White House Adopts An Energy Policy Where Everyone Loses

With his moratorium on new LNG export terminals, aging President Joe Biden and his advisers have stumbled on a way to upset both ends of the political spectrum. Domestic energy businesses want to export more, cheap US natural gas to foreign buyers. Following Russia’s invasion of Ukraine two years ago the US pledged to replace the natural gas no longer flowing through Nordstream to western Europe.

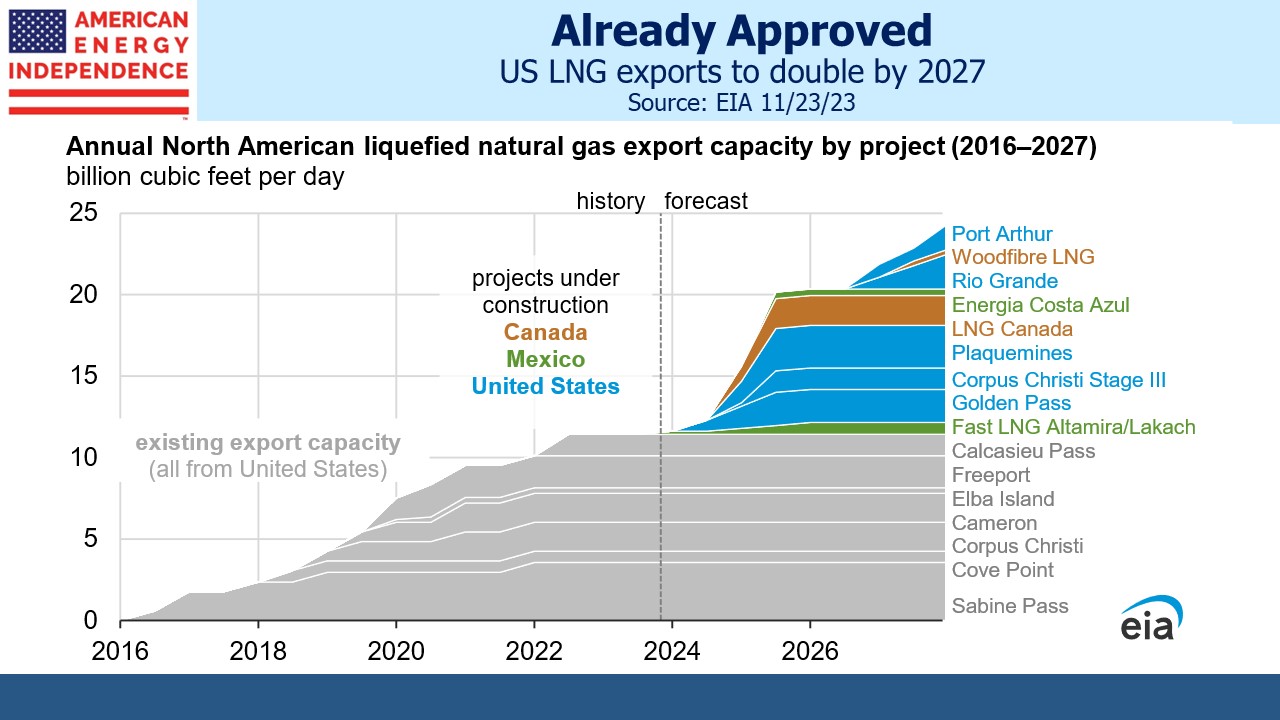

Many new LNG export terminals are at various stages of development. Planning and construction take several years. Now that the Department of Energy has been directed to examine the climate impact of each new facility awaiting approval, that will impose additional delays even assuming they’re approved. Venture Global’s Calcasieu Pass 2, or CP2, is the immediate casualty. This $10BN project is slated to export over 2.5 Billion Cubic Feet per Day (BCF/D), raising exports by 20%.

(Click on image to enlarge)

But enough projects have already been approved and begun construction that we’re still on track for a doubling of US LNG exports to around 24 BCF/D by 2027.

The White House has turned to Alex Haraus, a 25-year-old Colorado social media influencer, in an effort to excite young people enough to re-elect a doddering octogenarian. Like too many climate extremists, Haraus combines well-intentioned enthusiasm with poor recommendations.

His social media profile caught the attention of White House adviser John Podesta, and a Zoom meeting followed, which evidently impacted the new policy. Haraus and his TikTok followers believe that building LNG terminals assures long term trade in natural gas. Haraus presumably believes the world needs to run on solar and wind.

It’s a shame that youthful enthusiasm to curb Greenhouse Gas emissions (GHGs) isn’t directed towards practical solutions. LNG buyers are largely Asian. The International Energy Agency reports that China, India and other south-east Asian countries consume 75% of the world’s coal. They noted that last year’s 5% demand growth in China was driven by increased electricity consumption. This is partly because of the growth in EVs, often lauded by policymakers as evidence of China’s commitment to reduce GHGs. Yes, China’s EVs run on coal.

Coal-to-gas switching is how GHGs have fallen in the US and is our best chance to achieve similar success in emerging Asia. Haraus and his band of idealistic young supporters are pushing policies whose results won’t match their aspirations.

To cite just one example, Pakistan last year decided to quadruple coal-based power generation because of high LNG prices. Perhaps shocking to the Haraus TikTok crowd, Pakistan did not immediately turn to solar and wind.

Coal is cheap and easy to use. Its consumption keeps hitting new records as emerging economies consume more energy.

China and Russia are planning the Power of Siberia 2 gas pipeline to redirect supplies no longer going to Europe. Slow negotiations over the final terms have delayed construction, but it will eventually be built. This will reduce China’s need for coal, and thereby its GHGs.

Emerging economies would like to use more natural gas. We should encourage them.

So far the White House has upset energy companies around the world who are planning for more US LNG exports. Foreign business groups have expressed concern over America’s inconsistent posture on providing energy security. Japan’s government said they’re worried about the possibility of delays at facilities that haven’t yet gained approval. The White House has implemented a policy that will set back climate ambitions in the hopes of gaining youthful, idealistic votes in November.

Wall Street analysts regard it as a temporary delay that will be reversed after the election. That’s why there’s been little impact on stocks that might otherwise be affected. Cash flows from Energy Transfer’s proposed Lake Charles terminal were not reflected in the stock price. JPMorgan thinks further delays would reduce near term capex, a positive.

Similarly, delays to Cheniere’s planned addition of Trains 8 and 9 at their Corpus Christi Midscale facility could also boost near term free cash flow. Both Wells Fargo and Morgan Stanley expect the moratorium on new approvals to be lifted after the election regardless of who wins. Trump has already said he’d do so immediately.

This means that Alex Haraus and his idealistic TikTok followers are being played. Investors are betting that Biden will reverse himself if he wins the election. So by December the moratorium on LNG approvals will have upset just about everyone possible, from the energy sector and its customers to the climate extremists whose election support was rented. And it won’t have helped reduce GHGs, because of the widespread reliance on coal among Asian LNG importing countries.

More By This Author:

Emerging Markets Never DoBond Rally Helped Equity Valuations

Year-End Roundup