Friday, April 19, 2024 5:47 AM EST

UBS Group AG is planning significant job cuts across its investment bank, expected to affect over a hundred positions globally. This move follows the rescue of Credit Suisse, which increased UBS’s workforce substantially. Job losses are also anticipated in wealth management and markets units. The CEO aims to save $6 billion in staff costs. UBS’s shares fell due to proposed regulatory reforms, potentially resulting in a $20 billion capital hit. The restructuring process, coupled with the merger of parent banks and subsidiaries, makes 2024 a challenging year for the bank.

So, the seasonal patterns are particularly interesting right now as investors consider whether these jobs cuts are enough to boost sentiment surrounding UBS.

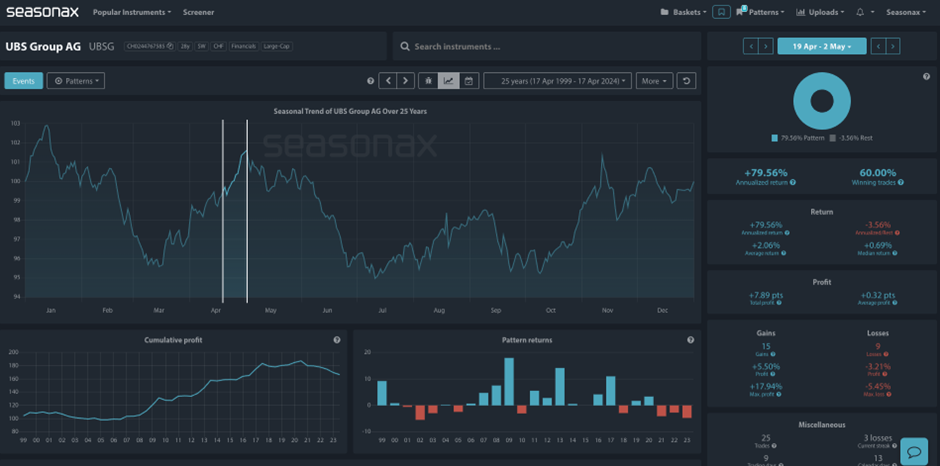

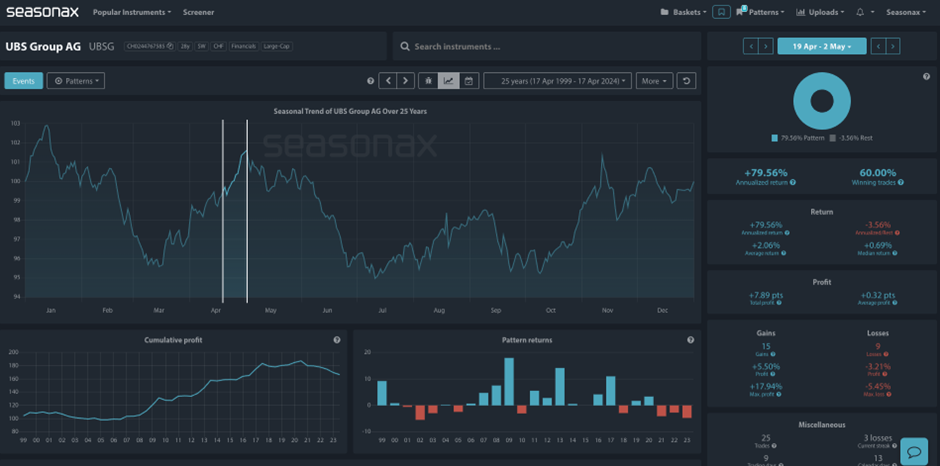

(Click on image to enlarge)

Over the last 25 years the share price has had a strong end to April with a 2.06% average return between April 19 and May 02. The largest gain was over 17% in 2009, but the last three years have seen falls of 4.07%, 2.71%, and 4.74%.

