Unemployment, Inflation And The Fed’s Choice

There was an historically large revision to the unemployment data this week, which was even worse than the headline when you dig into the actual numbers. On top of that, there is some “behind the numbers” data on inflation, which is typically not talked about, that will have a big impact on the Fed decision, not to mention traders and mortgages. This all has implications for the economy and maybe even for the election. While it's not quite Sophie's Choice, it's still not easy for the Fed.

This week we take a not-so-random walk through the data, trying to simplify what is actually a fairly complex subject. I think it is quite fun, but also important. Let's dive in.

Unemployment Shock

The Bureau of Labor Statistics (only a wonk would choose that name) did their annual revision this month, revising the last year down by 818,000 jobs, or roughly 68,000 jobs a month. This is in addition to the already revised 300,000 jobs downward on a monthly basis, or over 90,000 jobs a month from the original estimate.

When somebody asked my friend David Bahnsen if he thought the higher-than-normal jobs revision was a conspiracy trying to make the economy look better than it is, he quipped:

“If the conspiracy was to help the incumbent party in the election, having it get out 10 weeks BEFORE the election seems like a very bad conspiracy to me.”

A couple of thoughts. First, slightly more than 1,000,000 private sector jobs were lost in this revision. Government jobs went up almost 200,000. The private sector is where you can see the impact on the real economy, the one that produces actual GDP. There are some who might suggest that government jobs are a drag on the economy. Just saying...

Government jobs are not a function of demand, but of budget. If there is a budget for X number of employees, then the government agency will hire X number of employees. Given that there have been no budget cuts of any significance, in fact it has been the opposite, in the last three years, those who try to stare into the crystal ball of monthly employment data to predict the economy have a particularly difficult time.

In a conversation with Barry Habib today, he noted that one of the two most important data points the Fed will be looking at prior to its September meeting will be the August unemployment numbers coming out the week before. Given that we have just had a fabulous demonstration of how unreliable the monthly employment numbers are, how much confidence should we have in the Fed using that number to set the rate of the most important price in the world—the Fed rate? Of course, they know it's a flawed number, but they must make a decision anyway.

I've told this story before, but it bears repeating. It is almost exactly like some general in the spring of 1944 going to future Nobel laureate Kenneth Arrow and asking him to predict the weather over Normandy on June 6, 1944 (D-Day). After he told the general it was impossible, the general answered, “We know that, but we have to have a number for planning purposes.”

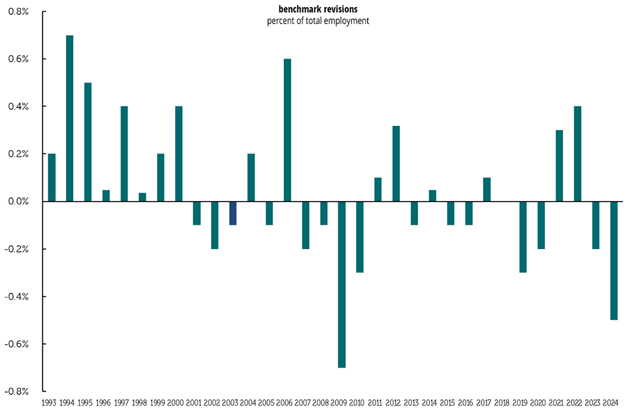

Historically, the revision was large but certainly not the largest. There have been larger revisions to the upside. My friend Philippa Dunne at TLR Analytics sent us this fascinating chart:

Source: TLR Analytics

Philippa noted:

“As you can see on the graph above, the 2024 benchmark, -0.5%, is the fifth largest over the last 32 years, among 2009’s -0.7%, 1994’s +0.7%, 2006’s +0.6%, and 1995’s +0.5%. It’s reassuring they aren’t all in the same direction. The annual benchmark is an integral part of the BLS process, and a major reason the establishment series is so important.

“Between 1993 and 2000, revisions averaged 0.3% in absolute terms, narrowing to 0.2% between 2001 and 2019, including 0.2% between 2001 and 2008, and 0.1% between 2010 and 2019. Since 2020, the average moved back up to 0.3%, not so surprising given the displacements of the pandemic.”

There's actually a very good reason that the numbers are so flawed, both up and down. It all has to do with the Birth/Death ratio. It is not a conspiracy to make the economy look bad or worse than it is, although some of my friends and various analysts contend that it is. The Birth/Death model is absolutely necessary. This is an establishment survey, which means they survey established businesses. By definition they won't have new businesses in their survey rolls, and it's no surprise that businesses that no longer exist don't answer the phone (or email).

