Entire 'Market' Rallies On NFLX Price-Hike - Shrugs Off Dimon, May, & Grassley

The House of Commons to Theresa May...

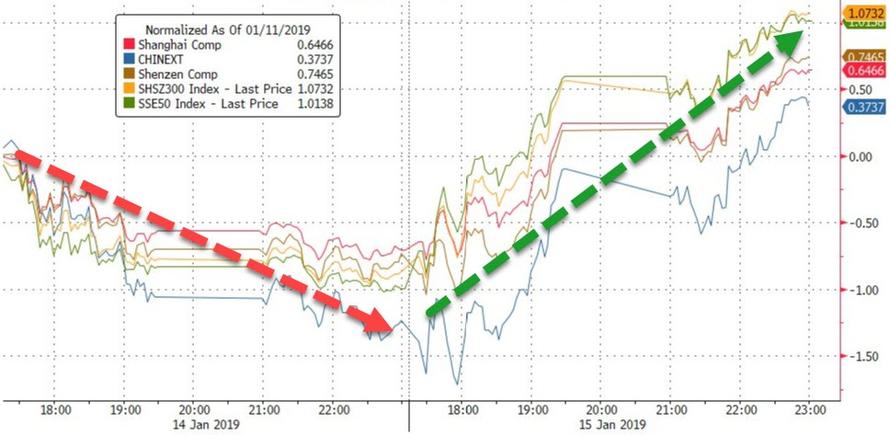

China stimulus chatter prompted some excitement, lifting Chinese stocks from Monday losses...

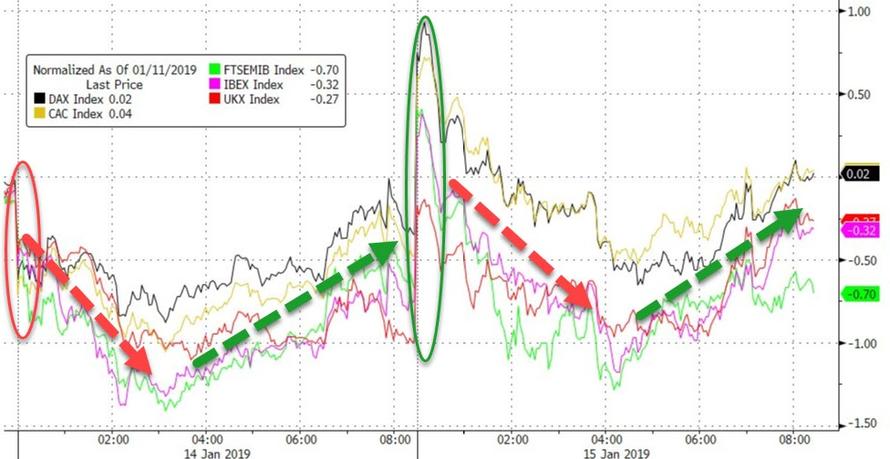

European stocks opened excitedly (China), faded notably, then ramped after US opened to close in the green for the day (leaving DAX and CAC unch for the week)...

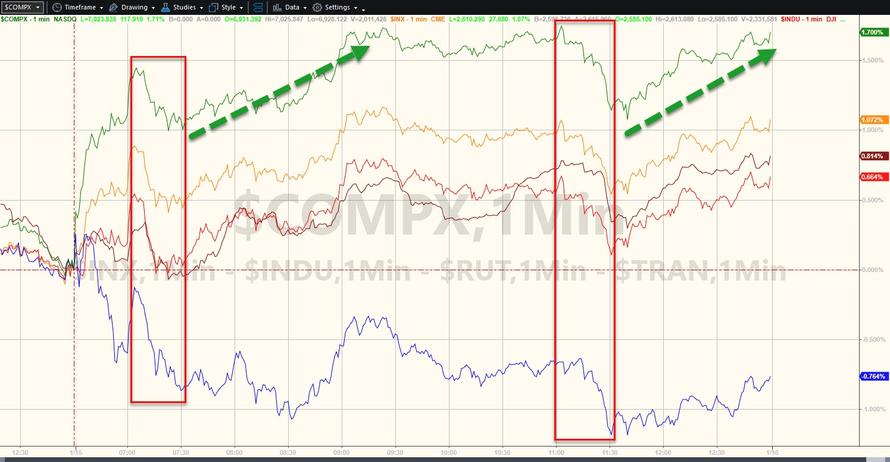

Quite a day in US markets...

