Used Vehicle Prices Up 6.4% Year Over Year

Used Vehicle Prices Up

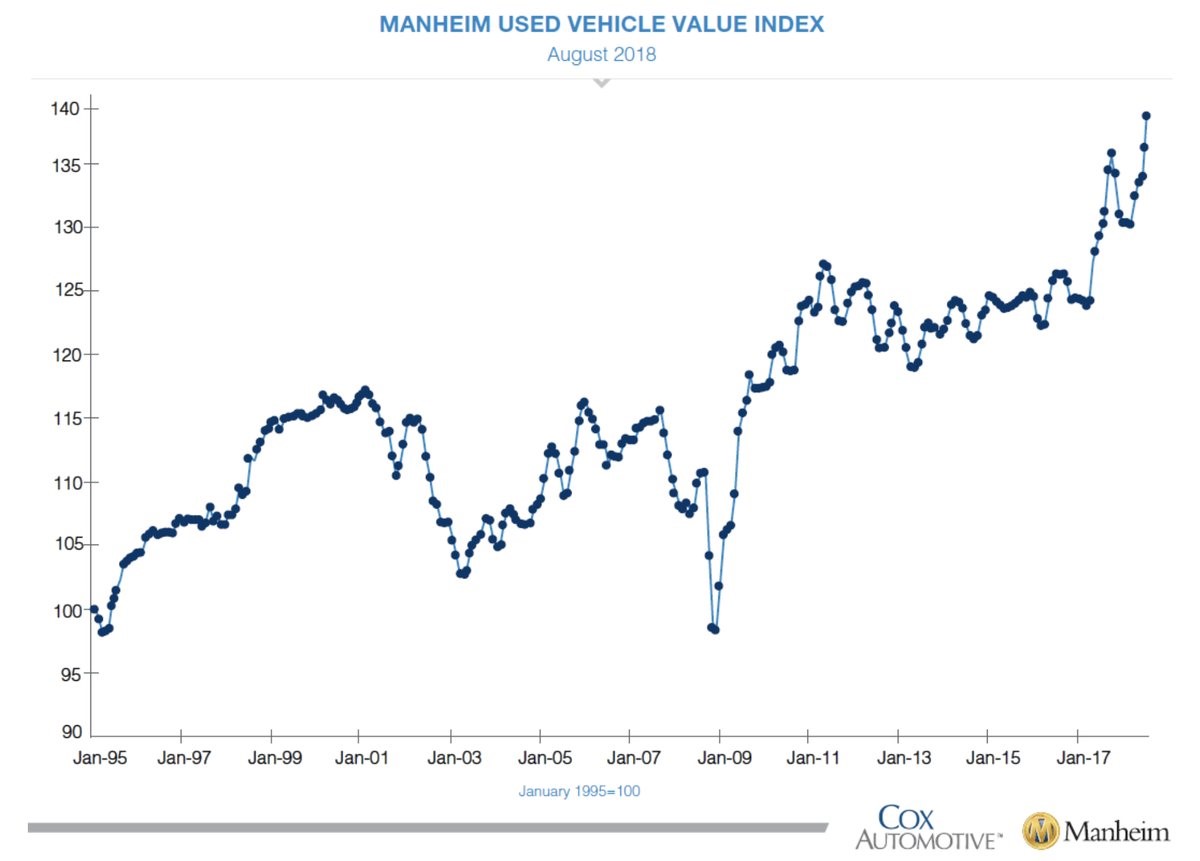

Used vehicle prices can be used to measure the strength of the economy. As you can see from the chart below, the Manheim used vehicle index cratered in late 2008 and was stable from late 2011 to early 2017.

The results in the past few quarters have been great. In August, the index was up 2% month over month and 6.4% year over year. So much for the fear of used car prices collapsing because of the huge inventory created by leases ending.

The supply is large, but the demand is larger. As of Labor Day, 3 year old vehicles are now worth 4.8% more than they would normally be worth. This is if they had normal depreciation occurred instead of the appreciation observed this year.

