The Climate Change Story Is Half True

The climate change story is true is some respects: The climate is indeed changing. And CO2 emissions do seem to affect climate. Burning fossil fuels does indeed make a difference in CO2 levels.

The problem I have with the climate change story is that it paints a totally inaccurate story of the predicament the world is facing. The world’s predicament arises primarily from too little affordable resources, especially energy resources; climate change models tend to give the illusion that our problem is one of a superabundance of fossil fuels.

Furthermore, the world economy has no real option of using significantly less energy, because the economy tends to collapse when there is not enough energy. Economists have not studied the physics of how a networked economy really works; they rely on an overly simple supply and demand model that seems to suggest that prices can rise endlessly.

Figure 1. Supply and Demand model from Wikipedia.

Attribution: SilverStar at English Wikipedia CC BY 2.5 (http://creativecommons.org/licenses/by/2.5)%5D, via Wikimedia Commons

The quantity of energy supply affects both the supply and demand of finished goods and services. History shows that the result of inadequate energy supplies is often collapse or a resource war, in an attempt to obtain more of the necessary resources.

Climate scientists aren’t expected to be economists, but have inadvertently picked up the wrong views of economists and allowed them to affect the climate models they produce. This results in an over-focus on climate issues and an under-focus on the real issues at hand.

Let’s look at a few issues related to the climate change story.

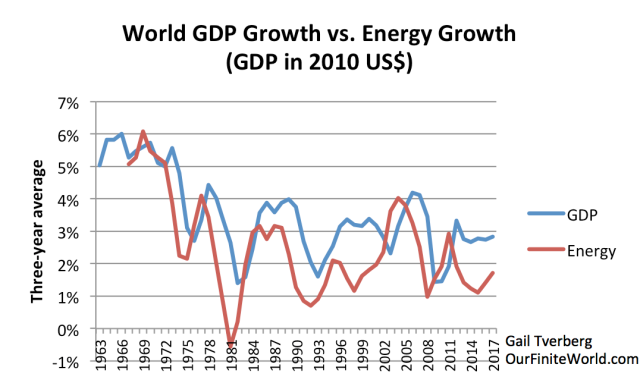

[1] Growth in energy consumption and in world GDP are very closely linked. In fact, energy consumption seems to be the cause of GDP growth.

If we look at the relationship between World GDP and energy consumption growth, we see a close correlation, with energy consumption increases and decreases often preceding GDP growth changes. This implies a causal relationship.

Figure 2. World GDP Growth versus Energy Consumption Growth, based on data of 2018 BP Statistical Review of World Energy and GDP data in 2010$ amounts, from the World Bank.

The reason why this close relationship exists is because it takes the “magic” of energy consumption to make the physical changes we associate with GDP growth. It takes energy to transport goods. It takes energy to heat goods, whether to refine metals or to cook foods. Refrigeration is similar to heating, except that heat is moved out of the space that is to be cooled. Electricity, of course, depends on energy consumption.

We cannot expect the relationship to be as close at an individual country level as at the world level, because service economies tend to require less energy per capita than manufacturing economies. If a government sees that energy supplies are running short, it can direct the economy to become more services-oriented. This workaround can keep the local economy operating fairly close to normally, at least for a time.

Longer-term, an economy that has been hollowed out by a lack of energy supplies is likely to find that a substantial share of workers are earning only very low wages. With this reduced buying power, many citizens cannot afford to buy expensive goods like homes and cars. This lack of purchasing power tends to hold down commodity prices of all kinds, since finished goods are made with commodities. It is this lack of purchasing power that tends to hold down oil prices and other energy prices.

[2] There are two very different views of our energy future, depending upon whether an analyst believes that oil and other energy prices can rise endlessly, or not.

Figure 3. Two Views of Our Energy Future

There is substantial evidence that the second view is the correct view. Nearly every time the price of oil rises very much, the US economy has tended to head into recession. And forecasters tell us that while some countries (oil exporters) would be winners with higher prices, on average the world economy will tend to shrink. Oil importers, especially, would shrink back in recession. Figure 4 shows a recent chart by Oxford Economics with the conclusion that oil prices cannot rise very much without adversely affecting the world economy.

Figure 4. Chart by Oxford Economics on their view of the impact of oil prices reaching $100 per barrel. Chart shown on WSJ Daily Shot, April 25, 2019.

