US Industrial Activity Feels The Headwinds

Image source: Pixabay

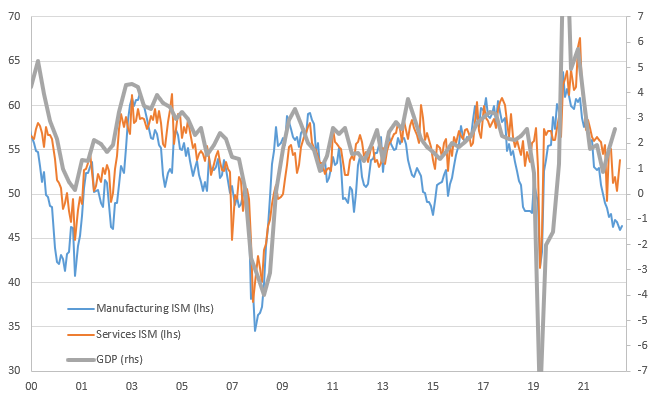

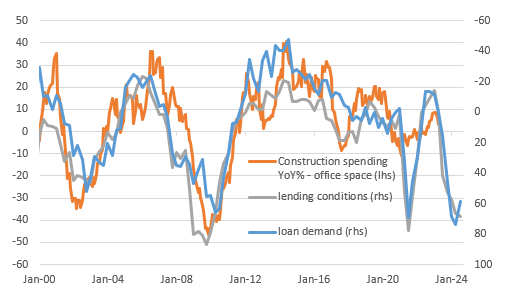

The US service sector continues to perform relatively strongly, but manufacturing is struggling as highlighted by the ninth consecutive contraction of the ISM report. Meanwhile, residential construction is rising due to a lack of homes for sale, but non-residential is starting to feel the squeeze from tighter lending conditions

Manufacturing has had nine consecutive months of contraction and non-residential construction is experiencing tighter lending conditions

ISM posts ninth consecutive manufacturing contraction

A lot has been made of the relative strength in US activity data recently, especially in contrast to the weaker China and European newsflow and the potential for rate cuts in Latam and Eastern Europe (Chile of course carrying through with a 100bp rate cut last week). There has been a slightly softer tone to this morning's US data though with a few disappointing outcomes.

The July ISM manufacturing index rose to 46.4 from 46.0 (consensus 46.9), but given it is below the 50 break-even line it still suggests the sector is contracting, as it has been doing for nine straight months now. New orders improved to 47.3 from 45.6 (contracting, but at a slower rate than in June), while production improved to 48.3 from 46.7. However, the improvement in the index readings is driven by much better performance in just a couple of industries since the details of the report show that just 11% of manufacturing industries are reporting growth, down from 22% in June with 22% reporting growth in new orders versus 28% in June. Every single activity-related component is in contraction territory, but at least that is also the case for prices paid, which came in at 42.6 (41.8 previously and lower than the 44.0 consensus), despite rising commodity prices.

ISM surveys & US GDP growth (YoY%)

Image Source: Macrobond, ING

Jobs market shows evidence of some cooling

Moreover, employment was poor, falling to 44.4 from 48.1, which leaves it at the weakest level for three years. Just 17% of industries reported hiring growth, down from 33% in June. None of this bodes well for any sort of positive manufacturing contribution in Friday's jobs number. Meanwhile, the JOLTS report shows job openings dropped to 9.582mn in June from a downwardly revised May figure of 9.616mn (originally 9.824mn). The consensus had looked for a 9.6mn outcome.

There has been some concern about the reliability of the JOLTS data given a big decline in the survey response rate so it is interesting to look at what other evidence suggests. Even after today’s decline, JOLTS suggests vacancies are around 38% higher than pre-pandemic levels while job website Indeed’s data suggests it is closer to 28% – still good, but not as high as JOLTS.

Construction to feel the squeeze as bank caution spreads

Rounding out the numbers we see construction spending rose 0.5% month-on-month in June versus 0.6% consensus, but May was revised up to 1.1% growth from 0.9%. Yesterday's Fed Senior Loan Officer Opinion Survey (SLOOS) suggested lending conditions are especially tight now for commercial real estate and we have seen a notable slowdown over the past couple of months in non-residential construction (0.1% in June after -0.2% in May whereas growth had averaged 2.4% MoM in the first four months of the year).

Senior Loan Officer Survey points to a sharp downturn in office construction activity

Image Source: Macrobond, ING

Above is a chart showing the relationship between the SLOOS data on lending to commercial real estate and office construction, suggesting office construction spending could fall 40% from current levels. By way of contrast residential construction is rebounding due to stability in house prices and a lack of existing homes available for sale. This means we suspect construction will likely slow to around zero by the start of the fourth quarter, before contracting as we start 2024.

More By This Author:

Why Market Rates May Continue To Rise After The Fed Peaks

The Commodities Feed: Copper Drops From Three-Month High After Weak China Manufacturing Data

Reserve Bank Of Australia Takes Another Breather

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more