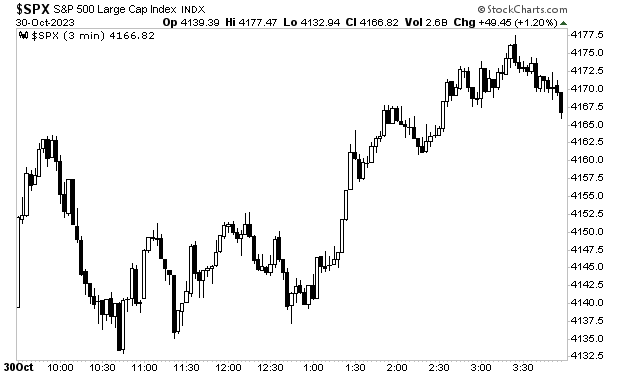

The Markets Fell For A Lie Yesterday… But This Won’t Last

Yesterday, the Treasury announced that it would “only” need $775 billion to fund the budget for the fourth quarter of 2023.

This was considered to be good news.

Back in July, the Treasury had announced it would need $852 billion for the fourth quarter. So the fact the Treasury surprised the markets by needing less was used as an excuse for traders to gun the markets higher.

(Click on image to enlarge)

There’s just one small problem with this…

The Treasury QRA was an obvious lie. There is no way on earth the Treasury only needs $775 billion in refunding for 4Q23. Heck, it needed $500 billion in the last month alone!

Moreover, it’s not as if the government is suddenly becoming careful about spending. The Biden Administration has added $4.6 trillion in debt since taking office. And the pace is actually INCREASING, not decreasing: they added almost $1 TRILLION in new debt between 1Q23 and 2Q23.

So again, the idea that the Treasury can somehow fund everything with just $775 billion in refunding needs in the 4Q23 is a joke. The real amount will be MUCH larger than that.

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The Great Debt Bubble burst in 2022. And the crisis is now approaching.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

More By This Author:

Will Janet Yellen Give Us A Santa Rally… Or A Debt Crisis?Are We About To Witness The First Major Central Bank Failure In Decades?

Manipulations Will Work… But Only For So Long