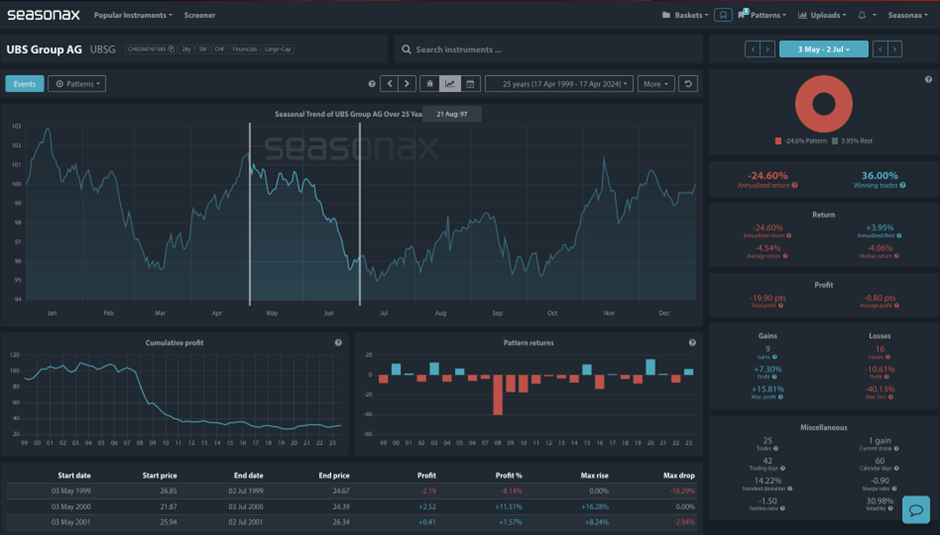

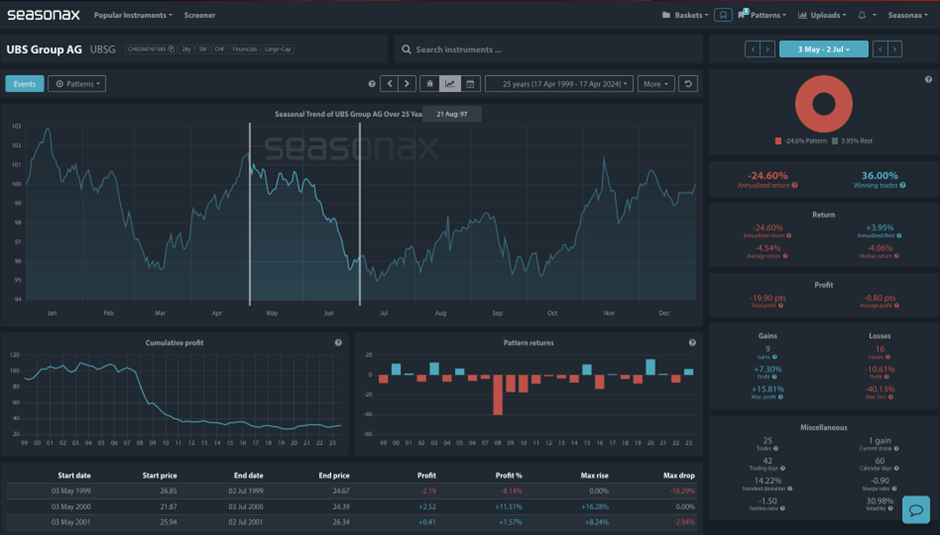

However, the period following this tends to be very weak. From May 03 through to July 02 the share price has fallen over 60% of the time over the last 25 years for an average fall of just over 4.5%.

(Click on image to enlarge)

So, will this weekly trend line hold as support for UBS around the 25.50 area? Will buyers take comfort from the cost saving job cuts?

(Click on image to enlarge)

More By This Author:

Weak Netflix Seasonals Ahead Of Thursday’s Earnings!

The UK’s Largest Grocer Issues Revised Profit Guidance

Is Boeing’s Loss, Airbus’ Gain?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.