Yield Curve Inversion Is Not A Perfect Recession Predictor

Image source: DepositPhotos

Yield Curve Inversion (short-term rates higher than long-term rates) is not a perfect recession predictor!

In fact, over the past 25 years, yield curve inversions have correctly predicted recession twice and been wrong twice.

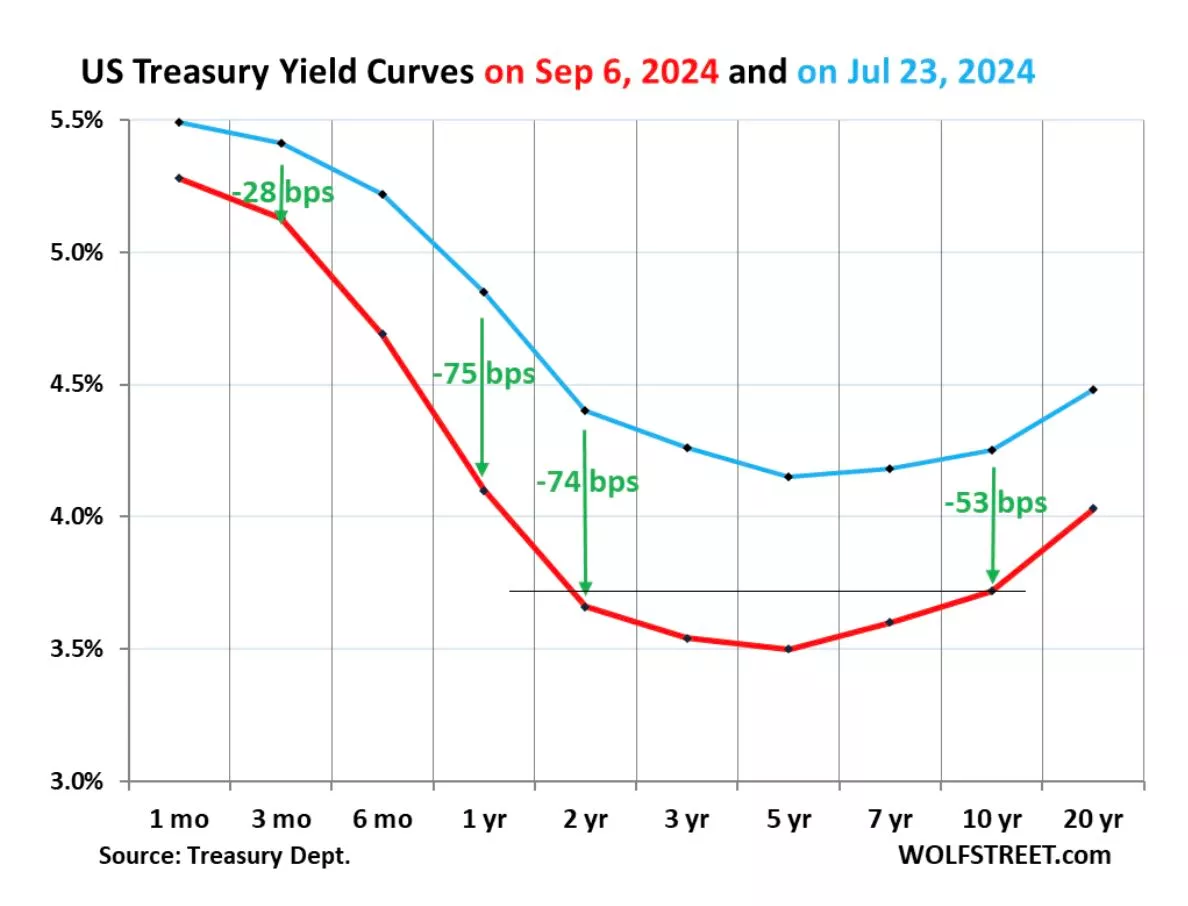

The treasury yield curve is now inverted on the short-end (i.e. 3-month bill 5.13% and 10-year 3.72%) but un-inverted on the longer end (i.e. 2-year 3.66% and 10-year 3.72%).

The QE that began in 2008 has distorted the predictive power of the yield curve. Therefore, at this point, we have to watch the data and wait and see if a recession comes.

More By This Author:

July Pending Home Sales At A Record Low...Dow Rallies 200 Points To New Record, Completing Comeback From Early August Rout

The Mortgage Market Improves, But the War Rages On

Disclosure: None.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!