What’s Turning The Markets: The Fed, China, And Corporate Debt

- The Federal Reserve has played an increasingly important role in investor sentiment.

- China is unlikely to roll off U.S. Treasuries due to the interconnectedness of the global economy.

- Triple B corporate debt is a huge risk factor to investors, and should be avoided.

- Combining a diversified portfolio of equities and bonds is the best path to take during times of uncertainty.

- If we do enter a downturn, gold could be a good safe haven investment.

The Evolving Role of the Federal Reserve

The market is on a weird ride. Word play seems to be the market mover of choice recently, with several of the President’s tweets about specific companies or tariffs moving the stock market. More recently, Federal Reserve Chairman Jerome Powell’s announcement on June 4th about the Fed being willing to do what is necessary to keep the economy expanding resulted in the second best trading day of 2019.

Source: Google Finance

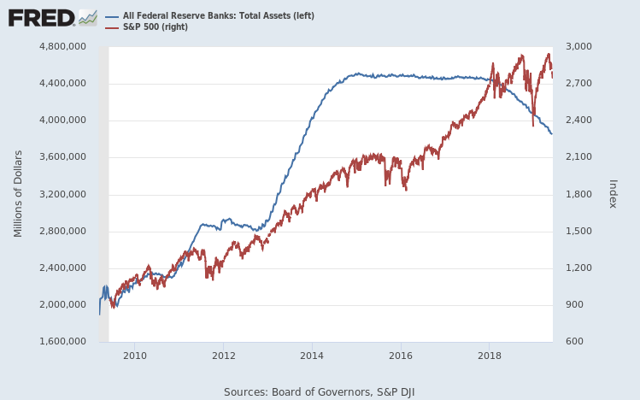

Powell’s statement was important news. The Fed’s balance sheet and the performance of the S&P 500 has been tightly linked over the past several years. The Fed announced in March that they would stop the unwinding of their balance sheet this September, resulting in a pause of the normalization of monetary policy which began in December of 2015. Their normalization goals were to “hold primarily Treasury securities, thereby minimizing the effect of Federal Reserve holdings on the allocation of credit across sectors of the economy” and “raise the federal funds rate and other short-term interest rates to more normal levels“.

Source: FRED

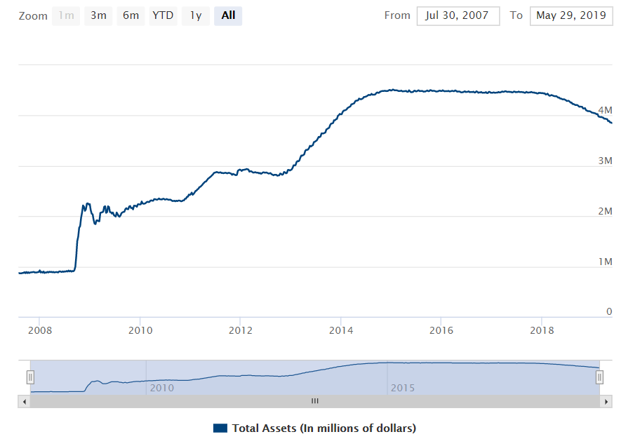

Now, the Fed intends to “slow the pace of the decline in reserves over coming quarters“. However, they barely made a dent in their Total Assets, which still total $3.8T. For comparison, the Fed held $900B in assets pre-Financial Crisis.

Source: Federal Reserve

There are ways to invest into the uncertainty of the market, with the most basic way to diversify portfolios well across asset classes. But there are also opportunities to invest in gold, which has proved to be a safe haven asset in times of economic downturn and unpredictability.

The History of the Fed: Clean and Lean

Back in 2002, a main principle of the Fed was to minimize their involvement in the private sector, specifically stated as “structure its portfolio and undertake its activities so as to minimize their effect on relative asset values and credit allocation within the private sector”. Keeping their portfolio “clean and lean” was a goal, and it subsequently allowed the Fed to do what they did in 2008.

The Federal Reserve’s overarching role is to support “maximum employment, stable prices, and moderate long-term interest rates in the United States” with monetary policy operations conducted through the Federal Open Market Committee.

The Fed Monetary Policy PDF highlights the Fed’s role in stabilizing prices, which creates stable growth, which in theory, should result in better economic conditions for everyone. The Fed exists to provide a balance to inflation and unemployment. But now, they seem to be entering the world of asset price management, with speculation that they are cutting interest rates to provide a boost the stock market.

