Why Perestroika Failed

Mikhail Gorbachev will be remembered both for what he did not do and for what he did. Beyond a few violent but brief interventions within the USSR itself (Lithuania, Georgia), what he did not do was send in the Soviet army to prevent Poland, Czechoslovakia, and the rest of the Soviet empire from reclaiming their independence. For that he will be remembered with gratitude and respect. The things he did were to implement glasnost (often translated as “openness”) and perestroika (economic reform, or “restructuring”). Those had more mixed results.

Glasnost was at least a qualified success. Freedom of speech, assembly, travel, and more were greatly, if not absolutely, liberalized. Many aspects of glasnost lasted all the way to Vladimir Putin’s crackdown in 2022. Even today, Russians by and large retain one key freedom that was denied to Soviet citizens: the right to leave the country, permanently or temporarily, as one wants.

But perestroika, the economic component of Gorbachev’s reforms, was a failure. It pulled the rug out from under the already tottering structure of central planning while doing little or nothing to lay the foundation for a real market economy. In retrospect, we can see three key impediments that doomed perestroika from its inception.

The inherently partial nature of perestroika

Central planning was never quite the right term for the Soviet economy. The system always was much more complex than that term suggests. Gosplan, the supposed central planning agency, had neither the knowledge nor the computing power to direct the operations of every factory and farm in the country. Over time, what developed was a system in which central authorities set a few priorities, which were implemented through a messy system of bonuses and sanctions mediated by bargaining between local and central interests. Enterprise managers were grudgingly granted a degree of autonomy over details. The whole system settled into a sort of polycentric equilibrium that somehow kept the wheels turning.

By the time Gorbachev came along, though, those wheels were turning more and more slowly. He decided to tinker. But tinkering with bits and pieces of a complex system while leaving others in place always risks unintended consequences.

Many of the key economic changes that Gorbachev introduced aimed to give enterprise directors more freedom in deciding how to meet goals that were still to be set, at least broadly, by the center. The new freedoms included greater control over production methods, hiring, and the sourcing of inputs. Enterprise directors also received more control over their finances, rather than having to follow a strict financial plan tailored to match detailed input and output mandates. But it was never Gorbachev’s intention to establish a real market economy. Among the things that Gorbachev left in place were state ownership of the means of production, incentives based on quantitative targets rather than profits, and price controls.

Limited enterprise autonomy without profits, prices, or private property proved to be a toxic mix. Managers did use their freedoms to acquire new equipment and hire new workers. In principle, enterprises were supposed to cover increased expenses from their revenues. In practice, however, financial shortfalls were papered over with government subsidies or easy loans from state lenders. Demand rose for machinery and raw materials, but their prices remained constrained, leading to shortages of producer goods. Increased competition for labor pushed up household incomes, but rising incomes plus fixed prices led to shortages in consumer markets, too. Together, inflexible prices, meager gains in output, and debt-financed growth of demand led to repressed inflation on a colossal scale.

By 1990, the contradictions of perestroika were apparent. Falling output and repressed inflation led to long lines and short tempers. A group of more radical reformers proposed a 500-day plan that aimed to complete the transition to a market economy by ending price controls, privatizing government enterprises, and opening the Soviet economy to the world. Gorbachev’s government toyed with accepting the plan but politics intervened, culminating in a failed coup in the summer of 1991 and the dissolution of the Soviet Union itself a few months later.

The missing institutional foundations

Going into 1992, the Russian Federation, with Boris Yeltsin as president, had inherited roughly half of the Soviet Union’s population and all of its economic problems. Just weeks after Russia formally became a sovereign country, the Yeltsin government unleashed a program of shock therapy that echoed the 500-day plan but compressed it into an even shorter time frame.

Decontrol of prices early in 1992 led immediately to hyperinflation. Over the course of the year, prices rose by more than a factor of 20. The long lines of the Gorbachev era disappeared overnight, but so did the life savings of ordinary Russians. Privatization led to the emergence of a new class of super-rich oligarchs but did not revive the economy as a whole. On balance, the events of that fateful year ended up showing that both the Russian reformers and many of their Western backers had only a superficial understanding of the nature of a market economy.

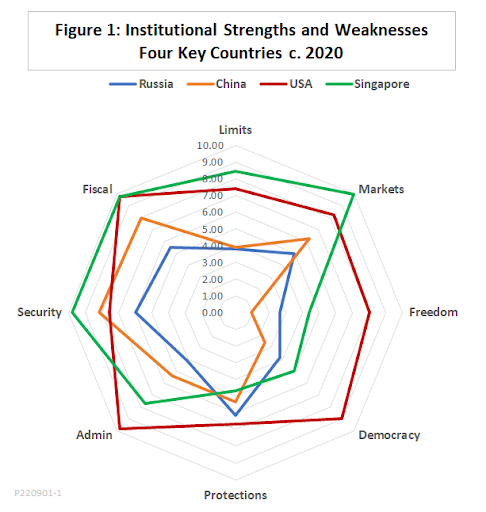

Somehow, in their fixation on technical details, the reformers had not recognized that a market economy can operate successfully only if its institutional foundations are strong. Without property rights, contract enforcement, and investor protections, you get not capitalism, but kleptocracy. Russia didn’t have the needed institutions in the 1990s and it still does not. Figure 1 shows the relative institutional strengths of four representative countries circa 2020. Each country is scored 0 through 10 according to three aspects of state capacity (administrative, security, and fiscal) and five characteristics of liberal democracy (constitutional limits on government, quality of market institutions, personal freedoms, procedural democracy, and social protections). Quality of market institutions, in turn, is measured as the average of scores for property rights, contract enforcement, and investor protections. (See here for details of the methods and measures underlying the chart.)