Prices went up because the economy is strong and the consumer is having a tough time affording new cars, so it is going the used route.

You can see that affordability has become a problem by looking at the year over year price changes in selective market classes shown in the chart below.

As you can see, only luxury cars saw a price decline.

Used Vehicle Prices - Results aren’t close to the heightened growth in the other categories.

This is bad for Tesla because it sells high priced vehicles. The Model 3 is supposed to be affordable, but the $35,000 base model isn’t available.

There were two other catalysts which caused prices to increase. First, buyers fear tariffs will cause prices to increase, so they want to get out ahead of the issue.

There are already tariffs on the metals used to produce cars. President Trump is threatening to put auto tariffs on cars from Canada and Europe. If the trade skirmishes end, used car prices will fall. If the tariffs are enacted, used car prices will skyrocket.

Used Vehicle Prices - It could actually become a great investment to buy a used car now and sell it after the tariffs are enacted.

The second catalyst is fear of rising interest rates. Buyers want to lock in the current rates when they take out loans, so they avoid paying higher rates next year.

This is a valid fear if you are deciding whether to buy a car this year or next year. I think we are near the end of the cycle where interest rates increase. However, with the Fed expected to hike rates 2 more times this year, it makes sense to buy a car now instead of next year if you can afford to.

Used Vehicle Prices - Weak Acquirers

There is a constant fear of buybacks promoted by the bears. They say we are at a cyclical peak because buybacks are at a record. Buybacks only signal profits are up.

They don’t signal optimism is too high. Excess capital is either going to go to more investment, buybacks, or acquisitions.

The riskiest moves are actually capex acquisitions. Buybacks are a lock to return the money to shareholders. And new capex and acquisitions might not work out operationally speaking.

It’s silly to look at buybacks like an investment in the company. They are retirement of the shares, so investors hold more of the company.

Used Vehicle Prices - Are dividends an investment in the company’s performance?

No, they are returns to shareholders just like buybacks. Obviously, a firm and its shareholders are invested in the success of the firm.

Buybacks can’t increase that unless leverage is being taken out because the firm thinks shares are so cheap.

Even leverage for buybacks has made sense in the past to return capital to shareholders without thinking of the money as an investment Internationally focused firms couldn’t repatriate their overseas cash without paying a lot in taxes.

This all brings us to measuring corporate exuberance, not by the record buybacks in 2018, but by acquisitions.

You can do your own analysis on each acquisition to form a unique opinion on if the acquirer overpaid or got a good deal.

The best way to review all firms is to look at the acquirer’s stock performance.

It’s traditionally thought that acquirer stocks always fall after they buy a firm. However, the chart below shows the median results in relation to the S&P 500 vary.

In 2013 and 2014, acquirers did well in relation to the overall market.

It’s weird to see the current 3 month performance for acquirers is much worse than in 2016 and worse than 2008 in relation to the S&P 500.

Investors aren’t confident in acquisitions even though the economy is solid and optimism is high. This could be a bad omen for future performance or a random result caused by a few deals skewing the numbers.

Used Vehicle Prices - Oil Prices Drive Recent Changes To Private Fixed Investment Growth

I have been interested in studying the effects oil prices have on the economy because America is becoming the energy powerhouse of the world.

The potential thesis I had was that high oil prices could create jobs in the energy industry. This would somewhat make up for the pain it causes consumers.

It turns out that the energy industry doesn’t employ anywhere close to the amount of people necessary to make high oil prices a net benefit.

While high oil prices are still bad for the overall economy, America has more control of its own destiny than most other nations and oil prices do effect growth.

As you can see from the chart below, recently there has been a divergence between private fixed investment growth with mining/extraction structure and equipment and without it.

The 2016 weakness was made worse by the decline in energy prices. The subsequent rebound, which is still underway, has been helped by the rebound in energy prices.

Sustained high energy prices could cause America to outperform some nations which don’t produce any energy. That being said, high oil prices are a signal global demand is strong.

China is a huge player in the oil market. Since China is expected to only have 6.3% GDP growth in 2019, the outlook for oil prices has diminished.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more