Tired Of The Vibecession

Ah, the Vibes. We are all sick of it.

Dictionary.com published “vibecession” yesterday, which was WILD1. A vibecession is the idea of a disconnect between consumer sentiment and economic data. So basically, the economy is doing fine, but people are absolutely not feeling fine.

Vibes have sort of taken a life of their own (particularly through the Twitter feed of Will Stancil) over the past few weeks (and do note, vibes have roots in Keynes and animal spirits, Soros and reflexivity, and the entire field of behavioral economics, so the whole debate is nothing new).

But the discourse on vibes has gotten lazy.

As Derek Thompson said -

Something I’ve been thinking for a while is we need to phase out the concept of “vibes” in Econ analysis. It’s not useless. In fact it’s almost too useful. It means too many things. Take this graph: Is this 2-party US polarization? A media effect? Consumer expectation effect?

Vibes are great because they can be everything and nothing at the same time. Steve Hou of Bloomberg -

The question is whether “bad vibes” really just are stand-in for omitted variables in an mis-specified/changed structural model. Hard to think vibes entirely untethered to bad fundamentals that are important to the utility function can be sustained.

Which basically translates to vibes are a catch-all error term. The way that we are talking about how people feel is like “yeah buddy sorry you’re feeling that way.” Like the vibes are off for reasons that make sense, and we can actually pinpoint it and hopefully begin to create some sort of vibeshift. The economic sentiment has cratered for four main reasons -

-

People are misinformed/misled

-

People are selfish

-

People are sad

-

People actually feel worse off

Misinformation and the Media Literacy Crisis

The media literacy crisis - a general idea of people reading and watching stuff that doesn’t quite compute because of headline sensationalism.

-

Morning Consult published a poll asking how people would want their purchasing power improved, and 63% of respondents said that they would prefer prices to go down rather than their own income to go up.

-

Morning Consult then asked, “well, would you want prices to go down if it meant a recession” and 37% of people said yes.

And there’s a lot of reasons for this. People REALLY just want prices to go down. If their income goes up, that doesn’t necessarily mean that prices go down. If this ambigious idea of a Recession happens, at least prices are going down.

John Burn-Murdoch of the Financial Times published a great analysis on consumer sentiment across developed countries, finding that -

Americans are consistently wrong in the negative direction on almost every measure we polled. By huge margins, they believe inflation is still rising (it’s falling), that it has outstripped wage growth (wages have outpaced prices), and that they have become less wealthy (they’ve become much wealthier).

So people are wrong about how the economy is doing. The FT attributes that to “expressive responding” or people giving incorrect answers to show that they are part of an ingroup. But I think it’s just because people are freaking out! And media headlines aren’t helping!

Derek Thompson had a piece stating “From Great Resignation, to "no one wants to work," to quiet quitting, to claims to historic employee misery, the financial press is plainly obsessed with doom-washing the modern workplace”.

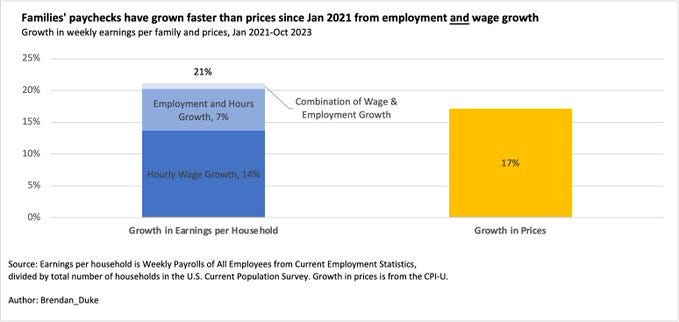

Brendan Duke did a great takedown of a CBS News article titled “Americans need an extra $11,400 today just to afford the basics” pointing out the weirdness of the COVID era and how careful we have to be with measuring what actually happened. He writes

When we measure the size of an average household's paycheck, we can see that it's gone up much more than prices since Jan 2021. Both from wage and employment growth

Media coverage can totally skew how people understand what actually is going on with the economy.

Inflation vs Disinflation vs Deflation?

And to be fair, just because inflation is going down doesn’t mean things are easier. A slowdown in the rate of increase in price levels doesn’t really mean all that much when you’ve been living in an absolute price pressure cooker for three years.

A lot of people hear ‘inflation going down’ and conflate that with prices going down.

-

But inflation is when prices are rising, disinflation is when prices are not rising as fast (what we have now) and then deflation is when prices actually decrease.

-

Deflation is a nightmare for a lot of reasons, because it basically means that we are in an economic downturn.

-

Deflationary doom loop equates to wage compression and layoffs because if you aren’t buying things, companies aren’t happy, and so on and so forth.

