Trump Part IV – The Causes And Uses Of An Economic Crisis

Similar to a security crisis, I can’t sleep because I worry Trump may inadvertently cause an economic crisis, which he may then uses as a pretext for further authoritarian moves.

Look, this can’t be a prediction about “what’s going to happen” with the economy under Trump. Most of the time when we talk about markets responding to a presidency, we are finding false signals in noise or we’re predicting things that are really unknowable.

I do worry, however, about two specific economic problems that Trump has promised to cause: Trade wars, and interference with US financial strength through the bond markets and Federal Reserve. The long-term problem with an economic crisis – besides the obvious pain and suffering – is a societal desperation that allows an authoritarian to make bold moves otherwise unavailable to him.

Let’s start with trade.

In the arena of international trade, Trump’s “plans” – such as they are – could and would cause a worldwide trade-war and global recession. He launched his presidential campaign pledging massive 35% tariffs on our major trading partner Mexico. He reiterated his plans many times on the campaign trail to retaliate both against Mexico, and against companies like Ford Motor that may move manufacturing jobs to Mexico. By the way, 16% of our national exports go to Mexico.

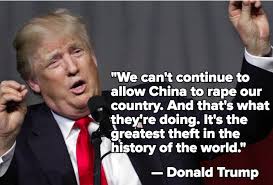

This doesn’t leave a lot of room for nuance

In addition, he has threatened 45% tariffs on Chinese exports both in Republican debates and in interviews with the New York Times. Some of our biggest global brands like Starbucks, Boeing, and Apple see the 1.3 billion Chinese people as their largest single market. By the way, 7% of our exports currently go to China.

Trump pledged to withdraw not only from the recently-negotiated Trans-Pacific Partnership but also to renegotiate or withdraw from 1994’s North American Free Trade Agreement with major trading partners Canada and Mexico. By the way, 19% percent of all U.S. exports go to Canada.

Trump’s promises mark a very big shift in US policy and leadership.

The problem with unilateral trade sanctions like this is:

- They don’t stay unilateral. Countries affected will obviously retaliate against us with their own trade sanctions, and;

- The United States would probably be in violation of international trade systems like the WTO.

Most experts agree that the Smoot-Hawley Tariffs of 1930 exacerbated the Great Depression worldwide, as both imports and exports from and to the United States dropped to about half previous levels.

The globalization of trade since the end of World War II – and in particular since the end of the Cold War – has greatly favored the United States, even if the effects of trade hurt particular industries or geographies. A reversal of that trade situation – championed by Trump as he champions those most hurt by globalization – will make us all poorer.

At the same time, high tariffs are unlikely to bring back manufacturing jobs. The bad news is that we pay people too much in this country and we enforce too many worker protections to make many manufacturing jobs viable here.

Trump has promised a trade war, but without a chance that it could possibly “work” in the sense of bringing back many jobs for those most affected by globalization.

Now, maybe Trump is just kidding about his trade war plans. Maybe it's just a goof, indicating his direction of thought, but he won’t enact anything as crazy as what he’s promised?

His selection of billionaire investor Wilbur Ross for Commerce Secretary, however, indicates Trump’s seriousness about protective tariffs. Ross made his career as an extraordinarily successful vulture investor in beaten-down industries such as steel and coal, domestic industries buffeted in part by regulations and high worker-costs, but also by international trade.

In 2002 and 2003, Ross bought up bankrupt steel-producers LTV Corporation, Acme Metals and Bethlehem Steel.

A well-timed 30% tariff on imported steel in 2002 enacted during the George W. Bush Administration helped raise the value of Ross’ steel holdings, which he eventually sold to Indian-owned Mittal Corp in 2005.

Incoming Commerce Secretary Wilbur Ross likes steel tariffs. Ross has indicated his support for both Trump and the idea of protective tariffs, and he clearly has the business experience to know that trade protection can enrich the owners of certain industries.

