Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Tuesday, July 15

Image Source: Unsplash

Bitcoin (BTCUSD) – Elliott Wave Technical Analysis & Trading Strategy

BTCUSD Elliott Wave Technical Analysis

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 3

- Invalidation Level: 110,588

Market Overview – Daily Chart

Bitcoin (BTCUSD) is currently showing continued upward movement through an accelerating wave pattern. At present, price action is in a consolidation phase, specifically wave iv of sub-wave iii, acting as a short-term correction. Once this phase completes, we expect upward movement toward wave v of 3, followed by the final wave (5) in the larger degree trend structure (1).

Trading Strategy – Daily Chart

- ✅ For Short-Term Swing Traders:

-

- Wait for wave iv to consolidate near Fibonacci zones (0.236–0.382).

- If a bullish reversal or a small impulse pattern is observed → Consider entering a long position to ride wave v.

- 🟥 Wave Count Invalidation:

-

- If BTCUSD drops below 110,588, the current Elliott Wave structure will be considered invalid.

- If BTCUSD drops below 110,588, the current Elliott Wave structure will be considered invalid.

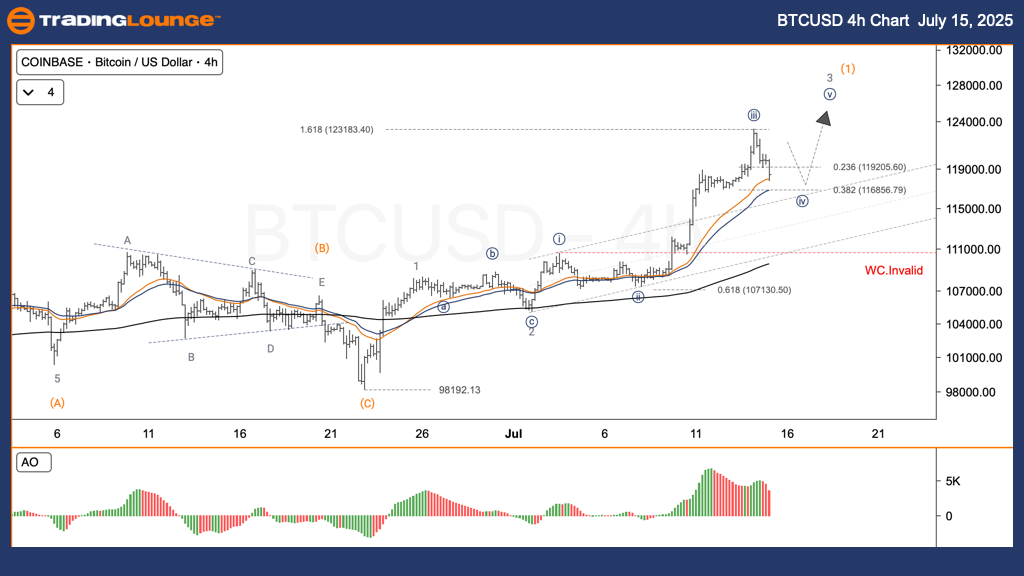

Bitcoin (BTCUSD) – Elliott Wave Technical Analysis & Trading Strategy (H4 Chart)

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Position: Wave 3

- Invalidation Level: 110,588

Market Overview – H4 Chart

BTCUSD shows the same structure on the 4-hour chart, confirming the consolidation phase of wave iv within sub-wave iii. This is a brief sideways move before Bitcoin resumes its upward path with wave v, continuing the impulse trend toward higher degrees.

Trading Strategy – H4 Chart

- ✅ Short-Term Opportunity (Swing Trade):

-

- Monitor consolidation zones near 0.236–0.382 Fibonacci levels.

- Upon detecting a bullish reversal or minor impulse → go long to capture wave v.

- 🟥 Invalidation Risk:

-

- A decline under 110,588 will invalidate the current wave structure, signaling a change in the trend.

- A decline under 110,588 will invalidate the current wave structure, signaling a change in the trend.

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

U.S. Stocks - Zoom Communications Inc.

Elliott Wave Technical Analysis: Euro/U.S. Dollar - Monday, July 14

Dogecoin Crypto Price News Today - Monday, July 14

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more