The Inflation Tax Is Eating Your Lunch

How much is the inflation tax costing you?

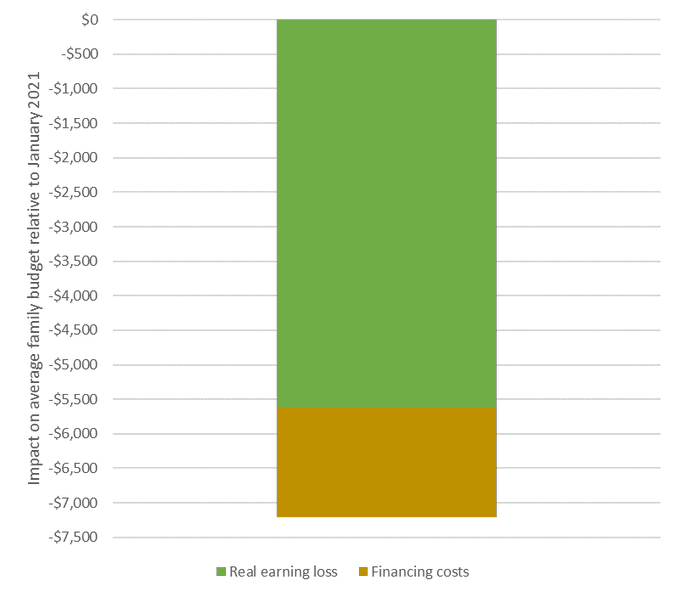

Based on calculations by public finance economist EJ Antoni, around $7,200 since January 2021 for the average family.

Antoni broke it down in a series of tweets.

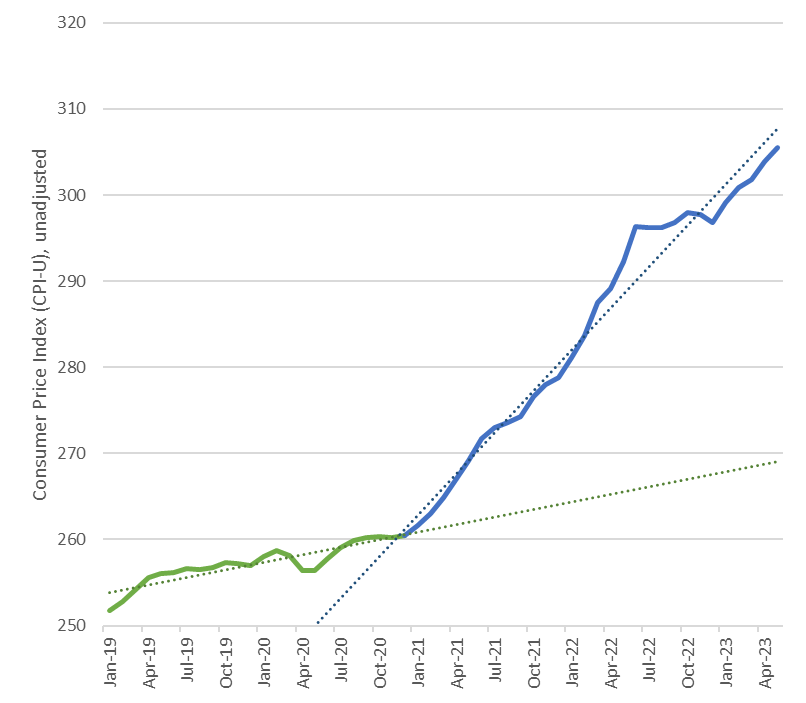

The first chart shows how price inflation has spiked since the beginning of 2021 based on unadjusted CPI.

The pace of price increases has slowed significantly based on headline CPI numbers. But if you consider core CPI, it’s clear that price inflation continues to run hot to this day.

And Antoni notes, we’ve seen very little in the way of price decreases.

