The Pared Back US Tariff Report That Never Was

The dollar has sold off and then bounced back today on a Washington Post report that the new Trump administration may be more selective in its use of tariffs than first thought. Trump has since refuted the report, stating that its facts were wrong. As our traders say: welcome to the age of Trump 2.0.

Washington Post report hints of a more targeted approach to tariffs

Within a little over three hours, President-elect Donald Trump has rebuffed a Washington Post report on tariffs.

The Washington Post article had suggested that the incoming Trump administration is looking at a more selective approach to US import tariffs than first feared. The article suggests that rather than the 10-20% across-the-board tariffs on all imports coming into the US, the administration may rather be looking more at 'critical' sectors. Here, the article admitted that those critical sectors in question were far from clear, but pointed to the defense industrial supply chain (industrial metals), medical supplies and energy production (batteries, rare earth elements, etc).

The initial market reaction here was for the dollar to sell off 0.8-1.0% on the view that tariffs would be narrower than first feared. After all, the FX market and financial markets in general have been bombarded with US tariff threats from late September. The news also saw the short end of the US curve fall around 4-5bp and US equity futures rally 0.4% on the view that more selective tariffs would be less inflationary, potentially providing a little more leeway for the Federal Reserve to cut rates.

Equally, the fact that this report made it unclear whether the Trump administration would pursue the auto sector (impacting Europe) saw the Eurostoxx Auto & Auto parts index rally 3.5% on the initial headlines.

Yet within three hours, Trump has posted that the report represents 'fake news'.

Trump to extend Biden's tariffs on strategic products?

Were any of the Washington Post suggestions to come to light, Trump would continue Biden’s tariff increases. Biden not only kept most tariffs in place under Trump’s first presidency but ordered tariff hikes on strategic products from China such as semiconductors, medical and surgical gloves, and textile facemasks back in 2024. Under Trump, higher tariffs wouldn’t be limited to China but could be implemented unilaterally. As above, targeted sectors might include critical medical supplies, once again ferrous metals, and materials for solar energy development.

Yet, hefty tariffs might be necessary to make domestic production truly competitive. This was highlighted by US graphite firms in December 2024, who sought tariffs as high as 920% to compete with Chinese producers

If we’ve learned anything over the years, it’s that Trump is unpredictable. He loves shaking up markets, but the final outcomes are often less dramatic than his initial announcements. However, officials and companies shouldn’t get too comfortable. We will only know what’s truly happening once it’s done.

What could this mean for US inflation?

On the subject of what tariff increases could mean for US inflation, here are the thoughts of our US economist, James Knightley.

The US is on track to have imported $3.3tr of goods in 2023, with around $435bn coming from China. Now, if President-elect Trump were to implement the full scale of tariffs he suggested in his election campaign, we are looking at a 60% tariff applied to imports from Chinese (potentially raising $260bn in revenue) and 10-20% tariffs on imports from all other countries ($287bn-$573bn). In a worst case scenario that assumes no substitution for American-made products – US manufacturing accounts for barely 10% of total economic activity these days and it simply isn’t capable of scaling up production rapidly enough to insulate the economy if Trump implements the across-the-board tariffs from the get-go – we are looking at cost increases for importers of $647bn-$833bn.

Some of that cost increase will be absorbed within the profit margins of the importing company and there may be some mitigation from foreign producers lowering prices, particularly with dollar strength having lifted revenue to local currency terms. In the case of the first Trump administration's 20% tariff on foreign-made washing machines, we saw consumer prices increase by around 12%. Since US-manufactured washing machines were not subject to tariffs we can say that the consumer bore more than 60% of the cost of the tariff.

With household nominal consumer spending amounting to around $20tr in 2024 and we make an assumption that 60% of the tariff is passed onto the consumer, then 60%*647bn = $388bn to 60%*833bn = $500bn. This would mean under the PCE deflator methodology this would lift inflation by between 2-2.5 percentage points, but again, there likely would be some substitution to American made products. We also have to remember that many items, particularly Chinese-made, are already subject to tariffs so the overall impact may be closer to 1-1.5% if Trump was to carry through with his promises at the maximum amount.

