US Economy: Inflation At The Gates?

As signs point toward a recovering US economy, Fed Chair Powell is still pushing his transitory narrative. Is high inflation temporary?

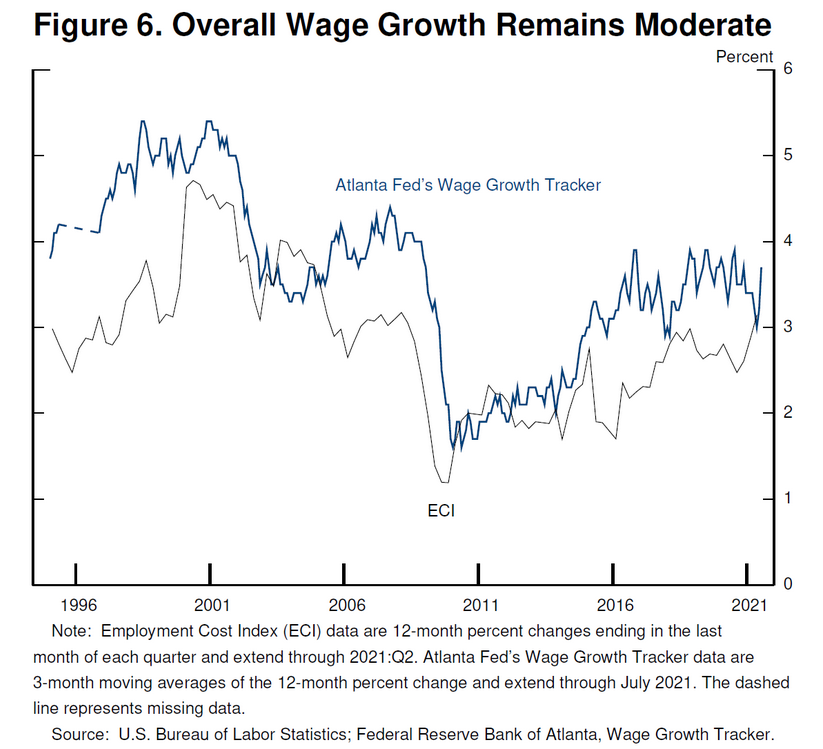

With inflation burning throughout the U.S. economy and the Fed confident that it can contain the flames, Chairman Jerome Powell remains married to his “transitory” narrative. And after he cited wage inflation as “moderate” – even though consolidated average hourly earnings increased by 4.3% year-over-year (YoY) and leisure & hospitality wage growth soared by 10.3% YoY on Sep. 3 – Powell often peddles semblance over substance.

To explain, I wrote on Sep. 2:

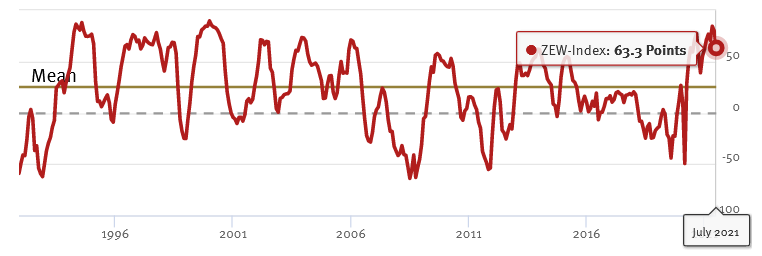

While Fed Chairman Jerome Powell said at the Jackson Hole Economic Symposium on Aug. 27 that “we see little evidence of wage increases that might threaten excessive inflation,” the year-over-year (YoY) percentage increase in the Employment Cost Index (ECI) in the second quarter (3.55%) was the highest since 2002. For context, Powell actually cited the Atlanta Fed’s wage tracker and the ECI to support his conclusion.

Please see below:

Moreover, while fiction remains his novel of choice, wage inflation has accelerated even more since his speech. For example, Walmart – the largest employer in the U.S. – announced on Sep. 2 that in-store employees will receive a raise of at least $1 per hour, which increases the retailer’s average hourly wage to $16.40.