Climate change modeling has inadvertently incorporated the opposite view: the view that prices can be expected to rise endlessly, allowing a large quantity of fossil fuels to be extracted. Of course, if fossil fuel prices are expected to rise endlessly, then expensive renewables such as wind and solar can become competitive in the future.

[3] To date economists and their policies have had pretty close to zero success in reducing world CO2 fossil fuel emissions.

Figure 5. World Carbon Dioxide Emissions for selected groupings of countries, based on BP 2018 Statistical Review of World Energy data. Growing Asia is my grouping. It is BP’s Asia Pacific grouping, excluding Japan, Australia, and New Zealand. It includes China and India, among other countries.

A popular view of economists is, “If every country limits its own CO2 emissions, certainly world emissions will be reduced.” In practice, this does not work. It simply moves emissions around and, in the process, raises total world emissions. A carbon tax sends high-carbon industries to Emerging Market nations, helping ramp up their economies. The country with the carbon tax on its own citizens then imports manufactured items from the Emerging Market nations with no carbon tax, aiding the Emerging Market countries without a carbon tax at the expense of its own citizens. How reasonable is this approach?

When Advanced Economies transferred a significant share of their industrial production to the Growing Asian nations, the growth rate of industrial production soared in these countries, at the same time that it stagnated in Advanced Economies. (Sorry, data are not available before 2000.)

Figure 6. Percentage increase over prior year for Industrial Production, based on data of CPB Netherlands Bureau for Economic Policy Analysis. Advanced Economies is as defined by CPB. My Growing Asia grouping seems to be very similar to what it shows as “Emerging Asia.”

This soaring production in the Growing Asian nations led to a need for new roads and new homes for workers, in addition to new factories and new means of transportation for workers. The net result was much more CO2 for the world as a whole–not considerably less.

If we calculate the savings in CO2 between the date of the Kyoto Protocol (1997) and 2017 for the US, EU, and Japan (the bottom grouping on Figure 5), we find that there has indeed been a savings close to 1.0 billion tons of carbon dioxide over this 20-year period. Unfortunately, Figure 5 shows:

- Growing Asia added 9.0 billion tons of CO2 between 1997 and 2017

- Middle Eastern oil producing nations added 1.1 billion tons of CO2 in the same period, and

- The Rest of the World added 1.5 billion tons of CO2.

So, what little CO2 savings took place in the US, EU, and Japan during the 20 year period between 1997 and 2017 were dwarfed by the impact of the ramp up of industrial growth outside the US, EU, and Japan.

[4] Probably the single most stupid thing world leaders could have done, if they were at all concerned about CO2 emissions, was to add China to the World Trade Organization in December 2001.

In looking at world CO2 emissions from fossil fuels, we can see a distinct bend occurring in 2002, the year after China was added to the World Trade Organization.

Figure 7. World CO2 Emissions with Trend Line fitted to 1990-2001 data, based on data from 2018 BP Statistical Review of World Energy.

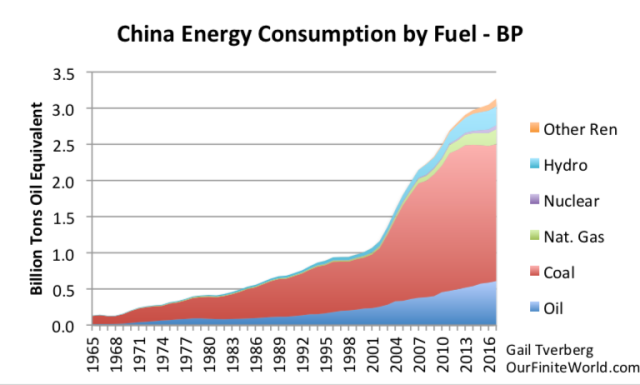

The fitted trend line shows that emissions were growing at about 1.1% per year in the 1990 to 2001 period. Once China, with its huge unused coal reserves, was added to the World Trade Organization, both China’s coal production (Figure 8) and its coal consumption (Figure 9) soared.

Figure 8. China energy production by fuel, based on BP Statistical Review of World Energy 2018 data.

Figure 9. China’s energy consumption by fuel, based on BP 2018 Statistical Review of World Energy.

With the extra “demand” from China for roads, homes, airports, and new factories, oil and other energy prices soared in the 2002 to 2007 period. Energy prices were again high in the 2011 to 2014 period, after the Great Recession was over. These higher energy prices (see Figure 10 below) encouraged drilling for new oil and gas, such as that from shale formations in the United States. This further helped raise world fossil fuel consumption and thus world CO2 emissions.

