The Fed Vs Inflation: What Traders Can Expect Next

In the continuing story of the Fed vs inflation, we’ve had lots of talk about rate hikes to come. We’ve also received some forward guidance from the Federal Reserve’s committee members, and we have a futures market that is signaling action. As new data comes out on a regular basis, the committee makes adjustments as needed. Meanwhile, financial markets are trying to read the Fed correctly and interpret the same economic data the Fed is looking at.

So, what are the markets expecting for the remainder of 2022?

The Fed vs inflation

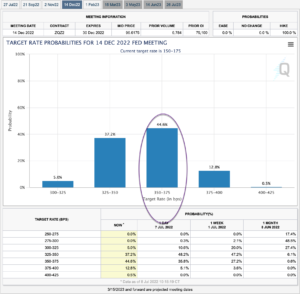

If the committee is true to its word, we can expect to see a 3% funds rate after the September meeting. That would include a 75bp hike in July followed by another one in September. For the remaining two meetings of the year, the market is expecting between another 50bp and 75 bp total (25/25 or 50/25) – see the Fed funds futures graph below.

It’s often said if the market is pricing in an event, there is less need for volatility. That may be the case here, because the VIX is not rising sharply in the face of new economic or Fed-related news. That can be dangerous; it smacks of complacency and acceptance. As we know, market behavior and can change on a dime.

This week, we’ll see more data directly related to inflation and economic growth. All eyes will be on the CPI and PPI, both of which recently ticked up to 40 year highs. The talk of “peak inflation” continues to make the rounds, but there is little evidence yet to support this thesis. Retail sales were disappointing in May and point to a softer economy. If June confirms that weakness, there will most likely be downgrades on economic growth. On a positive note, the jobs report was strong.

Traders have much to consider, but just keep in mind that the Fed’s only job right now is to do as much as possible to reduce inflation. That may mean more rate hikes than anyone could imagine, and it will be interesting to see how the markets respond.

More By This Author:

The Battle Of Bullish Vs. Bearish SentimentChange Your Trading Strategy In A Bear Market

Traders Lack Fear In This Bear Market

Disclaimer: Explosives Options disclaims any responsibility for the accuracy of the content of this article. Visitors assume the all risk of viewing, reading, using, or relying upon this ...

more