Likewise, with an abounding labor shortage, Southwest Airlines Co-CEO Gary Kelly said on Sep. 2 that “ground ops is where we’re finding the greatest competition for workers. The fact that we can hire one or two is encouraging, but you still can’t grow any faster than the slowest group.” Similarly, Thomas Rajan, VP of global talent at American Airlines, added that “you need this aggressive ground game to go where candidates are, and it is absolutely -- I hate to characterize it as a battle, but it is.”

Thus, with the airline industry aiming to hire thousands of pilots and flight attendants – not to mention baggage handlers, ticket/gate agents, cabin cleaners, aircraft fuelers and individuals that restock galleys – does it seem likely that wage inflation will abate anytime soon?

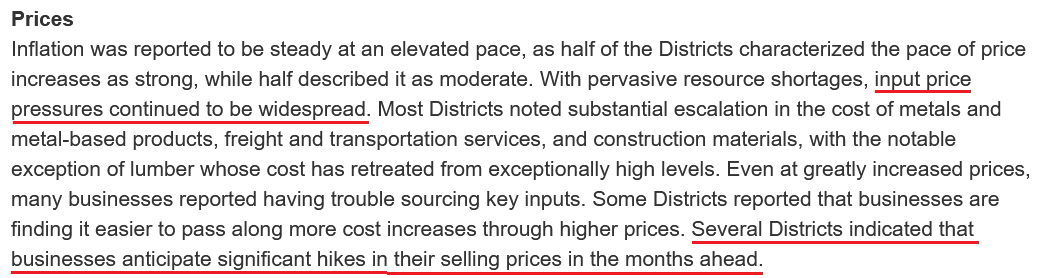

To that point, the Fed released its Beige Book on Sep. 8. And with “persistent and extensive labor shortages” causing “an acceleration in wages,” the inflationary wildfire continues to spread:

“With persistent and extensive labor shortages, a number of Districts reported an acceleration in wages, and most characterized wage growth as strong—including all of the midwestern and western regions. Several Districts noted particularly brisk wage gains among lower-wage workers. Employers were reported to be using more frequent raises, bonuses, training, and flexible work arrangements to attract and retain workers.”

What’s more, with wage inflation only playing second fiddle to input inflation, supply chain disruptions and material shortages have the inflationary merry-go-round still running extremely hot.

Please see below:

Source: U.S. Fed

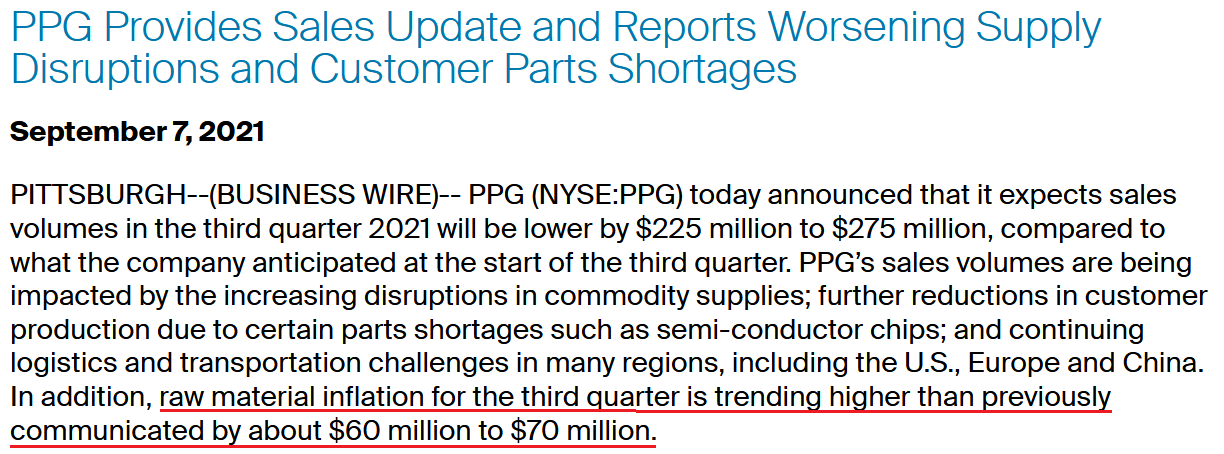

As further evidence, PPG Industries – a global supplier of paints, coatings, and specialty materials (and a member of the S&P 500) – announced on Sep. 7 that it’s withdrawing its “previously communicated financial guidance for the third quarter and full-year 2021.”

