The Presidential Election Won’t Stop The Mother Of All Deflations

Unfortunately, it doesn’t really matter which party wins the presidential election as neither one will be unable to stop the coming Mother Of All Deflations. While it is frustrating to watch just how insane this presidential race has disintegrated into, I try to not to focus on it.

Why? Because the U.S. Government will become totally powerless to deal with the future financial and economic collapse. Furthermore, most institutions will also lose the ability to function when the system cracks. This really isn’t a matter of if or when…. it's happening now..

According to a recent ZeroHedge article, Dallas “Pension Fund Panic” As Major Warns Of 130% Property Tax Hike To Avoid Collapse,

“This is much like a Bernie Madoff scheme, if you ask me,” said Dallas mayor Miek Rawling discussing the collapse of the local Dallas Police and Fire Pension Fund. The Dallas pension board wants the city to contribute $1.1. billion in 2018, but to do that, they would have to increase the property tax rate by 130%.

This is just one sign of many hundreds that continue to eat away at the financial and economic system.What is ironic to witness is the complete failure of the analyst community to understand the real reason for these financial disasters.While most of the blame is put on the totally useless Mainstream Financial Networks, the majority of the alternative media analysts are clueless as well.

This is due to the alternative media’s failure to understand the underlying energy dynamics. I used to read a lot of the alternative media sites (especially the precious metals), but presently only look over a few. Many of the precious metals sites continue to harp on matters that really aren’t important anymore.

Of course, they do this because they do not want to look at the vital energy dynamics. For some reason, most of the precious metals analysts look at energy as just another industry…. much like the retail or health care industries. It doesn’t matter to them that the price of oil is now $75 below the cost of new production of $125 a barrel (according to the Hills Group work).

The falling oil price is totally gutting the U.S. and Global Oil Industry. I wrote about this in my article, The End Of The U.S. Major Oil Industry Era: Big Trouble At ExxonMobil. Without transports fuels, the world’s economy disintegrates…. and disintegrate it will.

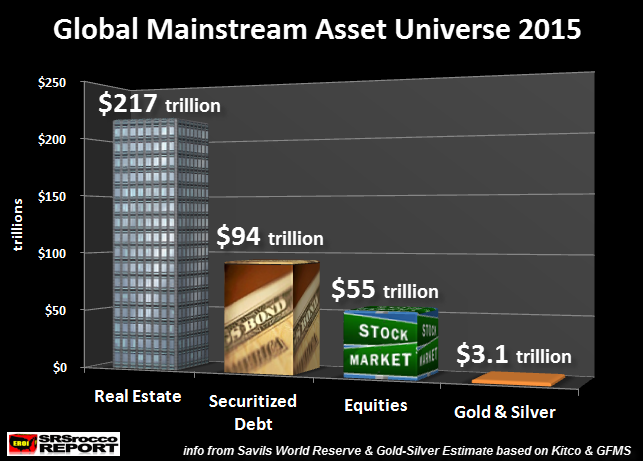

Thus, the collapsing oil price will destroy the value of most physical and paper assets, BUT NOT GOLD & SILVER. Here is a chart of the “Global Asset Universe” by the Savills Research Group Report:

As we can see, they estimate that the total Global Real Estate Market is valued at $217 trillion, Securitized Debt (Treasuries & Bonds) at $94 trillion and Equities (Stocks) at $55 trillion. In their report, they stated that all the gold mined in the world was valued at $6 trillion. I revised that figure to only include “physical investment gold and silver” which is estimated to be $3.1 trillion. You can check how I estimated the $3.1 trillion of gold and silver in my article, How High Will Silver’s Value Increase Compared To Gold During The Next Financial Crisis?

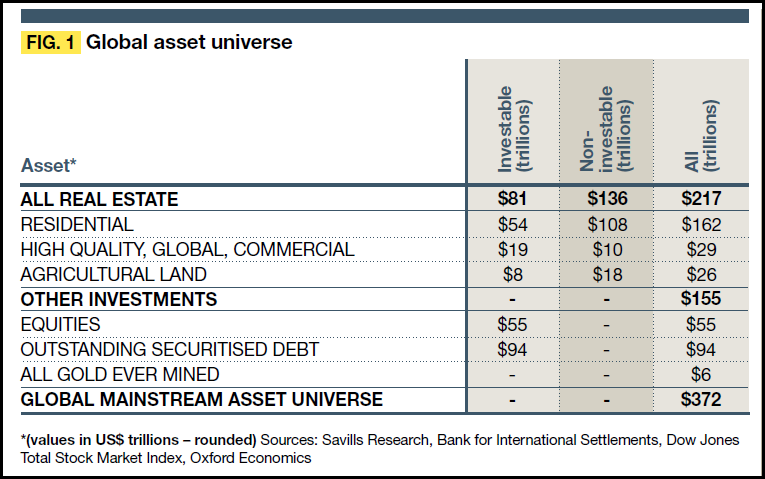

The Savills Group breaks down the Global Real Estate market into “investable” and ‘non-investable.”According to their estimates, they list that of the total $217 trillion in global real estate, only $81 trillion are investable, while the remainder is held privately.

The value of global real estate, stocks and bonds are totally inflated based on a much higher oil price of $110-$125.Now with the price of oil at $45, the value of these assets should have collapsed a few years ago.If we consider the price of oil was $110 in 2012 and now is $45, that represents a collapse of nearly 60%.