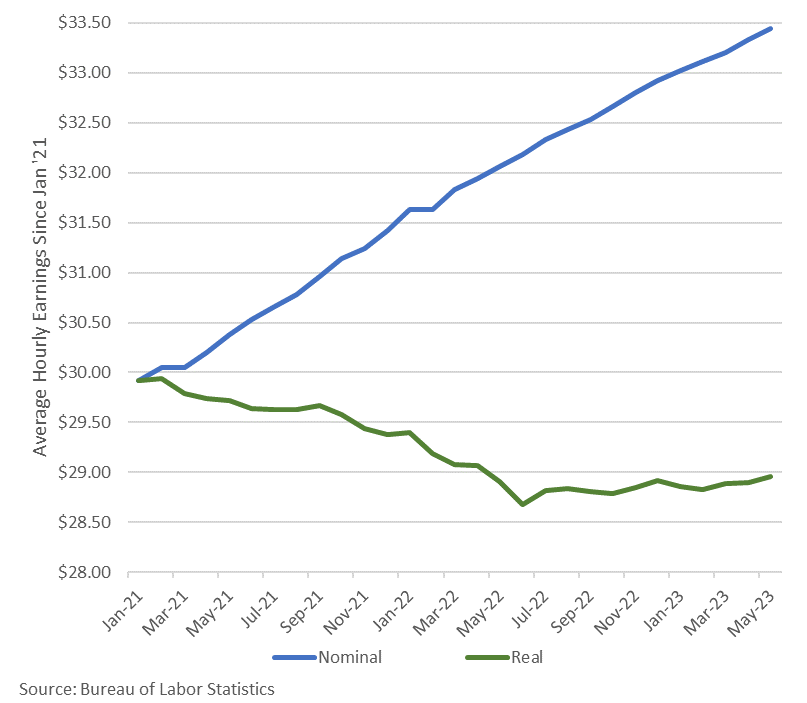

Meanwhile, real earnings have tanked. While average hourly earnings rose nominally from just under $30 in January 2021 to close to $33.50 today, real hourly earnings have tanked to $29. In other words, you’re earning more, but you’re getting poorer.

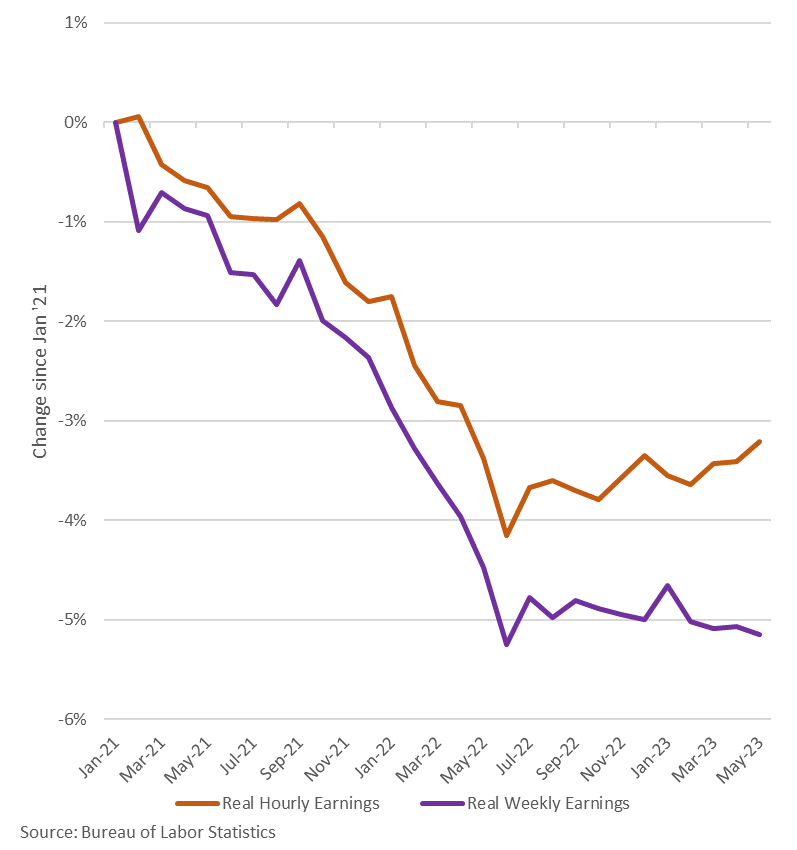

Antoni introduces another factor. The number of hours worked dropped even as real hourly earnings fell. This compounds the drop and pushes real weekly earnings down even further. Weekly earnings have fallen by 5.1% since January 2021, and they are currently at the lowest level since June 2022.

Antoni then runs some numbers.

Average family making extra $200/wk since Jan ’21 but that larger paycheck buys about $100/wk LESS, a $5,600 loss in purchasing power; meanwhile, interest rate hikes have raised annual borrowing costs another $1,600; average family effectively $7,200 poorer.”