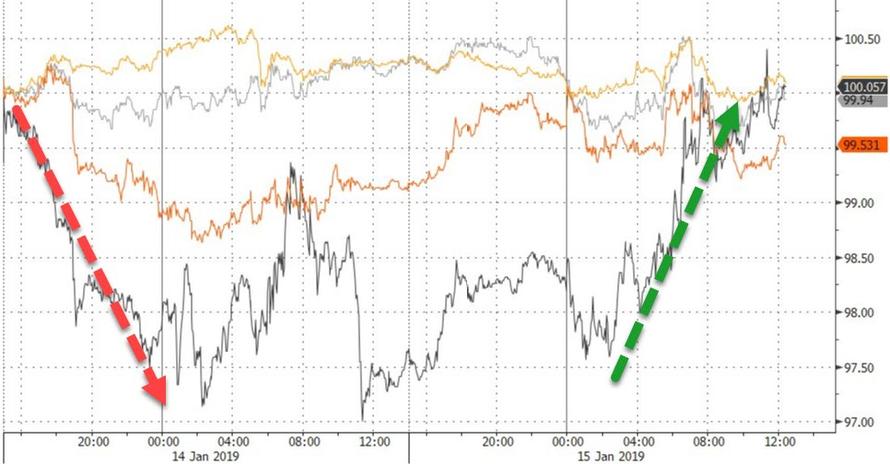

Overnight headlines on China stimulus juiced futures to start which then faded as Europe opened...

JPM earnings disappointment (along with WFC) dragged stocks lower into the open but a Netflix price hike prompted panic buying which was then dumped as Senator Grassley confessed "little progress" in China trade talks... but by then the machines had made up their mind and we ramped to the day's highs once again ahead of the Brexit vote. Stocks tanked as voting began and seemed triggered on a failed amendment as algos got confused. The Brexit deal was rejected (historically so), but stocks did not bounce back)...

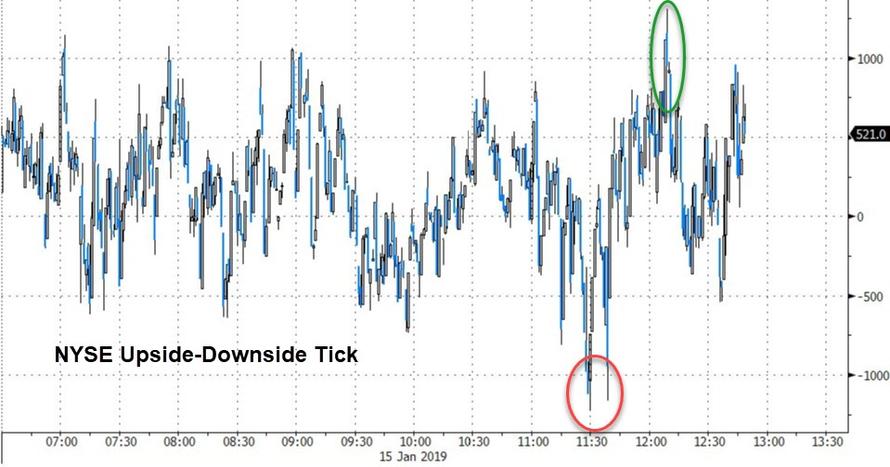

Some serious buying program stepped in again after 3pmET (highest TICK in a week) after some selling on May's defeat...

Nasdaq managed to get back above its 50DMA but none of the other majors did...

