US Economic Data Still Point To Moderate Growth For Q3

US economic growth in the first half of the year appears on track to continue in the third quarter, based on the median estimate via several sources that are aggregated by CapitalSpectator.com.

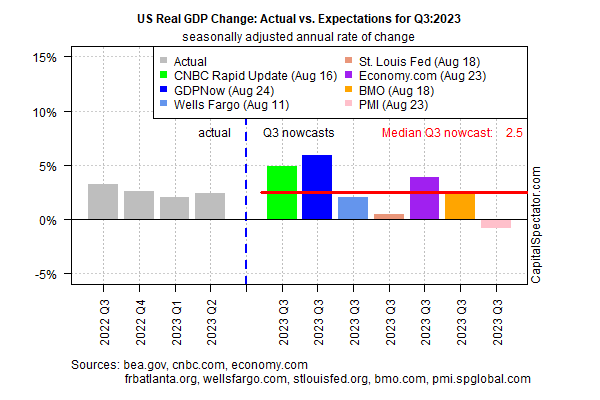

Today’s update indicates that US output for the July-through-September period is expected to rise 2.5% for GDP’s seasonally adjusted annualized change. This median nowcast reflects a slight increase over the 2.4% increase reported by the government for Q2.

The current 2.5% median nowcast for Q3 also marks a firmer estimate vs. the previous 2.0% estimate for Q3 published on Aug. 17.

Although the outlook for the current quarter remains encouraging, there are several caveats to consider. First, the upbeat nowcast is largely based on upbeat numbers for July. With many of the key data points published for last month, there’s a strong case for deciding that this year’s resilient US economy extended through July.

By contrast, the rest of Q3 – August and September – is still largely guesswork, and an early clue via sentiment data recommends caution.

This week’s release of the PMI Composite Output Index, a GDP proxy, indicates that US growth slowed to a crawl this month. “A near-stalling of business activity in August raises doubts over the strength of US economic growth in the third quarter,” says Chris Williamson, chief business economist at S&P Global Market Intelligence, which publishes the PMI numbers. “The survey shows that the service sector-led acceleration of growth in the second quarter has faded, accompanied by a further fall in factory output.”

PMI survey data is hardly the last word on economic activity for any one month, but the latest numbers certainly make a case for managing expectations down for some of the more robust estimates for Q3 until we see more hard data for August. Notably, the Atlanta Fed’s current nowcast for Q3 is a red-hot 5.9% increase for GDP, based on the GDPNow model as of Aug. 24. The latest PMI update, which is included in CapitalSpectator.com’s median estimate above, certainly presents a sharp contrast to the opposite extreme.

As usual, focusing on any one data point tends to be misleading and so our best guestimate, as always, remains the median nowcast. By that standard, there’s still a solid case for expecting that Q3 economic activity will post growth in line with the previous quarter.

There are still two months to go before the US Bureau of Economic Analysis publishes its initial Q3 GDP data on Oct. 26. For the moment, the median nowcast suggests that the recent trend of moderate growth continues. If and when there’s a convincing case for revising that estimate, up or down, we’ll see it in changes to the median estimate.

More By This Author:

Large Cap, Growth Are Main Risk Factors For Market Gains In 2023

So Many Equity Risk Premium Models, So Little Time

Analysts Assess Investing, Macro Implications Of Rising Real Yields

Disclosure: None.