US Could Soon See 2% Inflation

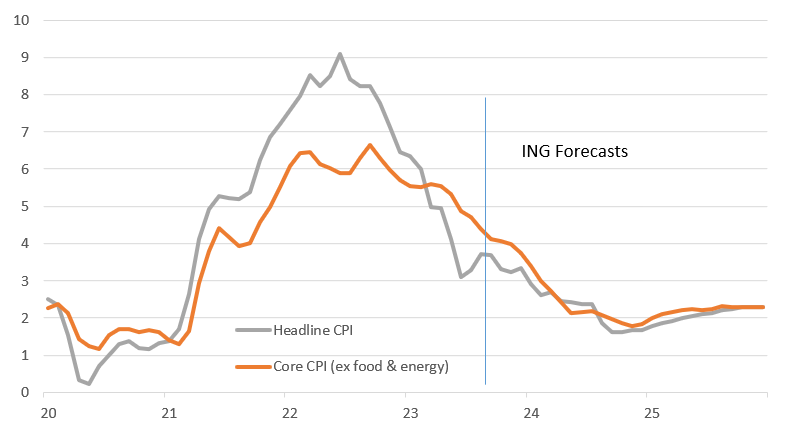

After encouraging inflation data in early summer, progress stalled in August and September amid robust consumer activity. But with tighter financial and credit conditions set to weigh further on corporate pricing power, supplemented by slowing rents and falling gasoline and used car prices, we expect to see inflation move close to 2% in 2Q.

Progress being made, but the Fed wants much more

At the recent FOMC press conference, Federal Reserve Chair Jerome Powell said that the economy has “been able to achieve pretty significant progress on inflation without seeing the kind of increase in unemployment that has been very typical of rate hiking cycles like this one”. Nonetheless, there was the acknowledgement that “the process of getting inflation sustainably down to 2% has a long way to go”.

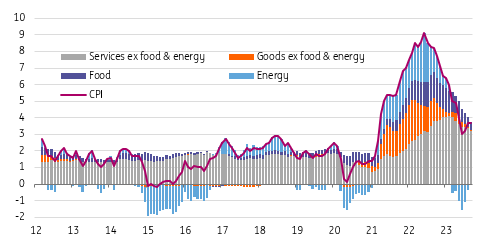

Headline US consumer price inflation has indeed fallen sharply from a peak of 9.1% year-on-year in June 2022, hitting a low of 3% in June 2023. However, this stalled in August and September with the annual rate rebounding to 3.7% as higher energy costs and resilience in some of the core (ex-food and energy) components re-emerged amid a strong summer for consumer spending. The annual rate of core inflation has continued to soften from a peak of 6.6% in September 2022 to 4.1% currently, but it is still running at more than double the 2% target.

In an environment where the economy has just posted 4.9% annualised GDP growth in the third quarter and unemployment is only 3.9%, there are several hawks on the FOMC who continue to make the case for additional interest rate rises, arguing that they cannot take chances and allow any opportunity for inflation pressures to reignite.

Contributions to US annual consumer price inflation (YoY%)

(Click on image to enlarge)

Macrobond, ING

But the Fed’s work is most probably done

The Fed is still officially forecasting one further 25bp interest rate rise this year, but we doubt it will follow through. The Fed last hiked rates in July and since then financial and credit conditions have tightened, with residential mortgages and car loans now having 8%+ interest rates while credit card borrowing costs are at all-time highs and corporate lending rates are moving higher.

It isn’t just the rise in borrowing costs that will act as a brake on economic activity and constrain inflation pressures. The Federal Reserve’s Senior Loan Officer Opinion survey shows that banks are increasingly reluctant to lend. This combination of sharply higher borrowing costs and reduced credit availability tends to be toxic for growth. The Fed itself has reported significant weakness in loan demand while commercial bank lending data shows a clear topping out in the amount of borrowing conducted by households and businesses. With real household disposable incomes falling for the past four months amid evidence of increasing numbers of households having exhausted pandemic-era savings, we expect to see GDP contract in at least two quarters in 2024. In this environment, we see the slowdown in inflation regaining momentum in early 2024.

