US Recession Odds Recede To Two Out Of Three Chance In 2024

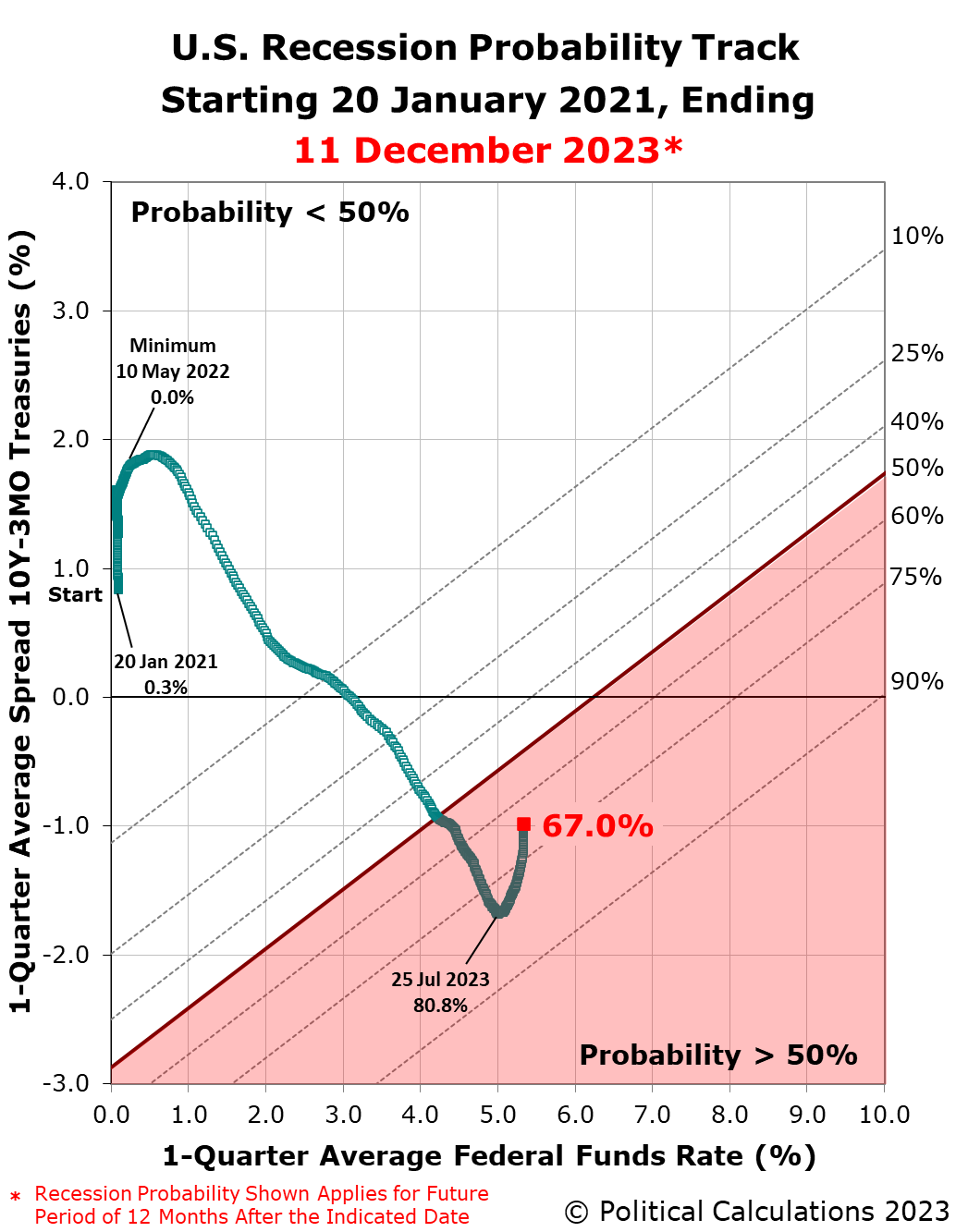

The probability the U.S. economy will experience an official period of recession sometime in the next twelve months continued to recede during the past six weeks. That probability now stands at 67%, which applies to the period from 11 December 2023 through 11 December 2024, which is to say there's about a two out of three chance of an official recession starting during that span of time.

The probability peaked at 80.8% on 25 July 2023, just before the U.S. Federal Reserve announced it would hike the Federal Funds Rate by another quarter point, bringing its target range up to 5.25-5.50%. The Fed has since held rates steady at that level and is expected to announce it will continue doing so after its Federal Open Market Committee concludes its two-day meeting on 13 December 2023.

Since July, the probability of a recession starting sometime in the next 12 months has declined. That change coincides with the average spread between the constant maturity 10-year and 3-month U.S. Treasuries over a one-quarter long period becoming less inverted in the weeks since the recession probability peaked. Since our previous update however, the U.S. Treasury yield curve has become more inverted. We may be looking at a reversal for the recession probability track at our next update in six weeks.

For now, here's the latest update to the Recession Probability Track illustrating how things stand going into the FOMC's two-day meeting:

(Click on image to enlarge)

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 11 December 2023 and 11 December 2024.

The probability of recession peaked at nearly 81% on 25 July 2023, which makes the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction.

Analyst's Notes

The Recession Probability Track is based on Jonathan Wright's yield curve-based recession forecasting model, which factors in the one-quarter average spread between the 10-year and 3-month constant maturity U.S. Treasuries and the corresponding one-quarter average level of the Federal Funds Rate. If you'd like to do that math using the latest data available to anticipate where the Recession Probability Track is heading, we have a very popular tool to do the math.

We will continue to follow the Federal Reserve's Open Market Committee's meeting schedule in providing updates for the Recession Probability Track until the U.S. Treasury yield curve is no longer inverted and the future recession odds retreat below a 20% threshold.

More By This Author:

Investors Shift Time Horizon To More Distant FutureHealth Insurance Cost Trends Before And After The Affordable Care Act

New Home Affordability In October 2023 And The Months Ahead

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more