Total US Debt Surpasses $23 Trillion For The First Time

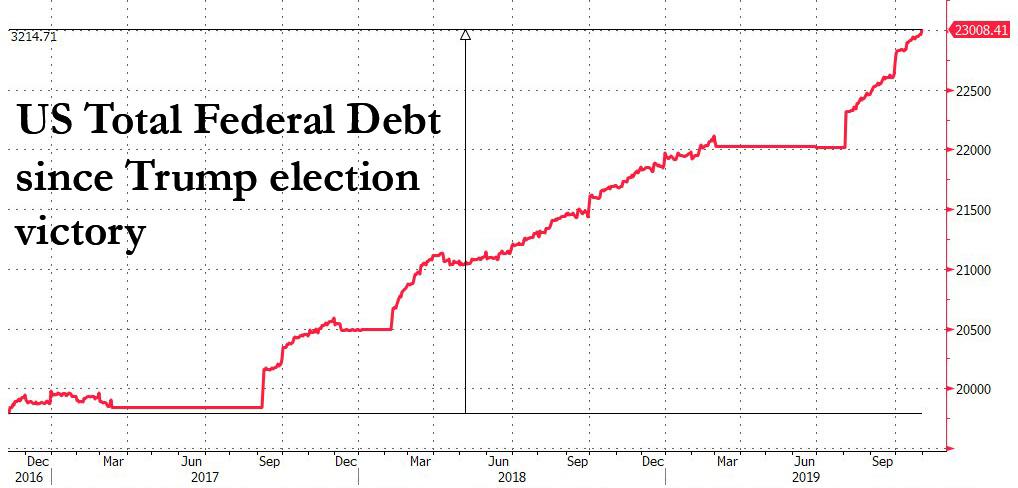

After total US debt was stuck at $22 trillion for five months, from March until August, until a deal was cobbled together by Congress to once again raise the debt ceiling, the obligations of the Federal government have soared fast and furious, and in just the past three months, total US debt increased by $1 trillion, surpassing $23 trillion as of Halloween 2019: truly a scary testament to America's insatiable thirst for debt.

(Click on image to enlarge)

Putting this increase in context: since Nov 8, 2016, when Donald Trump was elected US president, and when US debt was $19.8 trillion, the federal debt has increased by $3.2 trillion

(Click on image to enlarge)

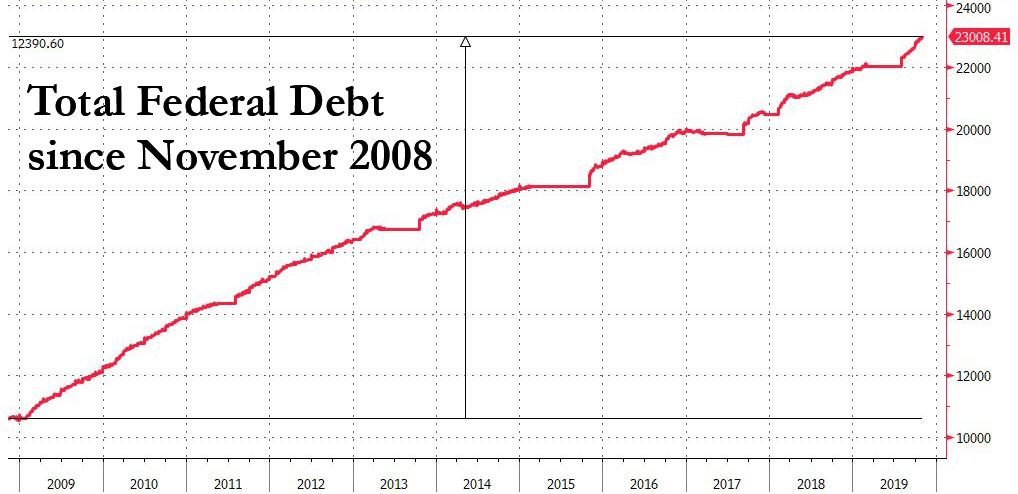

Going further back, to November 2008 when Barack Obama won the presidency, total US debt was $10.6 trillion. Since then it has more than doubled by $12.4 trillion.

(Click on image to enlarge)

Going further back is largely meaningless, because as the two chart above show, under just the last two US presidents, total US debt has increased by 115%, to a record $23 trillion.

Over the same period, US GDP increased (in nominal dollars) from $14.8 trillion to $21.5 trillion, a far more modest increase of $6.7 trillion. This also means that over the past 12 years, or the presidency of Obama and Trump, it took $1.85 in debt to generate $1.00 in GDP growth, the highest such ratio on record.

