US Budget Deficit Hits A Record $863 Billion In June, A 100X Increase

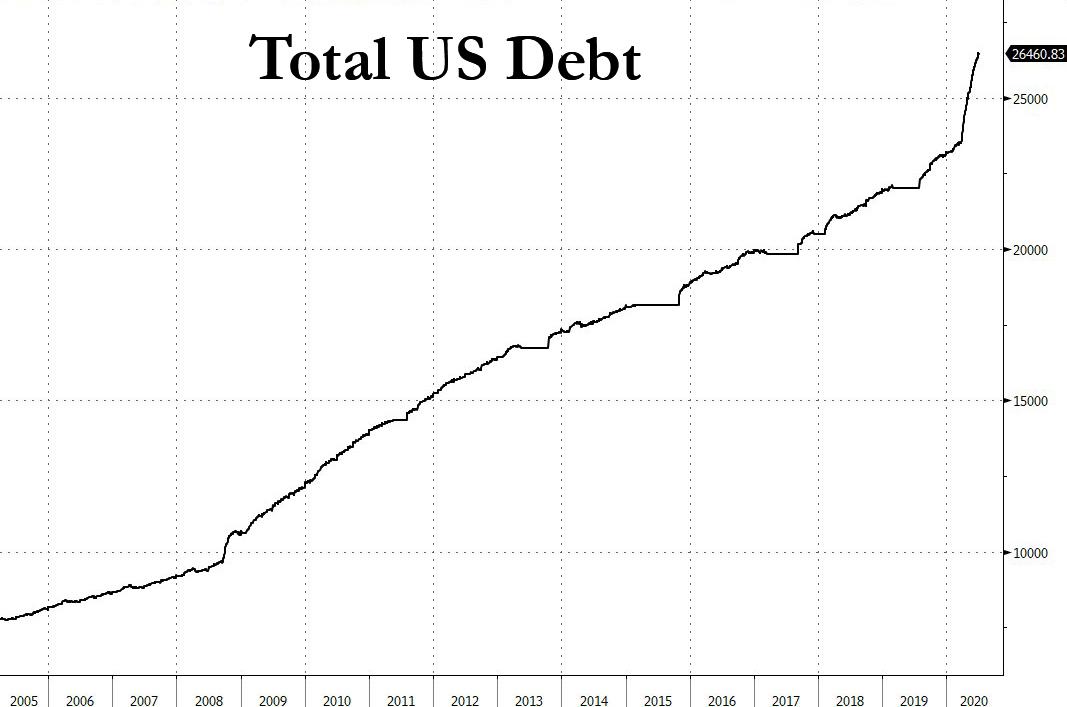

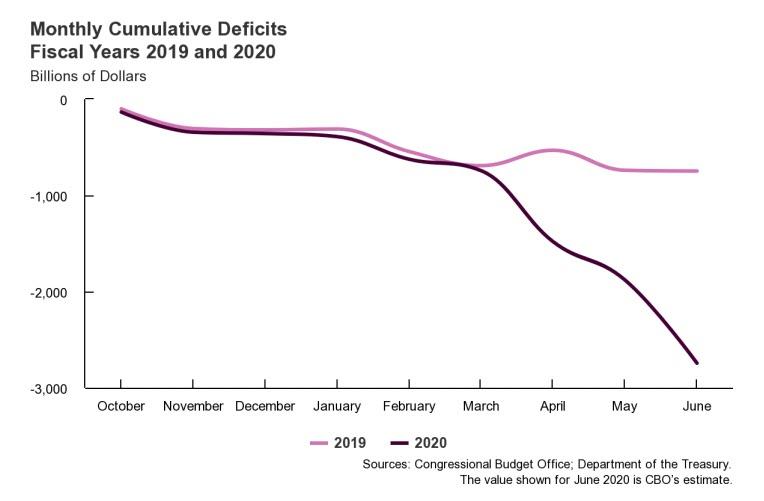

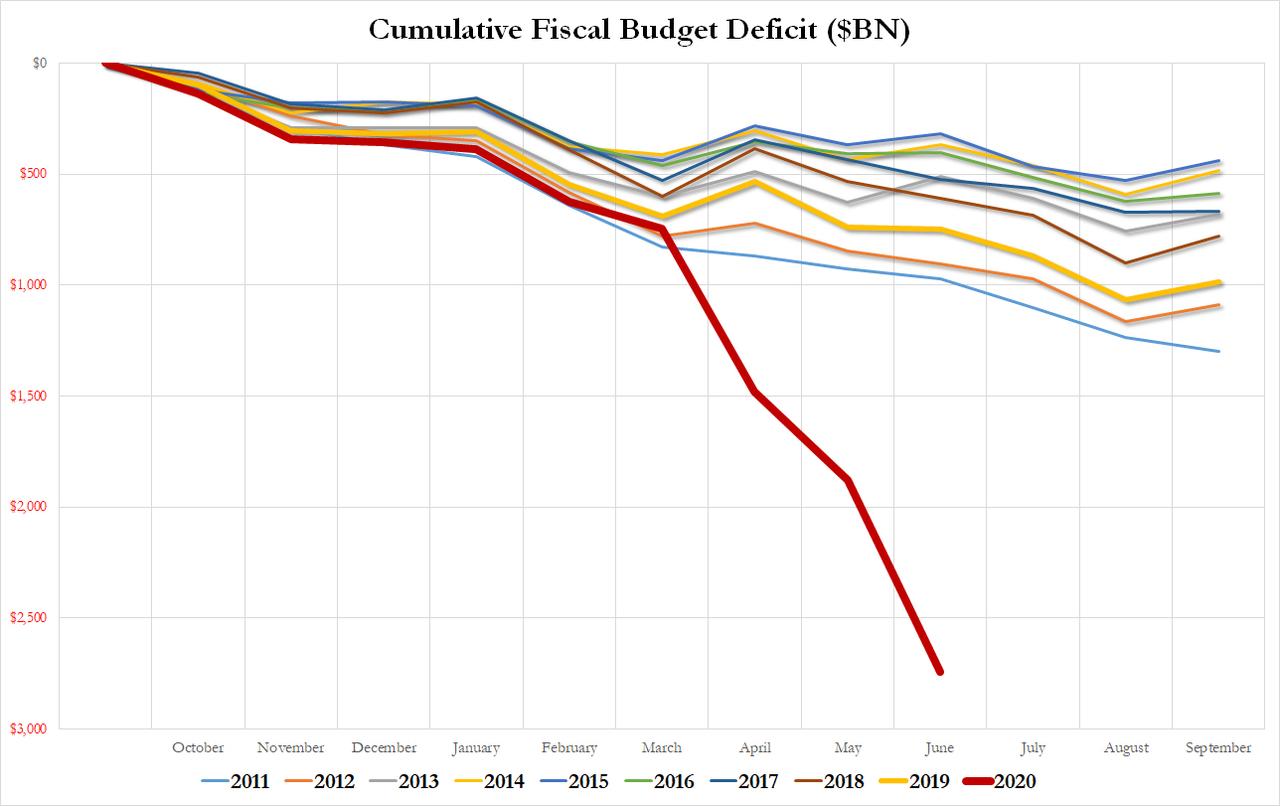

Those who have been following the record surge in US public debt (excluding the roughly $100 trillion in off-balance-sheet obligations), which exploded by $3 trillion in just the past three months and