And why is that?

“The coatings commodity supply disruptions have further deteriorated since the company’s earnings announcement on July 19, due to several additional force majeure declarations and lower material allocations from certain suppliers. The company also continues to assess the full impact of Hurricane Ida, which could include additional supply chain effects.”

Please see below:

Source: PPG

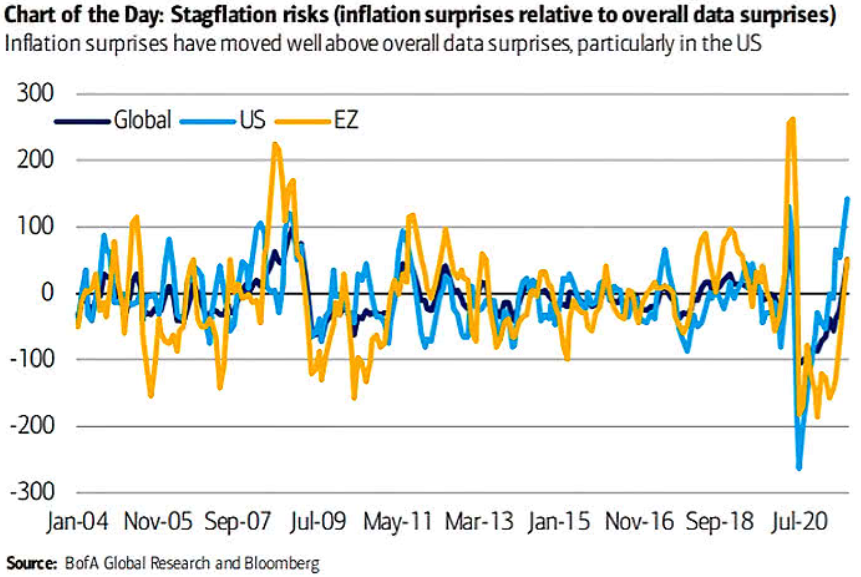

In addition, while I’ve been warning for months that inflation would come in much hotter than investors expected, upside surprises remain abundant even as economists increase their expectations. For context, an upside inflation surprise occurs when the realized data exceeds economists’ consensus estimate.

Please see below:

To explain, the light blue line (U.S.) above tracks inflation surprises relative to overall data surprises (like retail sales, GDP, nonfarm payrolls, etc.). If you analyze the right side of the chart, you can see that inflation surprises are still rising. Moreover, as the Delta variant cools the denominator – with economic mobility stifled due to the outbreak – coronavirus disruptions only accelerate the inflationary momentum. As a result, the pricing pressures are unlikely to subside until the Fed tapers its asset purchases and reduces speculation in the commodities market.

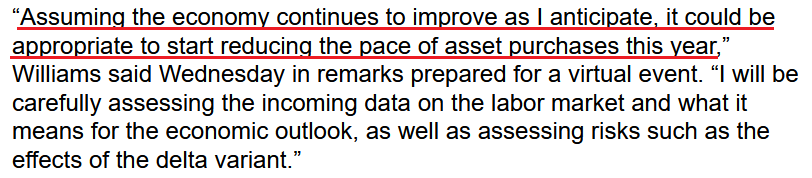

To that point, New York Fed President John Williams (a major dove) admitted on Sep. 8 that “I think it’s clear that we have made substantial further progress on achieving our inflation goal, [though], there has also been very good progress toward maximum employment, but I will want to see more improvement before I am ready to declare the test of substantial further progress being met.”

