Visualizing The Simple Reason Why America Will Drown In Deflation

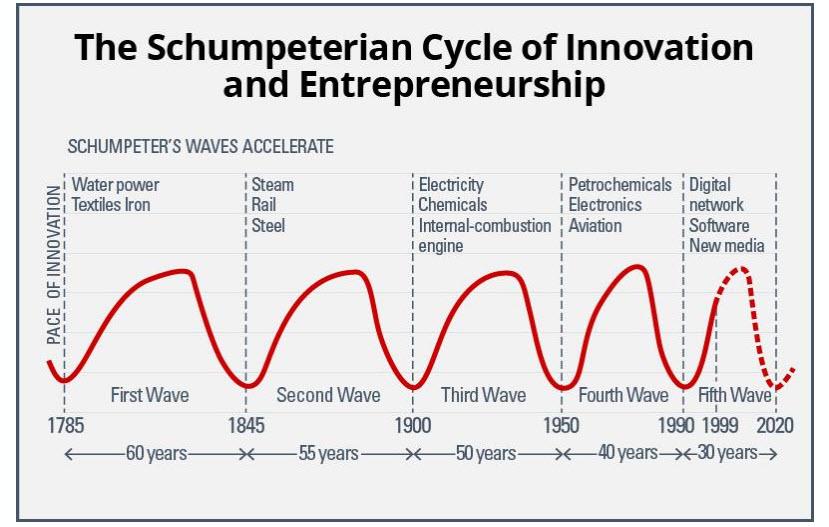

In reviewing his speech and presentation delivered at the 5th International Funds Summitt, in which he laid out the key investing themes to watch over the next decade (which include "banking as we know it", the desktop computer, oil prices and fiat money) SaxoBank's Christopher Dembik writes that our current, fifth wave of innovation, that began in the early 1990s...

(Click on image to enlarge)

... is characterized by low growth, low productivity, and lowflation. According to the Saxo strategist, unlike the fourth wave of innovation that lasted from 1950 to 1990, which has seen among other things the impact of electronics and aviation on the economic system, the current period is characterized by low productivity in most countries that ultimately leads to decreasing potential GDP growth. There is no single explanation for low productivity, but it is certainly partially linked to the fact that current innovations do not create new industrial sectors, as was the case in the past.

Which brings us to Saxo's main call for the coming years, namely that lowflation is the new normal.

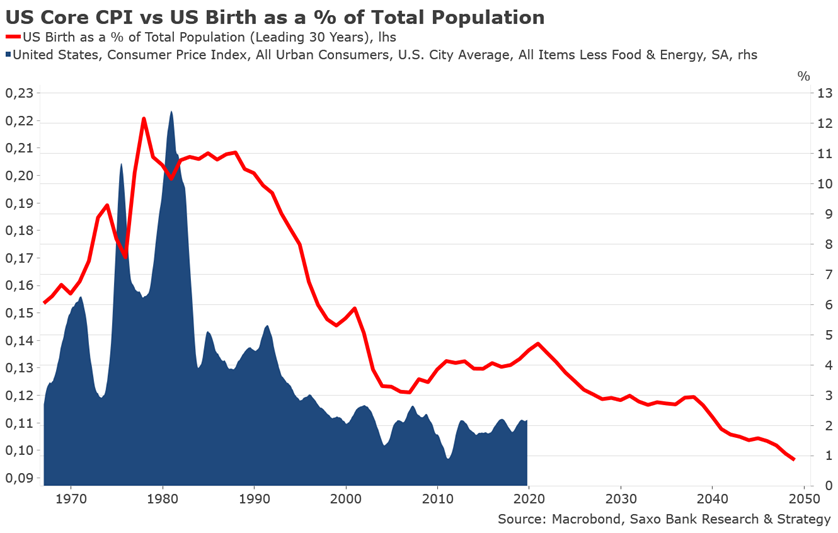

Below, Dembik shows one of his favorite charts. In it, one can see that US birth as a % of total US population leads US Core CPI by 30 years. It shows the direct impact of aging on the evolution of inflation. It is also the one chart that predicts that no matter what central banks do, the US is doomed to decades of deflation, Japanification and, more recently, Europification.

(Click on image to enlarge)

On the top of demographics, Dembik writes, new technology, oligopolies, and global debt accumulation are other strong structural forces driving inflation lower. In the developed world, we are getting used to CPI under 2% but what is probably most striking, and less commented, is that inflation is also decelerating at a very steady pace in Emerging countries, where it used to be very high. Based on the latest data, average inflation in the BRICS + Indonesia is around 3.5% YoY versus an average of 7% in the immediate post-GFC. In other words, in just about a decade, global inflation has been cut in half (for this to be true, one has to ignore capital markets of course, which our central bankers conveniently do).

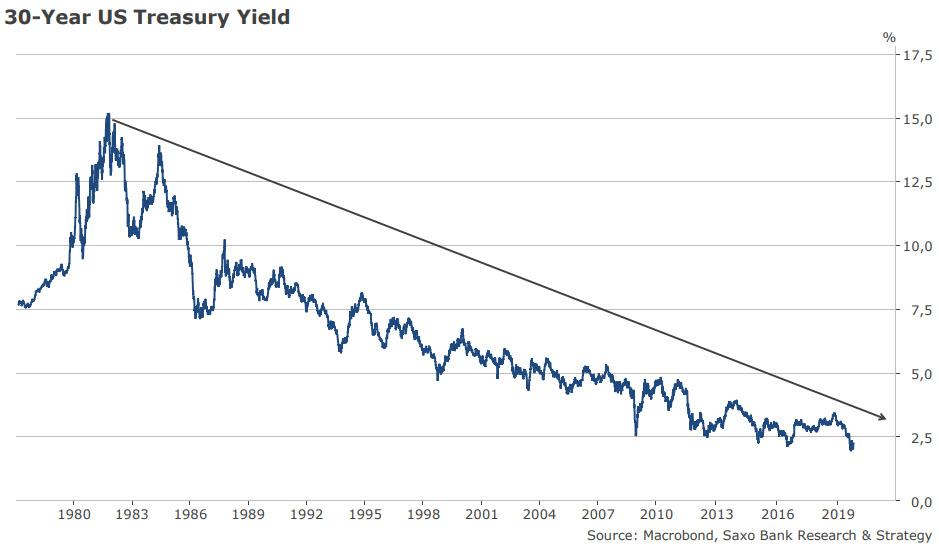

One can see the impact of the above factors most clearly in the yield on the 30Y Treasury.

(Click on image to enlarge)

And while many have argued that yields can only drop so low before inflation returns and the monetary situation is normalized, ending the 30 years bull run in interest rates, what they forget is that in 2015-2018 central banks tried just that - to normalize interest rates.

It ended in disaster, with the Fed resuming QE and undoing 40% of two years of quantitative tightening in 2 months, while the ECB lasted all of 9 months without QE before Mario Draghi was forced to resume bond purchases.

Incidentally, there is another blindingly simple reason why the US - and the rest of the world - is destined to drown in deflation: the world simply can no longer function under higher rates. Why? Because this is what the impartial Congressional Budget Office believes the trajectory of US Debt/GDP will be over the next 30 years.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more