hit an all-time high $26.46 trillion on Tuesday, will likely have some inkling that the US budget deficit in June will be staggering.

(Click on image to enlarge)

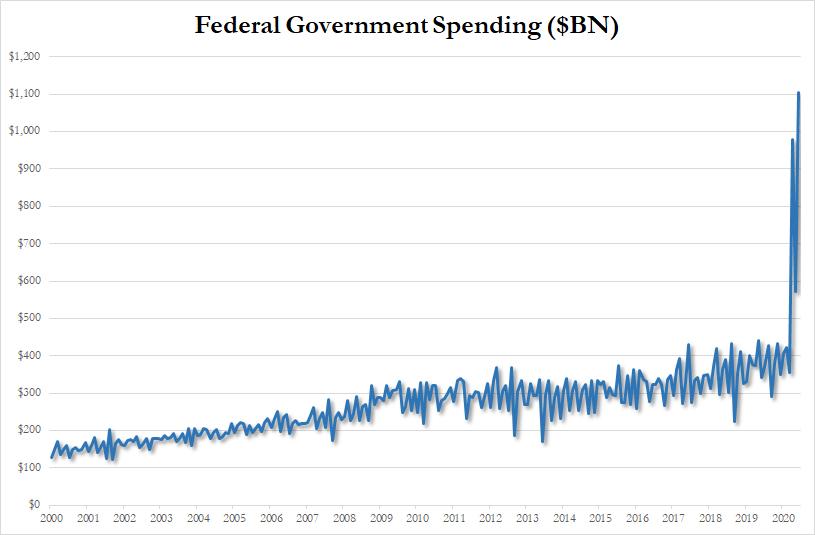

We can now confirm that: in its preview of the June budget deficit, the CBO reported that last month the US spent a record of $1.105 trillion, an increase of $763 billion from last year...

