US Growth Is Slowing, But Recession Doesn’t Appear Imminent

The US economy expanded at a much slower rate than expected in the first quarter, a prelude to recession, according to some forecasters. It would be naïve to rule out the possibility in the current climate, but there’s also a case for expecting the economy to muddle onward with a sluggish expansion.

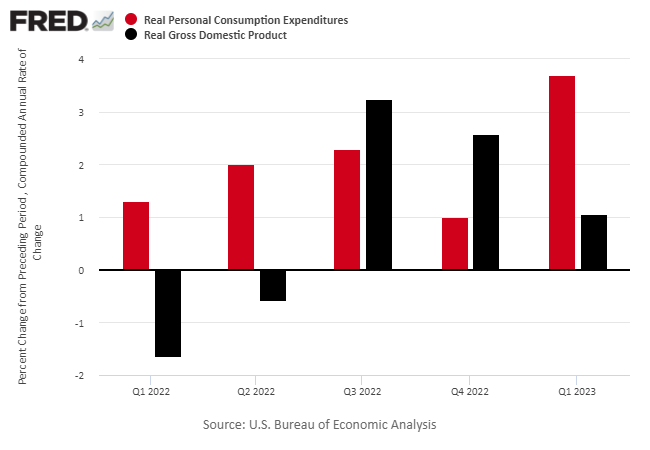

Consider the breakdown of yesterday’s initial estimate of GDP in the first quarter. Output rose 1.1%, far below the consensus forecast for 2.0% and even further below Q4’s 2.6% increase (seasonally adjusted annual rates). Despite the broad slowdown, consumer spending wasn’t the catalyst. In fact, personal consumption expenditures – the biggest slice of economic activity by far – accelerated, increasing 3.7% in the first three months of the year, the strongest pace in nearly two years. Supported by higher incomes and savings, Main Street continued to buy at a robust rate, offsetting some of the weakness in other corners of the economy. Indeed, business spending fell sharply as inventories declined and investing in housing and business equipment tumbled.

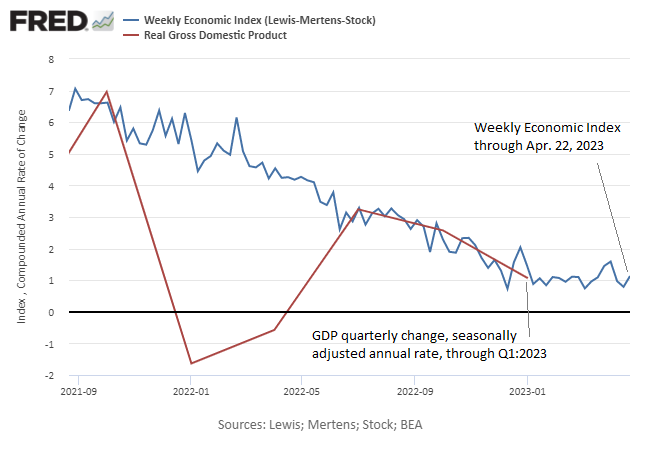

The net effect was a softer pace of growth, but there are clues that suggest the economy is stabilizing at a sluggish pace rather than tumbling into recession. One sign is the New York Fed’s Weekly Economic Index (WEI), which has been stable recently after sliding for more than a year. Although GDP can and does deviate sharply from WEI at times, the NY Fed’s index in April suggests that the downshift in the broad economy may stabilize at a weaker rate of expansion in Q2.

A similar narrative is found in survey data for April. The Composite PMI, a GDP proxy, has recently strengthened, hinting that recession risk may be lower than some forecasts suggest, based on data published on April 21, ahead of yesterday’s GDP numbers. “The latest survey adds to signs that business activity has regained growth momentum after contracting over the seven months to January,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. “The latest [PMI] reading [for April] is indicative of GDP growing at an annualized rate of just over 2%.”

The pushback is that other indicators point to an economy that’s continuing to slow and will soon fall into recession. The bond market is front and center here via deeply inverted yield curves. Hawkish monetary policy is on the short list of reasons for expecting the economy will soon contract. The lag effects from higher interest rates are still accumulating and so stronger headwinds lie ahead, runs this view.

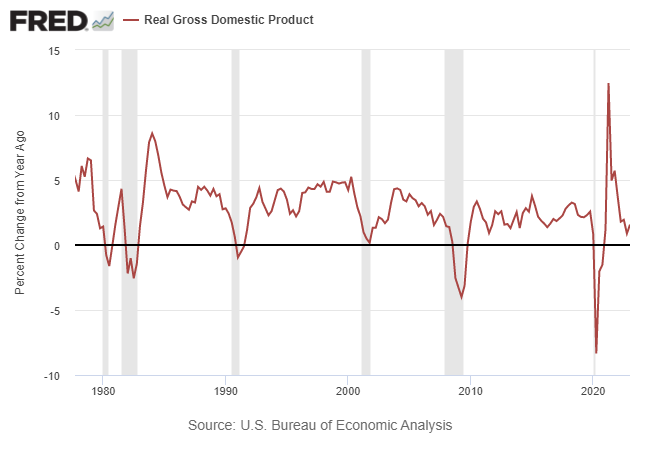

Yet it’s also useful to consider GDP’s year-over-year change to cut through the quarterly noise for the big-picture view. Despite the softer quarterly comparison, real GDP’s one-year trend ticked up in Q1, rising 1.6% vs. 0.9% in Q4. That’s still a sluggish rate, but it’s encouraging to see that the pace strengthened and remains well above the zero-percent tipping point that’s aligned with recessions in the past.

Another key factor is the labor market. Although there are signs that the pace of hiring is slowing, recent data still reflects a solid gain for payrolls. Jobless claims, a leading indicator for the labor market, remain near historic lows, which implies that hiring will remain upbeat for the near term.

The risk of recession can’t be ruled out, but for the moment it appears that a downturn isn’t imminent. If and when the economy slips over the edge, the mixed numbers will start to skew decisively negative. That may be coming, but for now, there’s still room for debate.

More By This Author:

Tech And Communications Still Lead US Equity Sectors In 2023

Large-Cap Growth Retakes Lead For Equity Factor Returns In 2023

Moderate Growth Expected For Thursday’s US Q1 GDP Report

Disclosure: None.