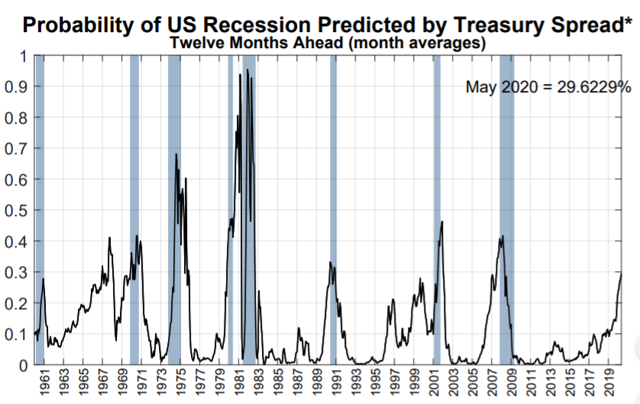

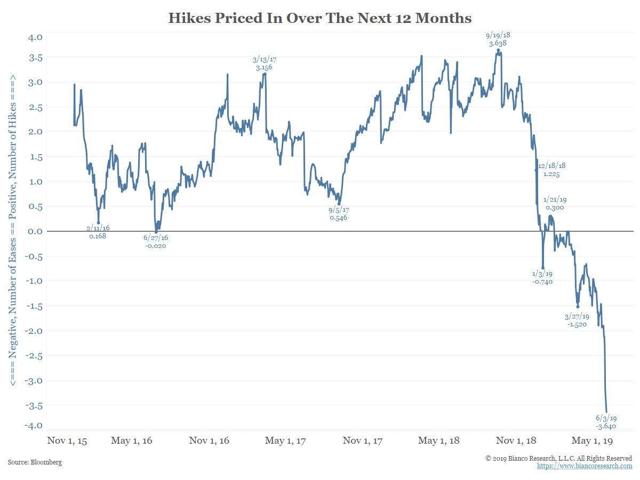

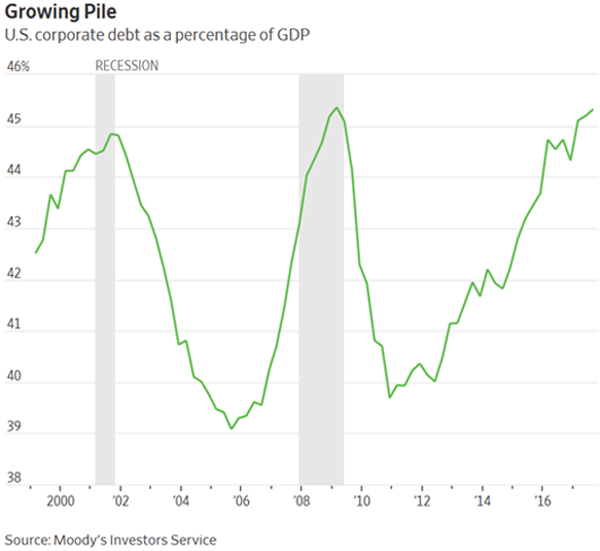

It appears that we are leaning even farther away from normalization, and towards the side of quantitative easing. Due to the uncertainty surrounding the trade war and overall economic stability, the market is pricing in three to four rate cuts in the next 12 months. Many are calling a recession in 2020 or 2021. The NY Fed calculated a 29.62% chance of a Recession by May of 2020, the highest probability calculated since 2008.

Is The U.S. About to Get Sick?

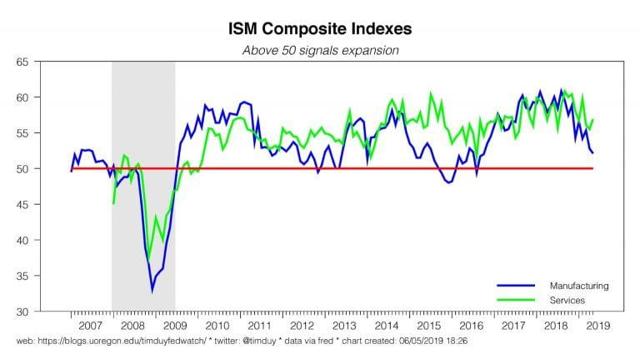

The old saying goes, “if the U.S. catches a cold, the rest of the world sneezes”. It appears that the US is about to at least suffer from some severe allergies based on economic data. The PMI and manufacturing output are both trending downward. But there is a divergence in the services sector, which held strong for the May report.

