Elliott Wave Technical Analysis: Sei / US Dollar

Image Source: Pixabay

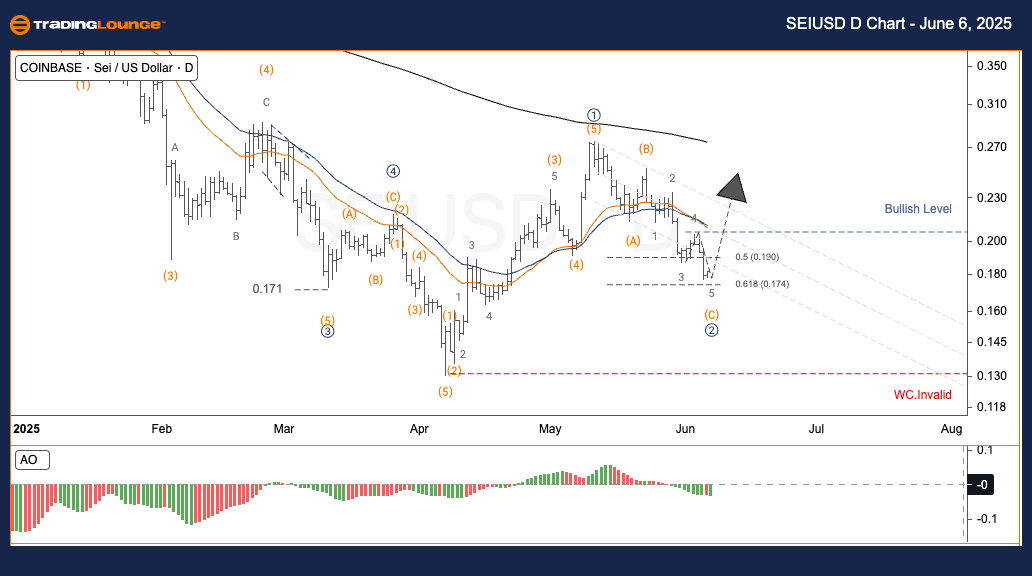

Elliott Wave Analysis - TradingLounge Daily Chart, Sei / U.S. Dollar (SEIUSD)

SEIUSD Elliott Wave Technical Overview

- Function: Trend Continuation

- Mode: Motive Wave

- Structure: Impulse Pattern

- Current Position: Wave 2

- Next Higher Degree Trend: To be determined

- Invalidation Level: Wave structure breaks below $0.130

SEI/USD Trading Strategy – Daily Chart

SEI/USD has formed a clean 5-wave structure completing wave ① at approximately $0.32. The price now consolidates in a corrective Zigzag pattern (A–B–C), which appears close to finalizing wave ② around a key Fibonacci support zone.

Suggested Approach

- Short-Term Traders (Swing Trading)

-

- ✅ Entry Idea: Monitor for a breakout above $0.220 to confirm the onset of wave ③. Upon confirmation, align trades with the prevailing trend.

Risk Parameters

- 🟥 Invalidation Point: Price dipping below $0.130 invalidates this wave scenario.

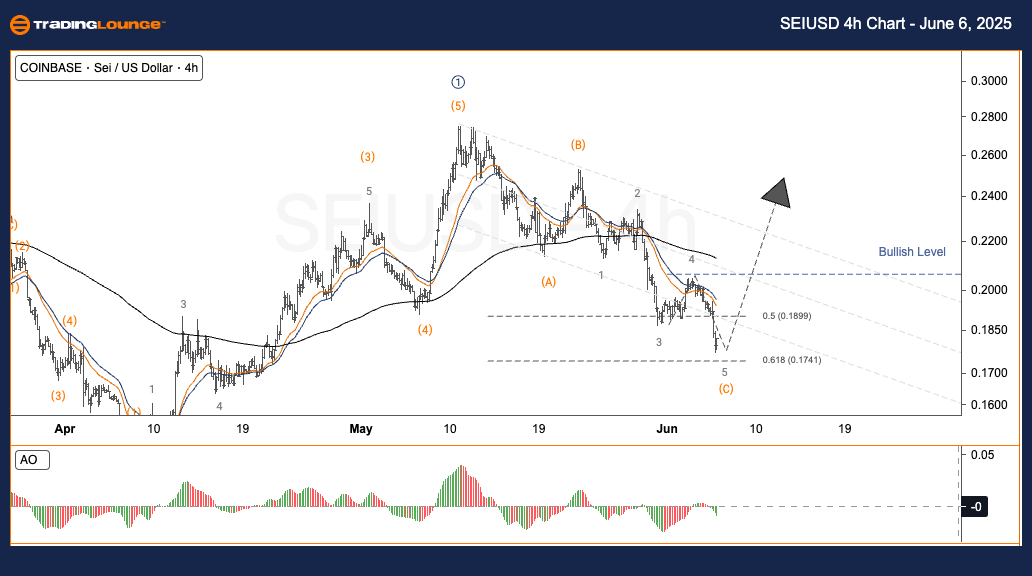

Elliott Wave Analysis - TradingLounge H4 Chart, Sei / U.S. Dollar (SEIUSD)

SEIUSD Elliott Wave Technical Overview

- Function: Trend Continuation

- Mode: Motive Wave

- Structure: Impulse Pattern

- Current Position: Wave 2

- Next Higher Degree Trend: To be determined

- Invalidation Level: Below $0.130

SEI/USD Trading Strategy – 4-Hour Chart

Following the completion of wave ① around $0.32, SEI/USD now undergoes a Zigzag correction (A–B–C), forming wave ②. This corrective movement is nearing its end at a Fibonacci support level.

Suggested Approach

- Short-Term Traders (Swing Trading)

-

- ✅ Entry Signal: Await a confirmed breakout above $0.220 to signal the beginning of wave ③. Traders should consider building positions in line with the upward momentum.

Risk Parameters

- 🟥 Wave Structure Invalidation: A drop under $0.130 will negate the current wave count.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Unlocking ASX Trading Success: Cochlear Limited - Wednesday, June 4

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Wednesday, June 4

Vechain Crypto Price News Today - Wednesday, June 4

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more