Pipeline Earnings Keep Climbing

Image Source: DepositPhotos

Earnings season for midstream energy infrastructure has been wonderfully devoid of excitement for many quarters. These companies just keep churning out more cash, typically within a few percent of expectations.

The exception is Cheniere (CEI), where earnings often come in substantially ahead of sell-side estimates. 1Q reported EBITDA beat by 12.5%. The company spent $1.2BN repurchasing stock and continued at about the same rate in April. They are moving towards self-financing their LNG terminal expansions and prioritizing debt paydown.

Cheniere’s stock has been a surprising laggard this year. It remains one of our highest conviction names. The most effective way the US can reduce global emissions is to export more natural gas to emerging economies, displacing coal the way it has in this country.

Cheniere is best positioned to profit from this opportunity.

Last week on my mid-west trip several investors asked me what risks the sector faces. The pandemic caused the worst sell-off any of us could have conceived, albeit a brief one. A recession would inevitably depress prices along with the rest of the equity market. And yet, reduced leverage and capex along with greatly improved dividend coverage mean we’d enter any downturn in much better financial shape than in the past.

There’s always downside risk, but more robust balance sheets should offer greater resilience.

EBITDA at Plains came in 3.5% ahead of estimates, helped by higher tariffs on crude pipelines. Their stock has returned 50% over the past year.

TC Energy (TRP) beat expectations by 3.5% with all segments doing well led by natural gas pipelines. Their Coastal Gas Link (CGL) pipeline will soon be sending deliveries to LNG Canada in Kitimat, British Columbia for export to Asia. Like CEI, TRP has lagged the market although for different reasons – the size of their capex program continues to weigh on the stock.

However, the company did place $1BN of projects into service during 1Q24, most of which was CGL. They’re guiding to $8-8.5BN in capex this year. Along with Enbridge, the Canadians are bucking the trend towards lower spending on new projects. TRP is -2% YTD.

Williams Companies beat estimates by 8%. The stock has returned 14% YTD.

In their weekly research note Wells Fargo highlighted the growing value of natural gas storage assets. Increased consumption of natgas isn’t being matched with commensurate additions of storage capacity, which is pushing rates up.

Wells Fargo estimates monthly storage rates have doubled over the past three years, to around $0.19 per thousand cubic feet. Williams Companies (WMB), Kinder Morgan (KMI) and Energy Transfer (ET) are among those best positioned to benefit.

Renewables growth is contributing to storage demand, because increased reliance on intermittent energy means more natural gas must be held available for power plants when it’s not sunny and windy. And climate extremists are opposed to any new infrastructure that supports reliable energy.

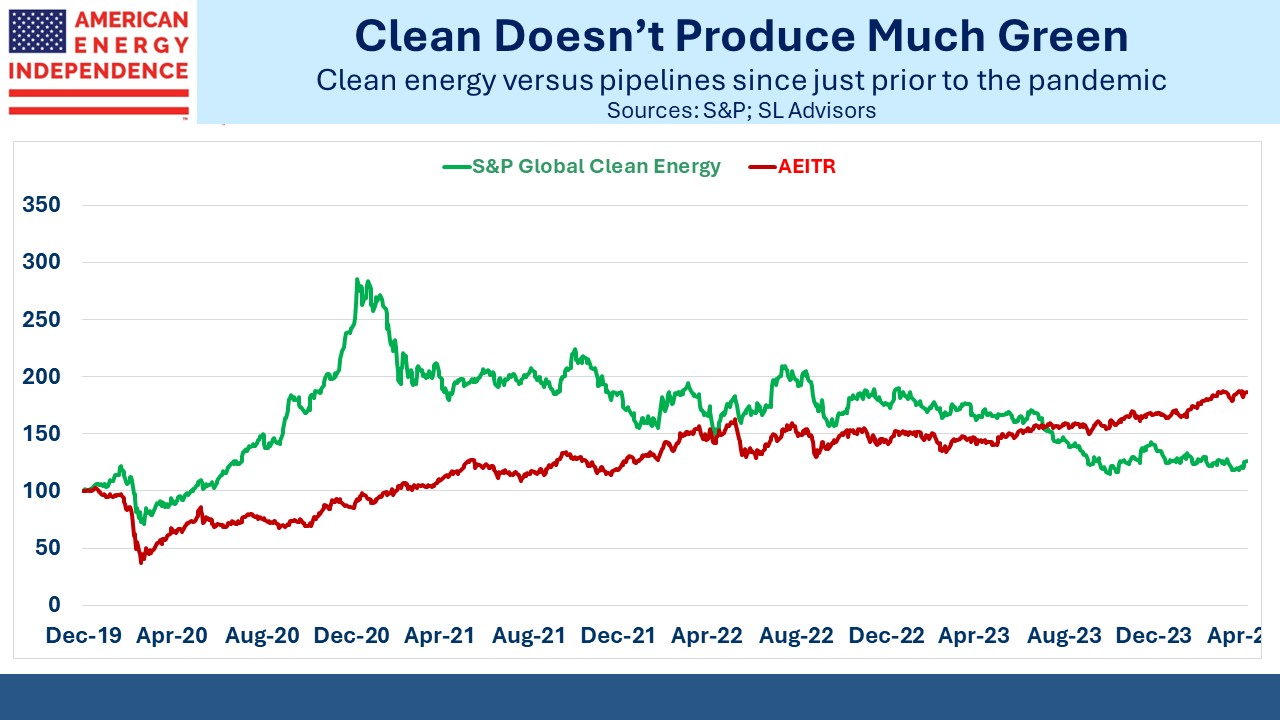

It’s fair to say the energy transition has been better for investors in traditional energy than renewables. Since the end of 2019, just prior to the pandemic, the American Energy Independence index (AEITR) has returned 15.5% pa versus only 5.4% pa for the S&P Global Clean Energy Index.

Investors in BP expect the company to scale back its climate targets. It makes little sense for them to produce less of what people want to buy until demand drops, which it is not. We noted this the other day (see Former BP Geologist On Energy). One investor said of investing in renewables, “returns are not there.”

It’s because proponents have wrongly claimed that renewables produce cheap energy, whereas electricity prices are rising wherever solar and wind gain share, including in the US.

The WSJ referred to “energy transition fatigue” in Households Wince at the Rising Price of Going Green. The article provides a lengthy list of costly surprises. Most notable is the Parisian who found that new energy efficiency rules forced him to spend €50K ($54K) on remediation before he could sell his apartment.

That’s what progressive policies will bring to the US if we don’t pay attention.

A couple of months ago we noted how environmentalists oppose any infrastructure, even when it’s new power lines to bring solar and windpower to customers (see Renewables Confront NIMBYs and watch America’s Looming Power Problem). A Federal judge had issued an injunction to invalidate a permit, preventing the last mile of a 102-mile project from being completed.

Last week a three-judge US appeals court overturned this injunction, allowing the project to be completed. It just shows that permitting for infrastructure projects needs an overhaul. If a developer can’t rely on previously issued permits from a government agency, nothing will ever get done. Climate extremists should especially want this because increasing our use of renewables will require substantial new infrastructure.

The energy transition is going pretty well.

More By This Author:

Discussing Energy In America’s HeartlandGains From Energy

Energy’s Slow Transition