Source: Tim Duy

Manufacturing has showed weakness, but as Tim Duy says,

The services sector is a much bigger portion of the economy. We need to be careful about not extrapolating a manufacturing sector specific shock to the rest of the economy.

Manufacturing gave a false Recessionary signal in 2016, and it could do it again. But it’s important to remember that manufacturing is a small part of the overall economy. Once nonmanufacturing dips downward, that might be the time to sound the alarm bells.

The most recent ADP nonfarm private payroll change was a shock to the market, with an estimated 185K jobs added, as compared to the 27K actually added for May 2019. That’s a stark contrast to April 2019’s 275K growth metric.

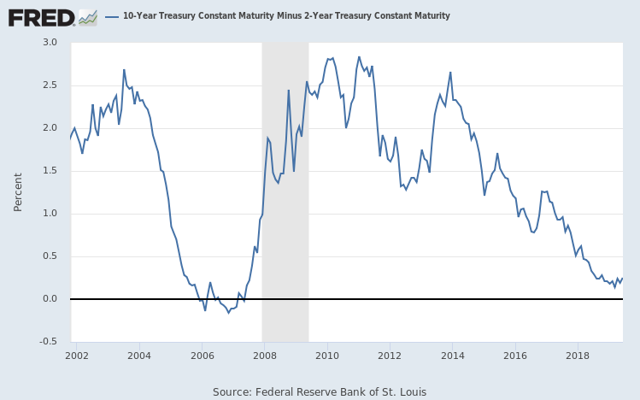

The yield curve is flirting with inversion, the closest it has been since March of this year. This is a commonly used recessionary indicator, subject to different interpretations from different people, but the point is that we are very close to a psychological tipping point.

Source: Fred

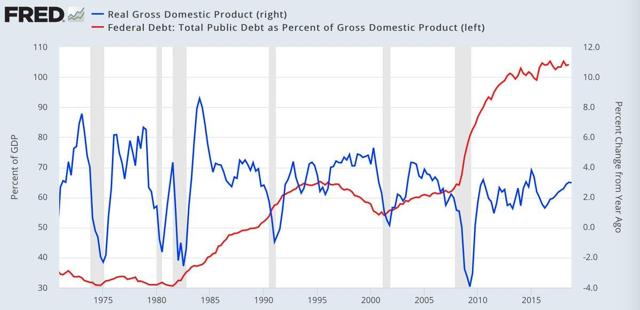

The U.S. is pretty over-leveraged right now, financing growth primarily through debt. It takes more and more debt for each basis point of growth, and an economy presumably can’t keep that up forever. Debt is financed by capital, and that’s why there cannot be any tightening. There is simply too much debt.

Source: Sven Henrich

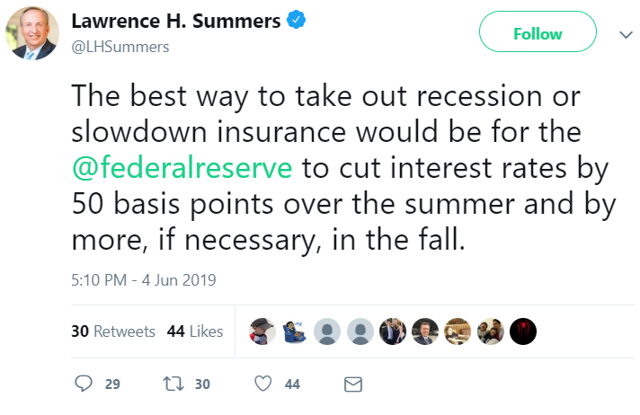

That’s why cutting rates is such a delicate task. Doing so in a late cycle market, with low inflation and unemployment has left some investors uneasy. However, some are strong advocates of another rate cut. Lawrence Summers wrote an op-ed in the Washington Post, and tweeted that the Fed must cut rates by 50bps, almost immediately.

Source: Larry Summers

Late cycle rate cuts are not a great sign. Economic conditions have become “solidly positive but modest“, as described above, but things are still uncertain, with gold and silver rallying, oil weakening, corporate spreads widening, and tightening in the credit markets.

