With COVID Aid Set To Expire By Year-End, Many US Citizens Face Their Own "Fiscal Cliff"

As the end of the year approaches, so does the end of numerous pandemic aid programs.

It's a timeline that leaves a large portion of the country dealing with their own "fiscal cliffs" as calendars are set to turn toward 2021, and hopefully, its ensuing recovery.

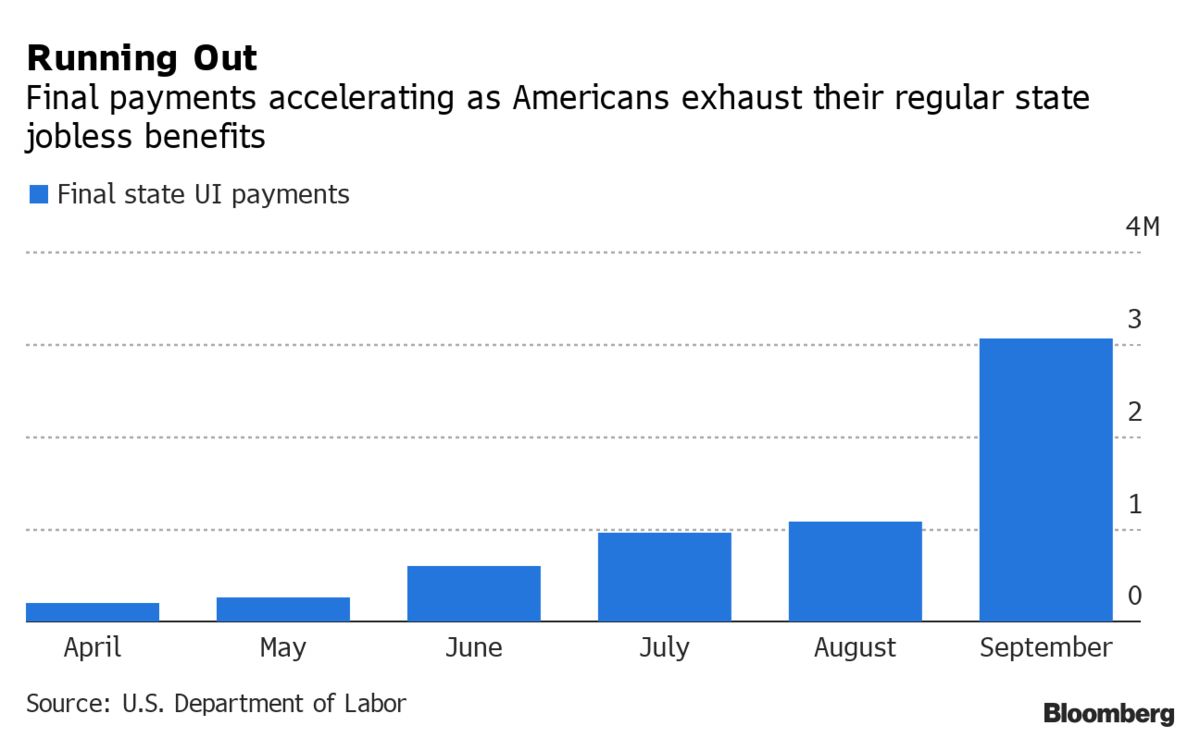

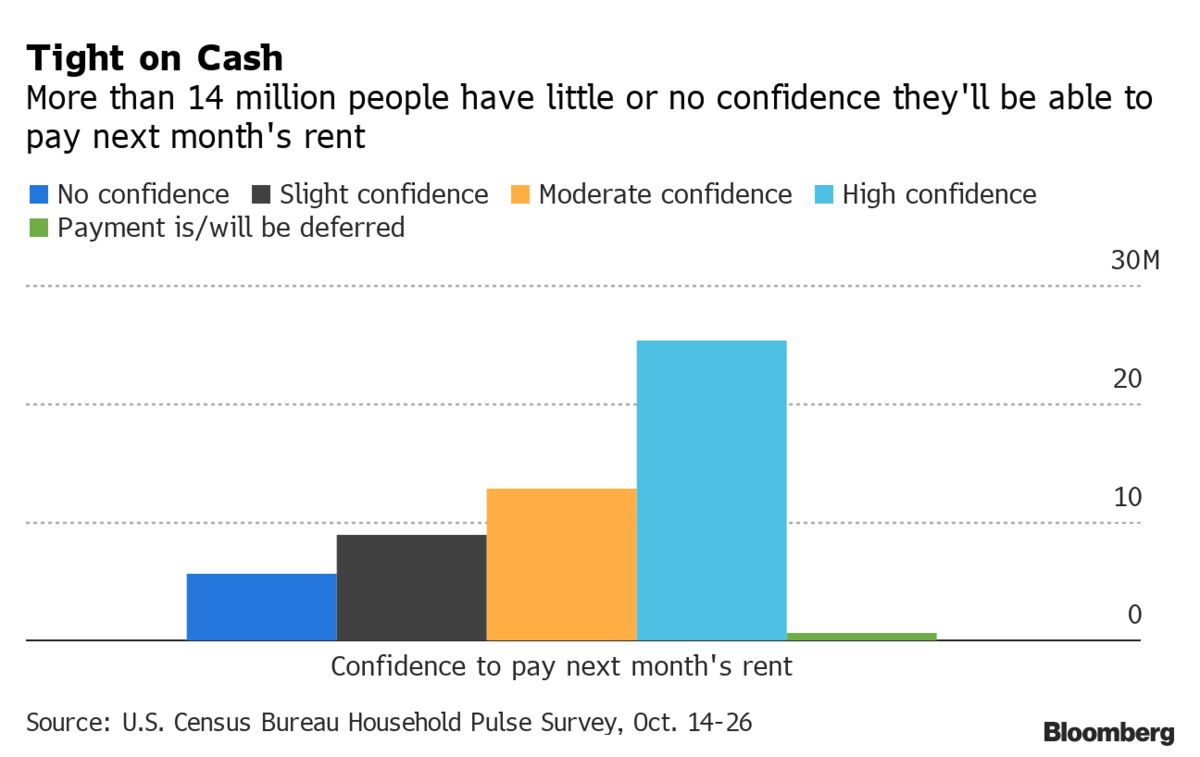

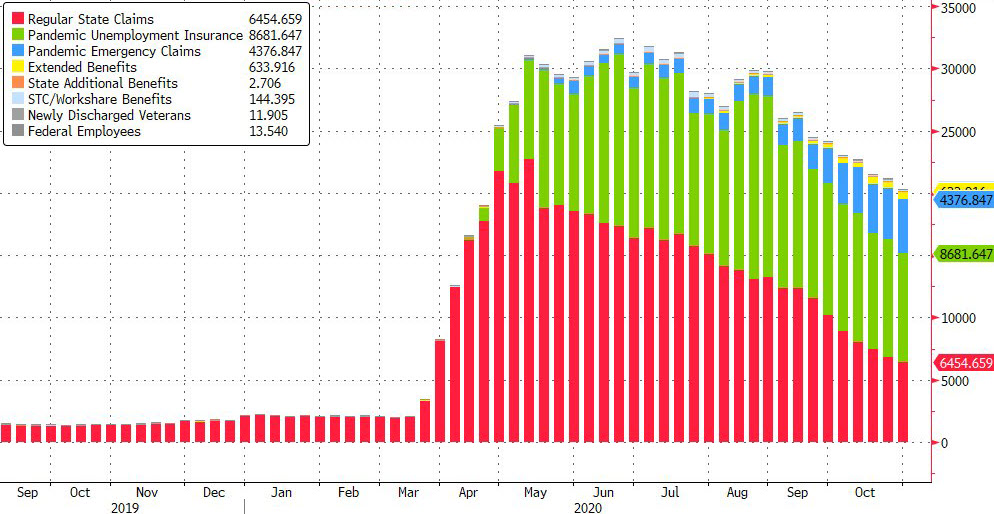

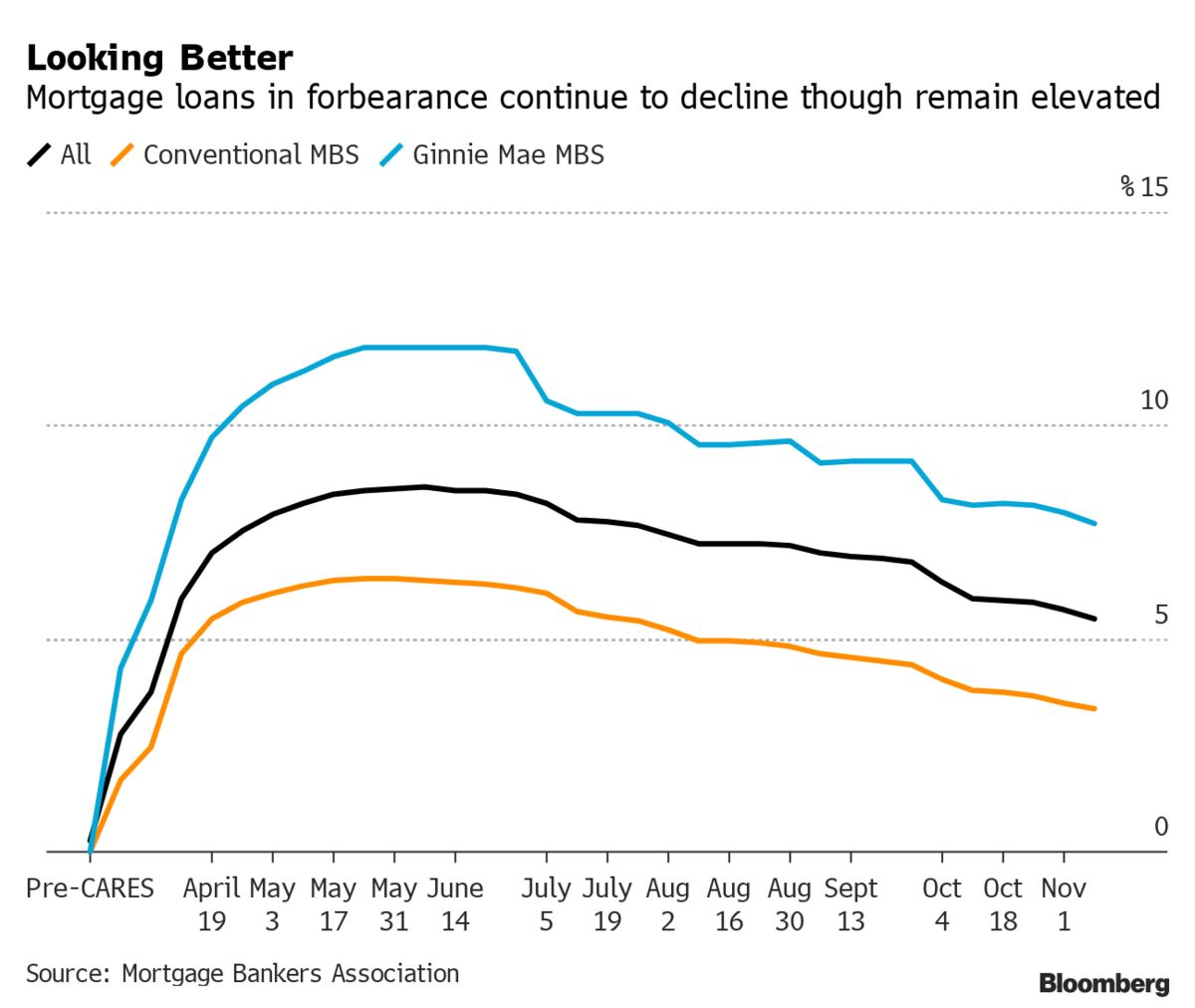

For example, Bloomberg notes that 12 million people are facing a late-December cutoff from the end of two federal unemployment-insurance programs. Additionally, student loan payments will no longer be frozen and mortgage forbearance, along with eviction moratoriums, will also expire. On top of that, the Fed's lending facilities for small businesses and local governments will also dry up.