(Click on image to enlarge)

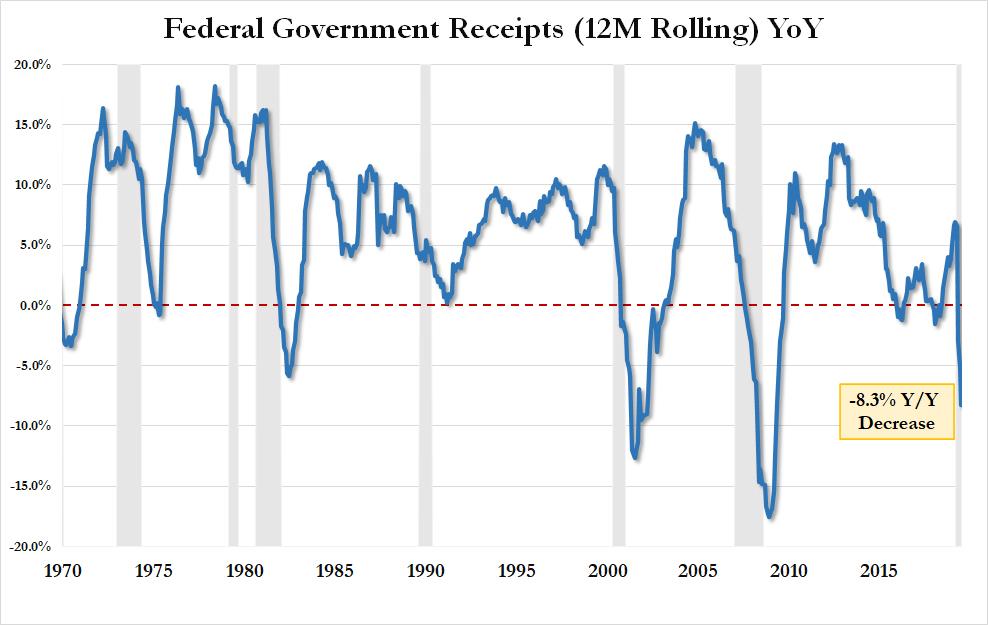

... while receipts shrank by $92 billion from a year ago to $242 billion, which on an LTM basis was $3.1 trillion, an 8.3% decrease Y/Y, the largest since the financial crisis and clearly confirming the US is in a recession.

(Click on image to enlarge)

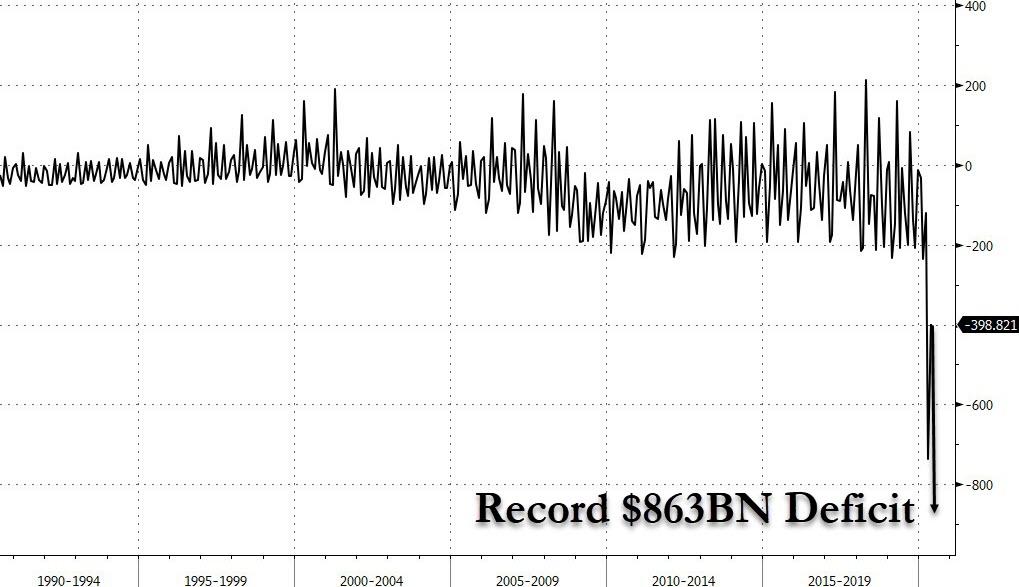

This means that the June budget deficit was a mindblowing $863 billion, an increase of 101x compared to the $8 billion deficit in June of last year.