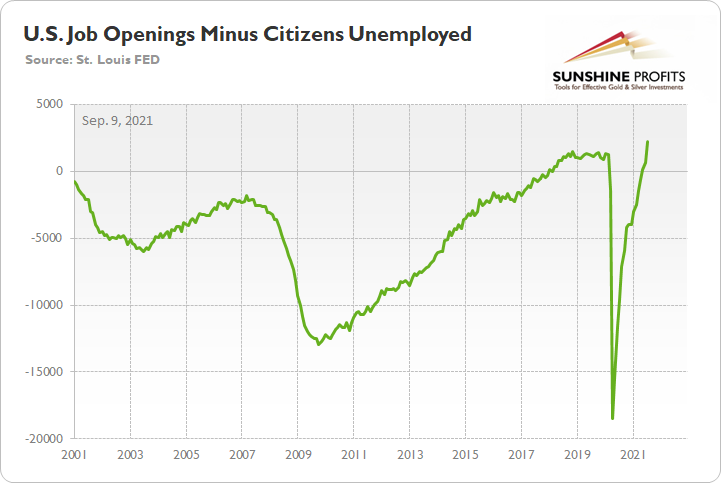

However, with U.S. job openings coming in at 10.934 million vs. 10 million expected on Sep. 8 (another all-time high), there are now 2.232 million more job openings in the U.S. than citizens unemployed.

Please see below:

To explain, the green line above subtracts the number of unemployed U.S. citizens from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the epic collapse has completely reversed, and the green line is now at an all-time high. Thus, with more jobs available than people looking for work, it’s only a matter of time before “substantial further progress” materializes.

And what does all of this mean for Williams’ taper timeline?

Source: Bloomberg

For context, “to start reducing the pace of asset purchases this year,” an announcement will have to commence in September or November to provide investors with “advance notice.”

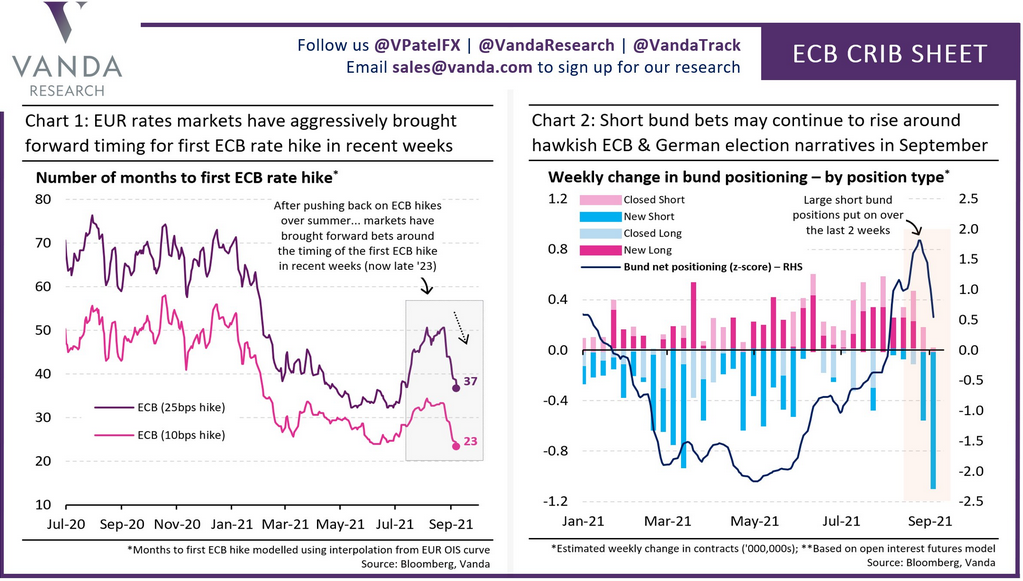

On the other side of the coin, the European Central Bank (ECB) will release its monetary policy statement today. And with ECB hawks reemerging in recent weeks, bullish bets on the EUR/USD have become fashionable once again. Moreover, because the currency pair accounts for nearly 58% of the movement of the USD Index, monitoring the situation is quite prudent.