This number is what most modelers politely call a “fudge factor.” It is the number you use when you don't know the real number, but you know it must exist. Without this number the revisions would be massively higher and the unemployment numbers would be almost completely useless as opposed to only somewhat useful now, at least in the short term.

The Birth/Death ratio is based on past performance. They essentially look at what has historically been the real number with the benefit of hindsight, and more or less assume that it will look the same in the future. Never mind the caveat that past performance is not indicative of future results.

There is simply no other way to do it, without actual forecasting, which we all know is impossible. And in general, most of the time it's not too bad. But because it is a backward-looking number, it is going to miss the inflection points. By that I mean when the market is recovering from a recession or a downturn, the model will miss the actual improvement in the employment numbers. The miss is similar on the downside.

I was surprised to learn from this table that the unemployment number has been revised upward 16 times and downward 15 times, with the occasional no revision, and often the revisions are de minimis. We only really notice it when the misses are big, but those misses tell us something: The economy is changing so pay attention.

So even though the August employment number, which comes out the 1st Friday of September, will likely be a flawed number that will later be revised, it can be put in context of the trend and therefore useful.

The Fed has clearly telegraphed a 25-basis-point cut in September. A sizable number of traders think the Fed will cut 50 basis points. I assume they are essentially thinking that the September unemployment number is going to come in soft enough to alarm the Fed to cut more than they are currently indicating. We will see that number in two weeks, so stay tuned.

What Inflation?

CPI inflation in July was 2.9%. The latest PCE inflation data was 2.5%. As we all know, the Fed prefers the PCE. We will touch on why in a few paragraphs. But since their target is 2%, we're obviously getting closer. And maybe closer than you think. I will use the CPI data to illustrate this point because it is more recent, but the PCE data would be similar.

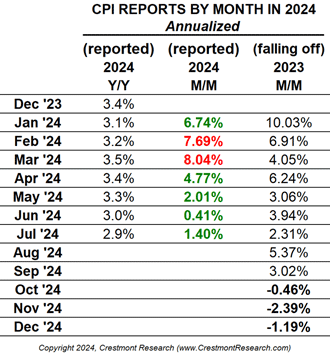

Ed Easterling of Crestmont Research sent me a note, and then we had a long chat. You get a shortened version. Let’s start with this table:

Source: Crestmont Research

First impressions: Since March of this year, the direction has generally been a gentle slope down. With the month-over-month numbers? Wildly volatile. You can see the last 12 months by looking at the far-right column, which is the 2023 month over month, and then the middle column of the 2024 numbers. The difference has gone from a negative 2.39% in November of last year to a high of 7% and 8% in February and March of this year. There are lots of factors involved: energy, core goods, etc. So how do we make sense of this?

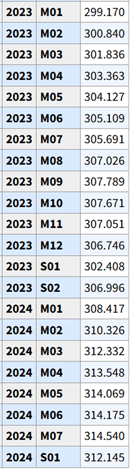

I think it helps to look at the actual index the CPI is based on. This is a cut and paste from the BLS website. They have this index back to 1913 (when the Fed was created). Just for the record, they recalibrated the index to 1982. So, in 1913 the index would have been 9.8. Today it is 314, or more than 32 times higher. My back of the napkin calculation says the dollar buys about three cents of what it did 111 years ago. Fascinating to see how slowly it rose and then took off over time. But let’s move on.

The “M” numbers are the months. The numbers which have an “S” preceding them are the average for the first half of the year (SO1) and then the second half (SO2). Inflation has been roughly 4.5% total since January of 2023, from 299 to 314. (Economists use numbers to the right of the decimal point to demonstrate they have a sense of humor.)

Source: BLS

Notice the last three months. The index has been flat as a pancake. This is not the first time of course, but over the last five months annualized inflation would be under 2%. That shows we are moving down from the last few years.

We get the next CPI release on September 11, the week before the Fed meeting. If inflation is 2% month over month in August, the annualized yearly will be 2.6%. If it is 3%, then it will still be 2.7%. That data will be important.

But what is it likely to say? We got a clue from this data from David Bahnsen, who writes a short memo on inflation a few times a month.