While higher steel prices help steel workers and owners, however, they hurt other industrial companies – like the auto or construction industries – that need to buy steel at the lowest price possible.

Trade wars can benefit some select sectors and people even while most of us end up poorer through higher costs. International trade has been a major generator of wealth since the end of World War II, with the United States as its biggest cheerleader. I’m afraid Trump intends to kill the golden goose, with severe economic consequences.

Undermining financial strength

The second economic crisis threatened by Trump is his promise to weaken the Federal Reserve. It will take some wise financial counseling to explain to Trump why his threats do not really help the United States. He has not shown evidence, however, that he can take that kind of advice, or learn from it.

I worry that over the next two years Trump will have the ability to reshape the Federal Reserve in ways that undermine one of the central bank’s key strengths – its independence from politics.

The Fed is the quasi-public, semi-mysterious, massively powerful, independent central bank for the United States. It’s an “independent” regulator, meaning it technically doesn’t report to Congress or the U.S. president. Given its mystery and importance, critics on the Left and Right often seek to curb the power of the Fed. Anything that powerful must be part of some kind of conspiracy, right?

President-Elect Trump — who served as human fly-paper for the bad economic ideas of fringy cranks throughout his campaign — caught this wave too. He accused the Fed of being in the tank for the Obama administration. Like the Republican Party, the Democratic Party, the FBI, the Electoral College, and the media to name a few — the Fed — Trump complained, was part of an unfair conspiracy against him.

But then Trump went further down an even darker path in attacking the Fed. In “Donald Trump’s Argument For America,” released in the days before the election, he linked images of Fed Chair Janet Yellen to the well-known faces of financiers George Soros and Goldman Sachs CEO Lloyd Blankfein, as part of a “global elite” conspiring against ordinary Americans. All three are Jewish, of course, and the ad recalled anti-Semitic conspiracy theories that follow the vile and fictional “Protocols of the Elders of Zion.” Whether Trump claims that Yellen is in the tank for his opponents, or whether he winks knowingly at anti-Semites about a global Jewish conspiracy, he has set the stage to justify curbing the Fed’s independence.

This video:

This should trouble us tremendously. The U.S. is a country that retains an outsized role in the global economy. One of America’s greatest strengths as a financial power is the belief that its central bank is not unduly subject to political control from any particular party or faction.

Usually when we talk about policies from the Fed, we don’t focus on Democrats and Republicans or Liberals and Conservatives, but rather “Hawks” and “Doves.”

In simplest terms, a “hawk” tends to worry about inflation more than unemployment, and pushes the board to raise interest rates quickly enough to avoid unexpected inflation. A “dove,” conversely, worries more about unemployment than inflation, and would tend to want to keep interest rates low as long as possible, to juice economic activity even if it spurs a little bit of inflation. I’m simplifying here, but these are the broad strokes.

A key point, though, is that a Fed governor — whether hawk or dove — is supposed act independently from politics. Almost as important is the idea that a Fed governor seems to act independently from politics. We count on the appearance of independence as much as the reality.

The first guarantee of independence is that the seven board members, known as governors, serve 14-year terms, thus guaranteed to outlast any U.S. President. A bit like justices appointed to the Supreme Court for life, Fed governors therefore should not owe their ongoing positions to any particular political faction. The next guarantee of central bank independence is that the Fed Chair is nominated by the President from among the governors and gets appointed to a four-year term that does not coincide with a President’s four-year term. Janet Yellen, the current Fed Chair, plans to stay in office at least through her term in 2018.

Inflation spikes correspond with political interference with the Fed

The specter of political interference in Fed policy has darkened our political scene before. Economist and former Minneapolis Fed President Narayana Kocherlakota recently wrote about historical problems when the executive branch interferes with the US Fed. During and following World War II, the Fed kept long-term rates artificially low to allow the government to borrow cheaply. Inflation soared to nearly 10 percent by the time the Korean War began in 1950. Later, Narayana reports, Presidents Johnson and Nixon pressured the Fed to stimulate the economy, leading in part to astronomical inflation of the ’60s and ’70s that peaked at 14 percent in 1980.

