovanni Bruno, Felix Goltz, and Antoine Naly, authors of the June 2025 study “Does ESG Information Deliver Investment Value? A High-Dimensional Portfolio Perspective,” provided important insights into this debate. The researchers adopted a rigorous methodology that mirrors real-world investment constraints by using only information that would have been available to investors at the time they constructed their portfolios.

Study Parameters

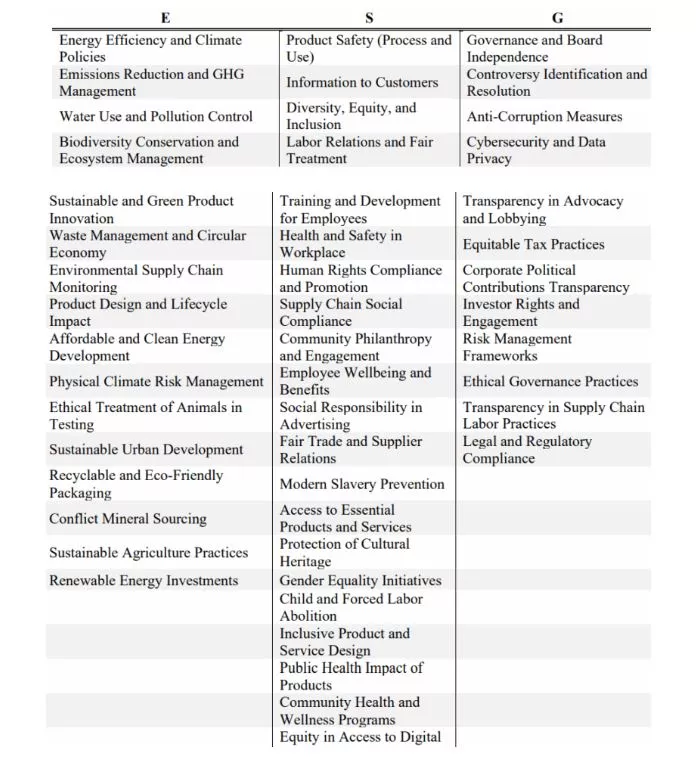

The research analyzed an extensive US dataset spanning from August 2008 to June 2023, incorporating 222 ESG metrics (each with at least 15 years of historical data) and 130 standard financial characteristics (including valuation, momentum, and quality factors).

The study specifically evaluated ESG metrics from the perspective of investors seeking to improve their portfolio’s Sharpe ratio, rather than those motivated by sustainability goals alone. The following is a summary of their key findings:

ESG Factors Are Not Redundant

The research revealed that ESG factors had low correlation with traditional financial factors, with average pairwise correlations ranging from -0.18 to 0.31. This finding suggests that ESG metrics capture unique information not already reflected in standard financial characteristics, indicating their potential complementary value (diversification benefits) in portfolio construction.

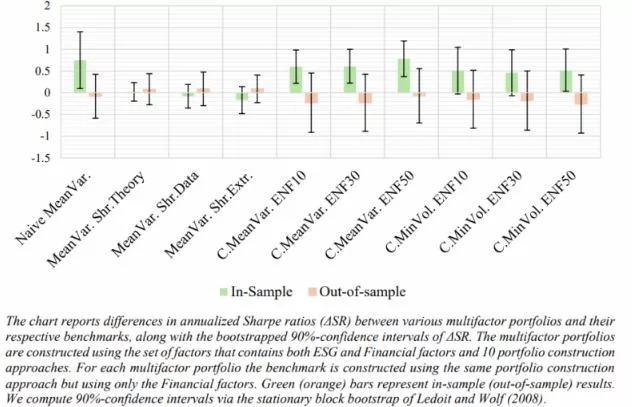

The Out-of-Sample Reality Check

While ESG information showed promise in traditional backtests, the results were strikingly different when subjected to out-of-sample testing. This rigorous evaluation method—which better simulates real-world investment conditions—revealed that ESG integration added no measurable value to portfolio construction. This discrepancy between backtest results and out-of-sample performance highlights a crucial distinction between theoretical potential and practical implementation.

Incremental value (Sharpe ratio increase) of ESG information

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

The Sustainability Paradox

The financially optimal use of ESG information does not necessarily lead to positive sustainability outcomes. The research found that effective ESG integration involves both:

- “Green” tilts: Emphasizing ESG leaders in areas like human rights and water resource management.

- “Brown” tilts: Emphasizing ESG laggards, including consistent allocation to sin stocks across different portfolio construction methods—purely financially motivated ESG integration may not align with investors’ sustainability objectives.

Volatility Reduction

Contrary to the expectations of institutional investors (61% of whom believe that integrating ESG criteria in portfolio construction can help reduce volatility), adding ESG characteristics to traditional financial metrics did not result in significant volatility reduction in out-of-sample tests, challenging another commonly cited benefit of ESG integration.

Investment Implications:

The research findings carry important implications for investors considering ESG integration:

For Investment Practitioners

- Scrutinize performance claims: Demand out-of-sample testing rather than relying solely on traditional backtests.

- Understand the trade-offs: Recognize that financially optimal ESG integration may conflict with sustainability goals.

- Manage expectations: ESG integration may not deliver the performance benefits or risk reduction often promoted.

For Asset Managers

- Transparent communication: Clearly distinguish between ESG integration for financial returns versus sustainability impact.

- Robust testing: Implement comprehensive out-of-sample validation for ESG-enhanced strategies.

- Client alignment: Ensure ESG approaches align with clients’ primary objectives—whether financial or sustainability-focused.

Summary: A Balanced Perspective

The research by Bruno, Goltz, and Naly provides a sobering, yet valuable, perspective on ESG integration. While ESG metrics offer unique information not captured by traditional financial factors, their practical investment value remains questionable when subjected to rigorous out-of-sample testing.

For investors, this doesn’t necessarily mean abandoning ESG considerations entirely. Instead, it suggests the need for:

- Realistic expectations about ESG integration benefits.

- Clear alignment between ESG approaches and investment objectives.

- Rigorous validation of ESG strategies before implementation.

As the authors concluded:

“For investors, this means they need to set realistic expectations about what ESG integration can achieve. And when faced with claims about performance benefits, they need to require out-of-sample testing, not just traditional backtests.”

More By This Author:

The False Dichotomy: Why The Active Vs. Passive Fund Debate Misses The PointUnlocking REIT Returns: Real Estate Investment Factors

Hindsight And Survivorship Biases In Managed Futures