The Fed Is Done And Market Rates Have Peaked – So What Now?

Image source: Wikipedia

Market rates have likely peaked. The 10yr hit 5% and the 2yr got to 5.25% in the past month or so. A move back toward 5% is not improbable for the 10yr, but it's more likely that we've morphed into a structural decline in market rates, and a steeper curve. Most of the time a peak for the Fed correlates with a good time to get long, or at least to average in as rates rise.

Most of the time a peak for the Fed correlates with a subsequent tendency for market rates to fall – it tends to be a good time to get long

Have market rates peaked in the United States? Most probably yes. The Federal Reserve is likely done too. If true, the Fed has in fact been done since 26 July this year and has been at a peak rate for almost four months now. When the Fed peaks, it’s a key moment for markets. Most of the time a peak for the Fed correlates with a subsequent tendency for market rates to fall – it tends to be a good time to get long.

Getting long can take on many guises. For asset managers, it means buying longer-dated higher quality securities, even into an inverted curve, as this means locking in existing running yield for longer. For liability managers, getting long means setting fixed rate receivers, which is effectively like a funded long in a bond. It’s also code for swapping to floating, where exposure to falling official rates is sought.

It's no surprise that over the long term being exposed to floating rates is the cheapest form of funding. Despite the volatility that is implied, an average upward sloping term structure tends to result in a lower cost of funding. In fact, there is no example of a 10yr fixed rate receiver resulting in negative carry at any time over the past number of decades (as 10 years is long enough for floating rates to on average be lower than the 10yr rate that has been locked in).

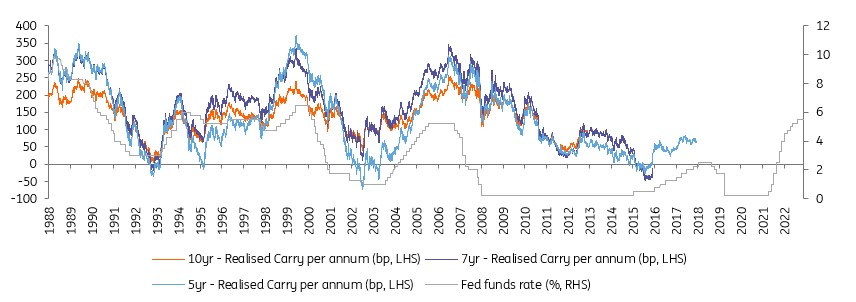

Moreover, when the Federal Reserve is at a peak, realised carry on fixed rate receivers tends to be maximised (graph below). It’s the opposite when we are at the bottom of the rate cycle, as this is the optimal time to set a swap to a fixed (rate payer). Similarly, for the asset manager, this is the best time to be short on interest rate exposure, as the path ahead then is for the Fed to be hiking rates, and pushing market rates higher. That’s for another day. Today we’re concerned with the peak in the cycle.

Realised carry from setting fixed rate receivers (5yr, 7yr and 10yr compared)

Getting long the bond market comes in many guises, but now is the time

How convinced are we that the Fed has peaked? You can never be 100% sure on this, but the odds firmly favour the view that they’re done. Latest headline consumer price inflation has fallen to 3.2% and the latest 3mth annualised reading for the core personal consumer expenditure deflator is at 2.5%. That’s bang on the 20yr average for US inflation. It has to be said that the US has managed a remarkable easing in inflation, despite the ongoing firmness in the labour market.

But that labour market firmness won’t last. Every day the effective funds rate remains at 5.3% the pressure builds on e.g. the typical credit card debt holder that finds themselves paying rates in excess of 20%. All debt holder subject to re-sets at higher rates face similar issues, ones that won’t go away as the Fed holds. Also, falling inflation does not mean falling aggregate prices, so living standard pressures from high prices remain. The transmission mechanism to the economy is through higher delinquencies, and a wider lower spending link in consequence.

The Federal Reserve does not need to hike rates further in order to sustain the pressure already beginning to be felt by the economy. As these pressures build, concern morphs away from inflation and towards sub-trend growth, and possibly recession. That places rate cutting on the radar. Ahead of that, market rates tend to ease lower. And once we are about three months ahead of an actual cut, the 2yr yield will gap lower – it can move lower by 100bp in a matter of days, and keeps going.

The engine that drives this is the Fed cutting from 5.5% currently, to (we think) 3% by mid-2025 (starting by mid-2024).

Market rates anticipate a lot of this ahead of time. The anticipatory move lower on the front end is where value comes from exposure to paying floating rates for liability managers. And for asset managers, that means lower funding costs, and moreover, downward pressure on longer tenor rates, that are pulled lower by shorter tenor ones.

If that all plays out, then being long is the way to go in the coming few months. A mini back-up in market rates is far from improbable, as the deficit pressure has not gone away and the economy has not exactly imploded. We'd use any such back-up as an opportunity to average in, adding to interest rate exposure for asset managers and to floating rate liabilities for liability managers.

More By This Author:

Rates Spark: Shifting The Rate Cycle DiscountUS Inflation Slowdown Has Much More To Go

The Netherlands’ Economy Is Still Stuck In Recession

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more