(Click on image to enlarge)

Putting June's deficit in context, it was greater than the full-year deficit recorded in 2018, and in fact in any year from 2013 to 2017. It is also just $120BN shy of the $984BN full-year budget deficit recorded last year when so many fiscal conservatives slammed Republicans for going crazy with spending on Trump's tax cuts. Little did they know what was about to hit.

According to the CBO, the record deficit stemmed "from the economic disruption caused by the 2020 coronavirus pandemic and from the federal government’s response to it, including actions by theAdministration and the enactment of four pieces of legislation." Furthermore, outlays by the Small Business Administration—which oversees the recently established Paycheck Protection Program—contributed significantly to the June deficit this year, accounting for almost half of the government’s spending.

Some more details on the breakdown.

While June 2020 receipts were down by 28%, to $242 billion—$92 billion (or 28 percent) less than those in June 2019., due to declines in wages and in economic activity generally, recently enacted legislation, and actions by the Administration, it was the avalanche of June spending that more than tripled in response to the pandemic:

- Outlays by the Small Business Administration increased from $80 million to $511 billion, primarily because of loans and loan guarantees to small businesses through the Paycheck Protection Program authorized by the CARES Act and PPPHCEA.

- Outlays for unemployment compensation increased from $2 billion in June 2019 to $116 billion this year. More than half of that rise stems from a $600 increase in the weekly benefit amount provided under the CARES Act. Benefits for regular unemployment compensation rose as well.

- Outlays for the Public Health Social Services Emergency Fund totaled $14 billion this June, compared with $300 million last June. Funding was increased by recent legislation to reimburse health care providers (such as hospitals) for health care costs or for revenues lost as a result of the pandemic. That fund also provides money for testing for and treatment of COVID-19, the disease caused by the coronavirus.

- Outlays from the Department of the Treasury’s Exchange Stabilization Fund increased from –$29 million to $9 billion, almost entirely because of equity investments in certain Federal Reserve facilities, which provide liquidity for a wide range of economic activities. Those facilities are designed to address financial strain caused by the pandemic. CBO expects that the increase in the deficit caused by those outlays will probably be offset in future years by payments to the Treasury from the facilities’ proceeds.

- Spending for Medicaid was $9 billion higher this June than last June for three reasons: increased enrollment, the 6.2 percentage-point increase in federal matching rates that states began to access in April 2020 (enacted in FFCRA), and FFCRA’s requirement that states retain enrollees on Medicaid until the end of the public health emergency. Spending by the Department of the Treasury for aviation worker relief totaled $6 billion in June. The CARES Act authorized that assistance for payroll support in the form of grants and loans.

- Spending for the Food and Nutrition Service was $5 billion higher—$13 billion in June 2020 compared with $8 billion in June 2019—largely because of the increase in Supplemental Nutrition Assistance Program benefits authorized by FFCRA but also because more people were receiving such benefits this June, CBO estimates. Payments for refundable tax credits were $6 billion in June 2020 compared with $2 billion in June 2019, primarily because of the CARES Act’s recovery rebates.

- Outlays for the Coronavirus Relief Fund, authorized by the CARES Act to provide grants to state, local, tribal, and territorial governments to offset pandemic-related expenses, totaled $3 billion in June. There was no such spending last year.

- Outlays for the Department of Education rose by $44 billion, mostly because the department made an upward revision of $70 billion to the estimated net subsidy costs of loans and loan guarantees issued in prior years. That revision was much larger than the $28 billion upward revision the department made in June 2019.

- Payments for interest on the public debt decreased from $40 billion in June 2019 to $18 billion this year. Although the debt was greater this June, inflation was considerably lower, resulting in smaller adjustments to inflation-protected securities.

- Outlays for the Department of Housing and Urban Development decreased by $14 billion, primarily because the department made a downward revision of that amount in June to the estimated net subsidy costs of loans and loan guarantees issued in prior years.

For the first 9 months of fiscal 2020, the federal budget deficit was $2.7 trillion, $2.0 trillion more than the deficit recorded during the same period last year.

(Click on image to enlarge)

Revenues were 13 percent lower and outlays were 49 percent higher through June 2020 than during the same nine-month period in the fiscal year 2019.

(Click on image to enlarge)

At some point, the market will realize that this insanity is simply unsustainable. And, in fact, looking at the surge in the price gold, that realization may not take too long.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

The really awful thing about debt is that it must be repaid. That is the very worst part! In our case it is really bad because those who will have to repay it have not even been born yet.

But the immediate effect is also quite nasty and especially devastating to those who are depending on savings for their support. That is the inflation caused by all of that give-away money bidding up the prices of almost everything. The Feds have it all wrong: printing more money does NOT create wealth. What are they thinking???