Please see below:

To explain, if you focus your attention on the chart on the left, the purple and pink lines track investors’ expectations for when the ECB will announce its first rate hike. If you follow the sharp drop in recent weeks, investors now expect that the ECB will hike interest rates by 25 basis points (the purple line) in 37 months instead of 50. Similarly, if you turn to the chart on the right, the long blue bar furthest to the right depicts how speculators’ short positions of German Bunds have surged over the last two weeks (expecting a hawkish uprising in interest rates).

However, if the ECB remains dovish and disappoints, the bullish bets could unwind, and the EUR/USD could suffer. And with German economic confidence declining for four-straight months, a hawkish shift by the ECB would be playing with fire.

To explain, I wrote on Jun. 9 and updated monthly:

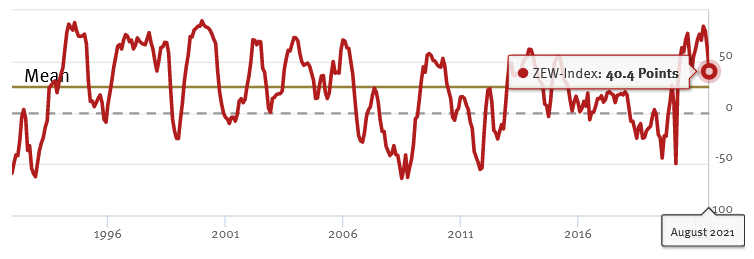

While investors continue to buy hope and sell reality, rather than rising to 86.0 (the consensus estimate), the German ZEW Economic Sentiment Index (released on Jun. 8) fell from 84.4 in May to 79.8 in June. For context, Germany is Europe’s largest economy.

Please see below:

Source: ZEW

To explain, the red line above tracks the German ZEW Economic Sentiment Index. If you analyze the behavior, you can see that 79.8 is still well above its historical average. More importantly, tough, notice how abnormally high readings are often followed by swift reversions? And with the prior high (84.4) only superseded by 2000, there is an awful lot of optimism already priced into the EUR/USD.

To that point, if we fast forward to Jul. 6, the German ZEW Economic Sentiment Index sunk to 63.3. And following right along, the EUR/USD ended the Jul. 6 session at its lowest level since Mar. 24.

Please see below:

Source: ZEW

Now, with August’s reading falling off a cliff, the German ZEW Economic Sentiment Index (released on Aug. 10) fell to 40.4 – its lowest level since November 2020.

Source: ZEW

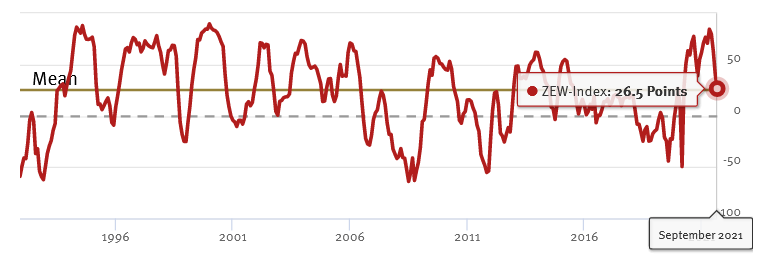

And with another month on the books and another new low, the German ZEW Economic Sentiment Index (released on Sep. 7) fell to 26.5 – its lowest level since coronavirus-induced lockdowns plagued the region in March 2020.

Please see below:

Source: ZEW

ZEW President Professor Achim Wambach provided the following context:

“Expectations fell markedly once more in September 2021. Although financial market experts expect further improvements of the economic situation over the next six months, the expected magnitude and the dynamics of the improvements have decreased considerably.”

The bottom line? If the ECB decides it’s time to scale back its stimulus, the central bank would be tightening at a time when economic confidence in Europe’s largest economy is at its worst. As a result, the medium-term shock to realized GDP will likely outweigh any short-term benefits that the EUR/USD may accumulate.

In conclusion, gold continued its downtrend on Sep. 8 and the GDXJ ETF (our short position) maintained its relative underperformance. And with the S&P 500 showing signs of slippage and the Fed’s dual mandate poised for completion over the medium term, upside catalysts for the PMs remain few and far between. As a result, the bearish implications remain intact, though a buying opportunity could emerge in December.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more