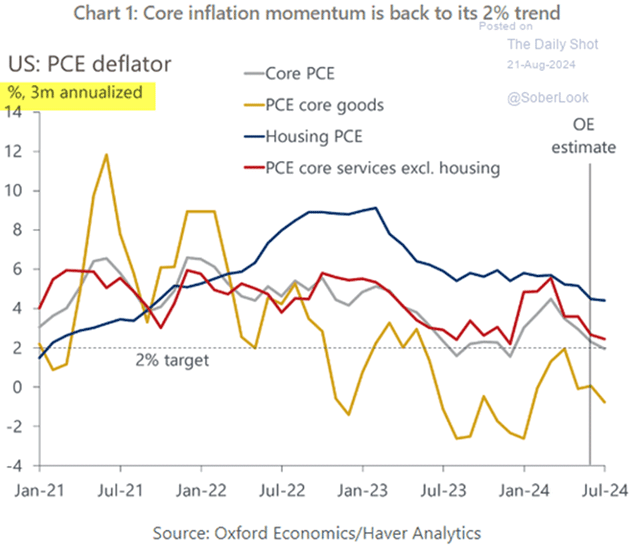

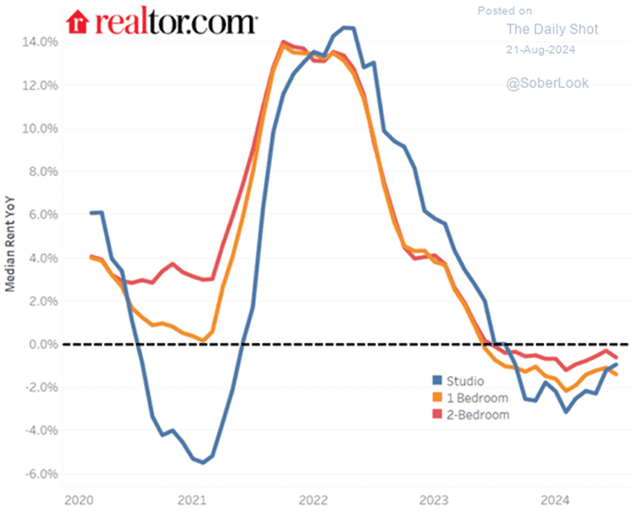

“As I have been pointing out for months, core goods prices are in outright deflation. Housing is highly distorted (see second chart below). And the core PCE level is now at the Fed target of 2%.”

Source: The Daily Shot

Core goods include energy and food. Energy, to my mild surprise, has been trending down with no contribution to inflation for the past few months there. Ditto for most food prices.

Plus, Owners’ Equivalent Rent (OER), which is used to substitute for housing costs, is clearly overstating inflation in the CPI.

Source: The Daily Shot

I *think* this is for new rentals, but even renewals are under 3%, not the over 5% in the CPI. OER is coming down month by month merely due to the lag in the way they calculate it. Home prices are up (a lot) but are also under pressure. Thought question (which no one knows the answer to): what would rentals and home prices be without the effect of (pick a number, but a large one) 10 million+ “non-conforming” immigrants over the last 3–4 years?

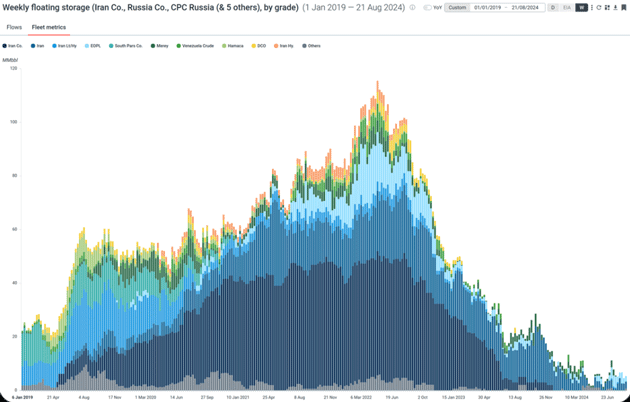

My friend Bill Hamlin, a very senior oil trader, sent me this chart. Only insiders pay attention to deep data like this, which shows the amount of oil in tankers (called floating storage) over the past five years. You can see it is close to five-year lows. There is no room for using the SPR. Production is up, but geopolitical risks are high. Energy prices could rise influencing inflation. But barring that, inflation will be low in August and likely in September as well.