As the figure shows, Singapore has the world’s highest score for the strength of market institutions, with a perfect score of 10. The United States does quite respectably with an 8.3. China is well behind, but its score of 6.2 was at least better than its scores for freedom and democracy. Of the four countries shown, Russia’s market institutions are by far the weakest, with a score of just 4.9. If data on Russia’s market institutions were available for the Yeltsin era, its score would have been even lower.

Cultural values

I had a front-row seat for a lot of this. After visiting Russia several times in the late 1980s, my wife and I settled in to teach in Moscow starting in the fall of 1990. We eventually founded our own small American-style MBA program and continued to run it through 2000, Vladimir Putin’s first year in power.

The students in my own classes mostly had backgrounds in physics, math, and engineering, so they had little trouble with the equations and models of economics and finance. Over time, though, I began to see that they had subtly different perspectives on some of the less quantifiable aspects of a market economy.

One example is captured by the common Russian expression “kto-kovo?” or “Who is going to get the better of whom?” If you start from a kto-kovo perspective, you see every potential business deal as a zero-sum game. By guile, misinformation, or force, someone is going to end up the loser and someone the winner. Mutual gains from trade, the basis of Western economic thinking from Adam Smith to the present, would be an accident, not the rule.

Another difference lies in the Russian understanding of envy. Russians distinguish more clearly between “black,” or malign, envy and “white,” or benign, envy than English speakers do. If your neighbor has a cow, white envy motivates you to work hard so you can get a cow, too. Black envy motivates you to poison your neighbor’s cow.

In a classic Russian joke, a man catches a magic fish. “I will give you anything you want if you throw me back in the sea,” says the fish, “but there is a catch. Anything I give to you, I will give doubly to your worst enemy.” The fisher thinks long and hard. Finally, he says, “OK, it’s a deal. Make me blind in one eye!”

Needless to say, a mentality of black envy is not a good basis on which to build a system of productive rivalry and mutual gains from trade.

In a 1994 book, Systems of Survival (a book that has never received the attention that it should), Jane Jacobs outlined her own insights into the cultural foundations of a market economy. Jacobs drew a contrast between two cultural types. One group, whom she called “guardians,” see the exercise of prowess as one of the most important virtues. They also admire a willingness to take vengeance, even when doing so is costly, and skill in deceit as a means of achieving an end. Although they are willing to trade when necessary, guardians do not view trade as an especially virtuous activity.

The second group, whom Jacobs called “traders,” have a different set of virtues. They value efficiency, novelty, industriousness, and thrift. They prefer voluntary agreements to achieve their ends. Accordingly, they place a high value on respect for contracts and on honesty. They are not completely unwilling to use force, but they tend to shun it as a regrettable necessity and to use it only as a last resort.

Jacobs thought that a healthy society requires a balance between guardians and traders. Guardians, a term she borrowed from Plato, are well suited for roles as government leaders, soldiers, and police, although, ironically, some of their values are shared by street gangs and organized crime. Traders, in turn, are well adapted to roles in industry, commerce, and agriculture. Their devotion to innovation and hard work, combined with their penchant for cooperating with others to achieve mutual gains, promote not only their own prosperity, but that of the whole society. However, markets work best under the rule of law and in a context of peace and security, hence the need for a balance of traders and guardians.

I read Jacobs’ book while living in Yeltsin’s Russia and became convinced that the Soviet experience had left that country with a fundamental imbalance: Too many guardians, not enough traders. What is more, perestroika and shock therapy opened the way for people imbued with a Soviet-era guardian mentality to become biznessmen, a perverse hybrid of the two cultural types. (There were a few biznessmenki, too, like Yelena Baturina, the wife of Moscow’s mayor, who used her connections to become the richest woman in Russia.) The biznessmen enthusiastically applied their virtues of prowess, vengeance, and deceit to the emerging market economy. The result was a carnival of fraud, corruption, extortion, and violent settlement of business disputes that poisoned any enthusiasm ordinary Russians might have retained for a market economy – if any remained after the 1992 hyperinflation.

To be clear, I would like to hedge my comments on culture with a few words of caution. Cultural traits are not uniform within any society. A mixture of guardians, traders, and hybrids of the two can be found in any society. Most of our own Russian students of the 1990s went on to become successful, law-abiding entrepreneurs and business professionals, although not a few found it easier to make their careers as emigres in the West than at home in Russia. Also, from what I read and hear at a distance, it appears that some of the more flamboyantly criminal features of Yeltsin-era business life have faded, not least because of Putin’s determination to let neither Gucci-wearing oligarchs nor leather-jacketed mafiosi establish themselves as competing centers of power. Many traders survive in the quieter corners of the Russian economy, but clearly the guardians rule.

Looking back, I remember speaking at a conference in Moscow that was sponsored by the Cato Institute in the late summer of 1990. The topic was economic reform. The 500-day plan, which had just come out, was greeted with enthusiasm by both Western and Russian conference participants. I don’t have my notes from the conference, but as best I remember, I was as hopeful as the others about the prospects for reform. Too hopeful.

By that time, we understood some of the more obvious flaws of perestroika, but we didn’t see how naïve it was to think the 500-day plan, or anything like it, would have fixed them. The debacle of privatization without property rights and commerce without the rule of law still lay ahead. The Russians invited to that 1990 conference turned out, sadly, to be an unrepresentative sample with above-average enthusiasm for markets and liberal democracy. Not until later did it become clear not only that perestroika had failed, but that because of its missing pieces, its lack of an institutional foundation, and an inhospitable cultural context, it never had a chance.

Photo credit: iStock

More By This Author:

Fighting Inflation: Can We Learn From Jimmy Carter's Mistakes?

Maybe Inflation Will Be Transitory After All

Guaranteed Income for the 21st Century Aims to End Poverty As We Know It