Figure 10. Historical inflation-adjusted oil prices, based on inflation adjusted Brent-equivalent oil prices shown in BP 2018 Statistical Review of World Energy.

[5] One way of seeing the truth of the close tie between the growth in energy consumption and economic growth is to observe the dip in world CO2 emissions at the time of the Great Recession of 2008-2009.

If a person looks at any of Figures 5, 6, 7, or 8, it is easy to see a clear dip in CO2 emissions at the time of the Great Recession. What seems to happen is that high prices lead to recessions in oil importing nations. These recessions lead to lower oil prices. (Note the dip in prices in Figure 10.) It is the fact that high prices lead to recessions in oil importing countries that makes the belief that energy prices can rise endlessly seem absurd.

[6] The European Union is an example of a major area that is fighting declines in nearly all of its major types of energy supplies. In practice, energy prices do not rise high enough, and technology does not help sufficiently to provide the energy supplies needed.

Figure 11. European Union energy production versus total energy consumption, based on BP 2018 Statistical Review of World Energy.

In the chart above, the colored amounts in the lower part are the amount of energy produced within the European Union, shown in layers, based on BP’s evaluation. The black line at the top is the amount of energy consumed by the European union. The difference between the black line and the colored part is the amount that must be imported from somewhere else.

The problem that the European Union has had is that nearly all of the energy types that the EU has been producing have been declining in spite of higher prices and improving technology. Coal is the EU’s largest source of energy, but it has been declining since before 1965. Oil, natural gas, and nuclear are also declining. Hydroelectric isn’t very significant, but its supply is staying more or less level.

The only category that is rising is “Other Renewables.” This category includes biofuels, wind and solar, and wood and trash burned for fuel. Except for the wood burned as fuel, these are what I would call “fossil fuel extenders.” They are only possible because we have fossil fuels. They help reduce the size of the gap between what is produced and what is required by the economy, but they come nowhere close to filling the gap.

There is controversy regarding how wind and solar should be counted in equivalence to fossil fuels. BP data treats the output of wind and solar as if they replace somewhat less than the price of wholesale electricity (worth about 3 to 5 cents per kWh). The International Energy Agency treats wind and solar as if they only replace the fuel that operates power plants (worth about 2 to 3 cents per kWh).* In practice, the IEA gives less than half as much credit for wind and solar as does BP. In exceptionally sunny places, solar auction prices can be low enough to match its value to grids.

It would make sense to treat wind and solar as replacing electricity, if the systems were set up to include substantial storage capacity. Without at least several days of storage capacity (the situation today), the BP method of counting wind and solar overstates the benefit of wind and solar. Thus, the value of Other Renewables to the EU tends to be overstated by the BP methodology used in Figure 11.

[7] There are huge differences in CO2 growth patterns between (a) countries whose governments have recently collapsed and (b) countries that are growing rapidly.

Government Collapse Related Countries. Russia, Lithuania, and Ukraine are all countries whose central government (the Soviet Union) collapsed in 1991. Romania was “only” a country that was dependent on the Soviet Union for imported oil and other trade. These countries all saw a major fall in industrialization after the collapse of the Soviet Union. Ukraine has been especially hard hit because it has never been able to replace the industry it lost with new industry.

Figure 12. Selected countries with falling CO2 emissions since 1990, based on BP 2018 Statistical Review of World Energy.

As I see the situation, the Central Government of the Soviet Union collapsed 1991 because the Soviet Union was an oil exporter, and the price of oil had fallen too low for an extended period of time, leaving inadequate funding for investment in new productive capacity. Russia was able to recover better than the other countries shown because once the price of oil rose again, it was able to again ramp up its oil production and exports, supporting its economy.

Examples of Rapidly Growing Countries. If we consider the CO2 patterns of a few growing Asian nations, we see very different patterns than those of the countries attempting to recover from the collapse of the Soviet Union’s central government. The CO2 emissions of the Growing Asian Countries have been rising rapidly, relative to 1990 levels.

Figure 13. CO2 Emissions of Selected Asian Countries, based on BP 2018 Statistical Review of World Energy.

