The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

That said, we can’t pretend as if the economy was cooking before Mother Nature interfered. It wasn’t. If one thing has become absolutely clear about the economy in 2017, it is that it has fallen off dramatically when compared to the last half of 2016.

This is the opposite of what was supposed to happen, what most people and all Economists were expecting. The rebound off the early 2016 trough was only the first part of bigger things, or so it may have seemed. For reasons beyond the mainstream grasp, however, the farther into 2017 we go the farther away that dream seems to get.

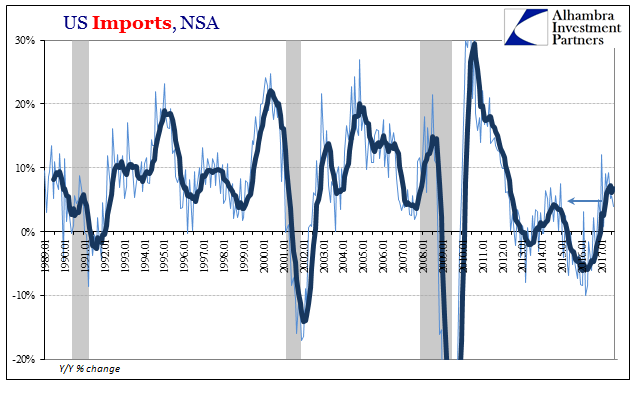

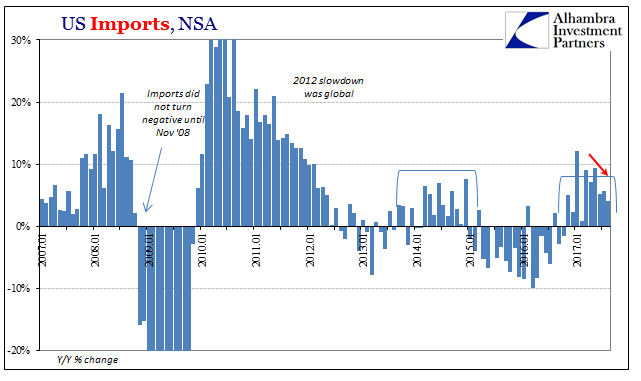

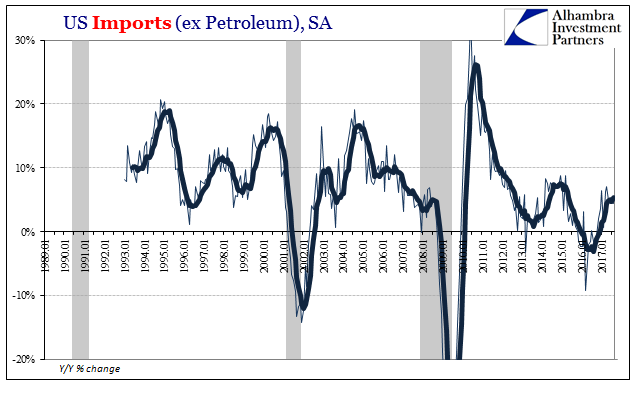

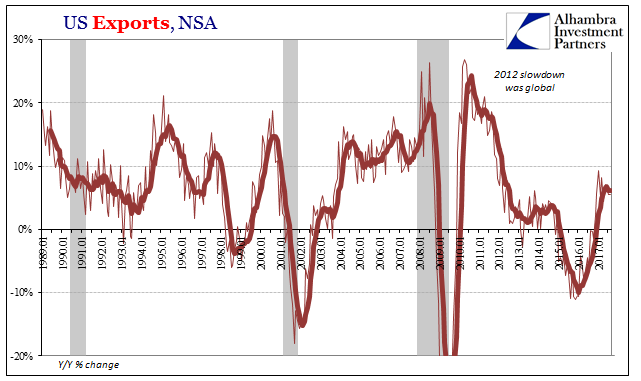

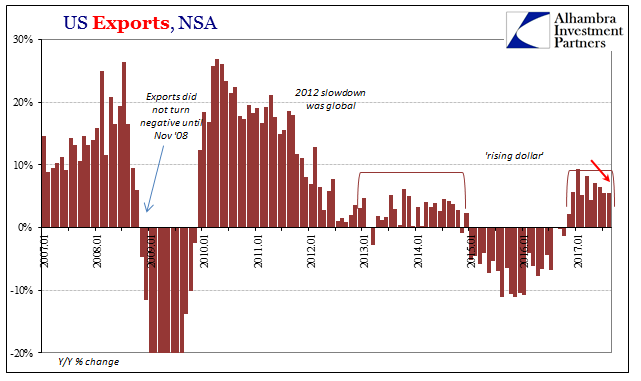

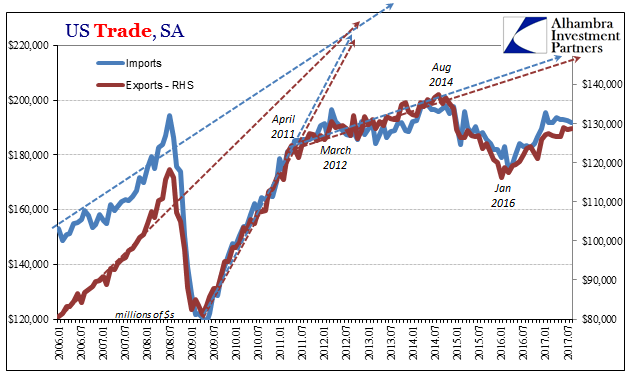

The latest data to confirm the pre-storm contradiction is from the Census Bureau. Both US exports as well as US imports continue to underwhelm not just in comparison to last year but with respect symmetry. The economy falls off around the world at each of these downturns and it just doesn’t come back, at least not like it used to.