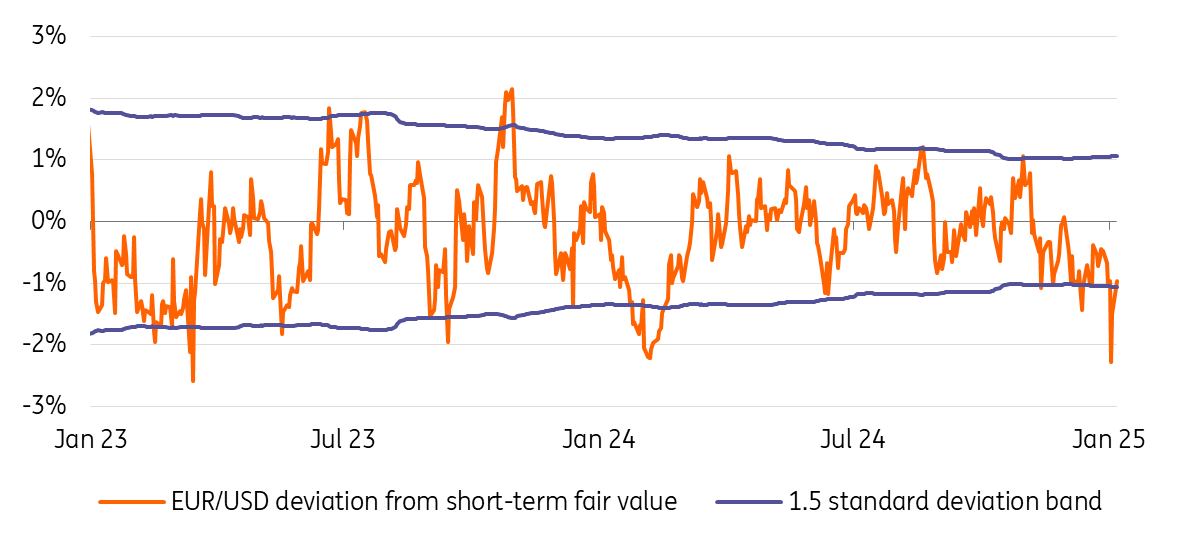

EUR/USD undershot its short erm fair value level last week

(Click on image to enlarge)

Source: Refinitiv, ING

FX: EUR/USD was oversold

The brief news of more selective tariffs caught the FX market long dollars. And Francesco Pesole highlighted on Friday that EUR/USD had overshot – by around 2% on the downside – its short-term financial fair value (see chart above). This is a short term model heavily skewed to rate differentials and risk appetite. While Trump's rebuttal of the original article has curtailed the EUR/USD bounce, some doubt about the potential breadth of the tariffs could see an overbought dollar hand back a little more of its recent gains. 1.05 is possible on EUR/USD were Wednesday's release of the FOMC minutes not to be as hawkish nor Friday's December payroll release as strong as some fear.

However, we see no need to change our EUR/USD forecast profile of a gentle grind towards 1.02 this year. The European Central Bank will be cutting far more quickly than the Fed amidst trade wars and US exceptionalism. As above, there is nothing to say President-elect Trump does not turn his attention to the European auto sector over the coming months. And equally, it is far too early to signal the 'all-clear' for other currencies in the frame, such as the CNY, CAD and MXN. Also, if the subject of US critical imports gains any traction, this St Louis Fed 2021 blog post is quite a good read. It identifies the communications sector as one of the most critical – perhaps serving another warning to the currencies of Taiwan and Korea.

Yet if there is one lesson to take from today's events, it is the increased volatility likely to accompany the speculation and delivery of the new administration's agenda. As one of our traders succinctly put it: "welcome to the age of Trump 2.0."

More By This Author:

U.S. Manufacturing Shows Encouraging Signs Of LifePoland’s Inflation Growth Below Market Expectations As Rise In Food Prices Slows

Benign Food Prices Help Turkey’s Disinflation Path

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more