US Manufacturing Surveys Confirm Contraction; Employment Weakest Since COVID Lockdowns

It's been a rough morning for Global Manufacturing PMIs - China, Turkey, Italy, France, Germany (shitshow), Eurozone, UK, Canada, and Brazil all printed below 50 (contracting).

So can USA, USA, USA buck the trend - besides we have something no other country has - "Bidenomics"!!!!!

US macro data has serially surprised to the upside in recent weeks, so expectations were for a rebound in US Manufacturing 'soft' survey data and S&P Global's PMI printed 49.0 in July (still in contraction), unchanged from the flash print earlier in the month (but up from the 46.3 final print in June). ISM's Manufacturing survey headline disappointed, printing 46.4 (46.9 exp) - still in contraction - but up marginally from the 46.0 June print. ISM hasn't been above 50 since August 2022...

(Click on image to enlarge)

Source: Bloomberg

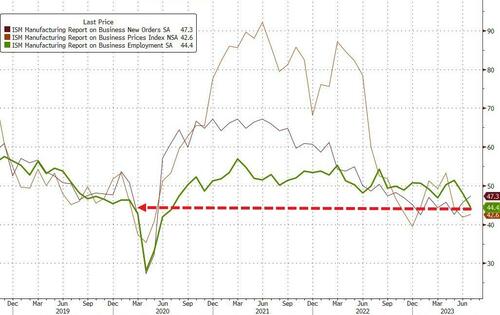

ISM's Manufacturing survey showed Employment slowing at its fastest rate since COVID lockdowns. Prices and New Orders continue to contract...

(Click on image to enlarge)

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“Manufacturing continues to act as a drag on the US economy, the recent spell of malaise persisting at the start of the third quarter. However, producers are clearly shrugging off recession fears and planning for better times ahead.

(Click on image to enlarge)

“The sector continued to suffer from lower demand, as a post-pandemic shift in spending from goods to services, and an ongoing trend of cost-focused inventory reduction, led to a further drop in orders.

"The overall rate of order book decline nevertheless moderated during the month, helped by a slower decline in exports, to help stabilize production. "

There are some silver-linings for those desperate to find something bullish 'soft-landing'-y to cling to...

“There were several other encouraging bright spots in the survey, most notably including a marked improvement in business expectations for output in the year ahead. Firms are therefore anticipating the current soft patch to soon pass, and importantly are hiring more staff as a result.

“There was also good news on the inflation front. The combination of weak demand and improved supply led to a further “buyers’ market” for many goods. Prices charged for goods consequently barely rose for a third straight month, which should help subdue consumer price inflation in the near term.”

Still, not exactly the exuberant economy that 'Bidenomics' promised.

More By This Author:

Futures Drop And Dollar Spikes As Bulls Get Cold FeetFutures Rise As Oil Jumps, Yields Gain, Yen Tumbles

Futures Rebound After BOJ YCC "Tweak" Turns Out To Be Less Hawkish Than Some Feared

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more