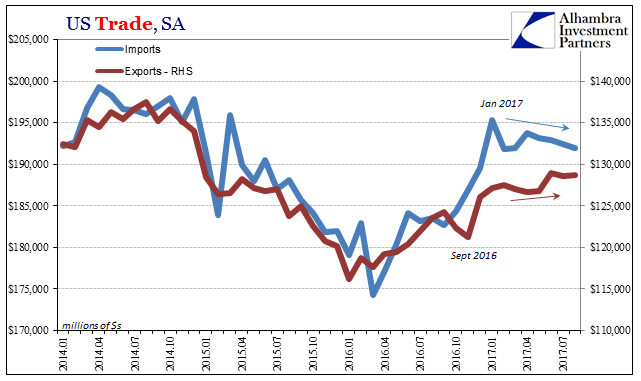

Imports were up just 4% in August 2017, the lowest rate of expansion since February. On the other side, exports were up 5.5%, a slower pace compared to earlier in the year after never having broken double digits.

The seasonally-adjusted estimates better illuminate this disappointment. In the last six months of 2016 plus January 2017, imports were up a respectable (though still stunted) 6.1% for those seven months. In the seven months since January, including August, imports are down 1.7%. It’s a pattern we see repeated all throughout the economic accounts.

That same result over a few months might be left to monthly variation or “transitory” factors, but a term of seven months declares openly a problem with US demand. We don’t have to wonder what that problem is, stated quite directly by the Census Bureau’s estimates for inventories up and down the supply chain. With inventories still unusually high, US demand for foreign goods must be restrained; no cyclical restocking is required nor possible.

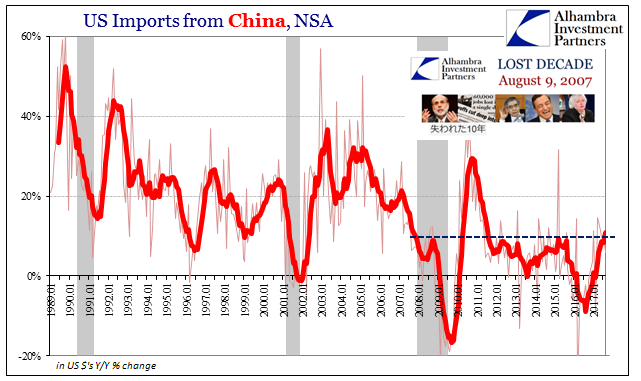

That has, of course, hampered economic resurgence all over the world. Imports from China were barely positive in August, rising just 4% when the Chinese economy really needs 25-30% growth from the US. There was barely any detectible difference even during that upturn in 2016 from the pace of 2014 despite a rather serious contraction in between.

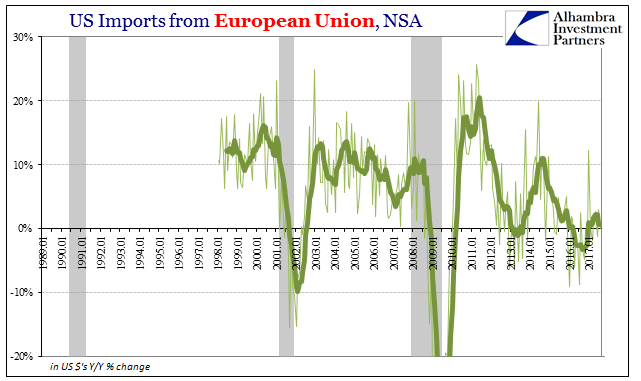

We find the same problem for Europe, where US imports from that part of the world haven’t even come close to matching the weak results from just before the “rising dollar” began.

Inventories are high because sales have flagged. Retail sales have behaved this year as imports, rising in the back half of last year and then just about zeroing out thereafter. Consumer spending has been weak because consumers exhausted themselves during that upturn very likely on the premise incomes would rebound, too. They didn’t.

In fact, incomes have remained rather weak all throughout. And incomes are in that situation because the labor market slowed with the “rising dollar” and kept on slowing through all of the rest. Despite the rhetoric about the unemployment rate, the jobs market has yet to accelerate again.

It’s fine to blame severe hurricanes for some of the dip that might present itself during these months in question. Any temporary impediment that may have been thrown up, however, hit while the underlying baseline was already in trouble.

Disclosure: None.