Elliott Wave Technical Analysis: Solana Crypto Price News For Wednesday, April 16

Image Source: Pixabay

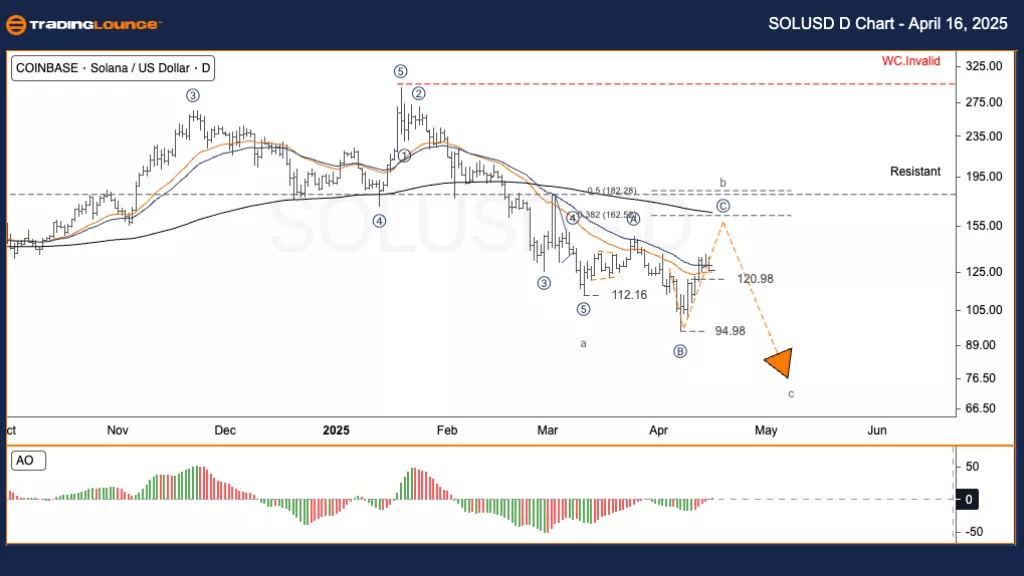

Elliott Wave Analysis – TradingLounge Daily Chart

SOLANA/ U.S. Dollar (SOLUSD)

SOLUSD Elliott Wave Technical Analysis

Function: Counter-trend

Mode: Corrective

Structure: Flat

Position: Wave B

Next Direction (Higher Degree):

Invalidation Level:

SOLANA/ U.S. Dollar (SOLUSD) Trading Strategy

The current SOLUSD (Solana) chart reveals an unfinished consolidation. Analyzing the wave patterns suggests that Wave C of the ABC corrective structure is still unfolding. The highs between $210 and $215, observed in early 2025, likely signaled the conclusion of the larger Impulse Wave (Wave V). Since then, the market has moved downward with weakening momentum. Wave a completed near $112.16, followed by a modest bounce in Wave b. Currently, Wave c is progressing.

Trading Strategies

Strategy

Approach

✅ For short-term traders (Swing Trade)

Watch for a bearish reversal signal near the $130 level.

If the price fails to hold and gets rejected at the Fibonacci resistance, consider initiating a short position.

Place a stop loss just above $135 for protection.

Risk Management

Elliott Wave Analysis – TradingLounge H4 Chart

SOLANA/ U.S. Dollar (SOLUSD)

SOLUSD Elliott Wave Technical Analysis

Function: Counter-trend

Mode: Corrective

Structure: Flat

Position: Wave B

Next Direction (Higher Degree):

Invalidation Level:

SOLANA/ U.S. Dollar (SOLUSD) Trading Strategy

The current chart of SOLUSD (Solana) still reflects an incomplete consolidation phase. Wave C in the ABC formation hasn’t yet played out fully. Earlier in 2025, the price peaked between $210–$215, likely ending the major Impulse Wave (Wave V). Since that peak, price action has shown a downward trend with reduced strength. Wave a ended at approximately $112.16, then a brief retracement formed Wave b. Now, Wave c is active and developing.

Trading Strategies

Strategy

Approach

✅ For short-term traders (Swing Trade)

Look out for a bearish reversal pattern near the $130 resistance level.

If the price shows rejection at the Fibonacci zone, a short position may be suitable.

Use a stop loss placed above $135.

Risk Management

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Visit Tradinglounge.com

More By This Author:

Unlocking ASX Trading Success: Amcor Plc - Tuesday, April 15

Elliott Wave Technical Analysis: Fortinet Inc. - Tuesday, April 15

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Tuesday, April 15

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more