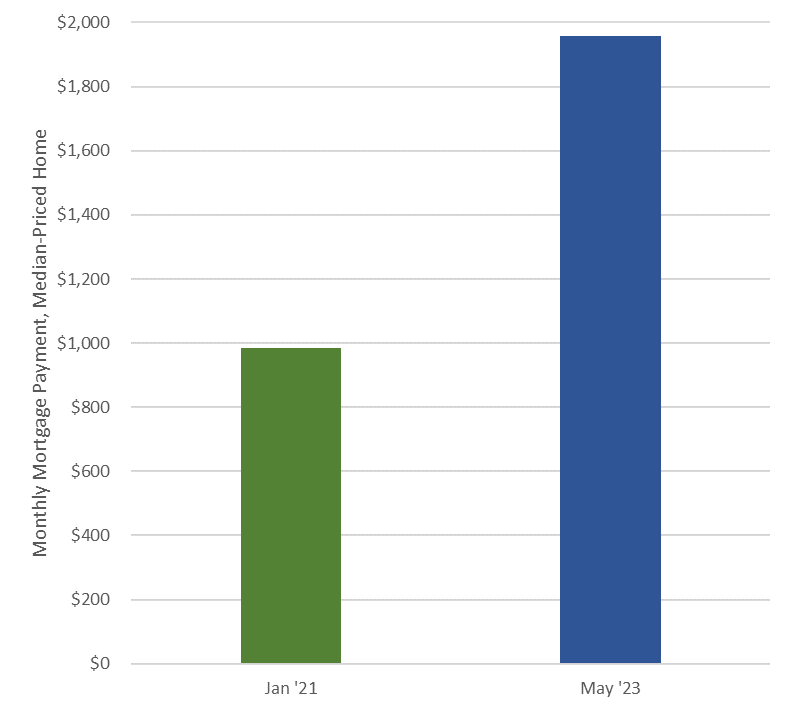

We’re not finished. The news is even worse if you are trying to buy a home thanks to skyrocketing mortgage rates. According to Antoni, the monthly payment on a median-priced home has doubled since January 2021.

That’s about $12k more per year and $350k over 30-yr mortgage, for the same house.”

Government Isn’t Free

Antoni’s calculations reveal the very real pain of the inflation tax. It’s made even more insidious by the fact that most people don’t see it. It’s not like you’re writing a check to the government. But you’re paying just the same.

Never forget that every dollar the government spends ultimately comes out of taxpayers’ pockets. There is no free lunch. In fact, the government is eating your lunch.

Governments can pay for their expenditures in three ways.

The most honest way is through direct taxation. In this scenario, the government collects the amount it spends each year in annual taxes. But that’s not particularly popular with voters, and politicians are reluctant to push tax increases.

The second way is to borrow money. The government sells bonds (Treasuries in the US) to willing lenders to finance current spending. But in effect, this is still direct taxation. It merely pushes the taxes into the future. When those bonds have to be paid off, the taxpayer will foot the bill – along with the interest expense.

This is much more convenient for politicians who have very short time horizons. By the time the bill comes due, they will likely be long gone. And if they’re still in office, they can always borrow more to pay off the current debt. As long as the taxpayer doesn’t feel the squeeze today, the politicians don’t have to worry about blowback.

But anybody who has ever run up a credit card knows you can only borrow so much. That’s a problem for politicians who want to kick the can down the road. Eventually, they run out of the road. In fact, we can see the barricades ahead. With a national debt approaching $32 trillion, there is no way the government can realistically pay off the national debt.

That leads to the third payment option – the inflation tax.

In this scheme, the US Treasury still sells bonds on the open market as it always has. But now, the Federal Reserve puts its thumb on the bond market, buying Treasuries and paying for them with money it creates out of thin air. This creates artificial demand for Treasury bonds, keeping the prices higher than they otherwise would be. Conversely, interest rates are lower than they otherwise would be.

This is a good deal for the Treasury, as it props up the bond market and keeps borrowing costs down. But money creation devalues the currency and effectively decreases your purchasing power.

We see that in falling real wages.

Here’s how it plays out.

When the government collects taxes to pay for spending, it literally takes your money and then gives it to somebody else. Your purchasing power is diminished because you have less money to spend. But the other person’s purchasing power goes up. They have more money to spend. From a macro perspective, it’s a wash. The amount of money in the system remains unchanged.

But when the government prints money and then gives it to somebody else to spend, your purchasing power hasn’t been diminished — at least not in nominal dollar terms. You still have the same amount of money in your bank account as you did before. But now there is another person out there who has new money. They can now go out and spend it. In effect, that person can compete with you to buy stuff. It creates a bidding war for goods and services. The result — more money in the system chasing the same number of goods and services. Prices rise. Everything becomes more expensive.

In effect, instead of the government taking your money, the government takes the purchasing power of your money.

That’s a tax.

And you are paying it in spades.

More By This Author:

At Its Core Price Inflation Still Running HotBig May Shortfall Pushes 2023 Budget Deficit Well Over $1 Trillion

Silver Is Significantly Underpriced Given The Looming Supply Shortage