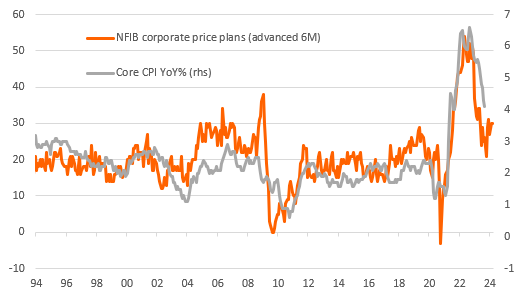

Corporate pricing power is waning

With business attitudes becoming more cautious on the economic outlook we are seeing a reduction in price intention surveys. The chart below shows the relationship between the National Federation of Independent Businesses' (NFIB) survey on the proportion of members expecting to raise prices in coming months and the annual rate of core inflation. It suggests that conditions are normalising, with core inflation set to return to historical trends.

NFIB price intentions surveys suggest corporate pricing power is normalizing

(Click on image to enlarge)

Macrobond, ING

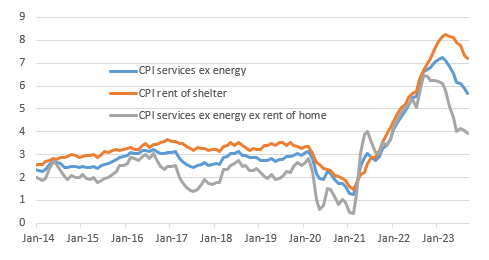

While concerns about the outlook for demand are a key factor limiting the desire for companies to raise prices further, a more benign cost backdrop has also helped the situation. The annual rate of producer price inflation has slowed from 11.7% to 2.2%, having dropped to just 0.3% year-on-year in June while import prices are falling outright in year-on-year terms. There are also signs of labour market slack emerging, with unemployment starting to tick higher and average hourly earnings growth slowing to 4.1% from near 6% just 18 months ago. Perhaps more importantly, non-farm productivity surged in the third quarter with unit labour costs falling at a 0.8% annualised rate. With cost pressures seemingly abating from all angles, this should argue for core services ex-housing, a component that the Fed has been keeping a careful eye on, to soften quite substantially over coming months.

Fed's "supercore" inflation should slow more rapidly

(Click on image to enlarge)

Macrobond, ING

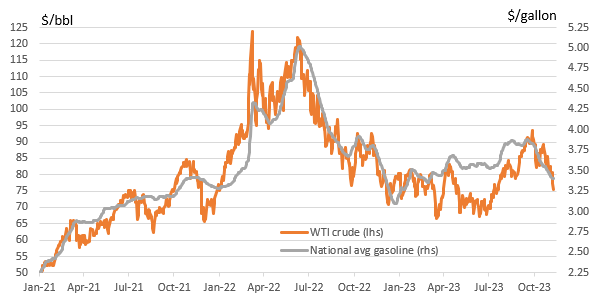

Energy and vehicle price falls to depress inflation

Another area of recent encouragement is energy prices. The fear had been that the conflict in the Middle East would have consequences for energy markets but, so far, we have seen energy prices soften. Gasoline prices in the US have fallen 50 cents/gallon between mid-September and early November, leaving it at its lowest level since early March. Gasoline has a 3.6% weighting in the CPI basket. Our commodity strategists remain wary, warning of the risk that an escalation in the conflict could lead to oil and gas supply disruptions from some key producers in the region, most notably Iran. For now though, energy prices will depress inflation rates and could mean at least one or two month-on-month outright declines in headline prices with lower energy prices limiting any upside potential from airline fares (0.5% weight in the CPI basket).