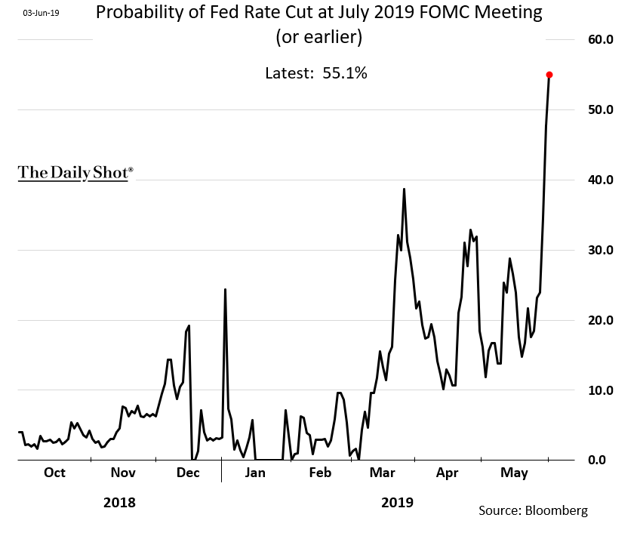

Source: The Daily Shot

There were only 2.8 cuts priced in on June 1. Now, there are 3-4 cuts priced in over the next 12 months. The market is pricing in a 50% chance that the Fed cuts rates at the next FOMC meeting. Powell stated at a recent forum that “we will act as appropriate to sustain the expansion“. Vice Chair Clarida expanded further, saying:

“We will put in policies that need to be in place to keep the economy, which is in a very good place right now, and it’s our job to keep it there.”

The FOMC has a job, in their view, to keep the economy afloat. As explained by Duy, the Fed is not going to wait for things to get really bad before they step in. They are willing to step in early, to divert things, and respond to shocks.

Source: Babak

With a growing number of cuts priced in over the next year, it appears that the market is expecting the Fed to step in. That might be good, or it could be very bad. Either way, it appears that the economy is slowing down, and a downturn could be looming. It is also important to consider China’s role in this macroeconomic equation.

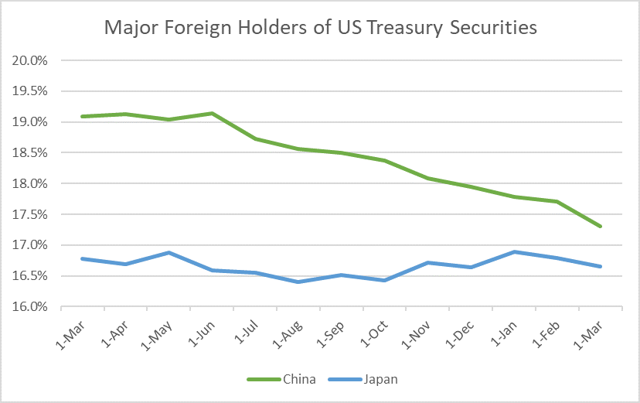

Debt Abroad: China and Japan Reducing U.S. Treasury Exposure

China and Japan have both been reducing their holdings of their US Treasury Securities. The data from the Treasury website dates back to only March of 2019, so it doesn’t take into account the events of the past two months. However, the decline is most definitely telling of the recent trade tensions, specifically between the US and China.

Source: US Treasury

China sold $20B of long-term US bonds in March. They would have to roll off another $1.12T to get rid of all their holdings, according to data from the US Treasury. If they did this, bond prices would fall and yields would rise, which would result in an U.S. economic contraction.

There is discussion that China is slowly phasing out their business model, which involved simply taking the surplus dollars that they received from their success in the United States, and investing them in Treasuries.

That was driven by the massive trade surplus that China carried. However, that trade surplus is shrinking, so the country theoretically doesn’t have as many U.S. dollars to invest, and thus, will not buy as many Treasury securities.

Source: Fred

Globalization is nothing to be sneezed at. China cannot dump U.S. securities, primarily because they need the US dollar to support their own economy, and act as a safety buffer for their banking system and currency.

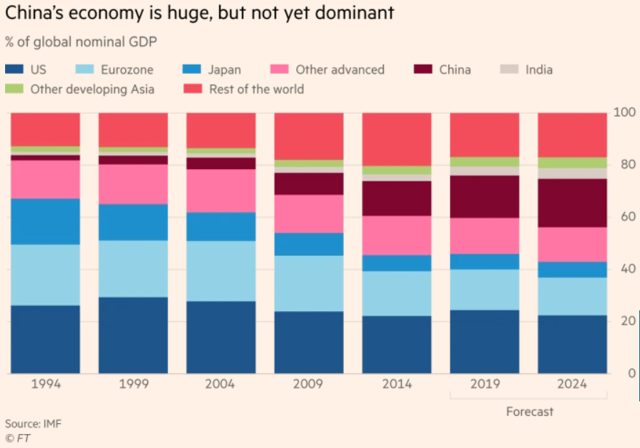

China is currently the second largest economy in the world. They offered inexpensive labor, cheap production, and American manufacturers took advantage of that. China is growing, and relatively quickly. They are expected to continue growing over the next five years, and the U.S. is expected to lose a reciprocal amount of power over that same time frame.