People are responding to surveys with a sense of desperation. A CNN poll asked people ‘how worried are you about the state of the economy’ and in August 2020, 58% of people said that they were worried. That number jumped to 84% in November 2023.

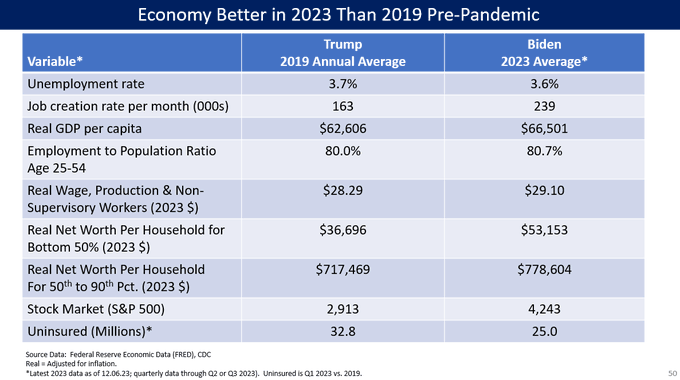

And like, objectively, the economy is MUCH better now. But during August 2020 people were able to stay at home, stimulus checks and unemployment benefits, there was support for healthcare, rent moratorium, student loan payments were paused, PPP payouts, etc etc. Look at the data!! that David Doney produced:

Data is better now. But better doesn’t mean good?

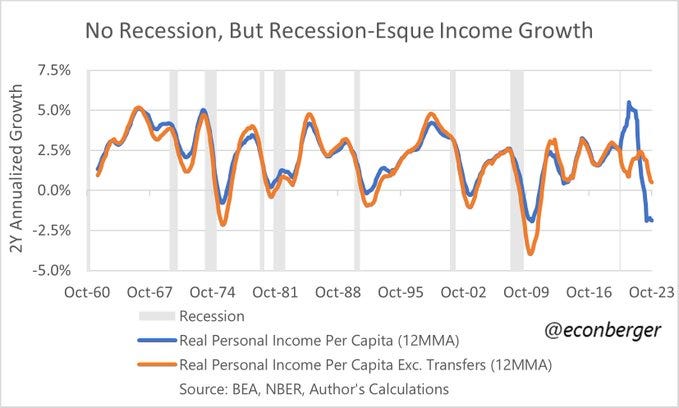

As Guy Berger wrote “Even though we haven't had an actual recession over the past 2 years, inflation-adjusted personal income per capita (blue) have behaved in a recessionary way. That's true even though "the economy is good" (orange)”

People feel like garbage because of all these omitted vibe variables from the broader analysis.

A New Normal

Status games happen in a society; we are animals at the end of the day.

Clearly, people want things to be cheaper. For things to be cheaper, it often means that labor has to be less expensive. There are some theories floating around that because wages are rising fast at the bottom, people resent having to pay more for once cheap labor, and hate feeling like their status is shirked by shrinking inequality.

A Revaluation of Labor

So we are having this weird conversation about how we value work. There are jobs that are in demand, like being a fry cook and then there are jobs that are not in demand, like email jobs. They are not as affordable as they used to be and we can see that with things like the Spotify layoffs. And this sucks. As Bucco wrote

Very weird time to be hiring in tech, and of course, tough to be looking. Have a ton of sympathy there Literally thousands of applications within 24 hours of posting any job And nobody who has a stable job is looking to move with recession fears looming (last in, first out)

So people are looking at the revaluation of labor and saying “well, I don’t like this.” Daniel Knowles of the Economist -

I have a theory to explain this, and it is that wages are rising fast at the bottom and a lot of people basically resent paying more for once-cheap labour, and hate feeling like their status has been undermined by shrinking inequality

There was this weird Expensive French Fry thing that happened on Twitter, where some dude tweeted a picture of $6.79 McDonalds French Fries and stated “$7 for a large fry. we are living in the Great Depression” And then of course, as G. Scott Shand writes

“Perfect example of the "vibes" theory. Post that fries cost $7 and gets 6k likes. Admits this is the marked up delivery price "for the meme". Deal on the same app is $1.14. Admits he has no idea the issue in the great depression was deflation not inflation.”

So David Watkins quote tweets that and says

What's particularly hilarious about this vibesession story is that the delivery markup price is, essentially, the McDonald's consumer hiring a low-wage gig worker so they don't have to leave the house. This complaint boils down to "the economy is bad bc the help costs too much"

And Will Stancil, who has more posting stamina than anyone I have ever seen (and I’ve seen a lot of stuff) says

One of the better theories for why everyone is so unhappy now is that richer people with more public voice are annoyed they no longer have access to the conveniences made possible by very cheap labor, while benefits are concentrated in a still-mostly-invisible class of workers

Going back to the Financial Times piece, people are feeling super frustrated, they aren’t able to gauge their economic situation properly, and a lot of people feel like their boat isn’t moving at the pace that they would want it to move.

