Interpreting Market Sentiments: Understanding The Fear And Greed Index

Image Source: Depositphotos

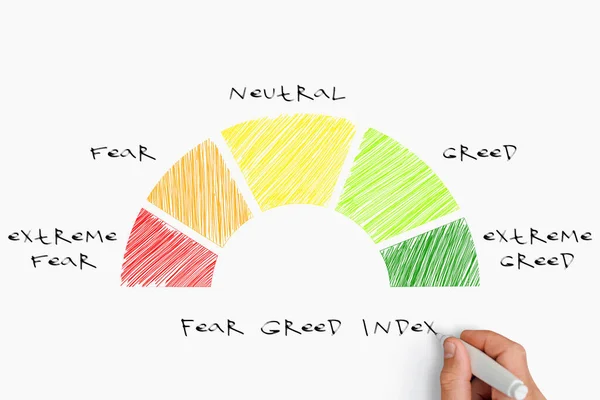

One detail that most investors overlook is that the world of finance is as much about human factors as it is about numbers. One of the most influential human factors is the psychological aspects that impact market behavior. While the way people think and behave is still described as a "black box" by most marketing theories, one indicator that we can use to demystify this black box and capture the emotional subtleties behind the numbers is the Fear and Greed Index. This indicator functions as a substitute for market sentiments by illustrating the delicate equilibrium between fear and greed that impacts investment decisions. Let's examine what the direction of this indicator's pointer means for financial markets and how the wise investor can use these trends to their advantage.

Understanding the Fear and Greed Index

The Fear and Greed Index is a comprehensive metric designed to evaluate the emotional state of investors. The index offers an overview of the present emotional climate in financial markets by utilizing many variables, including market volatility, spread of stock values, and trading options. The scale spans from 0 to 100, with lower values denoting profound concern and higher values denoting excessive greed. To comprehend the influence of market circumstances, it is important to have a thorough understanding of the components and size of the index.

For instance, cryptocurrency markets exhibit significant volatility. During periods of market growth, individuals often experience a heightened sense of greed, leading to the phenomenon known as Fear of Missing Out (FOMO). As well, individuals are frequently inclined to liquidate their coins as an illogical response to observing negative figures. From this recurring trend, two straightforward hypotheses arise.

- Excessive fear might indicate that investors are too apprehensive. This is a potential chance for purchasing.

- Excessive investor greed indicates an impending market downturn.

The Meaning of Fear in the Financial Market

Fear exerts a significant impact on investors' decision-making processes and market dynamics. To comprehend the significance of fear in the market, it is imperative to analyze its psychological foundations and investigate its contribution to inducing panic selling, risk aversion, and market volatility. Historical occurrences, such as the 2008 financial crisis, provide compelling illustrations of market behavior influenced by fear and the subsequent far-reaching consequences.

The Meaning of Greed in Financial Markets

On the other hand, greed, which signifies an insatiable want for greater wealth, can result in speculative bubbles and reckless risk-taking. To comprehend the meaning of greed, we specifically analyze its contribution to the escalation of market bubbles and subsequent collapses. An analysis of historical occurrences, such as the Dot-Com boom, offers a significant understanding of the repercussions resulting from unregulated avarice in financial markets.

Variables of Fear and Greed Index

- Volatility - An increase in volatility is regarded as an indication of a market characterized by fear.

- Bitcoin dominance refers to the proportion of the total cryptocurrency market value that is accounted for by Bitcoin. An increase in bitcoin dominance indicates a market sentiment characterized by fear, with investors seeking refuge in a safer asset. Conversely, a decrease in bitcoin dominance suggests a market sentiment driven by excessive greed, as investors shift towards more risky altcoins.

- Market momentum and volume are evaluated by comparing the current market momentum to the present volume. When the rate of purchasing volumes exceeds the longer-term momentum, it indicates that the market is becoming excessively driven by greed.

- Google Trends data is utilized to gauge the search volume for Bitcoin-related content. An upsurge in specific search phrases like 'bitcoin price manipulation' is regarded as an alarming indicator, whilst 'bitcoin price forecast' would be seen as more optimistic.

- Social media - Employing a Twitter sentiment analysis method, an abnormally elevated level of engagement is utilized to detect avaricious market conduct.

How is the Market feeling today?

Today, the cryptocurrency market is feeling rather greedy. Remember, this might indicate a probable price correction. As usual, it is in your best advantage to avoid market instability and rash, emotional judgments. As you can see, we have a lot of signs to assist us become smart investors and get back on track when we go off course. The Fear and Greed Index is only one of many; it is up to us to come to know them well enough to use them and understand their purpose.

More By This Author:

SEC Approves ETFs – Will Expectations Soar Or Stumble?

Leveraged Trading: Assessing The True Risks

Daily Check Analysis: BTC Pulse On Tuesday, Dec. 19

Disclaimer: The information provided on this article is for general informational purposes only. It does not constitute professional advice. Please consult with appropriate professionals ...

more