With President Trump able to appoint a new Fed chair and vice-chair in 2018, plus the chance to fill two more currently open spots on the Board of Governors, a real point of pressure exists. By 2018, he will have appointed four of seven Fed governors. Would Trump show restraint, or would he pressure the Fed to support his agenda?

Authoritarians, as a rule, cannot stand independent central banks. They don’t like the idea that some entity independent of them can wield vast power over both the real economy and banking institutions.

The U.S. enjoys a massive financial subsidy because, up until now, the wealthy of the world trust that our currency will not be suddenly inflated away to worthlessness. An independent Fed assures the world that authoritarians cannot bend monetary policy to their will. But authoritarian regimes, the kind that curb central bank independence, never get trusted with this kind of financial status, as a place where global holders of capital want to park their surpluses.

There are many areas where Trump’s actions might undermine our strengths as a country. Attacking the independence of the Fed is one of the most important ones to watch out for.

Threatening bond markets

Last but certainly not least, it takes a long time (dating back to Alexander Hamilton) to build up the kind of credit the United States gets for political independence in monetary policy, as well as the kind of trust that attracts global capital to fund our government. It probably only takes one aggressive authoritarian to make that capital flee. And if it flees quickly, that alone can cause a financial crisis.

During the campaign last Summer, Trump argued that if the US borrowed too much, he would simply re-negotiate our debts.

“I’ve borrowed knowing that you can pay back with discounts. [As President,] I would borrow knowing that if the economy crashed, you could make a deal.”

That’s not how it works with the US bond market. You don’t default (that’s what “making a deal” means) on the US bond market. Or at least, you don’t get to do it more than once. Because suddenly you’re Argentina, or Ecuador, or Ukraine when it comes to your ability to borrow. He’s talking about treating our country like one of his Atlantic City casinos, walking away and stiffing our lenders. If bond investors took him seriously and literally (like I do) we’d have an immediate financial panic. Personally, I think Trump’s attitude towards US sovereign debt is the scariest thing he’s ever said, in terms of a threat to the continuation of the United States of America as we know it.

And that’s saying a lot, considering what’s come out of his mouth or Twitter account.

Who will be to blame?

If an economic or financial crisis occurs under a Trump administration, I don’t see the events as something that would cause Trump to reflect on his actions or take responsibility for his errors. I think he will see the crisis he caused as an opportunity to blame his enemies.

Surely it will be fault of the Mexicans, the Muslims, the Chinese, the Jews or the journalists that his trade war or threats to default on our sovereign debt have hurt markets and the US economy.

An economic crisis – like a security crisis – can make people desperate for action, any action (however rash) to make it better. People who are angry or fearful about losing their jobs or financial status or fortunes are more likely to turn a blind eye to constitutional encroachments.

Those constitutional encroachments are in the end what I’m most worried about, and are what I will write about next.

Parts of this post appeared as two different columns in the San Antonio Express-News and Houston Chronicle.

Trump Part I – Fever Dreams

Trump Part II – Review of Recent Elected Authoritarians

Trump Part III – The Use of Security Crises

And Upcoming:

Trump Part V – The Constitutional Crisis

Trump Part VI – Principled Republican Leadership

Thanks for visiting Bankers Anonymous. Be sure to more

Fascinating article, but where to start?

First, Trump may be anti Semitic. But he is pro Zionist. People should know that Zionism and Judaism are really not historically linked. Judaism,a religion, existed for thousands of years and Zionism, a political doctrine, was formulated in the late 1800's. It would be good if people learned that there are differences, like the British Court ruled.

Also, he is not a tolerant person. Tolerance is key in these times. I do worry about his tendencies towards authoritarianism when times get tough, and they likely will.