Collective Sadness and Lack of Inspiration

People are misinformed, adjusting to a new economy, and they are sad. I think that there is a lack of inspiration at many levels because there is a lack of leadership at really high levels. I’ve written about this before, but it’s becoming increasingly apparent that there is a role model crisis.

I think George Santos is hilarious but he is hugely problematic. He was a policymaker, a person that we are expecting to make these huge decisions and be leaders of the free country and they are spending money on botox and Sephora. Even from a “what the world could like” perspective, we just don’t have it. As Conor Sen wrote

The thing I respect more in hindsight about Steve Jobs is as flawed of an individual as he was, he marketed and sold products based on an understanding of how people lived. The Cybertruck/Mars/AI stuff seems too often based on weirdo sci-fi guys living in their heads.

These people are inventing a reality that is only ever going to exist for them, and that leaves a lot of people out from tapping into that inspiration. If you’re trying to figure out how to pay rent, you’re probably not thinking about moving to Mars (maybe for cheaper housing). The way that we have innovation and inspiration now just feels so detached from what the average person needs, and because of that people can’t get connected, therefore, why try?

Economic Change Requires Leadership

We have to have better stories on a local level. We don’t have a Steve Jobs type figure saying ‘hey guys listen, get it together’. Instead we have things like the Sam Altman debacle, which is fine! Like he is a cool guy with cool stuff going on, but is he inherently inspiring? Not really! I don’t think he is out there maing the average person say ‘Ok I can go do this and this and be a better person and here is a cool product I can tap into.’

It’s exciting but not inspirational. People feel lost. Jake Anbinder of Cornell -

I think the post-Obama mentality is we are faced with a series of interlocking crises that traditional political channels seem incapable of resolving, and so the best we can manage is a kind of "muddling-through". What's distinct is that the belief in the intractability of these crises seems to exist almost in the postmaterial realm, such that it's immune to material evidence that they can be/are being addressed. That's how you get the bad vibes economy.

It just feels like crisis after crisis, and we don’t have the leadership to address it. So of course the freaking vibes are going to be off. Of course people are going to be feeling bad and sad. And then of course, there is economic material reality to this.

Material Reality and the Economic Experience

When I published the Vibecession piece back in June 2022, a lot of people did not read it and just responded to it. And that’s sort of the whole discourse, right? We live in a world built on knee-jerk reactions. Things are hard. It’s not just vibes. Real wages have been stagnant, people feel like they can’t get into the jobs that they want, they can’t afford a house. There are a lot of real world constraints that create the vibes that we are all collectively experiencing. As Talmon Joseph Smith of the NYT wrote -

We never solved the affordability crisis that was clear to see even in the uber low inflation 2010s where at least stuff was cheap, a palliative for more structural woes. then, stuff stopped being cheap. 3 years of big labor income growth doesnt erase 40yrs of lagging

Matt Bruenig of People’s Policy Project published this piece talking about the vibes versus material conditions, finding that -

By conventional social democratic measures, the economy is bad and recent trends in the economy have been mixed at best. Any conclusion to the contrary is therefore based on ideological, not factual, disagreement.

But of course, if you look at the underlying economic data, jobs and GDP and inflation and income and U.S. recovery are all pretty decent, especially relative to other developed nations. People are just tired and frustated as Matt Darling says -

