ESG Investment Leads The Fight Against Climate Change

Capital markets will be crucial for funding the transition to a net zero carbon economy.

Green investment is essential for sustainable economic growth and to fund the transition to a low-carbon economy. Profound economic transformation is required to keep global warming below 2 degrees Celsius above the pre-industrial average – which scientists say is crucial for avoiding climate change tipping points that will bring potentially catastrophic environmental, social and economic impacts.

Key takeaways:

- Winners and losers from decarbonisation pose opportunities as well as risks for investors.

- Capital markets will play a key role in mobilising the huge investment necessary for the transition to a net-zero carbon economy.

- Investors are demanding greater transparency and engagement to ensure sustainable investment and minimise ‘green washing’.

Green investment is essential for sustainable economic growth and to fund the transition to a low-carbon economy. Profound economic transformation is required to keep global warming below 2 degrees Celsius above the pre-industrial average – which scientists say is crucial for avoiding climate change tipping points that will bring potentially catastrophic environmental, social and economic impacts.

Massive investment is required for the transition to a low-carbon economy and to mitigate the impact of climate change, creating opportunities for investors to benefit from new, fast-growing industries and technologies.

The International Energy Agency estimates that the energy sector alone will require the equivalent of 10% of global GDP to achieve net zero by 2050, with huge public and private financing needed in:

- Electricity distribution

- Storage infrastructure

- Renewable energy

Increasing carbon taxes and green investment will create winners – clean energy, new technologies, healthcare – and losers such as fossil fuels and utilities. Stranded assets would include real estate and agricultural land that becomes untenable due to climate change, as well as fossil fuel reserves.

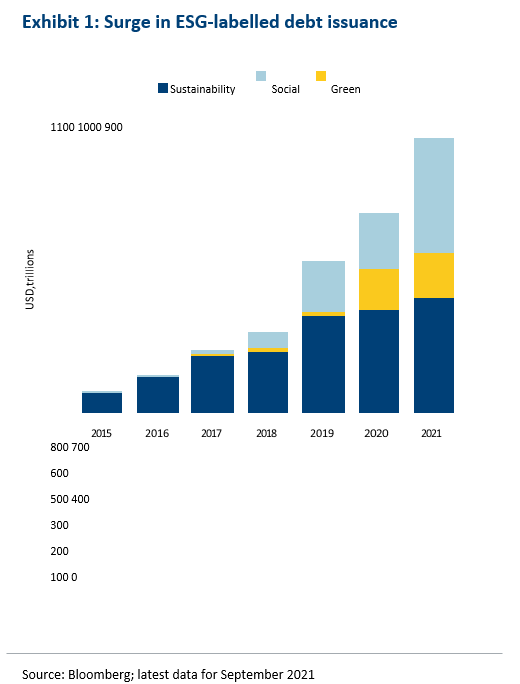

ESG debt issuance reaching new highs

The bulk of investment will come from the private sector to fund the transition to a net zero-carbon economy. As action to limit global warming and climate change becomes mores urgent, governments and businesses are increasingly going to capital markets to fund green investment.

Recent years have witnessed a surge in Environment, Social and Governance (ESG) debt issuance, accelerated by Covid, which has brought into sharp focus concerns over health and social inequalities within and between countries as well as in response to the increasing urgency of the transition to net zero.

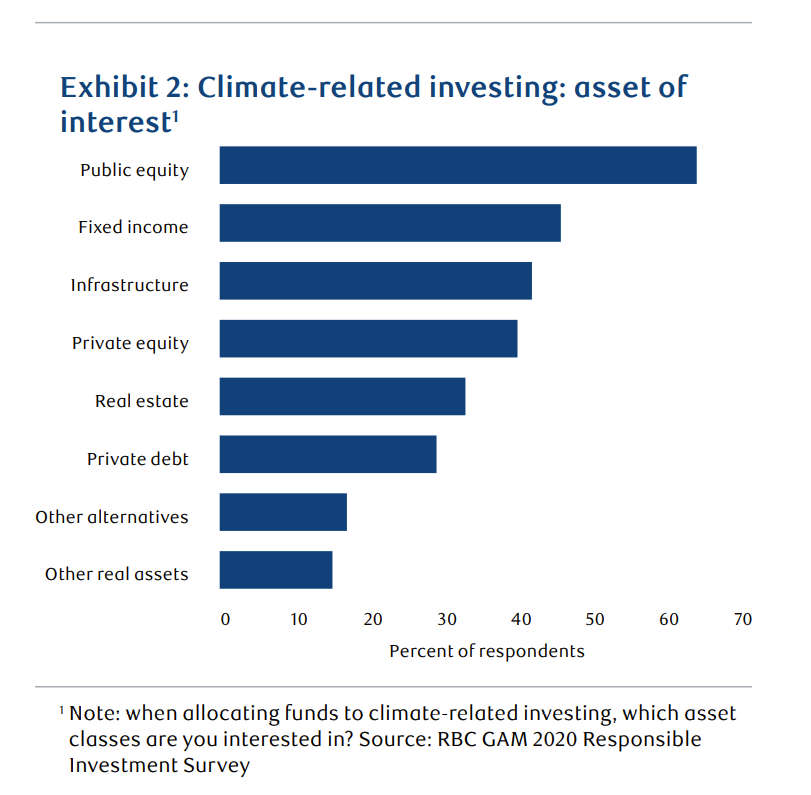

The market for ESG-labelled issuance currently stands at about $3 trillion, and this year’s figure already exceeds $1 trillion, according to Bloomberg estimates. (Exhibit 1). ESG corporate bond and loan issuance has picked up dramatically this year, nearly all tied to sustainability targets. More broadly, ESG assets under management is already some $35 trillion, more than a third of total AUM. RBC’s latest investor survey found a growing appetite for sustainable investment strategies across a wide range of public and private assets (Exhibit 2).

Investors are demanding greater transparency and engagement from issuers and asset managers to ensure that their capital is effectively and appropriately allocated to support the transition to a net-zero carbon economy and to minimise ‘green washing’.

Central banks and governments are also responding to the challenge of climate change. The European Central Bank and the Bank of England plan to incorporate ESG and climate change related criteria into their asset purchases, essentially to ‘green’ their corporate bond portfolios, while the UK recently joined other governments in issuing ‘green bonds’.

Disclaimer: For Bluebay Assest Managements' full disclaimer, please click here.