Second, Trump does hit a populist chord. He is threatening tariffs, and that is probably a good thing to threaten. We are getting killed with loss of manufacturing. I posted this quote in my article, Michael:

"In comparison to Figure 1A, the related-party exports shown as a share of overall U.S. exports in Figure 1B indicate that offshoring is a two-way street. Multinational companies from other countries are locating production in the United States for sale in other countries’ markets but are doing so at a much lower rate than the U.S.-based companies locating production offshore to supply goods to the U.S. market." Emphasis mine. www.talkmarkets.com/.../trumps-carrier-deal-bankstechnology-and-freedom

Third, the Fed has been trying, compared to other central banks, to lift us off zero. But more needs to be done. He cannot threaten to renegotiate our debt or we will be in big trouble. But he can issue 100-year bonds, and that would at least allow for spending without the crunch of short term debt: www.talkmarkets.com/.../trump-should-absolutely-issue-100-year-bonds

Banks are supposed to exist to help the real economy. All they seem to do is help big business that has workers captive to worldwide labor arbitrage. You can see why wide swaths of the US, most of the counties in the United States, rejected the globalist world view. I just hope Donald Trump has the wisdom to act thoughtfully, and not by uninformed reaction.

Can you really claim that #Trump is Anti-Semitic when his own daughter, #Ivanka is Jewish? He seems to have an unhealthy attraction to her, and an obvious appreciation for her husband's business and political acumen (Jared #Kushner). And there's nothing wrong with being pro-Zionist... a strong #Israel makes for a strong America.

Well, James, interesting comment. All we have gained from a close relationship with Israel is a wearisome policy of regime change that we carry out in the Middle East. It was, as I have written on Talkmarkets in the article Larry Summers 100 Dollar Bill Ban and Westfalia Lost, formulated by Oded Yinon. It was subsequently adopted by US Neocons, primarily through Richard Cheney. It is a very disturbing and immoral foreign policy, and points to a destruction of sovereignty on a wide scale. It has put religious people of all religions at risk in the Middle East. As for Trump, it has been written that he was antisemitic towards Jewish moguls in NYC. Obviously, he has said that he has German blood, the right stuff as he called it. So, he is conflicted at best.

That's a creepy comment for #Trump to make (though he is the king of creepy comments). We can agree to disagree on Israel, but America's policy of regime change has nothing to with any country but America.

As for Israel, we've gotten far more from our alliance with them. Not to mentioned the countless medical and technical advances that have benefited the entire world. All those who argue that we should boycott Israel would likely not get far in life if they truly boycotted EVERYthing that came out of that little country on the other end of the world. Check out this great list, I think you'll be surprised:

www.facebook.com/.../820698877940154/

We tolerate far more from countries who kill thousands of their own people or who openly support anti-America rhetoric, not to mention countries who supported and helped hide Bin Laden. Sad.

Impressive list, James. It is just that my wife is native American and I look at all forms of colonization as being just not right. After learning the story of her tribe, I can't buy into any justification for the oppression. Whether it was Cecil Rhodes, the US, Israel or Australia, it was all wrong.

Calm down.

First realize that you are the victim of the "Boogie Man is going to get you if we have tariff" propaganda campaign. You will know you are ill informed if any of the following is something you do not know. The first act of the first Congress was to impose tariffs on imports. All of the presidents on Mount Rushmore signed tariffs into law. That includes Thomas Jefferson who is well known to oppose tariffs. He had to pay the nation's bills. Every Republican presidential candidate from Abraham Lincoln in 1860 to Alf Landon in 1936 ran on a platform of tariff protection. From 1816 until 1967 the United States was the most tariff protected nation on earth during which time none of the Boogie Man is going to get you bad things actually happened. From the end of the Civil War and 1900 tariffs seldom went below 30 percent and occasionally went above 50 percent. During that time, contrary to the free trade shills, consumer prices went down, employment and wages went up, and we displaced free trade Great Britain as the most advanced industrial power on earth.