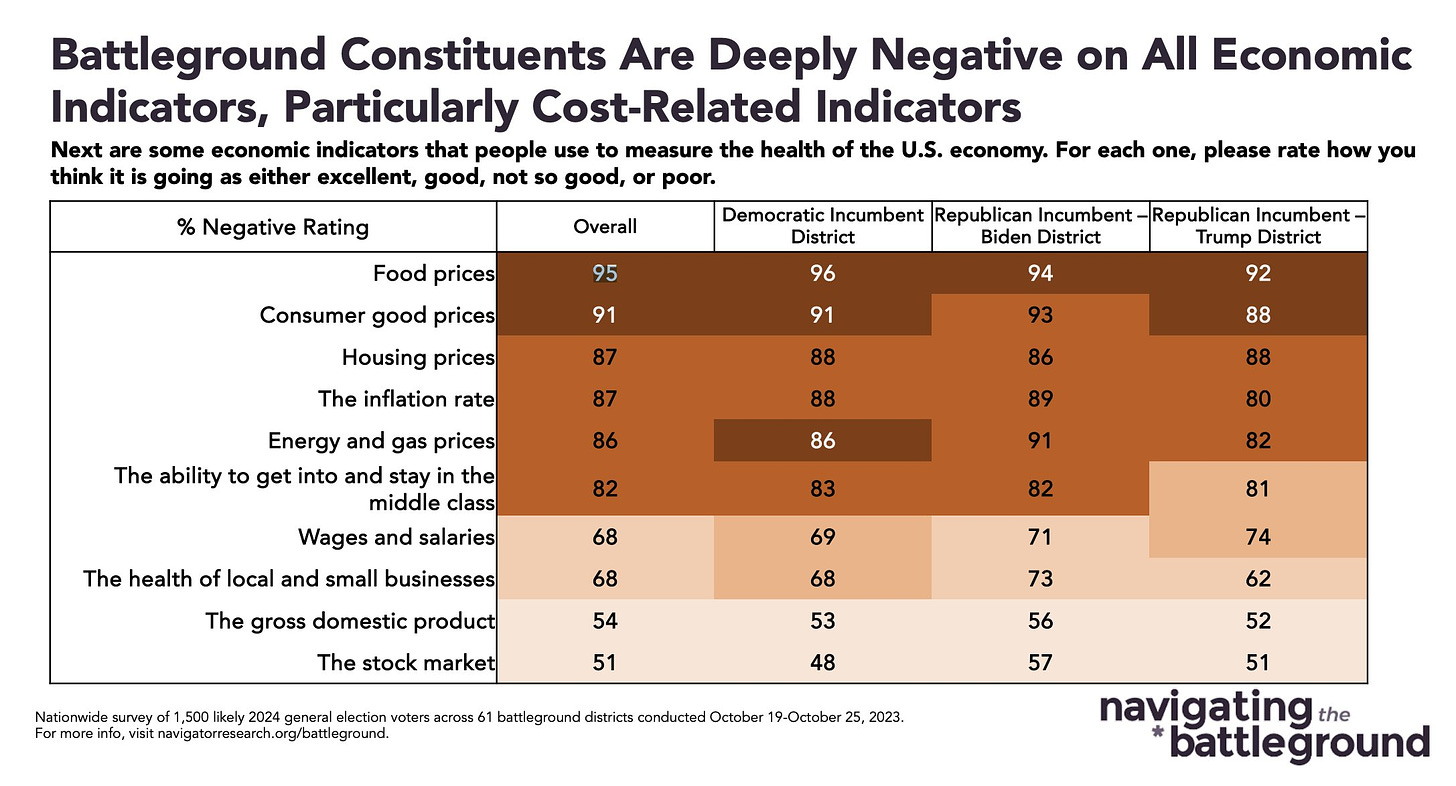

A funny thing about the vibes discourse is that surveyed people are pretty clear that they think the problem is "high prices". We don't need to invent exotic dark matter (though *why* "high prices" are more upsetting than similar periods is still worth investigating)

We see that in how they responded to the Morning Consult survey. People are not just mad about this year’s inflation, they are mad about all the inflation that came before that. Ryan Cummings and Neale Mahoney of Briefing Book wrote this terrific piece analyzing how much inflation wallops sentiment2 and it's a lot! Inflation is a pressure cooker. People are not just mad about what’s going on now, they are mad about all the stuff that happened before that. Things are still expensive, even though they are getting less expensive, as Jordan Weissman highlighted.

And if we look at consumption metrics, people are still spending money. But it’s kinda like that lady riding Splash Mountain with her arms crossed - doing the thing, but not happy about it.

I really liked this point from Victor Aguiar on the crisis in behavioral economics.

It's essential to create a program focused on establishing solid facts, drawing from neurobiology, psychology, and marketing. This collaborative effort could lead to a unified behavioral model that aligns with these established facts. Although traditional in approach, this is necessary to address the fundamental flaws in our current economic models and to identify a viable alternative as the very heart of our economic analysis.

People are complex and economics doesn’t (can’t!) take that into consideration. I think that when we think about vibes, it's just like, “you're just feeling a little sad today, buddy” and it's like so much more than that. It is neurobiology. It is psychology. It is social media. It is the mental health crisis that's going on. The loneliness crisis.

I wanted to talk about how vibes deserve to be analyzed a bit deeper than just writing it off as how people feel. They feel that way for a reason. I don’t know.

1Very cool, very grateful.

2They also argue that 30% of the gap between consumer sentiment and what you would expect based on economic conditions can be explained by partisan bias.

More By This Author:

The United States Has A Spending ProblemThe New Era Of Crisis Volatility

Deflation's Vicious Cycle

This first appeared in Kyla's newsletter at Substack. If any of it disappears or otherwise becomes inaccessible, you can subscribe at more

Well done.