The Ticking Time Bomb Gets Closer To Zero As The National Debt Quietly Blows Past $33 Trillion

Do you hear that? It’s a ticking time bomb.

Last Friday, the national debt quietly blew above $33 trillion.

As of September 15, the outstanding federal debt stood at a cool $33,044,858,730,468.04.

It took the Biden administration just three months to add another $1 trillion to the debt. It eclipsed $32 trillion back on June 15.

The debt has gone up at a dizzying pace. The government has added $1.58 trillion to the national debt since the end of the fake debt ceiling fight. In just one year, the Biden administration has added $2.16 trillion to the debt.

It’s hard to fathom $33 trillion. To put things into some perspective, every US citizen would have to write a $98,446 check in order to pay off the debt, and every American taxpayer is on the hook for $254,961.

Or to look at it another way, $33 trillion is more than the total economies of China, Japan, Germany, and the UK combined.

Yes, It’s That Bad!

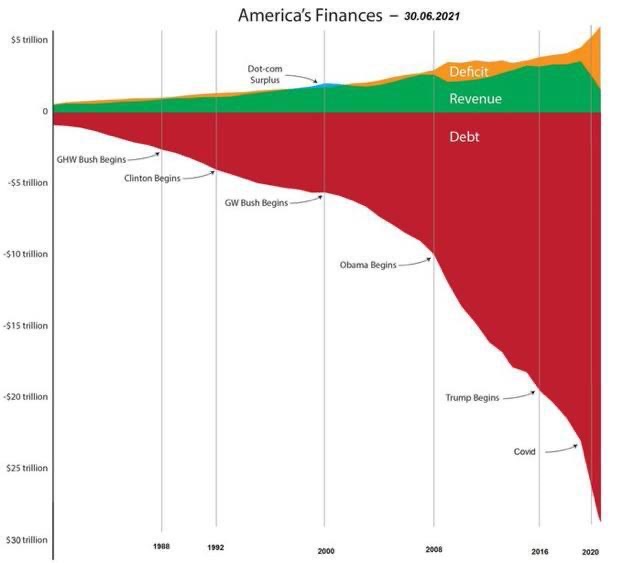

It’s hard to overstate just how bad the US government’s fiscal situation has become. We have a trifecta of surging debt, massive deficits and declining federal revenue.

That means there is no end in sight to this upward-spiraling national debt.

The biggest issue is the federal government spending addiction. In August alone, the Biden administration spent over $527 billion.

And there is more spending coming down the pike. Last month, the president asked Congress to appropriate $40 billion in additional spending, including $24 billion for Ukraine and other international needs, $4 billion related to border security, and $12 billion for disaster relief.

That won’t be the end of it. There is always something the government needs to spend money on and now it has a credit card with no limit.

Last year, robust tax receipts helped to paper over the spending problem as the federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. We’re already seeing receipts fall, and government tax revenue will decline even faster if the economy spins into a recession.

The debt-to-GDP ratio currently stands at 122.41%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

A Ticking Time Bomb

With interest rates climbing, the national debt is a ticking time bomb.

Uncle Sam’s interest expense is already rising at an astronomical rate, and it’s set to explode.

The federal government has paid well over half a trillion dollars ($630 billion) on interest payments alone in fiscal 2023, with one month left to go. Interest on the debt paid in July exceeded the amount spent on national defense that month. Uncle Sam is well on the way to spending more on interest payments than any line item other than Social Security and Medicare.

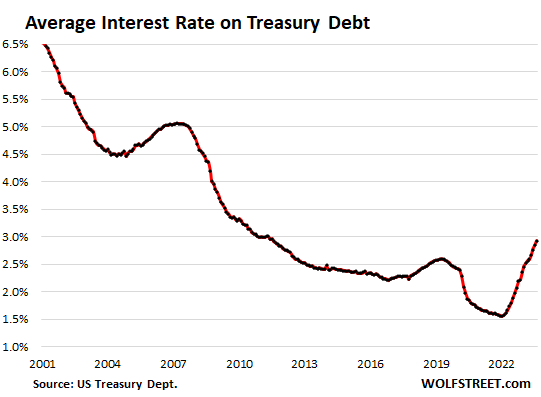

The average interest rate on the debt is now at the highest level since 2011, coming in at 2.92% as of the end of August. But that’s still relatively low, and the debt is more than double what it was back in the olden days of 2011.

Meanwhile, the average interest rate is poised to climb rapidly. A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

To give you an idea of where we’re heading, T-bills currently yield about 5.5%, the two-year yield is over 5% and the 10-year currently yields around 4.3%.

This has driven interest payments as a percentage of total tax receipts to over 35%. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

If the national debt climbs to $40 trillion (and given the current deficits it won’t take long) and interest rates remain at 5% (which Jerome Powell says will be necessary to tackle inflation) interest payments on the debt alone would skyrocket around $2 trillion per year. That means that even if the US government balanced the budget so receipts covered all spending minus interest payments, we’d still be facing a $2 trillion annual deficit.

Of course, there won’t be a balanced budget. So, let’s assume the federal government can maintain the current deficit level of around $1 trillion annually (minus interest expense). Even with this overly optimistic scenario, the Treasury would be running a $3 trillion annual budget deficit. (That’s the current $1 trillion deficit plus $2 trillion in interest expenses.)

And the most likely scenario is spending will continue to climb, along with the budget deficits. There’s no telling how high the annual deficits could run.

This is a fiscal powder keg. All it needs is a match.

The national debt has been growing for so long that most people just shrug when we talk about it. Nobody seems particularly concerned outside of a handful of contrarians. Sure, most everybody recognizes that it might be a problem “down the road.” But they believe the road is long, so we can get away with continuing to kick the can. But mark my words, eventually, they will run out of road.

More By This Author:

Gold Hits Record Highs In Cny, Jpy

Slow Burn

Currency Wars Versus Gold Standards