There’s One Factor Affecting U.S. Inflation Right Now That The Fed Can Do Nothing About

I know many of you are concerned about inflation. You’re worried about what it means for the cost of your food, fuel, and other necessary items.

The Federal Reserve gives the impression it is trying to fight inflation. Yesterday, it announced the biggest interest rate hike in over two decades – 50 basis points. This follows the 25-basis-point increase announced in March.

The latest move had been well signposted. So it came as no surprise to the markets. And Fed chair Jerome Powell was reluctant to be drawn on the Fed’s plans for future rate increases.

But the Fed is actually part of the inflation problem… not the solution.

It has created about $5 trillion since the Covid-19 pandemic began in 2020. That elevated financial markets, but not the strength of the real economy. And it compounded the already growing distortion.

It remains to be seen what impact the Fed’s latest inflation-busting strategy has on prices.

But the reality is that raising rates by even 50 basis points won’t make much of a dent in real inflation. Neither will the Fed’s plans to let up to $95 billion of bonds “run off” its nearly $9 trillion balance sheet per month.

But no matter how effective it turns out to be, there’s another factor driving inflation higher. And it’s one the Fed can do absolutely nothing about – global supply chain disruptions.

Today, I’ll show you how one worrying development could hinder any attempts by the Fed to control inflation…

Continuous Supply Shocks

Over the last couple of years, you’ve likely become more familiar than you ever wanted to be with the term “supply chain disruption.”

The supply of certain items or services has stopped or been curtailed for various external reasons.

For example, as I wrote to you recently, the war in Ukraine is having an effect on the global food supply and prices. And it’s also putting pressure on major commodities, especially oil.

Before that, we had one of the world’s biggest container ships running aground in the Suez Canal. It blocked a main supply artery for nearly a week. This caused major disruptions to global trade for months…

And before that again, we had the much-talked-about impact of Covid-19 lockdowns on the global supply chain. Due to staff and raw material shortages and factory shutdowns, goods just weren’t being manufactured in the same quantities as before.

Each one of these “supply shocks” sent shock waves through the global economy. Prices soared. Supply chains broke down.

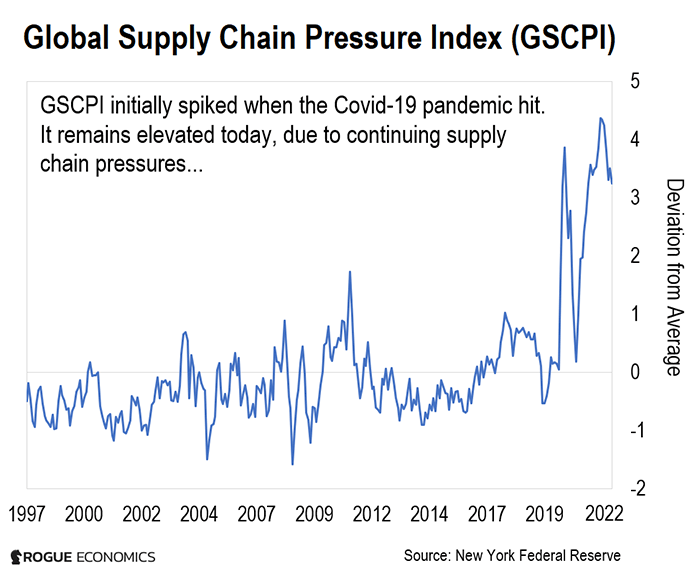

You can see this in the Global Supply Chain Pressure Index (GSCPI) chart below. It combines nearly thirty commonly used metrics to monitor potential disruptions affecting global supply chains.

The index surged early in the pandemic. Pressures eased as production resumed. But they picked back up again during the winter of 2020 as Covid-19 infections jumped.

Supply chain pressures remained at historically high levels throughout 2021, peaking in December.

Fast-forward to today, and we’re still in the middle of one of the biggest global supply chain disruptions.

A disruption in the supply of even a small, seemingly insignificant component of a larger product can result in a knock-on disruption to the entire chain…

Ultimately, it can lead to long delays in goods reaching the supermarket shelves. And higher prices… Hence rising inflation.

Crucially, recent developments in China to combat the spread of Covid-19 suggest that the problems with the global supply chain are far from over…

China’s Zero-Covid Policy Affecting Supply Chains

You see, while most other countries have lifted coronavirus restrictions, China has gone in the other direction. It recently redoubled its efforts to impose strict Zero-Covid policies to deal with the Omicron variant of the coronavirus.

It imposed major lockdowns to prevent the spread of the virus. That includes stopping manufacturing and any other businesses considered “nonessential.”

These lockdowns are affecting manufacturing centers, financial hubs, and some of the world’s largest container ports.

Case in point: Shanghai, China’s biggest city.

The last time I was in Shanghai was in 2016. It was a thriving international metropolis, where global business people met to discuss deals, product movement, and factory production plans.

Nomi at Shanghai Airport in 2016

Hongqiao train station in Shanghai was bustling during Nomi’s 2016 visit

Today, just two people per apartment building – yes, the entire building – are allowed to leave each day for a maximum of two hours. Anyone testing positive for the virus must quarantine, whether they have symptoms or not.

But because of Covid restrictions, commercial trucks have a hard time delivering food and household goods to households in Shanghai. Inside the city, only vehicles with passes are allowed.

This means that even rich people in China’s wealthiest city have difficulties getting their hands on food.

Having upended the commercial systems, the government attempted to provide for the 25 million residents of Shanghai on its own.

It failed miserably… with predictable results: general food scarcity and mushrooming black markets.

Unsurprisingly, the government’s Zero-Covid stance is pushing some citizens to the brink.

Lootings, unrest, and clashes with police have become commonplace.

And the lockdowns and other Covid-fighting measures mean ports are not operating at capacity. Imports and exports are affected. That spells trouble…

Forty-seven million 20-foot containers passed through Shanghai Port last year. They were carrying goods to and from China’s global trading partners. Authorities are now looking at forcing dockworkers to stay on site to help ease the growing delays and congestion.

Similar draconian measures have been introduced in the Chinese manufacturing hub of Guangzhou. And Beijing is increasingly looking like it’s next in line.

Why This Matters to You

I know there are much bigger things happening across the world right now. But here’s why the lockdowns in China should matter to you…

China is the world’s second-largest economy and a major exporter.

In 2021, China’s share of global exports was roughly 15%. That’s the highest in a decade.

Today, China accounts for 18% of all the goods the U.S. imports. And for computers and electronics, that number rises to 35%.

Just think how many items in your house have “Made in China” on them. Or how many of your other possessions have small components made there.

So, any disruptions in the supply of goods and raw materials from China will have a huge knock-on effect on prices across the world.

We’ve already seen global supply chains disrupted due to the pandemic and other events. And we’ve already got high inflation.

But if China continues with its Zero-Covid policy, both could get much worse. And the Fed won’t be able to do a thing about it…

Of course, distortions almost always spell opportunity, if you know where to look.

Disclosure: None.