Source: Financial Times

The other holders of US Securities are negligible, with the United Kingdom, Brazil and Ireland rounding out the top 5, all representing ~4% of Foreign Holders US Treasury Securities.

Only $6.4T of U.S. debt is actually international, which is a 4% year over year increase. For comparison, the United States’ Federal Government owns $5T of the debt, representing almost 23% of the $22T total debt amount.

So no, China will not “pull the trigger and dump Treasuries” nor will they “dump U.S. bonds as a trade weapon“. Right now, the U.S. treasuries are still somewhat of a safe haven investment. The U.S. dollar is still the primary reserve currency.

If either of those things change, and Treasuries are no longer safe and people don’t trust the dollar, that’s when the real turmoil could come about. The current system is built on the “full faith and credit in the US government” and when that goes away due to rash decision making and abuse of privilege by American leaders, other countries take notice. Challenging the American power would be no small task, and would require a concentrated effort across the global economy. The probability of this occurring is low, but it is still something to consider.

Leveraged Lending: Things to Avoid

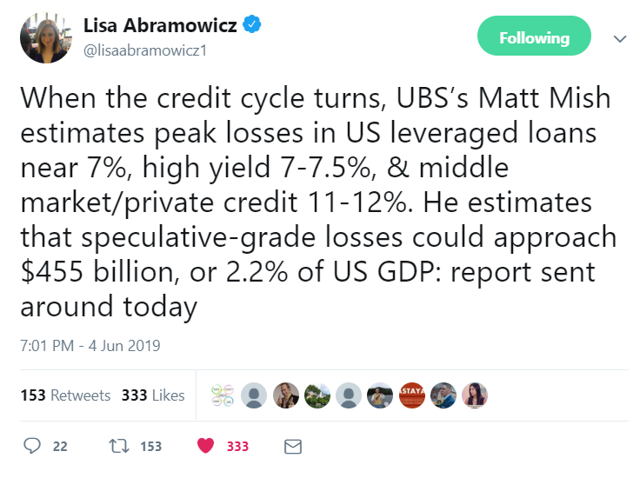

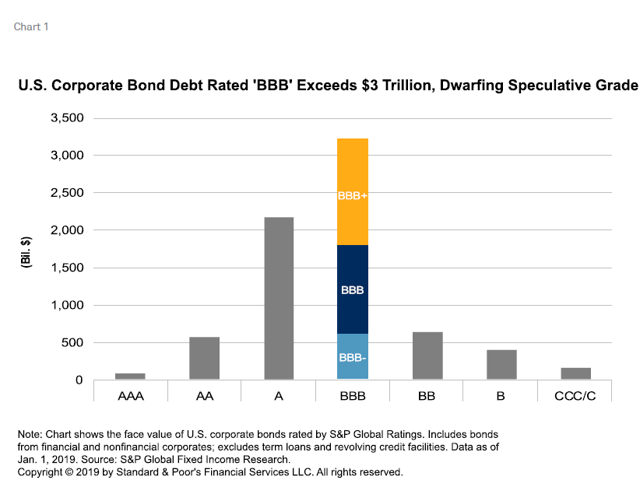

The U.S. government isn’t the only one with a debt problem. Right now, triple-B rated companies have accumulated $3T in debt. If the economy weakens, those loans are vulnerable to default. Credit rating downgrades would reverberate through the economy, with estimates that even non-junk debt could see “$300 million to $1 trillion of credit-rating downgrades during the next downturn”, according to Ted Berg, a Treasury Department researcher.

Source: Lisa Abramowicz

The total BBB market accounts for 53% of all investment grade bonds in the U.S. The average retail investor is exposed to “these bonds through diversified mutual funds, exchange-traded funds, insurance, and pensions” according to S&P Global. Most of the debt in BBB is BBB+, with only 25% at the lowest level of BBB-.