China’s flattening CO2 emissions since 2013 are an indication that much of its cheap-to-extract coal has been mined out. It has been difficult for China to maintain its level of coal production (see Figure 8, above), given the low level of coal prices in recent years. This problem of low coal prices seems to be parallel to the problem of inadequate prices for oil producers.

[8] Unfortunately, the real story about economies is that they are governed by the laws of physics. Like plants and animals, and like hurricanes, they are dissipative structures that grow for a time and eventually come to an end.

We know that over the ages, many, many economies have grown for a time and then collapsed. But the study of how and why this has happened has been divided among many fields of study, including physicists and historians. Economists, who tend to be hired by politicians, seem to be among the last to understand collapse. They simply model the future as if it will reflect a continuation of past patterns. With such models, economic growth will continue forever.

But growth forever isn’t what really happens. Eventually, growth in population outstrips growth in resources. Various workarounds are tried, often requiring growing specialization, bigger businesses and governments, improved technology and more international trade. This additional complexity tends to lead to too much wage disparity. The problem with wage disparity is that it tends to lead to a large number of workers with very low wages.

The low wages caused by increased wage disparity tend to harm the economy. These low-paid workers cut back on their purchases of discretionary goods–for example, they delay buying a new car or visiting restaurants. These cutbacks lead to what look like “gluts” of commodities such as oil and metals used in making finished goods. Commodity prices tend to fall instead of rise, in order to clear the gluts.

As wage disparity grows, low-wage workers become very unhappy. They may elect radical leaders, or they may try to overthrow a king. With the many low-wage workers, it becomes difficult to collect enough tax revenue. Governments may collapse for lack of tax revenue. Sometimes, governments will attack other economies to try to solve their low-resource problem in this way.

[9] Climate change modelers have not understood that one of the things that they should be concerned about is near-term collapse. The rising wealth disparity in recent years is a major indicator that the world economy may be headed toward collapse.

Economists and politicians model the world as if business as usual will continue forever, but this is not the way the real situation works.

Meteorologists and other climate scientists have closely examined historical climate situations, but when it comes to future patterns of energy consumption, they are far outside of their field. They miss the likelihood of near-term collapse. With the assumption of economic growth forever, it is easy to arrive at projections of growth in fossil fuel consumption almost forever. This, of course, leads to growth in CO2 pollution and a very concerning rise in temperature.

In fact, with the story of economic growth forever, climate change becomes the most serious problem the world is facing. People believe that 100 or 500 years from now, the economy can be expected to operate as in the past. One of our biggest problems will be rising oceans and the need to move our cities back from them. Also, weather changes will be of huge concern.

[10] If the world economy is headed toward near-term collapse, climate change shrinks back in the list of things we should be worried about.

Most of us remember what happened in the Great Recession of 2008 and 2009. Collapse of the world economy would likely be far, far worse than this recession. It would involve debt defaults as the economy stops growing fast enough to repay debt with interest. It could perhaps involve collapses of governments, similar to the collapse of the central government of the Soviet Union in 1991. If low oil prices are again a problem, collapses could especially affect oil exporting nations. In some cases, the use of fossil fuels could fall as quickly as the decline in CO2 emissions for Ukraine (Figure 12).

I often think that the concern about climate change comes from the fact that it can be modeled as if nothing else changes in the future. Surely, if researchers were modeling the overfishing in the sea, they would come to a correspondingly bleak view of how the sea might operate 50 to 100 or 1000 years for now. Similarly, if researchers were modeling our problems with soil erosion, they would come to a correspondingly bleak view about soil conditions, 50 or 100 or 1000 years from now.

One of the problems with the climate change model is that it overlooks the huge number of limits we are reaching simultaneously. These issues will surely change how the economy functions in the future, in ways that are not reflected in today’s climate models.

[11] The great draw of wind and solar is that they seem to solve problems of any type: either too much fossil fuels or too little.

Very few dare talk about the real problem we are facing–a huge number of limits coming at us from many directions at once. World population has risen too much relative to resources. Wage disparity is too great. Aquifer levels are being drawn down, far more quickly than they are being replaced. Pollution of many types (not just CO2) is becoming a problem. Microbes are mutating more quickly than we can find new antibiotics to fight them.

There seem to be plenty of fossil fuels in the ground, but there is a mismatch between the prices consumers can afford and the prices producers need in order to be profitable. It is not just the price of gasoline used at the pump that is important; the prices of finished goods made with energy products (such as homes and automobiles) are just as important. Young people are especially being squeezed with all of their educational loans.

