The 2022 Stock Market Crash

Image credit: © Aaron Kohr | Dreamstime.com

The recent “Federal Reserve Rally” is in response to the Federal Reserve’s announcement that it will taper its bond-buying program and will also raise interest rates three times in 2022. You’d think that this would be bad news for the stock market because it signals the beginning of the end of Zero Interest Rate Policy (ZIRP), but the market sees this announcement as confirmation that the Fed is in control, and that this control is good. The market believes the Fed can control inflation.

But the truth is that the Fed is merely pretending to be in control by getting out in front of the inevitable—taking responsibility for what it cannot control. We will have serious inflation and a consequent increase in interest rates, and there’s nothing the Fed can do to stop it. In fact, the Fed is responsible for the serious inflation that is just beginning to manifest itself; it will get worse.

It began with Quantitative Easing (QE) to avert a 2008 recession, followed by recent COVID relief coupled with a new spending bill for infrastructure. It’s been an experiment in money printing based on Modern Monetary Theory (MMT) that recommends poking the inflation bear if it can solve economic problems.

The bear is not happy. MMT pundits advise increases in taxes to rein in excess money supply when inflation appears, but there is little political will to do enough of this to ward off inflation. Inflation is inevitable and substantial.

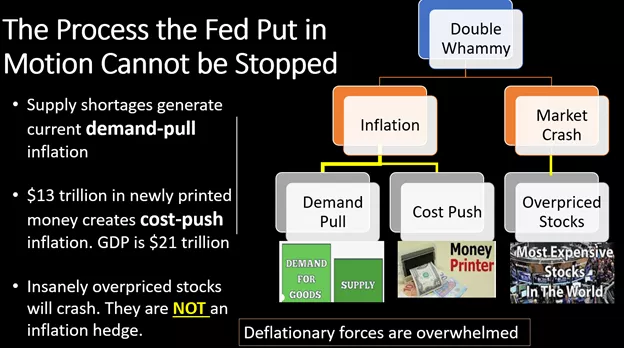

The US is heading toward a double whammy of rampant inflation that generates a stock market crash. Rampant inflation forces rising interest rates that trigger a crash in stock prices.

Inflation

Inflation follows the money. Quantitative easing (QE) has dumped $4.5 trillion into the US bond market, creating “money illusion,” the perception that an inflated asset is actually worth more. Bond investors think they’re richer, and it doesn’t stop there. Many moved their bond investments into stocks, inflating that market too. The cost of our most expensive war — World War II — is $4.8 trillion in today’s dollars.

In other words, QE created inflation in stock and bond prices, without raising the cost of consumer goods. Consequently, there’s the false impression that the $4.5 trillion in new money was not inflationary because it did not move the CPI inflation needle.

But COVID relief of $5.5 trillion has moved the CPI needle because some of that new money was helicoptered in relief checks that are being used to pay rents and buy things. Pandemic-induced supply shortages exacerbate the problem.

New money creates classic inflation where too much money is chasing too few goods. This is called “cost-push” inflation. The other form of inflation is “demand-pull” where demand outstrips supply. As supply channels re-open, demand-pull inflation should subside—it is transitory. But $10 trillion in new money ($4.5 trillion in QE plus $5.5 trillion in Covid relief) is not transitory—it will drive inflation for years, and no one knows how high it will go.

But the government appears oblivious to inflation threats, choosing to pass legislation for even more spending. So far $3 trillion has been approved for infrastructure spending and another $2 trillion to “Build Back Better” is underway.

Money printing has run amuck.

Interest rates

In ordinary times, investors price bonds to provide a return above inflation. Although these are not ordinary times, with some government bonds “paying” negative yields, this cannot last. Bond yields must go up when Fed manipulation ends.

The Fed could try to limit these increases but doing so would increase the money supply even more because the Fed would have to increase their bond purchases rather than taper as announced. The Fed has painted itself into a corner.

The stock markets

Much has been written recently about stock market behavior in periods of rising interest rates. Historically, the stock market has done well in this circumstance. But we have never ever hadZIRP before. ZIRP changes everything as I lay out in this article.

One of the explanations/rationalizations for today’s insanely high stock prices is today’s low bond yield, Thanks to ZIRP, US bond yields have never been lower. Security analysts calculate a “fair value” for a stock by discounting its future earnings using current yields. If that discount rate increases, fair values decrease.

The end of ZIRP will crash the stock market. I speculate on the extent of the damage in this article.

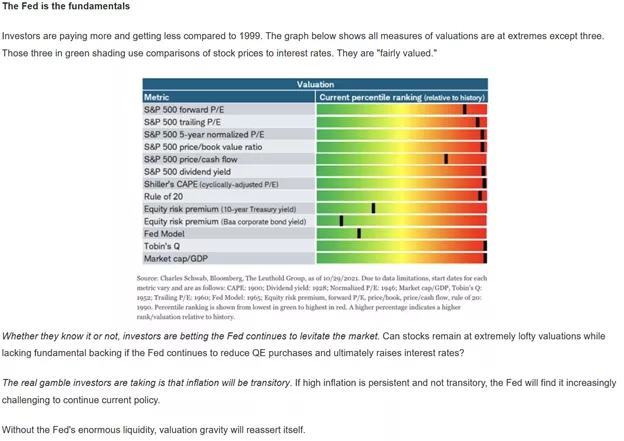

In Can the Stock Market Crash Like it Did in 2000? Michael Lebowitz shows that current measures of stock market expensiveness are at their extremes, except for measures that incorporate Fed intervention in ZIRP.Stocks are expensive because of ZIRP. Inflation will force the end of ZIRP.

“Do you have faith the ‘new era’ of Fed-managed markets can levitate stocks well above historical norms?” Lebowitz concluded. “Or will this new era resolve itself like prior ‘new eras’ with market crashes?

Conclusion

Despite Federal Reserve assurances, the future is not bright. There is a price to pay for an avoided recession and an awfully expensive ongoing pandemic, not to mention profligate government spending.

Those near retirement in target-date funds will be shocked to discover they are not protected. Those in the ubiquitous 60/40 stock/bond mix will wish they had heeded the numerous current warnings to protect themselves.

Disclaimer:

For more guidance please see Bursting Bubbles Blast Baby Boomers and more