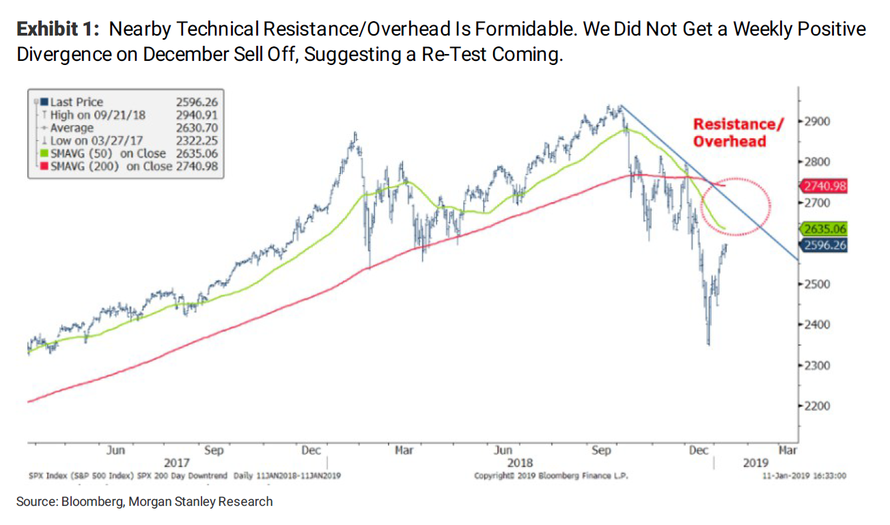

The S&P's 61.8% retrace of the December drop and the 50DMA are in the same neighborhood here with strong trendline resistance also...

NFLX announced prie3-hikes and investors panic bid the stock (and dragged all FANG and Nasdaq higher)...NFLX is up 32% year-to-date!!!

JPM managed to mimic Citi's moves yesterday as it ramped into the green during the day session after pre-market losses...

Citi is now up 18% year-to-date...

VIX was crushed again (to a 17 handle intraday) but credit did not play along)...

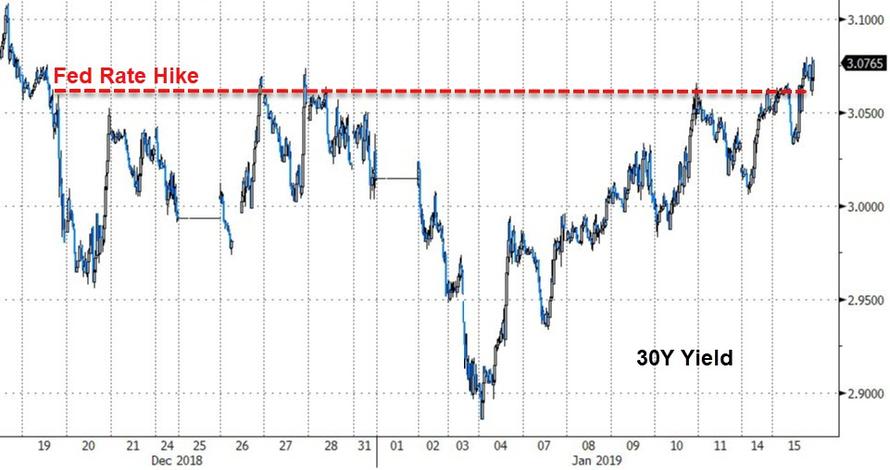

Modest shifts in Treasuries today with the long-end underperforming...

30Y Yields are back at their highest since

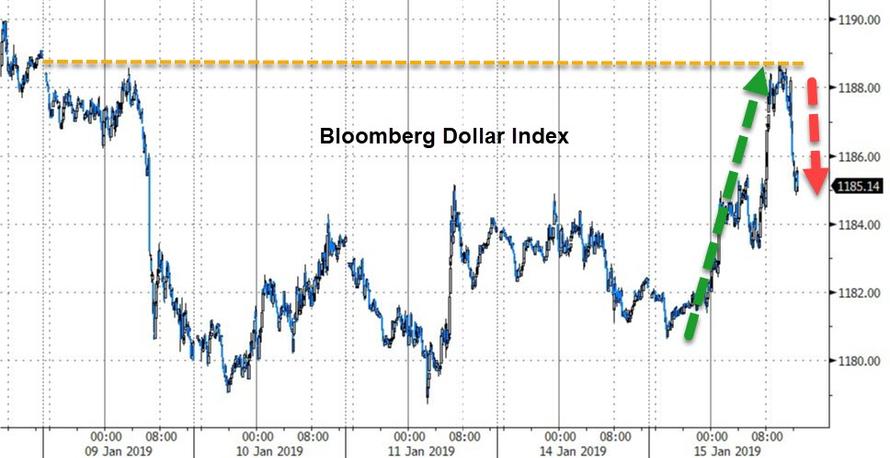

The dollar surged overnight and extended its gains into the Brexit vote - then as cable squeezed back higher, the dollar sank...