If our problem can be framed as a problem of “too much,” rather than “too little,” we have a situation that is much more salable to the average consumer. People can easily believe that prices will rise endlessly, and that the economy will continue to grow forever. If economists have faith that this can happen, why not believe them? In this context, potential solutions such as wind and solar seem to make sense, even though, with adequate storage, they tend to be high-cost.

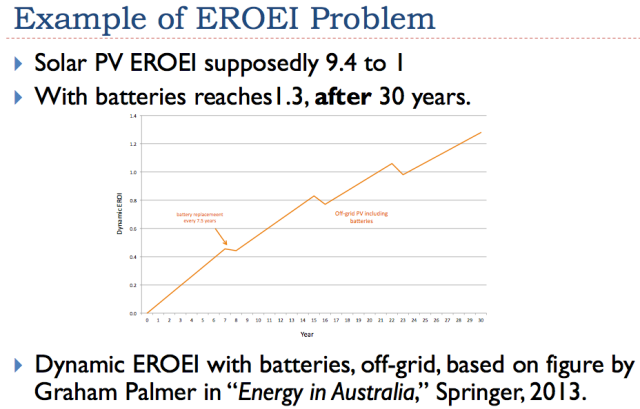

[12] Wind and solar, when analyzed without the need for energy storage, seem to help reduce CO2 emissions. But if substantial electricity storage needs to be included, this CO2 benefit tends to disappear.

Most analysts (such as those doing Energy Returned on Energy Investments calculations) have overlooked the need for electricity storage, if penetration is to ramp up. If the direct and indirect energy costs of storage are considered, the expected climate benefit of wind and solar tends to disappear.

Figure 14. Slide by author referencing Graham Palmer’s chart of Dynamic Energy Returned on Energy Invested from “Energy in Australia.”

This is only one estimate. More extensive calculations are needed, but the indications of this example are concerning.

Conclusion: Ultimately, the climate story, as it tends to be quoted in the news media, is misleading.

The climate story we hear tends to give the impression that climate change is a huge problem compared to all the other resource and environmental problems we are encountering. Furthermore, a person gets the impression that simple solutions, such as wind, solar, carbon taxes and voluntary cutbacks in fossil fuel use, are available.

This is a false picture of the situation at hand. Climate change is one of many problems the world economy is facing, and the solutions we have for climate change at this time are totally inadequate. Because an increase in energy consumption is required for GDP growth worldwide, even voluntary cutbacks in fossil fuel usage tend to harm the economies making the reductions. If climate change is to be addressed, totally different approaches are needed. We may even need to talk about adapting to climate change that is largely out of our ability to control.

The benefits of wind and solar have been greatly exaggerated. Partly, this may be because politicians have needed a solution to the energy and climate problems. It may also be partly because “renewable” sounds like it is a synonym for “sustainable,” even though it is not. Adding electricity storage looks like it would be a solution to the intermittency of wind and solar, but it tends to add costs and to defeat the CO2 benefit of these devices.

Finally, IPCC modelers need to develop their models more in the context of the wider range of limits that the world is facing. Perhaps it would be worthwhile to model the expected impact of all limits combined, rather than limiting the analysis to climate change. In particular, there is a need to consider the physics of how an economy really operates: energy consumption cannot be reduced significantly at the world level without increasing the probability of collapse or a major war.

Footnote:

*Island economies and other remote economies sometimes burn oil to produce electricity. In this case, the cost of fuel consumption for electricity generation will be much higher than the $0.02 to $.03 cents per kWh quoted in the text, so the economics will be different. For example, if diesel is selling for $3.00 per gallon, the cost per kWh of fuel for electricity from diesel will be $0.24 per kWh, based on EIA efficiency estimates. With this high cost of fuel, substituting wind or solar for part of the diesel generally makes economic sense.

The “catch” is that whether the remote economy powers its electricity with oil or with oil plus wind/solar, the price of electricity will remain high. If the remote economy is primarily operating a tourist trade, high electricity prices may not be a major issue. But if the remote economy wants to sell goods in the world economy, its cost of finished goods can be expected to be high compared to the cost of goods made elsewhere, because of its high electricity cost. The high cost of electricity is one of the reasons for the economic problems of Puerto Rico, for example.

Disclosure: None.

Energy is used by the nation that makes stuff, China. It is the driver of the world economy. Must read article.

Yes, very eye opening.