Unfortunately, many people do not understand that the value of real estate, stocks and bonds are based on the value of energy. Instead, they blindly believe the value of these assets are based on “SUPPLY & DEMAND” or some other VOO-DOO Economics.

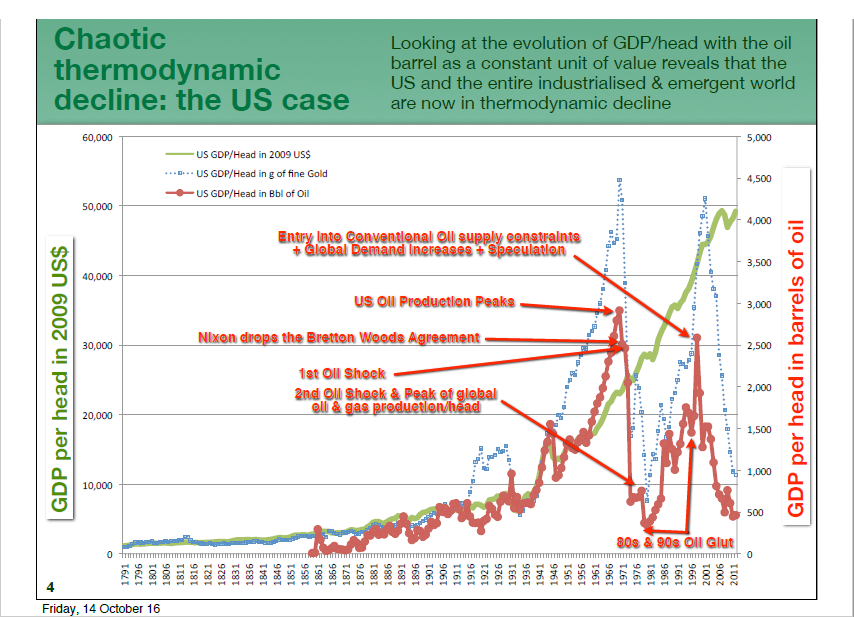

If we look at Louis Arnoux’s chart showing the U.S. GDP value per American in gold and oil units, it collapsed back in 2012. Again, the U.S. GDP and value of most paper assets should have collapsed along with gold and oil, but they didn’t:

The chart shows how U.S. GDP per American (Green) continues higher even though gold per head (Blue) and oil per head (Red) collapsed in 2012.

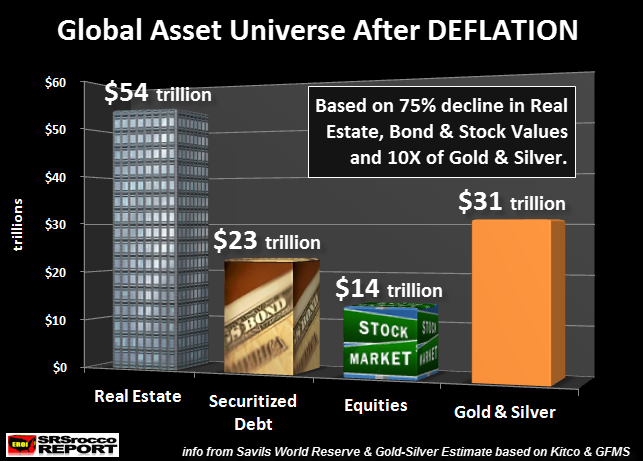

Thus, we have the Greatest Real Estate and Financial Bubble in history looking for a pin… and the pin is the falling price and production of oil. I will explain this in more detail in upcoming articles, however if we assume a 75% collapse in the value of real estate, bonds and stocks, this would be the result:

Global Real Estate values would fall to $54 trillion, Securitized Debt would drop to $23 trillion and equity values would fall to $14 trillion.Thus, the total value of these assets would collapse by $274 trillion to $91 trillion.However, the value of physical gold and silver would surge to ten times its value to $31 trillion.

Of course, this is just an estimate, but if we consider the value of real estate, stocks and bonds falling 75%, only 10% of that $274 trillion lost is $27 trillion. Which means, just 10% of the value of these assets moving into gold and silver would push their value up to $31 trillion.

Again, this is just an estimate, but investors have no idea just how quickly the value of global real estate, bonds and stocks will fall in the future.I put a figure of a 75% collapse, but that is just in the beginning to middle stages. I would imagine, by the time the global crash is complete, these values could literally fall by 90-95%.

The current Presidential Election is a complete farce. Even though I try to stay away from politics, it becomes extremely frustrating to see the public totally brainwashed by Mainstream media propaganda.

People need to start distancing themselves from anything that is run by a centralized system, whether that be government, finance or the economy. It is time to look to more local and regional solutions as the viability of centralized systems collapse over the next 5-10 years.

Disclosure: None.

As Edward Lambert said, the Fed missed the interest rate cycle. Deflation is a real possibility if his calculations are correct. www.talkmarkets.com/.../edward-lambert-on-bond-demand-the-coming-recession-and-new-normal

Yes, it certainly is a possibility. Lambert knows what he's talking about.

I don't know about stocks, but bond prices are based on massive demand. I think the author should look into this. I write about it and I think bond demand is increasing.