The only people claiming Smoot-Hawley exacerbated the Great Depression are a bunch of liberal arts majors who can not read and interpret data. International trade started to decline in June 1929. Smoot-Hawley was passed a year later in June 1930 but did not go into effect until a year after that June 1931. When Smoot-Hawley started collecting additional tariff 80 percent of the trade decline had already happened.

The United States is a trade deficit nation. As such it is not possible for us to suffer long term harm from a trade war. A trade war would benefit the American people.

Free trade is a Ivory Tower theory that is antithetical to the real world experience of the United States.

Calm down, ignore the Boogie Man, and let the good times roll.

Can you elaborate on the Ivory Tower theory and how that applies here?

Al dos not understand that manufacturing is slowing everywhere and that, as Kyle Bass has said, real helicopter money is the only real answer in this declining environment. Europe runs trade surpluses and it has not helped manufacturing.

I am not as anti free trade as you are, Al. Can I call you Al to distinguish you from the comic book character? Anyway, I am not as anti free trade as you are. I remember that goods like shoes were very expensive before free trade. I remember that you could not get as many goods. There is a balance that could be achieved and more manufacturing must be located into the US. I agree with you there.

But, you want to swing that pendulum, a Spanish Inquisition-like pendulum, so far in opposition to free trade that your view could end up cutting us all up.

If you take the real (inflation adjusted) wages of American blue collar workers from 1947 to their peak in 1972 and project the trend to today and compare that trend line number to what they have failed to gain the wage loss is greater than the lower prices, if any, from free trade. The last time I did that calculation the required wage increase was 80 percent. It varies from month to month but unlikely to change much. I used a least squared fit in a PERL script. Let me know if you get a different number.

To the extent that free trade produces lower prices then those lower prices would tend to push real (inflation adjusted) wages up yet blue collar wages today are below what they were in 1972. The inescapable conclusion from that fact is that combination of price and wages have worked to the disadvantage of American blue collar workers.

Let me also point out that there exists no peer reviewed economic analysis proving free trade produces lower price. Moreover, the lower prices argument assumes that consumer price is directly related to cost. Economic theory says that is wrong. Price is determined by what the market will bear not cost of production. Consider the margins Apple gets. If Foxconn charges them less to assemble them are they really going to reduce price below what the market will give them? The same considerations apply if #Trump requires #Apple to make them here.

Have your opinions on Trump evolved at all since you wrote this?

I remember when my aunt owned a top of the line Buick, in the 50's. It broke down in the middle of the desert, and could have been serious. But now, thanks to the Japanese, the least expensive new car is dependable. We will not benefit by high tariffs. It will destroy tourism and jobs you don't even know exist. You want the world and their nukes to become Sparta on steroids while we are Athens? Or maybe you want us to just physically take over the world and brutalize the world like Rome? Yes we need more factories here, but we just need other countries to build them here. Implementing stiff #tariffs will halt that strategy.

Your predictions are antithetical to more than 100 years (1816-1967) of real world experience as the most tariff protected nation on earth.

You are clinging to an Ivory Tower theory. In the real world tariff protection made us wealthy while free trade has resulted in declining prosperity for the vast majority of Americans. Enough Americans no longer believe the myth of free trade to make #Trump president. Are you also a member of the Flat Earth Society?

Remember that #Trump will not destroy all free trade. He makes stuff out of the country. And Al, my aunt's car broken down in the desert when I was 7 and it was 110 degrees has nothing to do with an Ivory Tower. How more real can you be, stuck in the middle of the desert in a top of the line blue beautiful Buick? Stuff is made in superior fashion now, and there are big dangers to tariffs. The economy will slow down if too many tariffs are thrown up, unless you get a lot of nations to start bringing factories here. If it is profitable, in certain industries, tariffs are appropriate. As an article on Business Insider explained back in 2010, there were already 12,000 tariffs on products in industries that our government has chosen to protect. www.businessinsider.com/americas-biggest-tariffs-2010-9

Remember those shoes I talked about? There is still a 37 percent tariff on leather shoes, Al.