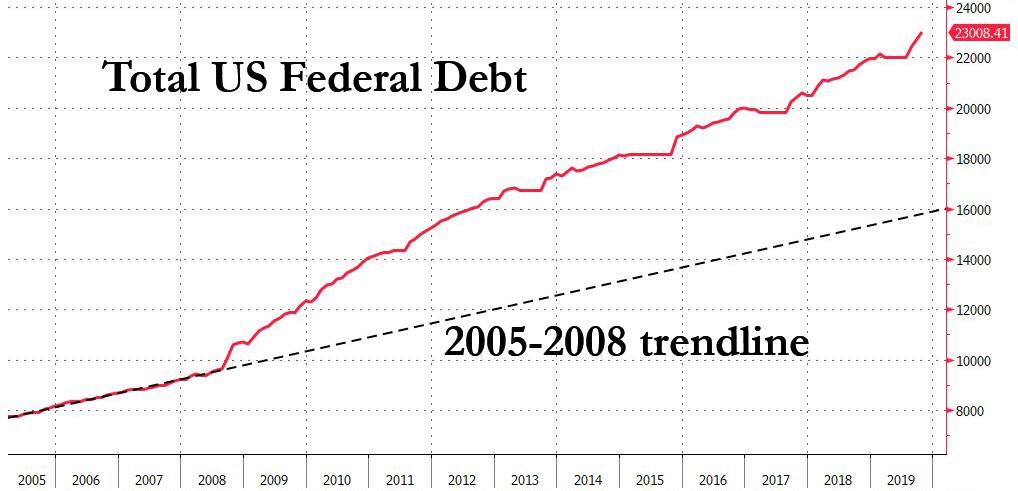

One other startling observation: whereas US debt prior to the financial crisis of 2008 was rising at a fairly aggressive pace, extrapolating current total US debt based on where it would have been had it not been for the Fed's housing and credit bubble, indicates a level just around $16 trillion. Instead, debt is currently at $23 trillion. This suggests that it has cost the US an additional $7 trillion in debt, or 44% of what debt would have been had it not been for the Fed's serial bubble creation just to paper over the consequences of the global financial crisis.

(Click on image to enlarge)

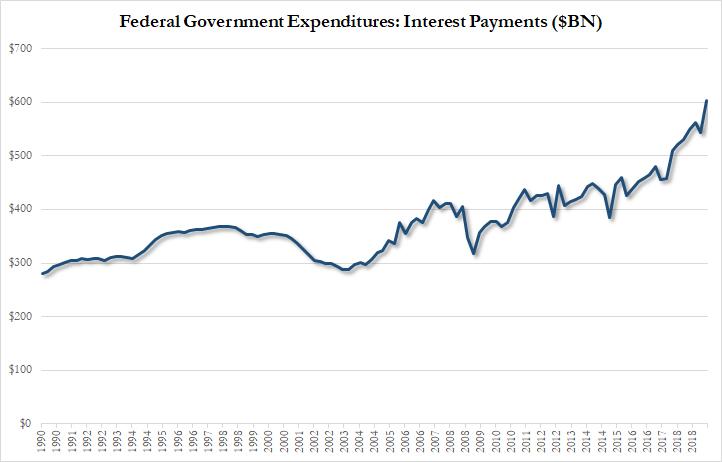

The ominous side effects of this record debt pile up are starting to be felt in the US budget as well: in fiscal 2019, the government spent just shy of $600 billion on interest payments equivalent to nearly the entire US Medicare budget, and more than the amount spent on the combined costs of education, agriculture, transportation and housing.

(Click on image to enlarge)

Furthermore, as we reported last week, the US debt is expected to increase by well over $1 trillion annually for the foreseeable future: while deficit for 2019 came in just under $1 trillion, at $984 billion, it is expected to grow by over $1 trillion each year for the foreseeable future.

"Reaching $23 trillion in debt on Halloween is a scary milestone for our economy and the next generation, but Washington shows no fear," said Michael A. Peterson, CEO of the conservative Peter Peterson Foundation. "Piling on debt like this is especially unwise and unnecessary in a strong economy."

While the key drivers of US government spending are mandatory programs such as Social Security, Medicare and anti-poverty programs, a major fiscal stimulus enacted by the Trump administration - which as we reported yesterday failed to achieve any sustainable increase in US GDP - has grown the deficit considerably.

(Click on image to enlarge)

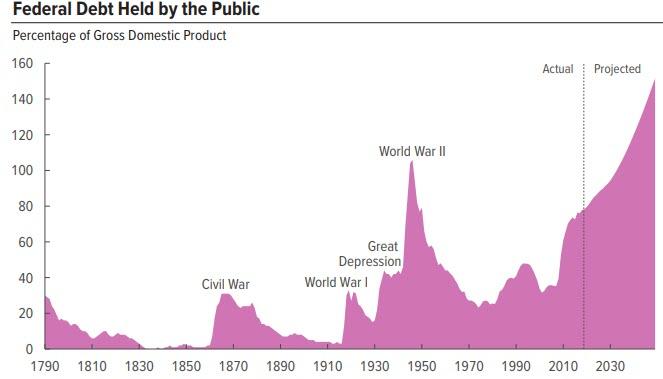

One final piece of bad news: according to the CBO's baseline forecast, the US debt picture is dismal and only set to get far worse. The chart below hardly needs any explanation.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more