Source: Bill Hamlin

Again, CPI shows a higher inflation rate than PCE. Recently that has been a differential of ~0.5%. If CPI comes in at 2.6%, then PCE could be 2.2% or less…? There is certainly room for a 25-basis-point cut. A weak or even merely soft unemployment number for August could actually spur them to a 50-basis-point cut.

Note that five out of the last six rate cutting cycles began with a 50-point cut, generally during a recession or crisis. The markets have been wrong about rate cuts for several years, but they might actually be right this time. We could see 150 bps or more over the next six meetings.

Since we are not in a crisis or recession, I don't expect a 50-basis-point cut absent a dismal unemployment number in September. However, the manufacturing sector is clearly in, at a minimum, a small recession. There are a host of reasons that lower interest rates would benefit the economy, and I think if the market were actually setting rates rather than 12 people sitting around a table, rates would already be lower.

I sincerely hope that we get nowhere close to the zero bound ever again. I think we should consider 2% to be the boundary. If something can't be done for a 2% fed funds rate, then what makes one think that 1% or less would make that much difference? That doesn't benefit real businesses, even though it would certainly make some sectors of the financial industry and private equity happy. And we shouldn't be doing anything for them in that regard.

I’m So Confused

We are in an interesting time. Earnings revisions this past quarter have been generally positive, and this has been reflected in the market, which doesn't seem to want to roll over. And likely won’t until a recession. That's a good thing. Unemployment is clearly softening, but GDP is still well above 2%, which is better than the average of the first 20 years of this century. Inflation is also softening, but gold is at an all-time high.

I can't remember a time when it was so hard to look out over the next six months and make a prediction. I have been wrong on a few occasions, but at least I felt comfortable making a prediction about the direction of the economy. That is just not the case today. There are too many conflicting signals. For once in my lifetime, the Fed might actually be ahead of the curve if they start the interest rate cut cycle. The American consumer hasn't come close to throwing in the towel.

In the very long term, I am an optimist, but I still believe we will have a crisis near the end of this decade because of the debt cycle and the deep divide in this country, which will make the crisis even worse and extraordinarily difficult to solve. Over the next six months to a year? Hard to say.

If all that sounds confusing, I guess that's because I am confused. I think it's time to go fishing, sit in a boat, and meditate. Maybe when I come back some clarity will manifest itself.

Note: I wrote the bulk of this letter Thursday night. Here is my reaction to Powell’s Jackson Hole speech.

The money line was, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Powell clearly highlighted his concerns about employment. As I said above, that data will be critical to choosing between 25 and 50. Everything else discussed above is still pertinent, as I thought it would be. It was a very much as expected speech.

Haida Gwaii, Dallas, and an Update on My Daughter

I want to thank everyone who sent kind notes and offers of help when I mentioned that my daughter Abbi had experienced seizures, a serious fall, and they found a brain tumor. It truly moved me deeply. What a great family we are.

It turns out the tumor is small, and the doctors are relatively certain it is benign and was not the cause of the seizures. I knew the twins had brief contact with their biological mother but did not know that their father died from a heart attack. Some readers will remember that her sister had a stroke a few years ago and pushed through a hard road to recovery. The doctors now believe it is a heart issue and have her on a monitor. By the time you read this she should be back at home. She is on meds for the seizures, and hopefully we can determine what the problem is. We adopted Abbi and her twin sister Amanda in late 1985 from Korea. Looong story…

We all have great memories of our kids growing up. My twins annoyed their siblings because they were so perfect. At least in my eyes. Someone took this picture and sent it to me. It took me back because I remember them as very young girls in almost the exact same pose. Amanda spent almost every night with Abbi. This was from Tuesday. Abbi is on the left.

Tuesday Shane and I leave for Vancouver and then northwest British Columbia on an island named Haida Gwaii where we will be at a fishing resort with the West Coast Fishing Club and 30 of my friends and readers. A first-class and magical place.

While I am hopefully catching trophy salmon, next week you will be gifted with a brilliant writer talking about elections and markets. It will be a must-read.

I fly to Dallas for a quick trip in the middle of September to meet with Mike Roizen and the team with which we are launching what we hope will eventually be a large group of longevity-based clinics. More on that soon. If you are a lawyer with experience in creating operating agreements and subscription documents, and you are not a senior partner wanting $800+ an hour (which all my friends are now!) drop me a note. Just being frugal.

More By This Author:

A Head Fake, Maybe25 Years And Counting

The Hunger Games: The Fed Version