Source: S&P Global

Normally, during times of uncertainty, investors will shift towards bonds. Investment grade corporate bonds are normally a solid investment during a downturn. But now, more than 50% of those bonds are on the bottom tier of the investment grade ladder.

Low interest rates are a precursor to this, allowing corporations to finance share buybacks and other capital projects using debt. That is not a bad thing. However, the risk to that is the corporations have become overleveraged, which makes them vulnerable to downgrades and a credit crunch.

Source: MarketWatch

Because of this, investment grade corporate bond ETFs are not the best investment during this particular moment of uncertainty. Just as an example, VCIT, the Vanguard Intermediate-Term Corporate Bond ETF has a 55% exposure to BBB rated bonds. If we do enter a downturn, those BBB rated bonds have the potential to be downgraded, get kicked out of the index, and reduce the overall price of the VCIT, resulting in large losses for investors.

Reading the Signals: How To Invest into Uncertainty

There are ways to invest during times of conflicting signals and data. During times of uncertainty, investors usually seek safe haven investments to preserve capital and position themselves to profit off the turmoil. If the Fed chooses to cut rates, asset prices will be inflated again, but it is uncertain how long that stimulus will last.

It is also uncertain what will happen after. Interest rates presumably cannot remain extremely low forever, but perhaps this is a new normal. But if we do enter into a more severe correction, and rates are already hovering at all-time lows, the Fed doesn’t have much room to create any impact. They would have to use an alternative policy tool.

It also is important to note that monetary policy does not create growth. The Fed cannot make workers and companies more productive by simply cutting rates. As Michael Batnick recently wrote “apparently a decade of ZIRP, over 100 consecutive months of job growth, a quadrupling of the stock market, and E-scooter alternatives wasn’t enough.” The Fed has been accomodative for a decade, and it still hasn’t been “enough”.

Business cycles are a natural part of investing, and they should be embraced. Sometimes, it takes a massive wipe-out to learn how to really surf. The Internet companies of the early 2000s learned that the hard way. It took a downturn to get the companies that truly had a solid business plan and solid fundamentals to float to the surface. That’s when we experience true economic progress.

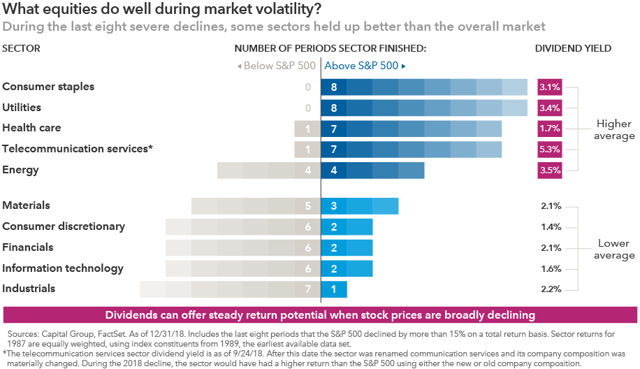

Basically, it’s confusing out there. There’s a lot of voices shouting, and trying to make sense of it all can leave anyone weary. That’s why it’s smart to pick a diversified basket of assets. At risk of sounding like a broken record, a healthy mix of bonds, equities, and commodity ETFs is truly the best bet that an investor can make, during any market.

Conclusion: Diversification is Still King

Consumer staples and utilities tend to do well during times of market volatility, as well as health care, telecom, and energy. The higher dividend yield tends to provide a boost to returns, and can reduce the overall cost basis of the investment over time, thus resulting in higher overall gains. Choosing stocks that are in these sectors, and have higher-than-average yield, could be a good choice.

Source: Capital Ideas

There are also opportunities to get into fixed income. High quality bonds tend to be more stable, and have a higher return over times of uncertainty. Diversification is the name of the game during times of economic downturns as well, and investors should make sure that their portfolio isn’t concentrated in any one sector or asset class.

Source: SPDR

Gold is always an interesting place to be. It provides solid long term returns, increasing at a CAGR of 7.56% since 1971. Gold also tends to move inversely to the market, depending on the market environment. State Street has the SPDR Long Dollar Gold Trust, GLDW, offering investors exposure to the inverse correlation between the market and gold, as well as exposure to the dollar, which still is the world’s reserve currency, and also performs well during downturns. The DXY is up ~5% YTD, and could be further bolstered by weakness around the world, with recession fears popping up in Australia, New Zealand, and around the globe.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

moreComments

No Thumbs up yet!

No Thumbs up yet!