You Want Truly "Sound Money"? A Thought Experiment

Many proclaim a desire for "sound money," but "backed by X" currencies are not "sound money" unless they can be converted directly into X. Those proposing gold-backed currencies are trying to secure the promise of "sound money" without actually doing the hard part, which is convertibility to the underlying asset.

The only way a currency can be "as good as gold" is if it can be converted to gold. Without a conversion mechanism, the currency isn't backed by anything but an illusory connection between reserves and the currency being issued.

The only way an oil-backed currency is actually backed by oil is if the currency can be converted into an oil futures contract, i.e. a claim on actual oil. This is what made America's "gold standard" an actual gold-backed currency: other nations could (and did) demand gold in exchange for their surplus dollars.

As I've discussed elsewhere, America's geopolitical goals required running sustained trade deficits to support our allies' economies, which left these exporting nations with surplus dollars they could trade for gold. America's gold reserves were being drained and if the convertibility had been left in place, the reserves would have fallen to zero: with the gold gone, that would have been the end of the gold standard.

Rather than waste our time with illusory "backed by X" schemes, why don't we cut out the intermediary paper-digital currency and just use gold and silver as money directly in coinage? In other words, if we want truly sound money, then use intrinsically valuable metals as money.

So let's run a thought experiment on this very ancient and common-sense sound money. Please withhold your screams that "this can't possibly work!" until the end. On second thought, let's just dispense with all the quibbles right now: gold and silver coinage was "sound money" for millennia, so we know it works. If we can't make it work now, that's our fault, not the fault of precious-metal coinage as money.

Three problems immediately arise:

1. The gold reserves are not large enough at the current price.

The US currently holds 261,500,000 ounces of gold in reserve (8,133 tons). At the current price of gold around $1,900 per ounce, this stash is worth $500 billion--nowhere near enough to equal the current monetary base or money supply. Per the Federal Reserve:

Currency in circulation: $2.292 trillion.

Monetary base (currency in circulation plus reserves): $5.418 trillion.

M1 Money Supply: $9.913 trillion

M2 Money Supply: $21.327 trillion

2. The amount of "money" and "assets" that can be converted to cash floating around the world far exceed the reserves.

World individually held wealth (2022): $480 trillion

According to a report from the Boston Consulting Group, there was $27.5 trillion US dollars worth of electronic money in circulation around the world.

3. This generates the third problem: like every other asset, gold-silver coins will be bought up and hoarded by the wealthy few, leaving none for the the many to use as money.

There is no way to have a currency that circulates if every coin is immediately socked away, mostly by the wealthy both domestically and overseas.

The solution is three-fold:

1. Arbitrarily set the value of gold in the coins at $20,000 an ounce. Thus a coin containing 1/100th of an ounce is stamped with a value of 200 dollars. The value of a coin containing 1/1000th of an ounce is set at $20. The difference between the current price of gold and the $20,000 per ounce valuation in US dollars is the value of the coins being legal tender in the US.

The same mechanism could be used for silver coinage: the value of silver in the coins could be set at $250 per ounce.

This limits hoarding, at least until the global price of gold approaches $20,000 an ounce and the price of silver approaches $250/ounce.

This would set the total value of the dollar amount stamped on the coins of the US gold holdings of 261 million ounces at $10 trillion. This is roughly double the current monetary base.

2. Reverse-split the dollar 100-to-1, so $100,000 is reduced to $1,000. This will reduce the dollar-denominated "wealth" to a number more in line with the currency in circulation. A house that is currently worth $300,000 would be worth $3,000, and so on. A $1 coin would have the same purchasing power as a $100 bill today.

This would reduce total household wealth in the US from $140 trillion to $14 trillion--more in line with the monetary base of $10 trillion.

3. Make holding coins abroad illegal and subject to immediate confiscation. Furthermore, make it a federal crime to hold more than $5,000 in coinage. This limit is necessary to keep the wealthy from buying up and hoarding the nation's coinage. To enforce this, each coin must have its own unique ID stamp so it can be tracked.

This changes the coin currency from an anonymous commodity that can be acquired without limit by criminals or the wealthy to money that is intended to circulate rather than become yet another asset hoarded by the wealthy.

There are other forms of precious metals the wealthy can accumulate in vast quantities, but money for the citizenry is intended for circulation, not hoarding by the wealthy.

One could argue that the difference between the arbitrary value of the coin--a $10 coin would only have 10% of that value in precious metals--is too high for these coins to be "sound money." But this misses the point: "sound money" doesn't require the value of the precious metal set by global markets to equal the dollar value stamped on the coin.

Sound money simply means the money has an intrinsic value that isn't reliant on some intermediary mechanism such as paper or digital money supposedly "backed" by one kind of tangible asset or another--a form of money that has no intrinsic value if it can't be converted to the tangible asset itself.

Any US resident could convert their electronic dollars into coinage with intrinsic value at any bank, with a maximum of $5,000 to disable hoarding by the wealthy. Note that once the dollar is reverse-split, then that $5,000 would be enough to buy a house currently valued at $500,000.

When the electricity goes out, coins are still money.

These coins would have value for 1) containing a defined quantity of precious metals and 2) being legal tender in the US.

As noted, the value stamped on the coins has to far exceed the price of the metal to discourage hoarding. Without this vast premium for being legal tender, precious metal coinage would immediately disappear into the vaults of the wealthy.

One of the great fictions about money is that it is neutral. It isn't. It's either designed for the elites or for the citizenry. Since we've never really had a currency that wasn't designed for the wealthy to accumulate and hoard, no one even knows what a currency designed for the citizenry even looks like.

A monetary base of metal money would place strict limits on the central bank, Treasury and government spending. It would no longer be possible to conjure currency out of thin air to fill every interest group's trough or bail out the banks again. Free money for financiers would not longer be possible. Neither would giving every taxpayer "free money" to spend to support consumption. The Treasury could still sell interest-bearing bonds, but the monetary base could not be expanded by a few keystrokes.

In other words, a stable monetary base would be inconvenient for financial and political elites. There would be limits on their power and predation. But there would also be limits on the citizenry's demands. Promises made to win elections ("I'll give you more free money than my opponent") could no longer be honored with "free money" conjured out of thin air.

Living with constraints is the cost of having sound money.

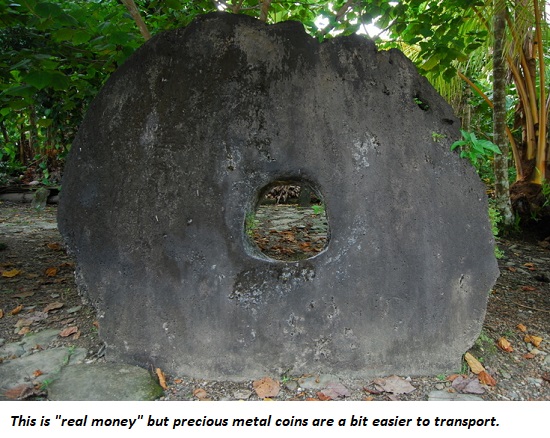

This is a stone coin on the island of Yap. It's an extreme example of money. Metal coins are certainly more transportable and easier to use.

More By This Author:

Contrarian Thoughts On The Petro-Yuan And Gold-Backed CurrenciesWant To Know Where The Economy Is Going? Watch The Top 10%

The Forgotten History Of The 1970s

Disclosures: None.