On top of this, we expect to see new and used vehicle prices (combined 6.9% weighting in the CPI basket) being vulnerable to further price falls in an environment where car loan borrowing costs are soaring. New vehicle prices have risen more than 20% since 2020 amid supply problems and strong demand while used vehicle prices rose more than 50%, according to both the CPI measure and Manheim car auction prices. Prices for used cars have fallen this year but still stand 35% above those of 2020. Experian data suggests the average new car loan payment is now around $730 per month while for second-hand cars it is now $530 per month.

With car insurance costs having risen rapidly as well (up 18.9% YoY with a 2.7% weighting in the CPI basket), the cost of buying and owning a vehicle is increasingly prohibitive for many households and we suspect we will see incentives increasingly capping the upside for vehicle prices. It is also important to remember that the surge in insurance costs is a lagged response to the higher cost of vehicles – and therefore insured value – and that too should slow rapidly (but not fall) over coming months.

Gasoline prices and oil prices surprise to the downside

(Click on image to enlarge)

Macrobond, ING

Rent slowdown will be the big disinflationary force in early 2024

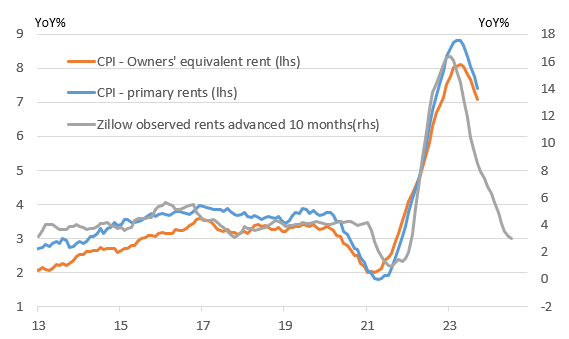

The big disinflationary influence should come from housing over the next couple of quarters. The chart below shows the relationship between Zillow rents and the CPI housing components. This is important because owners’ equivalent rent is the single biggest individual component of the basket of goods and services used to construct the CPI index, accounting for 25.6% of the headline index and 32.2% of the core index. Meanwhile, primary rents account for 7.6% of the headline index and 9.6% of the core. If the relationship holds and the CPI housing components slow to 3% YoY inflation, the one-third weighting that housing has in the headline rate and 41.8% weighting in the core will subtract around 1.3 percentage points of headline inflation and 1.7ppt off core annual inflation rates.

Rents point to major housing cost disinflation

(Click on image to enlarge)

Macrobond, ING

On track for 2% inflation next summer

There are some components on which there is less certainty, such as medical care, but we are increasingly confident that inflationary pressures will continue to subside and this means that the Federal Reserve will not need to raise interest rates any further. Next week’s October CPI report may not show huge progress with headline CPI expected to be flat on the month and core prices rising 0.3% month-on-month, but we expect headline inflation to slow to 3.3% in the December report with the annual rate of core inflation coming down to 3.7%.

Sharper declines are likely in the first half of 2024. Chair Jerome Powell in a speech to the Economic Club of New York acknowledged that “given the fast pace of the tightening, there may still be meaningful tightening in the pipeline”. This will only intensify the disinflationary pressures that are building in an economy that is showing signs of cooling. We forecast headline inflation to be in a 2-2.5% range from April onwards with core CPI testing 2% in the second quarter.

With growth concerns likely to increase over the same period, this should give the Fed the flexibility to respond with interest rate cuts. We wouldn’t necessarily describe it as stimulus, but rather to move monetary policy to a more neutral footing, with the Fed funds rate expected to end 2024 at 4% versus the consensus forecast and market pricing of 4.5%.

ING CPI forecasts (YoY%)

(Click on image to enlarge)

Macrobond, ING

More By This Author:

Rates Spark: The 4.5% Line In The Sand Is Breached

Asia Morning Bites For Thursday, November 9

The Commodities Feed: Brent Settles Below $80

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more