A new report by the Century Foundation found the following deadlines looming:

- An estimated 7.3 million workers will see their Pandemic Unemployment Assistance (PUA) benefits expire on December 26, and 945,000 will run out of PUA before December.

- Pandemic Unemployment Assistance (PUA) benefits are only payable through December 26, and last thirty-nine weeks in all states and forty-six weeks in a subset of high unemployment states (Alaska, California, Connecticut, Delaware, District of Columbia, Illinois, Michigan, Nevada, New Jersey, New York, Ohio, Oregon, Rhode Island and Washington). PUA eligibility started the week ending February 9, but most eligible for PUA lost employment in March and will be reaching the end of their benefits at the end of December.

- An estimated 4.6 million workers will see their PEUC benefits prematurely expire on December 26.

- Moreover, an additional 3.5 million will have already run out of PEUC benefits before the December 26 cutoff.4 (PEUC provides thirteen additional weeks of benefits to only those running out of state benefits; workers receiving PUA are not eligible.)

- Only 2.9 million of those running out of PEUC will be able to collect EB in 2021—but states will have to pick up half of the cost at a time when their trust funds are depleted.

- Those workers running out of PEUC benefits can claim EB benefits, a program first authorized in 1970 that provides between six and twenty weeks of benefits, depending on the state’s unemployment rate and law. State law provisions are frequently tied to federal funding and the percent of workers collecting regular state benefits.

- A total of more than 16 million workers will have lost CARES Act benefits by the end of the year.

- In addition to the 12 million workers who will see their CARES Act benefits expire on December 26, an estimated 4.4 million workers will have already exhausted CARES Act benefits before this cutoff—and all of these workers will be heading into 2021 with little or no aid available to them.

You can read the full Century Foundation report here.

There is some hope that Covid relief could come as part of a spending bill needed to avoid a government shutdown, but with most of congress adjourned - and the rest deadlocked - hopes for getting a deal done in 2020 seem dim. Ah, the neverending efficiency of government.

In the interim, people like 63-year-old Larry Long of Willow Grove, Pennsylvania are counting down to receiving their last PUA check. He told Bloomberg he hasn't been able to pay his bills since the supplemental $600 per week in unemployment benefits has expired.

He said: “Basically all I can do is try to have food in here and to make arrangements with utilities and the landlord. I am extremely worried about the virus. As an older Black male with a touch of diabetes, I am scared to death. I’m scared to death to go outside. I’m scared to death to stay home.”

Jennifer Marshall, of Hendersonville, North Carolina told Bloomberg she has "exhausted" all state benefits and is now "looking at nothing". “I don’t know what else to do. I’m literally sitting here with $4 in my wallet,” she said. She said he has listed both her car and her microwave for sale online.

57- year-old Lori Fulton, who used to work part-time at several gigs before they shut down from Covid, said she's worried about finding a new home because her landlord is getting ready to move a family member into her home.

“Who’s going to rent a place to you when you have no income? If 2021 doesn’t look better, I’ll be homeless,” she concluded.

But hey, Wal-Mart just posted blowout earnings - so if you're looking for some supplemental income, there's always...

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

It is disgraceful that our politicians are unable to work out an agreement. Millions of Americans will end up homeless and hungry if they can't get a package through.

Agreed. Even if they do intend to eventually pass more relief, to cause so much anxiety and leave everyone without knowing is unconscionable.

If Trump really cared about the people, he could easily have passed an executive order to extend unemployment benefits. But now that the votes were cast, and he's out, he couldn't care less.

Are you surprised? He stole millions of dollars from every day hard working Americans with his bogus Trump University. Then conned them into funding his wall, which ended up just going into the pockets of his cohorts like Steve Bannon. Noe he's asked them to pay for his bogus election legal lawsuits, but most aren't reading the find print that says most of their money will actually go to paying off Trump's debts.