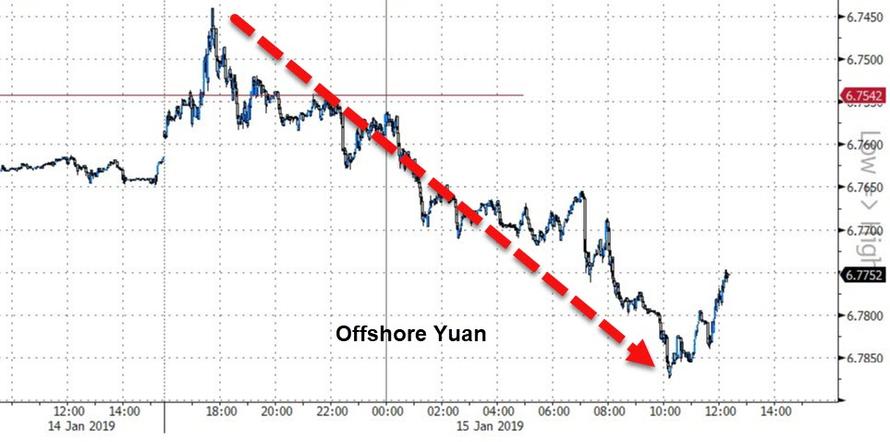

Yuan tumbled, extending losses after Chuck Grassley's comments on China trade talk progress...

Cable slid all day long into the Brexit vote and bounced back into the green after as Corbyn called for a confidence vote (expected to lose) and May suggested a softer approach of reaching across the aisle (we suspect just simple over-positioning more likely for the squeeze)...

Cryptos were holding in before collapsing into the US equity close...

WTI ramped back to unchanged today as copper rallied on China stimulus, PMs limped a little lower as the dollar rallied...

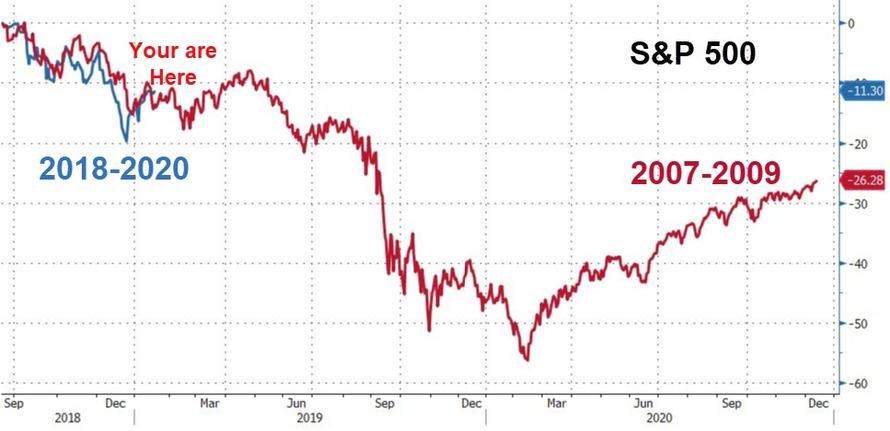

Finally, we are worried - during his usual morning ramble today, CNBC's Jim Cramer sounded a lot like 2007 Jim Cramer...

"JPMorgan is a one-off"...

"...we're not going into recession"...

"...those who sold JPM at 97 are first class morons"

And that did not end well last time...

And this is probably nothing...

The NY Fed recently updated its recession-risk model – up to 21.4% in December, from 15.8% in November and 14.1% in October. The odds have doubled in the past year and haven't been this high since August 2008. pic.twitter.com/K7wUV6XqKx

— David Rosenberg (@EconguyRosie) January 14, 2019

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more